At a recent Spark session, Anupama Sharma from the Centre for Insurance and Risk Management (CIRM) spoke about the major lessons livestock insurance has handed out. We bring you the highlights:

Around 50 million households in India depend on livestock for sustenance. Livestock acts as insurance for households that depend on agriculture for income. For close to 18 million households, livestock is the primary source of income. While the share of agriculture in the GDP has declined over the years, the share of livestock in agriculture – GDP has steadily been on the rise.

Quite obviously, studying livestock insurance is extremely important. Consequently, studying risks accruing to livestock dependent livelihoods is also important. The two risks that livestock dependent livelihoods are subject to are:

- Production Risk

- Price Risk

Production risk is a function of –

- Death – accidental and natural

- Disease – deaths due to epidemics and stoppage of milk production due to diseases

- Lack of nutrition

Price Risk is more market specific, and arises due to a poor supply chain for milk production and changes in the supply-demand equation in livestock and dairy products. Price risk plays second fiddle to production risk, since the latter is massive and pandemic. It is only after production risk is mitigated that price risk can demand attention.

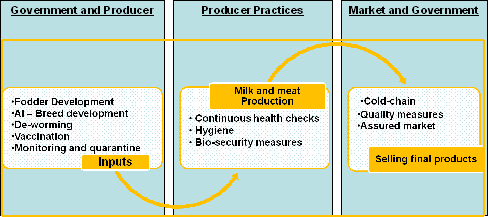

Livestock supply chain and ideal risk handling stakeholders:

Market and Government as stated earlier, only come into play at a later stage; when all production risks are taken care of. There are risks that are a precipitate, after all risks in the orbits of government & producer and producer practices are accounted for. These risks are residual risks and are the uncertainties that insurance covers.

Livestock risk management and livestock insurance in India:

Livestock risk management aims at improving the value of livestock and reducing the vulnerability of low income households. There are two components to risk livestock management – risk reduction and risk transfer, both aiming at soothing premium levels. Sadly, risk reduction mechanisms have not been functioning efficiently.

Public players have established a monopoly in the Indian livestock insurance market. Private players have trickled in only from 2003. As such, the market has a lot of shortcomings and inefficiencies. Most insurance products offer only death and Permanent Total Disability (PTD) cover and there are no products that cover risk beyond death. Moreover, demand is feeble due to low product knowledge and low awareness levels about insurance as a concept.

Challenges therefore, are manifold.

Assessment of cattle value tops the chart for supply-related challenges. This can be overcome by installing a National Identification System and employing models like a Standard Valuation Chart. These initiatives may be expensive at the outset, but can be scaled up at later stages. Pricing of premiums is another issue since there is little historical data. A solution to this can be digitising data available with insurers.

Conducting awareness camps and animal health camps may help surmount demand related challenges.

Livestock insurance: Lessons from across the globe

Revamping the livestock insurance space in India can be done best by adopting solutions from the world’s mature markets. The USA has moved from schemes covering death to price risk hedging. Insurance covers exist for fire, lightning and theft. In accordance with the US Agricultural and Risk Protection Act, the US Department of Agriculture and the Risk Management Agency provide Livestock Risk Protection for cattle. The EU has shifted from structuring and selling death covers to policies that cover disease. Through private insurers, statutory and non-statutory schemes, covers for death due to accidents or non-epidemic diseases are now available. Kenya has moved focus to designing covers that hedge transaction cost and a host of other risks like catastrophic events that affect fodder.

The livestock insurance industry in India can develop better productivity covers, disease covers and can bundle uncorrelated insurance products. It can also develop better financing mechanisms for risk reduction and develop better incentives for reporting epidemics.

CIRM in collaboration with KGFS, Dairy Network Enterprises (DNE) and HDFC ERGO has developed risk reduction products packaged with insurance and has also structured a productivity insurance product in partnership with BAIF. There is optimism in the air about forthcoming innovations and prospects for the sector as a whole.

One Response

Good job done Anupama. I am sure CIRM with their excellent initiatives would be in a position to enthuse the players in the insurance industry to proactively get insurance done for milch animals especially those in the rural areas. May I suggest Anupama to give a presentation at National Insurance Academy Pune, so as to spread the awareness amoungt the top persons in the insurance industry.