Over the past several months, there have been reports of growing debt stress among microfinance borrowers in Assam[1]. Reports of collection agents harassing the borrowers, especially women, for the non-repayment of dues, have led to protests and general social unrest in the area. The state of Assam has already been the subject of several shocks such as political protests, a natural calamity in the form of a flood, and not to mention, the ongoing pandemic[2]. The cascading of these multiple shocks, in turn, has led to an increase in delinquencies for both banks and microfinance institutions[3]. In response to these agitations, the state of Assam passed ‘The Assam Microfinance Institutions (Regulation of Money Lending) Bill, 2020’ with an intention to protect economically vulnerable people from microfinance institutions (MFI) and money lenders. This bill has provisions on, among others, the maximum limit of borrower indebtedness (significantly lower than the prescribed regulatory limit), the number of permissible MFIs lending to borrowers, and specifics on permissible recovery activities. These provisions directly challenge the authority of the Reserve Bank of India (RBI) which regulates banks and Non-Banking Financial Institutions (NBFCs) including NBFC-MFIs.

NBFC-MFIs are a separate category of NBFCs formed by the RBI based on recommendations of the Sub-Committee of the Central Board of Directors of RBI to Study Issues and Concerns in the MFI Sector (popularly known as the Malegam Committee)[4]. The creation of NBFC-MFIs was, in turn, a response to the financial crisis in Andhra Pradesh (AP) in 2010, where the State Government passed an Ordinance[5] to control the lending activities of banks and NBFCs in the state[6]. But the Malegam Committee wasn’t the first. There were attempts prior to this to regulate microfinance, albeit through a legislative route[7].

The immediate result of the AP crisis was a steep rise in delinquencies from pre-crisis PaR 30[8] figures of less than 4% to around 24% in 2011[9]. Further effects were that in the year after the ordinance, the Indian microfinance sector saw a decline of both overall loan portfolio and number of borrowers by around 20%[10], and a significant decline in the average household consumption in the AP region[11].

Such knee-jerk reactions to instances of harassment by microlenders of over-indebted households[12] deprive low-income households who have a legitimate demand for credit. It also begs the question of why citizens must shift to formal credit if basic protections cannot be provided to them in their interactions with lenders. As the events in Assam seem to be following a similar path as those in AP from a decade ago, it is incumbent upon the RBI to reflect on the issues plaguing the sector and to explore, beyond a cursory assessment of political risk, why such events that result in great costs to low-income borrowers and the providers of finance to them, keep recurring. We provide some analysis.

1. Unsuitable Indebtedness limits

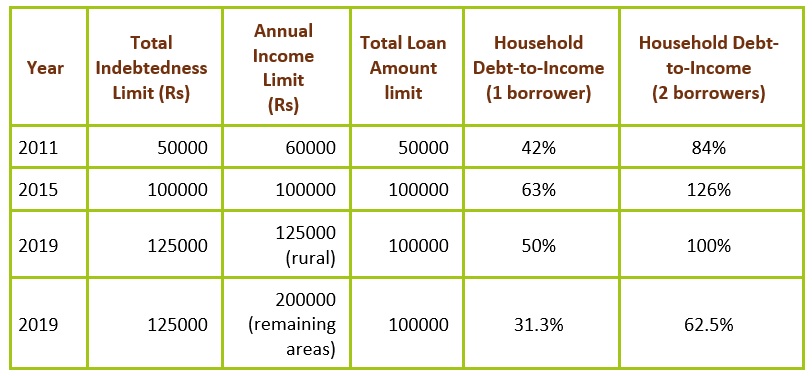

At the heart of the recurring issues is a failure of the consumer protection mandate of the RBI to protect the interests of low-income household borrowers. NBFC-MFIs’ micro-lending is restricted by the RBI to households with up to Rs. 1.25 lakh income (rural) and Rs. 2 lakhs (remaining areas). The total borrower indebtedness is capped at Rs. 1.25 lakh, irrespective of whether the borrower belongs to a rural or non-rural household[13]. An estimation of the household debt-income ratio considering the average MFI interest rate and tenure shows us that these limits (which have been revised upwards multiple times since they were first introduced) are likely increasing the borrowers’ risk of over-indebtedness even if one were assuming stable monthly incomes and no expenses (see Table 1[14] on likely figures of household debt-to-income given the current lending criteria[15]).

NBFC-MFIs are permitted to lend up to an indebtedness limit of Rs.125,000 (this includes interest) to a single member of a non-rural household irrespective of the quantum of non-microfinance loans the borrower or her household already has. Assuming a conservative estimate that the borrower will take two years to repay the amount borrowed, and that this amount is in fact the upper limit allowed, then this implies that her annual indebtedness limit for microfinance loans is Rs.62,500 and that her debt-to-income ratio on an annual household income base of Rs.200,000 is 31.3%. If there are two microfinance borrowers in the household, which is quite common, the debt-to-income ratio will increase to 62.5%. For a rural household with a lower income base, the corresponding ratios are higher, at 50% and 100% respectively.

Table 1: Revisions to MFI Lending Criteria to Rural Households

In reality, expenses form a substantial portion of allocations for incomes[16] of low-income households. The average annual expenses for an Indian rural household belonging to the bottom 3 income quintiles[17] stands at 90% of income and that for an urban household is at 86%. The allocations do not reduce much for households belonging to the third quintile alone (71% and 74% for rural and urban respectively). If one were to make a more realistic calculation of debt-to-Income in the form of debt-to-disposable surplus of the household, all these households will be in the red, indicating that these prescriptions are not just wrong for the purpose they are meant to serve, but they also inflict egregious harms on India’s low-income households.

Further, making the matter worse is the incomplete picture of borrower indebtedness that is reported to credit bureaus. A 2016 study in the Krishnagiri district by Dvara Research showed that less than half of a household’s institutional debt is captured in the reporting to credit bureaus[18]. The study found that this incomplete credit profile led to about 33% of households being misclassified as being eligible to receive loans when in fact their indebtedness levels were above the prescribed total indebtedness limits.

Moreover, only NBFC-MFIs are subject to these debt-to-income limits as well as the multiple lending limit of having not more than two NBFC-MFIs lend to a borrower. These entity-specific regulations mean that other entities such as banks, including small finance banks, most of whom were earlier NBFC-MFIs, can lend beyond these limits to the same borrower, adding to their indebtedness.

In short, the prescribed indebtedness limits are unsuitable, and the issue worsens due to the lack of a complete picture of borrower indebtedness being required by / made available to lenders.

A possible solution

There have been efforts by the Microfinance Institutions Network (MFIN) to bring all lenders of microloans to adhere to a set of common guidelines under their ‘Code for Responsible Lending’ which is applicable to an extent to banks as well[19]. Additionally, MFIN also plans to bring in a 360° credit bureau report which provides information on all the members of the borrower household and not just the borrower alone[20]. However, these efforts will only solve part of the problem.

The RBI must categorically require all lenders to undertake an assessment of the borrower’s repayment capacity before sanctioning loans[21]. Such an assessment must take into account the disposable income and all repayment obligations of the borrower, without which, the provider’s lending may push the borrower into over-indebtedness even if the provider continues to adhere to the prescribed regulatory limits[22]. It is important that such a requirement be placed on all lenders (banks and NBFCs) and for all retail credit products (such as farm loans and MSME loans) and not just on NBFC-MFIs or only for microloans. No borrower must be over-lent by an entity simply because such a rule does not apply to them.

Once such a requirement is in place and the RBI builds some muscle to supervise the ability of lenders to undertake such assessments with the full seriousness that such assessments deserve, the stipulation of a maximum number of loans or loan limits will become redundant and can gradually be removed. Needless to say, this would also help in creating intensified price competition in microfinance.

2. Inadequate credit market monitoring abilities of the supervisor

With the current supervisory system of returns in place for banks and NBFCs, the RBI has visibility only on the outstanding amounts in a region or economic sector on a quarterly basis. This means that it does not collect information on fresh credit disbursed every quarter. Without this, the RBI will not be able to track a periodically changing picture of the extent of lending, and any subsequent overheating in the credit ecosystem on a granular basis, such as for the various districts of Assam. Moreover, while the lender has visibility over the debt serviceability of its borrowers and the Credit Information Companies record borrowers’ outstanding credit and repayment behaviour, this information is not visible to the RBI[23] in a manner that it can be tracked at a sufficient level of granularity.

A possible solution

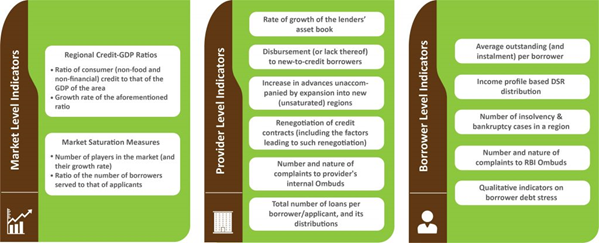

We propose that the RBI build capabilities to monitor credit markets at a granular level and in doing so, build in-house capabilities to detect and prevent regional or customer-segment level pockets of borrower debt stress. We propose a framework for the same (in Figure 1) with indicators at three different levels – 1) Market 2) Provider and 3) Borrower-level. Building data collection and analysis capabilities along the lines of this framework will provide the RBI an increased level of visibility over the level of indebtedness in the economy, as well as oversight of the credit markets [24].

Figure 1: Framework for Credit Monitoring and Detection of Over-indebtedness

Among the component indicators of the framework, is the borrower level indicator of debt service capacity ratio (DSR)[25], which could serve as an early warning indicator of difficulties faced by the borrower households in meeting their repayment obligations. For information on DSR to become visible to and usable by the RBI, we propose that all providers must capture and report the distribution of borrower DSRs across income segments to the RBI. Given that real-time tracking of DSR may not be feasible, other indicators in conjunction with the DSR can be used to provide reasonable visibility into localised overheating. For instance, a high number of loans per borrower is often correlated with the incidence of over-indebtedness. Therefore, capturing the distribution of this indicator (i.e., distribution of number of loans per borrower across income categories) could help tremendously to produce early warning signals for the RBI. Further, these indicators, when analysed together with market level indicators such as the credit-district GDP ratio as in the case of districts in Assam, would alert the RBI to signs of regional over-heating, based on which the RBI could intervene to slow down credit growth.

To conclude, we see that such regulatory and supervisory lapses affect both borrowers and providers in the credit market. Political parties in Assam are now calling for loan waivers of microloans. Such political decisions could further worsen delinquencies, the credit culture, and future credit prospects of borrowers. Therefore, it is imperative that these lapses be addressed by the RBI so that such crises do not occur as often as they do.

[1] Malik.S. (2020, February). Microfinance Lenders in Assam See the Biggest Jump in Stressed Assets in Q3. BloombergQuint. Retrieved from: https://www.bloombergquint.com/business/microfinance-lenders-in-assam-see-the-biggest-jump-in-stressed-assets-in-q3

[2] Nath.HK. (2020, December). Assam minister slams MFIs for harassing poor women over failed loan repayments. India Today. Retrieved from: https://www.indiatoday.in/india/story/assam-minister-slams-mfis-harassing-poor-women-over-failed-loan-repayments-1754685-2020-12-31;

Roy.S. (2020, October). Micro-credit collections in East, N-E lagging national average. Business Line. Retrieved from: https://www.thehindubusinessline.com/money-and-banking/impacted-by-covid-floods-mfi-collections-in-east-north-east-still-at-80/article32872563.ece

[3] Nahata.P. (2020, January). ICRA Flags Asset Quality Risks for Microfinance Lending in Assam. BloombergQuint. Retrieved from: https://www.bloombergquint.com/business/icra-flags-asset-quality-risks-for-microfinance-lending-in-assam

[4] See Report of the Sub-Committee of the Central Board of Directors of Reserve Bank of India to Study Issues and Concerns in the MFI Sector. Retrieved from: https://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/YHMR190111.pdf

[5] See ‘Andhra Pradesh Micro Finance Institutions (regulation of money lending) Ordinance, 2010’. Retrieved from: https://indiamicrofinance.com/wp-content/uploads/2020/08/Andhra-MFI-Ordinance.pdf

[6] See commentary on the key aspects of the ordinance situation in 2010: Mor.N, Ananth.B. (2010, November). Andhra Pradesh Financial Crisis Threatens to Snowball into a National Crisis. Retrieved from: https://dvararesearch.com/2010/11/18/andhra-pradesh-financial-crisis-threatens-to-snowball-into-a-national-crisis/

[7] See ‘The Micro Financial Sector (Development & Regulations) Bill 2007’ which sought to designate NABARD as the regulator of the micro financial sector. Accessible from: https://www.prsindia.org/billtrack/the-micro-finance-institutions-development-and-regulation-bill-2012-2348

[8] Portfolio at Risk (PaR) 30 is the percentage of gross loan portfolio that is overdue by more than 30 days.

[9] Mader.P. (2013, February). Rise and Fall of Microfinance in India: The Andhra Pradesh Crisis in Perspective. Strategic Change. Retrieved from: https://www.researchgate.net/publication/264487807_Rise_and_Fall_of_Microfinance_in_India_The_Andhra_Pradesh_Crisis_in_Perspective

[10] ibid

[11] Sane.R, Thomas.S. (2015, November). The real cost of credit constraints: Evidence from Micro-finance. The B.E. Journal of Economic Analysis & Policy, Volume 16, Issue 1, Pages 151–183, eISSN 1935-1682, ISSN 2194-6108, DOI: https://doi.org/10.1515/bejeap-2014-0154

[12] See commentary on the key aspects of the ordinance situation in 2010: Mor.N, Ananth.B. (2010, November). Andhra Pradesh Financial Crisis Threatens to Snowball into a National Crisis. Retrieved from: https://dvararesearch.com/2010/11/18/andhra-pradesh-financial-crisis-threatens-to-snowball-into-a-national-crisis/

[13] See ‘Qualifying Assets Criteria – Review of Limits’, RBI Notifications. Retrieved from: https://rbidocs.rbi.org.in/rdocs/notification/PDFs/NT95A0F9E84CA85C4CE3A1ABA9B2E2459569.PDF

[14] Expanded from N.Kumar, D.George. (2019, October). Let’s stop kicking the can down the road: Highlighting the important and unaddressed gaps in microcredit regulations. Retrieved from: Dvara Research Blog | Let’s stop kicking the can down the road: Highlighting important and unaddressed gaps in microcredit regulations

[15] See ‘Qualifying Assets Criteria – Review of Limits’, RBI Notifications. Retrieved from: https://rbidocs.rbi.org.in/rdocs/notification/PDFs/NT95A0F9E84CA85C4CE3A1ABA9B2E2459569.PDF

[16] Unpublished work from Dvara Research’s Household Finance Research Initiative using data from the CPHS-CMIE survey. The averages have been taken for the period 2014 to 2019 to smooth out volatilities in individual years.

[17] The average annual income of rural households belonging to the bottom three quintiles is Rs.113,532. This roughly matches to the annual income limit of Rs.125,000 prescribed for microlending to rural households.

[18] Prathap V., Khaitan R. (2016, December). When is Microcredit Unsuitable? Dvara Research Working Paper Series No. 2016-02. Retrieved from: https://dvararesearch.com/wp-content/uploads/2017/01/When-is-Microcredit-Unsuitable-Guidelines-for-Lending.pdf

[19] Ray.A. (2019, Sep). Lenders of micro loans to follow a responsibility code. The Economic Times. Retrieved from: https://economictimes.indiatimes.com/industry/banking/finance/mfin-sa-dhan-release-code-for-responsible-lending-for-micro-credit-industry/articleshow/71150442.cms?from=mdr

[20] See CARE Ratings Webinar – Is microfinance sector on the path of recovery post moratorium (51:23). (2020, August). CARERatingsOnline. Retrieved from: https://www.youtube.com/watch?v=2fIhdh6cLW4

[21] One of the good practices as highlighted by FinCoNet in its report on responsible lending is ‘Reasonable assessment of the interests of a consumer’ which states that credit providers and credit intermediaries must facilitate the provision of credit only upon the reasonable assessment that it meets the interest of the consumer, including affordability. See FinCoNet report on responsible lending- Review of supervisory tools for suitable consumer lending practices. (2014, July). International Financial Consumer Protection Organisation. Retrieved from: http://www.finconet.org/FinCoNet-Responsible-Lending-2014.pdf

[22] For a comprehensive description of business processes that MFIs can incorporate into their operations to reduce instances of borrower over-indebtedness, refer: George.D. (2019, February). A Practical Note on Operationalising Suitability in Microcredit. Retrieved from: https://dvararesearch.com/wp-content/uploads/2019/02/Operationalising-Suitability-in-Microcredit.pdf

[23] Bhattacharya.D., Neelam. A., George.D. (2021, January). Detecting Over-Indebtedness While Monitoring Credit Markets in India: An Approach. Retrieved from: https://dvararesearch.com/2021/01/28/detecting-over-indebtedness-while-monitoring-credit-markets-in-india-an-approach/

[24] ibid

[25] Debt Service Capacity Ratio = (Income of the Borrower – Expenditure of the Borrower)/ Repayment Obligation of the Borrower