IFMR Capital recently completed two securitisation transactions. Eta Pioneer with Trichy based Grama Vidiyal Microfinance Limited, and Theta Pioneer with Satin Creditcare Limited.

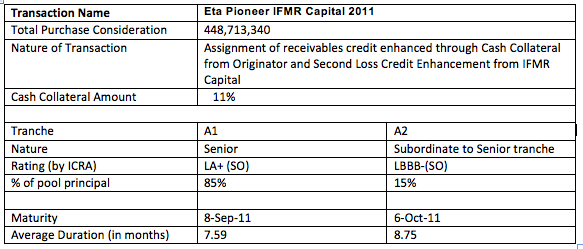

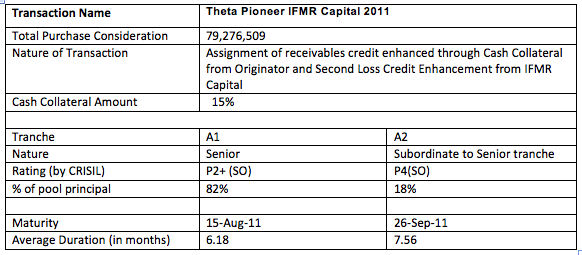

IFMR Capital structured, arranged and invested in an INR 448.7 million securitisation transaction backed by 51,770 microloans originated by Grama Vidiyal Microfinance Limited and in an INR 79 million securitisation transaction transaction backed by 9,399 microloans originated by Satin Creditcare Limited.

Both the transactions were in the form of rated securitisation of receivables credit enhanced through cash collateral from the originator, EIS from pool cash flows and second loss credit enhancement from IFMR Capital. The senior tranche of Eta Pioneer has been rated LA+ (SO) and that of Theta Pioneer has been rated P2+ (SO). As always, IFMR Capital invested in the subordinated tranche.

This is IFMR Capital’s second securitisation with Grama Vidiyal Microfinance and first with Satin Microfinance as a single originator. Satin had earlier participated in three multi-originator transactions structured and arranged by IFMR Capital. Through this structure and investment by IFMR Capital, the window of funding continues to be made available for Grama Vidiyal Microfinance while for Satin Microfinance it is an important graduation from multi-originator to single originator securitisation, emphasizing the positive impact of securitisation on the efficiency of microfinance companies. IFMR Capital continues to demonstrate its commitment to providing efficient and reliable access to capital for institutions that impact low-income households

Details of the transactions (INR):

5 Responses

Congrats to the IFMR Capital team for infusing liquidity to high-quality MFIs in this difficult environment

Congratulation! A very positive message to MFI sector.