The economic and financial costs induced by the COVID-19 crisis have been tremendous, and the ordeal is seemingly far from over. In this post, we investigate one such cost, the cost of Interest on Interest (IoI), that emerged out of the RBI’s policy to grant a 6-month debt moratorium on various categories of loans, in light of news reports suggesting the Government of India has decided to waive IoI on loans up to 2 crores[1]

On March 27, 2020, the RBI, announced that financial institutions (FIs) may grant a loan repayment holiday (moratorium)[2] to borrowers for up to three months. Later on, on May 23, 2020, the RBI extended the moratorium period by another 3 months. The moratorium did not, however, amount to a strict stopping of the clock on debt repayment, since the RBI allowed banks to continue to charge interest for the period of the moratorium and, since such interest was not being paid, it added to the principal amount due, i.e., to capitalise the interest. Given the uptake[3] of the moratorium, it may be said that the RBI was successful at “mitigating the burden of debt servicing brought about by disruptions on account of the COVID-19 pandemic”[4] in the short run. However, the subsequent debt servicing burden is expected to only increase, especially due to the accrual of IoI. Table 1 illustrates the numbers for a hypothetical MFI customer.

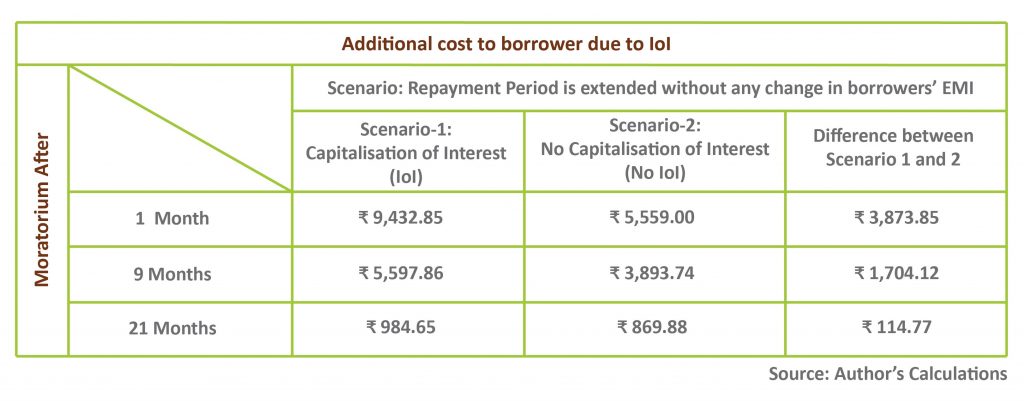

Table-1: Additional Cost to Borrowers due to IoI

[for an MFI loan, having Principal: ₹ 50,000, Annual Interest: 23%, to be repaid in 24 equal monthly instalments (EMI) and availing 6-month moratorium]

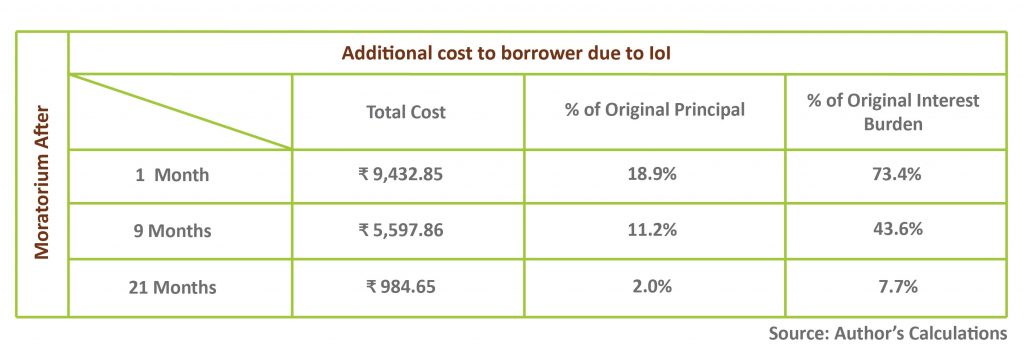

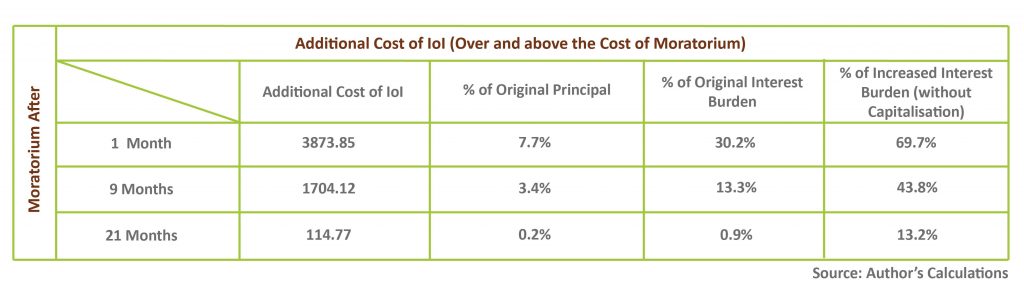

For a borrower who opts for a 6-month moratorium after repaying just 1 EMI, the example above indicates that she would have to pay an additional amount of Rs. 5,559, which represents more than 10% of her original Principal, or 70% over and above her original interest burden through the loan’s lifecycle. Further, when such a borrower is also expected to pay an additional IoI (at the same rate that the loan was disbursed), the borrower incurs an additional cost of almost Rs. 3,900, representing a 70% increase from the additional amount that she would have had to pay regardless due to the moratorium. The total burden of interest accrued, and IoI, thus come up to approximately Rs. 9,400 representing almost 20% of the initial Principal of Rs. 50,000 and a 73% increase in interest burden compared to a no-moratorium scenario. Thus, IoI leads to a significant increase in the debt servicing burden in almost all cases, ranging from 13% to almost 75% (See Tables 2A and 2B).

Table-2A: Total Cost of the Moratorium With IoI (as % of Original Principal and Interest Burden)

[for an MFI loan, having Principal: ₹ 50,000, Annual Interest: 23%, to be repaid in 24 EMI and availing 6-month moratorium]

Table-2B: Additional Cost of IoI (as % of Original Principal, Interest Burden, and cost of moratorium without IoI)

[for an MFI loan, having Principal: ₹ 50,000, Annual Interest: 23%, to be repaid in 24 EMI and availing 6-month moratorium]

Thus, the question emerges, who ought to bear this additional cost of interest on interest? Presently, the opinions on this subject are divided. A few commentators believe that it ought to be the responsibility of the FIs to absorb the burden, as COVID-19 and the resultant lockdown may be characterised as “cost of doing business”. Such an argument does not, however, hold much water when it is recognised that the COVID-19 shock is of an unprecedented nature, and consequently, there was no market available to firms for insuring against such a shock. Further, if providers are required to bear this cost, then it is very likely that they will have difficulties in servicing their own debt, and therefore in raising fresh funds, etc. It is then not hard to imagine that the cascading effect would be that of destabilising the financial system, especially in light of the liquidity crises which are fresh in market participants’ memories. Finally, if MFIs are mandated to forego the IoI, these last-mile providers would have no option but to reduce lending, thus severely limiting access to formal credit for low-income households (LIHs).

Arguments have also been made in favour of LIHs bearing the additional cost of the IoI. Such arguments often draw from two strands. The first posits that if the additional IoI is not paid to the lender, there would be a systemic risk to the MFI industry, which can be catastrophic. While this argument is true, it is not necessary for the borrower to repay MFIs to ensure stability. Any form of compensation to the MFI industry (up to an optimal amount) could easily achieve systemic stability, without the borrower having to bear the IoI. The second strand of the argument focuses on the timing of the Government’s steps on bearing the IoI. The argument supposes that absent an announcement by the Government at the very outset that it will bear the IoI, it is best not to intervene at all, since a late intervention would seem unfair to the borrowers who have already repaid. This, too, seems reasonable, and ideally, there should have been a prompt announcement by the Government. However, the argument is not quite valid in view of the fact that borrowers who did repay even during the moratorium period are not liable for IoI in any case, and so the Government’s announcement, even if it comes after the moratorium has ended, is designed to give some assurance and relief to borrowers who needed the moratorium, and therefore should not be faulted for availing of it. Further, in a country where loan waivers are commonplace, it seems that the Government stepping in to bear the IoI would not be so surprising. Finally, unlike the loan waivers, which affect the industry by disturbing repayment discipline, the impact of a one-time waiver of IoI is expected to only be positive for borrowers and providers alike.

It is important to note that the lockdown has substantially reduced the income earning capacity of many households, especially LIHs. It is unrealistic to expect them to bear the additional interest accrued due to the moratorium, and counterproductive to insist that they be liable for IoI. It should be noted here that the lockdown was a measure taken by the Government to adequately prepare for a potential capacity crisis in the health sector. The NBFC-MFIs might not be able to forego the entire accrued interest from their customers as this would severely affect their profitability, possibly even capital, and hence, their capacity to lend. Also, the COVID-related resolution framework is available to the borrowers of these entities, while these entities themselves cannot avail such resolution from their lenders. This could further strain NBFC-MFIs’ balance sheets. If the Government comes up with a formula to bear part of the accrued interest with the rest being borne by the NBFC-MFIs, this would ensure that there is no additional burden on LIHs while also keeping the NBFC-MFIs’ balance sheet healthy enough to support further lending.

[1] See the Times of India news report, titled “Centre ready to waive interest on interest during moratorium”, accessible at: https://timesofindia.indiatimes.com/india/centre-ready-to-waive-interest-on-interest-during-moratorium/articleshow/78455446.cms

[2] As part of the COVID-19 Regulatory Package. For details, see: https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11835&Mode=0

[3] According to RBI’s Financial Stability Report (FSR), June 2020, 50% of the borrowers representing 55% of debt outstanding had availed the moratorium during March and April 2020. See Table 1.4 of the RBI’s FSR, accessible at: https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=50122. A more recent study of select microfinance providers by Dvara Research, titled “COVID-19 and Debt Moratorium- The Case of Microcredit” suggests even in July, 2020, 20-40% of customers availing moratorium. Accessible at: https://dvararesearch.com/covid-19-and-debt-moratorium-the-case-of-microcredit/

[4] See Opening Paragraph of RBI’s COVID-19 Regulatory Package; Accessible at: https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11835&Mode=0