The All-India Debt and Investment Survey (AIDIS) carried out by the National Sample Survey Organisation (NSSO) and the Consumer Pyramids Household Survey (CPHS) carried out by the Centre for Monitoring Indian Economy (CMIE) are two nationally representative surveys that document how households borrow, save, spend and invest. In the wake of the Ministry of Statistics and Programme Implementation (MOSPI) releasing numbers from the latest (77th) round of AIDIS, we compare what both the surveys say about the participation in formal financial services by Indian households.[1] We expect reasonable similarity between them, given that both are considered nationally representative, and the essence of the questions asked to elicit household financial decisions are fundamentally the same. We acknowledge, however, that there are bound to be minor differences as the surveys differ in their design, sampling strategy, sampled households, and therefore the responses elicited.

AIDIS is a cross-sectional survey that interviews a different set of households roughly once every ten years, whereas CPHS is a panel survey that interviews the same set of households once every four months. Since it is a one-time survey, AIDIS collects detailed information on both household participation in and allocation towards a suite of financial instruments whereas CPHS only captures the former.[2] AIDIS follows a two-stage stratified sampling strategy[3] while CPHS follows a multi-stage stratified sampling strategy.[4] AIDIS sample comprises more rural than urban households, whereas the vice-versa holds true for CPHS.[5][6] Keeping these caveats about the surveys in mind, we proceed to look at how the numbers stack up vis-à-vis participation in formal financial assets first, and liabilities later.

Participation in formal financial assets

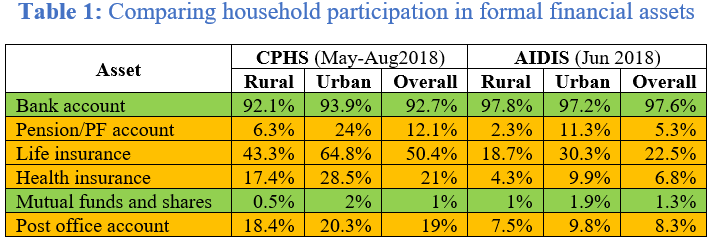

Table 1 describes household participation in formal financial assets according to the two surveys. Both the surveys report more than 90 per cent of households owning at least one bank account and roughly one-two percent of households investing in mutual funds, stocks and shares. But CPHS reports significantly higher participation in post office savings accounts, pension/PF accounts, life insurance, and health insurance. Some of these differences can be attributed to the way in which the questions are framed, and data is collected across the two surveys.

For example, CPHS has a direct question on members’ coverage under health insurance and we consider households with at least one member covered under health insurance to measure health insurance participation. However, in AIDIS, we can only use payment of premium for health insurance as a proxy for coverage, thus potentially excluding those covered under state and employer sponsored health insurance. This may explain, at least in part, the significantly higher figure for health insurance in CPHS. For some of the other financial assets however, the manner in which the questions are asked and participation measured is broadly the same, yet large differences prevail across the findings of the two surveys. Differences in the percentage of households with pensions, life insurance and post office account is more than double across the two surveys.[7] [8]

Participation in liabilities

Household participation in liabilities, both formal and informal,[9] are compiled in Table 2. Both surveys report a third of the households to be indebted and one in five households to have a formal loan. But, CPHS reports a significantly higher share of households having an informal loan (33%) than AIDIS (14%). On closer analysis, we find this difference to be mainly because CPHS, unlike AIDIS, also documents credit taken from shops under informal loans. The numbers converge when we exclude these loans while measuring informal loan participation in CPHS. However, CPHS still reports a substantially higher share of urban households having informal loan(s) while AIDIS reports a significantly higher share of rural households having formal loan(s).

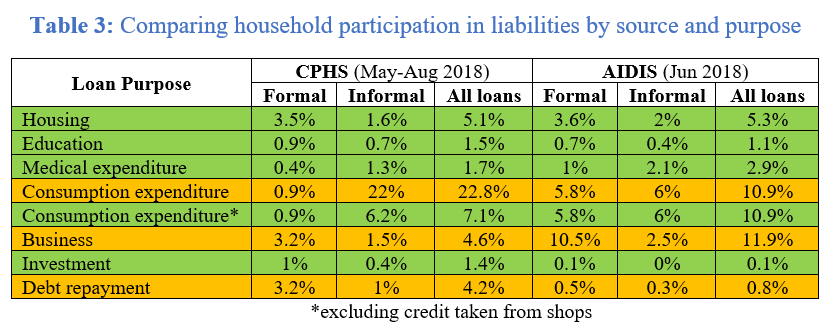

Finally, we check household participation in loans taken for different purposes that are documented in both the surveys. These numbers are compiled in Table 3. Both surveys report reasonably similar share of households that have taken loans for housing improvements, health and education expenses, and investment. CPHS reports a substantially higher share of households that have taken loans for consumption expenditure, and here again, the numbers converge when we exclude credit taken from shops. AIDIS reports a significantly higher share of households that have taken loans for investments in business. This can be because AIDIS probes its respondents on business related loans in greater detail, under four separate categories of revenue and capital expenditure on farm and non-farm businesses, whereas CPHS collects this information under a common head of loans taken for business investment. A higher share of households report taking loans for repaying debt in CPHS (4.2%) than in AIDIS (0.8%).

Discussion

To summarise the findings, we find numbers on bank account ownership as well as incidence of indebtedness to be comparable across both the surveys. However, CPHS reports significantly higher participation in other formal financial assets like post-office savings, pension/PF accounts, and life and health insurance, compared to AIDIS. Whether this is due to any inherent limitation of the CPHS sampling strategy as critiqued by Jean Dreze and Anmol Somanchi merits further investigation.[10][11]

We hope this comparison enables survey designers and researchers to deliberate on what can make both CPHS and AIDIS richer sources of information on Indian households than they already are. For instance, we see merit in CPHS adding questions about the participation in and usage of e-wallets and other digital financial services, that AIDIS has captured in this round. Similarly, CPHS has shown that shops are a major source of informal credit among Indian households, and this calls for other surveys like AIDIS to consider shops as a legitimate source of informal credit to get a more comprehensive and accurate picture of indebtedness among Indian households.

[1] AIDIS has collected household data as on June 30, 2018. We use data from the May-August 2018 wave of CPHS to make the numbers comparable

[2] A household’s participation in an asset or a liability refers to the household’s ownership of the asset or uptake of loan, whereas a household’s allocation towards an asset or a liability refers to the amount the household has invested in the asset or the loan amount that it has borrowed

[3] AIDIS follows two-stage stratified sampling where the census villages/sub-units of villages are the First Stage Units (FSUs) in rural areas and blocks/sub-units of blocks are the FSUs in urban areas. The Second Sampling Units (SSUs) are households situated in the FSUs. The selection of the FSUs and SSUs is done using Simple Random Sampling Without Replacement (SRSWOR)

[4] CPHS follows multi-stage stratified sampling strategy where homogeneous regions form the broadest level of stratification. Homogenous regions are neighbouring districts with similar agroclimatic conditions, urbanisation levels, and female literacy rates. CPHS divides India into 110 homogeneous regions. The villages and towns of 2011 Census then act as the Primary Sampling Units (PSUs) within these homogeneous regions. Households from these PSUs become the Ultimate Sampling Units (USUs)

[5] AIDIS interviewed 69,445 rural and 47,006 urban households during visit 1, and 68,291 rural and 44,781 urban households during visit 2. CPHS interviewed 53,337 rural and 95,823 urban households during the May-August 2018 wave

[6] After applying weights to the AIDIS sample, we have a total of 26.01 crore households all-India, with 17.24 crore rural and 8.77 crore urban households. After applying weights to the CPHS sample, we have a total of 29.37 crore households all-India, with 20.07 crore rural and 9.3 crore urban households

[7] CPHS collects information on outstanding savings as well as savings made during the data collection period (May-August 2018) across different savings instruments, and we consider these for measuring participation in post office savings accounts, pension/provident fund accounts, mutual funds and shares, and life insurance

[8] For measuring participation in AIDIS, we consider households having a non-zero balance in bank accounts, post office savings accounts, and mutual funds and shares. For pension accounts, we consider households with at least one member covered under Atal Pension Yojana, or which have made contributions to pension/PF accounts. For life insurance, we consider households which have paid premium for endowment/term-life insurance, households enrolled under Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), households with at least one member having life insurance, or if the sum assured under life insurance is greater than zero for the household, as proxies

[9] Formal liabilities are loans taken from financial institutions such as banks, co-operatives, microfinance institutions, self-help groups, etc. whereas informal liabilities are loans taken from moneylenders, employers, friends, relatives, etc.

[10] https://economictimes.indiatimes.com/opinion/et-commentary/view-the-new-barometer-of-indias-economy-fails-to-reflect-the-deprivations-of-poor-households/articleshow/83696115.cms

[11] https://economictimes.indiatimes.com/opinion/et-commentary/view-there-are-practical-limitations-in-cmies-cphs-sampling-but-no-bias/articleshow/83788605.cms

Cite this item:

APA

Niyati Agarwal, R. S. (2022). Comparing Participation in Formal Financial Services across Two Nationally Representative Surveys: CPHS vs. AIDIS. Retrieved from Dvara Research.

MLA

Niyati Agarwal, Rakshith S. Ponnathpur & Sahana Seetharaman. “Comparing Participation in Formal Financial Services across Two Nationally Representative Surveys: CPHS vs. AIDIS.” 2022. Dvara Research.

Chicago

Niyati Agarwal, Rakshith S. Ponnathpur & Sahana Seetharaman. 2022. “Comparing Participation in Formal Financial Services across Two Nationally Representative Surveys: CPHS vs. AIDIS.” Dvara Research.