Over the ages, shelter has remained as one of the most basic and important needs of human beings. People’s housing needs have increased manifold in recent times as the population grows, the middle class expands and younger generations choose to move into nuclear family units, or move near the increasingly popular regional work hubs. However, with high costs of construction materials, high capital costs and increasing complexity of the legal and technical paperwork needed, accessibility and affordability of house ownership continues to remain a challenge.

Housing finance acts as a bridge to provide financing and open up the housing market to aspiring house owners. In recent times, specialist housing finance companies (HFCs) targeting the low-income/financially-excluded household segment have emerged as a key player to meet the demands of the newly bankable population who do not have credit history in conventional terms, and are often not served by banks and mainstream HFCs. The lending model and operational processes of these specialist HFCs- which we will refer to as Affordable Housing Finance Companies (AHFCs) – are the subject of this post.

Housing Finance Sector Review: The Environment for AHFCs and HFCs

There are several players in the housing finance space, such as Scheduled Commercial Banks (SCBs), Housing Finance Companies (HFCs), Affordable Housing Finance Companies (AHFCs), Financial Institutions (FIs), Regional Rural Banks (RRBs), Scheduled Cooperative Banks, Agriculture and Rural Development Banks, State Level Apex Cooperative Housing Society and development organisations like MFIs or SHGs. However the most significant contribution comes from SCBs and HFCs (including AHFCs).1

As of 28 November 2013, there are 18 HFCs which have been granted Certificate of Registration2 (CoR) with permission to accept public deposits including 6 HFCs that are required to obtain prior written permission from National Housing Bank (NHB) before accepting any public deposits. 39 HFCs were granted CoR without permission to accept public deposits. 5 applications for grant of CoR are still under process.

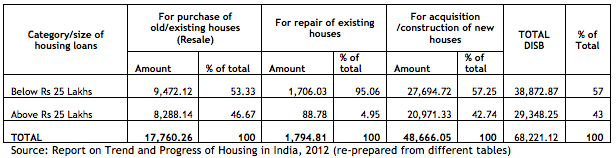

HFCs typically offer three products – housing loan, home improvement loan and Loan against Property. As of March 31, 2012, the percentage of housing loan to total loans offered by HFCs was about 74%3. The general product bifurcation of disbursement for housing in FY 2011-12 by HFCs is given below which clearly depicts the high demand for loans below 25 lakhs.

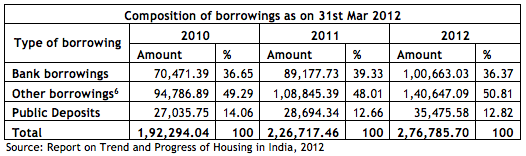

To enable continuous and uninterrupted disbursements of loans to eligible borrowers, AHFCs must have continuous, diverse, and reliable sources of funding. Currently, these sources are limited to raising equity from private sources, bank funds, private placement of debt, and for a handful of AHFCs (such as Gruh Finance, Saral Home Finance), public deposits with or without prior written permission. For the larger universe of AHFCs, however, the lack of access to capital markets and public deposits compels AHFCs to rely heavily on bank funding, in the form of both long- and short-term loans. This mixed composition of liabilities, when combined with the largely long-term nature of assets – the housing loan portfolio – to the tune of 86.7% of assets having a tenure above 7 years4, requires AHFCs to manage the risk of asset-liability duration mismatches including risk of refinancing short-term debt at higher interest rates. Hence, Asset Liability Management (ALM) becomes a key challenge to HFCs that are highly leveraged and rely predominantly on bank funding.

The regulatory authority and apex financial institution for HFCs, the NHB provides refinance assistance to eligible HFCs against their existing housing loans. Such a refinance scheme would be very beneficial for AHFCs and would help them in managing their ALM mismatches. NHB carried out refinancing to the tune of Rs 17,500 crore5 in the year ended June 2013 and expects to disburse Rs 20,000 crore under the refinance window. Funding of HFCs as on Mar 31, 2012 is shown in the below table:

In Part 2 of this post we write about the key features of the lending model, divergence in processes adopted by some AHFCs and the road ahead.

—

- As per Report on Trend and Progress of Housing in India, 2012, Table 14 on Percentage-wise Breakup of Disbursements between various categories of PLIs in 2011-12, SCBs constituted 61.51% and HFCs 36.85% of the total disbursement.

- http://www.nhb.org.in/Regulation/list_of_housing_finance.php

- NHB-Report on Trend and Progress of Housing In India, 2012

- NHB-Report on Trend and Progress of Housing In India, 2012

- Article titled ‘Banks, housing finance firms rush for refinance’ published online on August 20, 2013 at www.business-standard.com

- Borrowings through bonds and debentures, inter- corporate deposits (ICDs), commercial papers, sub-ordinate debt.