India Post through the decades has been an institution that has permeated the length and breadth of the country through its 155,000 branches. Its outreach, twice as large as that of all the commercial banks put together, puts it in a unique position in the quest towards financial inclusion. The humble post office, which the seeking eye can find in both urban and rural areas with relative ease, can be a potent force in delivering financial services, an argument which an expert committee on “Harnessing the India Post Network for Financial Inclusion” makes in their report. The committee was chaired by Ajay Shah, Senior Fellow, National Institute of Public Finance and Policy. Kshama Fernandes of IFMR Capital was also on the committee that has listed ten recommendations to deliver the following three integrated products to every Indian citizen:

- A savings account hosted on a lightweight banking platform

- A broad based payments network

- A competitive mechanism to deliver microloans to the poor

The summary recommendations of the committee are:

- India Post should deliver lightweight, low cost bank accounts to all Indian citizens and especially to the financially excluded population.

- India Post should look for ways to leverage its low cost platform by providing India Post branded accounts to other strategic partners, such as MFIs, mutual fund and insurance companies, and telecom operators.

- India Post should apply itself towards the challenge of achieving high volumes of money orders where payments of as little as Rs.10 are achieved at a charge of less than Rs.0.1 while requiring no subsidy from the exchequer.

- India Post should evolve the money order to become a mechanism for transferring money from one POSB account to another, instead of just being a mechanism for delivering cash from one person to another.

- India Post must build a payments infrastructure, through an array of contracts with partners, connecting up all POSB accounts and accounts of its partners, to effectively become a person to person money order capability (through mobile phones or web browsers) for a large swathe of India.

- India Post must elicit a large number of partners in terms of financial inclusion players, mobile service providers and innovative new technological choices in order to increase the size of the network.

- India Post must work closely with a diverse array of government agencies so that their G2P payments requirements are met through a combination of POSB accounts held by citizens and money orders delivered by government to those POSB accounts. The Ministry of Finance must work with India Post in rapidly rolling out this platform and network, given its important implications for direct, targeted delivery of government subsidies.

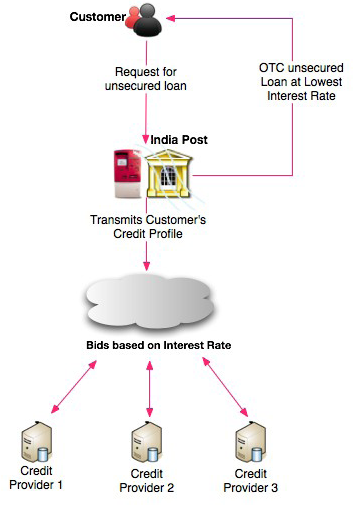

- India Post should play a role in the emergency credit aspect of financial inclusion, through a platform-building approach where private lenders deliver credit to the poor through a competitive framework.

- India Post should request the addition of its financial inclusion project into the Terms of Reference of the recently announced Technology Advisory Group for Unique Projects, and the leadership team of the India Post financial inclusion project should closely engage in the work of this Group, so as to bring in the best practices for project management.

- The role of the Post Office Savings Bank as an agent of the Ministry of Finance should be revisited and expanded to enable India Post to play a larger, direct role in financial inclusion and build appropriate enabling architecture.

Microcredit delivery

The Expert Committee makes interesting recommendations on delivering microcredit. According to the Report of the Committee on Financial Sector Reforms (CFSR) established by the Planning Commission, over 70% of loans taken by those in the lowest income quartile in India are from informal sources – moneylenders, relatives and friends. The Expert Committee believes there is a large latent demand for consumption and emergency loans. Thus a simple product – a Rs.500 loan with repayment at the end of the month, if available ubiquitously, may have a huge impact.

The Committee recommends that India Post act as an enabler and a facilitator of microloans. An individual Rs.500 loan should be offered with a maturity of month after obtaining his/her post office savings account information and Unique Identification.

Image source: Harnessing the India Post Network for Financial Inclusion

The report goes on to say that the geographical risk for lenders is minimised as the country-wide network of 155,000 post offices will make the defaults among the borrowers un-correlated.

India Post’s scale and volume gives it many advantages such as reduced cost of transactions and building up of customer database leading to a reliable credit information bank. But it could be the citizen of India that gets the biggest advantage because, the building with the red signpost that reads “INDIA POST” could be the critical window to a range of sophisticated and affordable financial management tools.

Read the full report on Harnessing the India Post Network for Financial Inclusion here.