Transparency in public disclosures by financial institutions is key to the effective functioning of market disciplining mechanism in the banking system. In the last few decades, in the aftermath of financial crises, transparency in reporting standards and its links to financial stability has been a topic of much debate and discussion across the globe[1]. Back in India, the Punjab National Bank scam[2] exposed the need for the availability of relevant and timely information on the activities of banks, and since then, there have been renewed calls for greater transparency in bank balance sheets.

Market disciplining, along with prudential regulations and regulatory supervision, work towards identifying, monitoring, and where required, disciplining the risk-taking activities of financial institutions and help maintain systemic stability. While there are limitations and possible adverse effects of transparent disclosures, our review of literature on transparency indicates that there is ample evidence on the effectiveness of market discipline and the importance of transparent disclosures in achieving this, along with the associated economic benefits. Broadly, there are three channels through which this mechanism operates – the depositor channel, the public investor channel, and the private investor channel. While there are overlaps among these classes of market participants, there are important differences in their mechanism of operation. One crucial difference is that the first two channels depend entirely on public disclosures, thereby making transparency of such disclosures essential to accurately assess the financial health of banks by these two channels.

Our Study

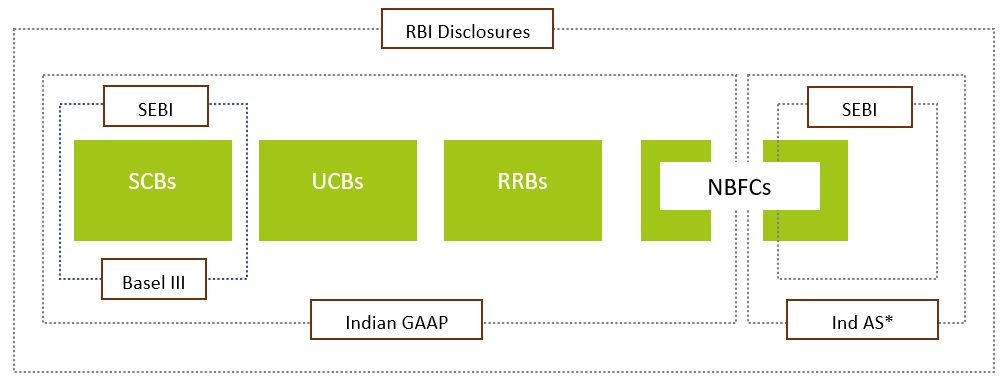

In this paper, we assess the public disclosure regime of the Indian banking sector, particularly those applicable to scheduled commercial banks (SCBs), urban cooperative banks (UCBs), regional rural banks (RRBs), and non-banking finance companies (NBFCs) and comment on the level and quality of disclosures enabled by this regime. Among NBFCs, we focus only on those that have permissions to raise their liabilities from public investors or depositors. Accordingly, NBFCs-D (both listed and unlisted) and listed NBFCs-ND-SI are part of the analysis. While NBFCs-D are subject to market discipline by public depositors and (or) public investors, market discipline operates through the channel of public investors in the case of listed NBFCs-ND-SI. The analysis is restricted to public disclosures mandated by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Where disclosures mandated by the regulators were found to be lacking on transparency, the relevant accounting standards, both under Indian Generally Accepted Accounting Principles (Indian GAAP) and Indian Accounting Standards (Ind-AS) issued by the Institute of Chartered Accountants of India (ICAI) were evaluated to assess whether they help fill the identified gaps.

Figure 1: Applicability of Disclosure Regimes on RBI-regulated Entities

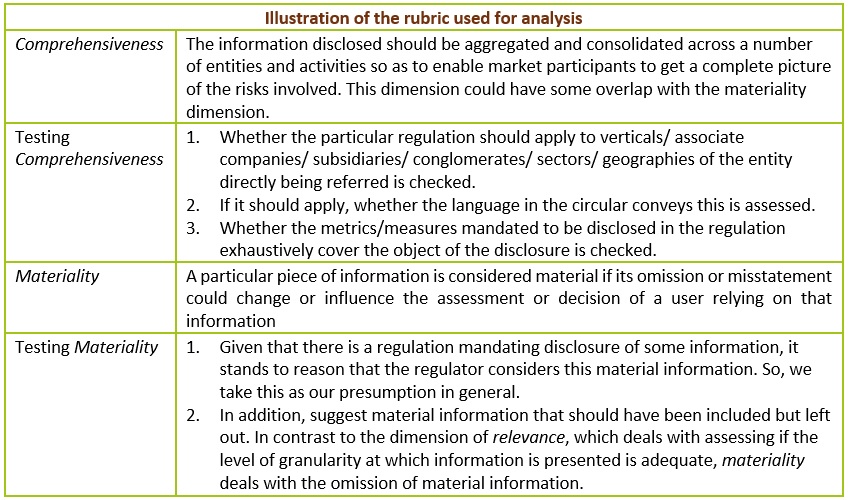

To assess the level and quality of transparency enabled by the above applicable disclosure regime, we use the framework presented by the Basel Committee in its report titled Enhancing Bank Transparency, published in 1998. This report identifies six broad categories of information, which when disclosed in clear terms and in adequate detail, can enable market participants to assess the financial health of banks. In this report, however, we focus only on three categories of information which can be classified as being related to a) risk exposures, b) risk management strategies and practices, and c) financial position – to bring greater alignment between the objectives of this study and Dvara Research’s primary focus on financial stability[3]. The Basel framework also lists five dimensions or qualitative characteristics of information that contribute to transparency. These are comprehensiveness, relevance and timeliness, reliability, comparability, and materiality. We assess, using a rubric, the disclosure requirements under the above three categories of information against each of these dimensions and comment on the level of transparency promoted by the present disclosure regime. For instance, the rubric for assessing comprehensiveness and materiality is shared below as an illustration:

Key Findings from our Analysis

We list below some of the main findings for each of the entities –

Scheduled Commercial Banks

For SCBs, our study finds that, for the most part, the disclosures fare well on the dimensions of comprehensiveness, reliability, and comparability. The disclosures are comprehensive in that they cover all the geographies, business verticals, types of exposures (banking and trading book, and markets. On the reliability dimension, most of the information disclosed is historical and audited. This enhances the reliability of the information disclosed. Where there is ex-post divergence, like for NPA numbers, there are disclosures which provide information on these divergences. Also, the disclosure formats and metrics to be disclosed are defined objectively and applied uniformly across all SCBs. This enables an easy and accurate comparison of information among SCBs.

Regarding timeliness, the frequency of disclosure should match the minimum time it takes for risks to materialise for the disclosure to be considered timely. Risk here can be thought of as any event causing a material change in the books of accounts. For credit risk, this is at least 90 days, while market risks can manifest in a much shorter period. Thus, the capital, NPA position, and exposures of a bank could substantially change over the period of a quarter or less. However, this gap is mitigated largely because Basel Pillar III disclosures on credit risk and capital adequacy are required to be disclosed at least every quarter, with the other Pillar III disclosures to be made at least on a half-yearly basis.

The disclosures are found wanting in the remaining dimensions of transparency, i.e., on relevance and materiality. The shortcomings are most pronounced for information on risk exposures, and to a much lesser extent for information on financial position. With respect to the information on risk management strategies and practices, the Basel III disclosures mandate such information for each of credit, market, operational, and banking book interest rate risks. The disclosures in the Notes to Accounts have similar information on liquidity risk. However, a major lacuna here is the absence of an integrated picture of the risk management policies of the bank. This is important as it is not always obvious to the consumer of this information what the overall risk management philosophy of the bank is and if there are any blind spots in their risk management processes.

Non-Banking Financial Companies

In the case of NBFCs, comparability was one dimension along which disclosures were found to be most transparent across all NBFCs under consideration in this study. On the other hand, timeliness of disclosures was a point of concern as majority of the disclosures are to be made only annually. Similar to banks, significant changes to the financial health of the listed NBFCs can take place over the period of a quarter or less. Thus, annual disclosures fall short when it comes to ensuring that key financial information is made available to various stakeholders in a timely manner.

Listed NBFCs and Unlisted NBFCs for whom Ind-AS is applicable

In the case of listed NBFCs, our study finds that the disclosures on their financial position are relatively more transparent when compared to the disclosures on risk exposures. For example, disclosures on the borrowings of listed NBFCs include information on carrying values of borrowings, amounts overdue (including interest accrued and not paid), and borrowings by instrument type. In addition to this, as per SEBI regulations, listed NBFCs are also required to make disclosures to stock exchanges on defaults in payment of interest / instalment obligations on credit obtained from banks / FIs and unlisted debt securities. These disclosures hence provide material and relevant information required to help stakeholders understand the borrowing profile of the listed NBFCs. In contrast, disclosures on risk-related information were lacking on relevance and materiality. For example, disclosures on credit risk do not include information on total advances extended by the listed NBFCs by economic sector. This would be useful to understand the exposure of the listed NBFC to different real sectors of the economy and possible credit risk arising from such an exposure pattern.

The findings discussed above for listed NBFCs are equally applicable to unlisted NBFCs for whom Ind-AS is applicable, with the exception of SEBI’s disclosure requirement on defaults in repayment of debt. The non-applicability of the SEBI regulations would mean that the disclosures on borrowing profile would be inadequate for these NBFCs.

Unlisted NBFCs-D with a net worth less than Rs. 250 Cr for whom Indian GAAP is applicable

At an overall level, both financial position and risk-related disclosures were found to perform poorly on transparency. For instance, disclosures on risk management strategies and practices were found to be inadequate across all types of risks faced by the NBFCs. With respect to risk exposures, inadequacy was most significant on the dimensions of materiality, relevance, and timeliness. To exemplify, on credit risk, only information on standard assets and NPAs is available. This is inadequate as assets do not turn NPA overnight. Disclosing the Days Past Due (DPD) buckets for standard assets would better enable market participants to estimate the emergent NPA situation. On market risks, RBI disclosure requirements stop short at providing information on sources of such risks. They do not go further to provide information on the expected impact from such risks (e.g., sensitivity analysis) on the financial position of the NBFCs. Disclosures on the former too were found to be inadequate as they do not provide comprehensive information on all sources of market risks.

Urban Cooperative Banks

Disclosures belonging to the categories of financial position and more so, of risk exposures of UCBs, performed poorly on the dimension of materiality. This is especially the case with disclosures related to NPAs. For instance, details such as sector-wise NPAs, the concentration of NPAs among certain entities or borrowers, and slippages of NPA amounts across the classifications of substandard and doubtful are not included in the disclosures. The current set of disclosures on NPAs provides no sense of incipient stress, i.e., movements of past-due credit amounts before they become NPAs or results of stress tests of the bank which could give a picture of the potential movement of NPAs. Also, there are currently no disclosures on the liquidity risk position of UCBs. This is a major lacuna as these entities offer demand deposits.

Regional Rural Banks

For RRBs, all the risk exposures-related disclosures were inadequate along the dimensions of relevance, timeliness, reliability, and materiality. For instance, disclosures on asset quality are not timely since they are only disclosed annually, whereas the picture of asset quality of both advances and investments is subject to changes even in the span of a quarter. Also, there is insufficient granularity in the information disclosed, especially in the disclosure of restructured accounts, thus reducing the relevance of the disclosures. The reliability of asset quality disclosures too is low as any divergences found in the classification of NPAs are not required to be disclosed.

The Way Forward

We outline below some of our major recommendations that RBI can consider implementing to enhance the transparency of disclosures mandated by it –

-

Greater and more consistent disclosure of risk metrics for all entities covered: A common thread running through our analysis is the inadequate disclosures of risk-related information for SCBs, NBFCs, UCBs, and RRBs. The focus of disclosure needs to shift from disclosing only gross values of exposures and capital charges, to disclosing more qualitative and quantitative information on the underlying risk drivers and the models used for valuing these risks.

-

Disclosure of Stress Test results for all entities covered: The design of the stress test scenarios gives insights into the management’s view on the relevant risk drivers, while the results of the stress tests indicate the impact of the evolution of these drivers on the balance sheet of the bank. This information is forward-looking and complements the historical information disclosed in the risk metrics.

-

Bringing greater alignment between RBI mandated disclosures and Ind-AS: In the case of NBFCs, Ind-AS was found to mitigate many of the inadequacies in the transparency of RBI’s disclosure requirements. This was especially the case with disclosures on risk management practices and strategies where it requires NBFCs to disclose their approach to risk management for each type of risk. On the quantitative side, however, they cannot always be viewed as improving the overall transparency levels. For instance, with respect to risk exposures, while Ind-AS prescribes specific disclosures (for example, sensitivity analysis for market risks), thereby filling the gap in RBI’s disclosure requirements, it leaves it up to the discretion of NBFCs on how they want to make these disclosures. Here, RBI can build on the guidance provided by Ind-AS by defining clearly the disclosures required and ensure that key information relevant to stakeholders of NBFCs are mandatorily disclosed, thereby also promoting comparability of such information across NBFCs.

-

Extending Ind-AS for Scheduled Commercial Banks, Urban Cooperative Banks and Regional Rural Banks: Our analysis of the disclosure regime applicable to NBFCs indicates that the disclosures under Ind-AS could complement many of the inadequacies in RBI’s disclosures. Therefore, we recommend extending the applicability of Ind-AS to SCBs, UCBs and RRBs. This would not only aid greater transparency, but also harmonise the accounting standards applicable across all entities. In particular, the disclosures on expected credit loss (ECL), mandated by Ind-AS, would enhance the relevance of information on credit risk. More importantly, due to ex-ante provisioning under ECL, investors can get a better idea of how well these banks are able to assess their credit risk.

-

Mandating quarterly disclosures for NBFCs, UCBs, and RRBs: Lack of timeliness of disclosures is a common concern across NBFCs, UCBs and RRBs as almost all disclosures are only annual. While there is no scientific basis to determine the frequency of disclosures, the minimum duration for materialisation of risk, compliance costs, and cognitive limitations of information users are some of the factors that need to be considered. Considering the above factors, we believe that disclosures on certain aspects like capital, NPAs, and credit risk need to be made at least on a quarterly basis. This is also in line with Basel III disclosure requirements.

The full paper is available here.

[1] See Goldstein, M., & Turner, P. (1996). Banking Crises in Emerging Economies: Origins and Policy Options. BIS Economic Papers, No. 46. Bank of International Settlements. Accessible at: https://www.bis.org/publ/econ46.pdf; Barth, M., & Landsman, W. (2010). How did Financial Reporting Contribute to the Financial Crisis? European Accounting Review, 19, issue 3, p. 399-423; (2013). Review of Accounting Practices Comparability of IFRS Financial Statements of Financial Institutions in Europe. European Securities and Markets Authority.

[2] See Radhika Merwin, “PNB scam: how a system was gamed.”, February 21, 2018, Business Line. Accessible at: https://www.thehindubusinessline.com/opinion/pnb-scam-how-a-system-wasgamed/article22818081.ece

[3] The other three categories of information not covered in this study, but part of the Basel Committee paper includes financial performance, accounting policies, and basic business, management, and corporate governance information.