Continuing on our series on Unemployment Support In India, this post provides an overview of the Mahatma Gandhi National Rural Employment Guarantee Act (2005).

The notion that public works programs can provide a strong social safety net through redistribution of wealth and generation of meaningful employment has been integral to the Indian policy-making agenda. The Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) 2005 is currently a major part of this agenda. The Act was enacted at a point in time when more than a decade of sustained high growth in GDP experienced in the 1980s and the 1990s was perceived not to have made a sufficient dent in poverty in the rural India.

The Act was notified on 5 September 2005 and was implemented in rural districts in 3 phases. Each state is required to design an employment guarantee scheme based on a set of national guidelines. Public work programmes or employment generation programmes like the Maharashtra Employment Guarantee Scheme (MEGS), Food for Work Programme (FWP), Sampoorna Grameen Rozgar Yojana (SGRY) and National Food for Work Programme (NFFWP) have been used to address the issue of unemployment and generate employment through the creation of labour- intensive productive assets and have thus provided the foundation for the MGNREGA.

Rationale

A common feature of all the schemes mentioned above was that they were formulated and executed by implementing agencies and their termination was at the will of the executive. The theoretical rationale behind employing these programmes is fourfold: i) mitigation of unexpected and seasonal shocks ii) mitigation of idiosyncratic shocks iii) anti- poverty measures; and iv) provision of public goods and services.

Mandate

The Act mandates enhancing livelihood security in rural areas by providing at least 100 days of guaranteed wage employment in a financial year to every household whose adult members volunteer to do unskilled manual work.

Objective

The primary objective of the Act is augmenting wage employment for the poorest of the poor while the secondary objective is to strengthen natural resource management through works that address causes of chronic poverty, like drought, and thus encourage sustainable development. (MoRD 2012).

The Act is an attempt to provide a legal guarantee of employment to anyone in rural areas willing to do casual manual labour at a statutory minimum wage. What makes the MGNREGA distinct from any other public employment programme is that it is a universal and enforceable legal right concurrent with some of the provisions of Article 391 and Article 412 of the Directive Principles of State Policy in the Indian Constitution that enshrine the ideals of the Right to Work.

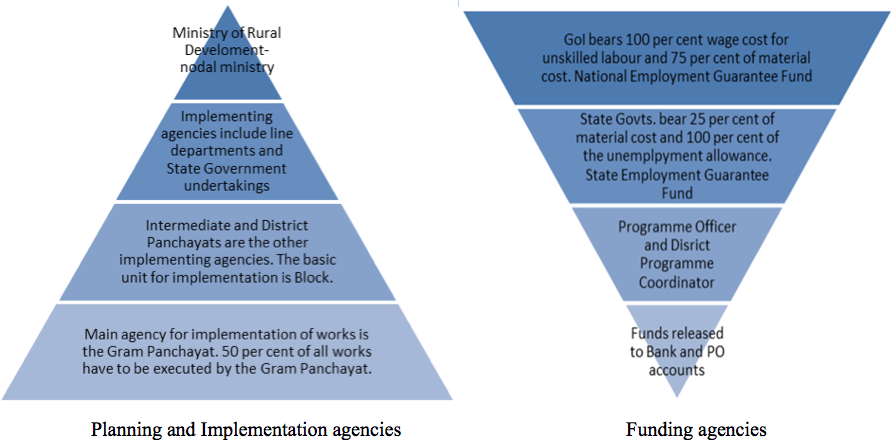

Planning, Implementation and Funding

The graphic below depicts the processes and agencies involved in planning, implementation and funding of works under the MGNREGA.

Design features

Key design features in the context of social security and unemployment support:

- Guaranteed Employment – Any adult member of a rural household applying for work under the Act is entitled to employment. Every rural household is entitled to not more than 100 days of employment.

- Guaranteed Wages – Wages are to be paid on a weekly basis and not beyond a fortnight. Wages are to be paid on the basis of:

- Centre- notified, state- specific MGNREGA wage list

- Time rates and Piece rates as per state- specific Schedule of Rates (SoRs)

- In any case, the wage cannot be at a rate less than Rs. 100 per day.

- Unemployment Allowance – If work is not provided within 15 days of applying, the state is expected to pay an unemployment allowance which is one- fourth of the wage rate.

- Provision of Work – Work is to be provided within a 5km radius of the applicant’s village, else compensation of 10 per cent extra wage is to be provided to meet expenses of travel.

- Gender Equity – Men and women are entitled to equal payment of wages. One- third of the beneficiaries are supposed to be women. Worksite facilities like creches are to be provided at all worksites.

- Financial Inclusion – Since 2008, all wage payments have had to be transferred to bank or post office accounts of beneficiaries.

- Social Security Measures – In 2008, a provision was created which made it possible to cover beneficiaries under either the Janashree Bima Yojana (JBY) or the Rashtriya Swasthya Bima Yojana (RSBY).

- Transparency and Accountability – All MGNREGA- related accounts and records documents have to be available for public scrutiny. Contractors and use of machinery is prohibited.

- Rights- based, demand- driven approach – Estimation and planning of work is conducted on the basis of the demand for work. Hence, beneficiaries of the scheme are enabled to decide the point in time at which they want to work.

—

1 – Article 39- Certain principles of policy to be followed by the State: The State shall, in particular, direct its policy towards securing

a) that the citizens, men and women equally, have the right to an adequate means to livelihood;

d) that there is equal pay for equal work for both men and women

2 – Article 41- The State shall, within the limits of its economic capacity and development, make effective provision for securing the right to work, to education and to public assistance in cases of unemployment, old age, sickness and disablement, and in other cases of undeserved want.

References – Ministry of Rural Development (MoRD). “MGNREGA 2005: Report to the People”. New Delhi (2012).

3 Responses

Thanks

THE INFORMATION PROVIDED IS GREAT….

how can u address the issues of traditional occupational people in India with this MGNREAGA programme