The household sector, comprising of individuals, households, proprietorships, and other non-corporate entities, has over INR 46 trillion as outstanding in the Indian formal credit market.

The ability to access credit enables an individual and her household to gain better financial wellbeing and economic welfare outcomes, and an excess of credit can diminish any developmental gains. Excess household debt can also negatively affect the growth and stability of the economy. Signs of borrower distress have been appearing in many states over the past years and most recently in the eastern states of India (for instance, legislation was passed in Assam in 2020 to regulate formal microfinance lenders). Many of these events did not end well, either for borrowers or for lenders. This serves as a reminder that there is a need to develop a regulatory capacity to monitor credit markets and to prevent and manage distress caused by over-indebtedness.

Unlike several jurisdictions, especially Europe[1], India does not have a clear definition of over-indebtedness (OI). Quantitative measures such as incidence of defaults on loans are inadequate as the impact of over-indebtedness is often experienced by the borrower before going into default. This distress in the repayment of loans often remains undetected due to the measures that households take. The measures range from mild coping mechanisms, such as borrowing from family, acquaintances and informal lenders, to extreme coping mechanisms, such as skipping meals or discontinuing children’s education. Long-drawn and geographically concentrated OI may also develop into systemic risk and political unrest, adversely impacting credit markets and inhibiting growth in the real economy.

The Reserve Bank of India (RBI) uses various approaches to combat OI, including ex-ante micro-prudential tools, like mandatory credit bureau checks and placing loan exposure limits. It also uses ex-ante macro-prudential tools like asset-level risk-weighting approaches and prescriptions on asset provisioning. Presently, the provider has visibility over the debt serviceability of their borrowers, and Credit Information Companies (CICs) record her outstanding credit and repayment behaviour. However, the RBI currently does not have access to such indicators. Thus, to discharge its assigned objective of ensuring “systemic stability” and “consumer protection”, the RBI must have visibility over the debt serviceability levels in the economy. This visibility must be at an appropriate level of geographic granularity (e.g. district-level, for India’s more than 700 districts) and borrower segment level.

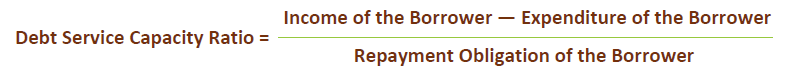

Thus, in this new report, the Financial Systems Design Initiative at Dvara Research recommends that the RBI require providers to report the debt serviceability of borrowers under a uniform methodology. One approach would be to use the Debt Service Capacity Ratio (DSR) as a universal indicator of OI. This may be computed by subtracting expenses from the income of the borrower and then obtaining a ratio of the repayment obligation to that of the surplus thus obtained, see illustration below.

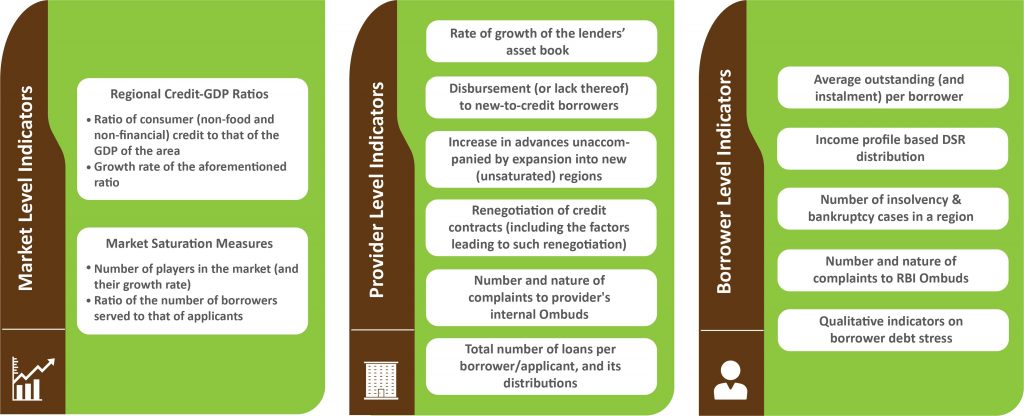

However, due to the seasonality of income streams and unforeseen expenses, DSR is expected to be dynamic, and it is impractical, if not impossible, to track DSR in real-time for all districts and customer-segments of the economy. Therefore, a set of secondary indicators are needed to ensure that the levels of indebtedness in the economy are visible to the RBI. In the report, we propose a Framework with indicators, which, when deployed together, is expected to provide an increased level of oversight of the credit markets and, visibility over the levels of indebtedness (and over-indebtedness) in the economy. Figure 1 describes the components of such a Monitoring and Detection Framework designed with twin outcomes in mind, that of financial stability and financial consumer protection.

Figure 1: Framework for Credit Market Monitoring and Detection of Over-Indebtedness: Component Indicators

The report discusses how the proposed indicators may be deployed to monitor credit markets and measure the levels of indebtedness and prevalence of OI. To exemplify, severe shifts in the regional Credit to GDP Ratio for a customer segment or sector may indicate simultaneous pockets of over-heated credit markets and under-served populace. Similarly, market saturation estimates the relationship between demand and supply, where higher values indicate a greater degree of credit penetration, often correlated with a higher incidence of household OI.

Provider level indicators such as growth in the size of credit providers are useful as uninhibited growth in saturated geographies, or demographic sub-categories could inadvertently lead to the overburdening of borrowers. We also discuss a similar approach adopted by the Zambian Central Bank to monitor the health of its credit markets and identify potential overheating.

Borrower (segment) level indicators measuring various aspects of borrowers’ liability profile, including debt serviceability, are the richest source of information for assessing indebtedness. We propose in the report that RBI should capture the DSR distribution of new disbursements across income segments as the primary indicator. Additionally, we also discuss how other borrower-level indicators enhance the efficacy of the Monitoring and Detection Framework.

We also propose a validation strategy whereunder consumer-level qualitative indicators concerning debt stress faced, sacrifices made, etc., can be captured as key inputs in assessing whether borrowers in a geography and/or customer-segment are over-indebted. These qualitative indicators could be sourced through third-party localised demand surveys that RBI can commission based on early warning signals from the Monitoring & Detection Framework and are envisaged to act as important inputs for the proposed Framework. These surveys may validate the results of the Framework, as well as the Framework itself (component indicators and algorithms deployed therein). Also, commissioned thematic studies (akin to research commissioned by UK’s Financial Conduct Authority to study the interactions of the ageing population with financial services, and the review into the unsecured credit market) are also proposed to enhance RBI’s oversight over India’s credit markets.

In the report, we posit that when deployed together, the Monitoring & Detection Framework and validation strategy will work hand in hand and provide the RBI with greater visibility over the credit markets along with the extent of, and causes behind OI. To contrast this proposed state of supervision against the abilities of the existing system, we study the data formats through which the RBI captures data from its regulated entities, to see if the data they generate can be used to build the proposed Framework. Specifically, we focus on:

1. Availability of Asset Class Detail for entire/partial portfolio: We ask if the formats capture the details of the asset book of the provider. Thus, the question becomes the primary filter to determine the usability of the data captured under the reporting format to detect the prevalence of OI.

2. Granularity of Asset Class Details Captured (for entire portfolio): For reporting formats capturing asset class details, we analyse the captured details and their level of granularity.

3. Standalone and combination analysis possible for A, B and C below:

A. Whether the format captures data for Geo-Spatial Identification of Loan (Intra-India).

B. Whether the format captures data on Income Profile-based Debt Serviceability of Borrower.

C. Whether the format captures data for Identification of Deployed Sector.

Studying the 168 regular off-site reporting formats for Non-Banking Financial Companies (NBFCs) and Scheduled Commercial Banks (SCBs), we observe that data collected is inadequate. Reporting formats for NBFCs, even Systemically Important NBFCs (NBFC-SIs), do not simultaneously capture various indicators like average loan outstanding of a borrower, type of borrower, economic activity of borrower, and geography of disbursement. RBI, however, has better visibility for banks.

The Basic Statistical Return-1 (BSR-1) format may be used to generate much of the needed insight into the portfolio of banks for the purposes of the Monitoring & Detection Framework. However, the reporting under the BSR-1 formats is different for small loans (up to INR 2,00,000) and larger loans. The BSR-1B format captures district-level details of loans given to each occupational and organisation category by their credit limits (up to INR 25,000 and between INR 25,000 and 200,000). However, the data recording format prevents a combined analysis of the various parameters it records, unlike in the case of the BSR-1A format, which is for larger loans. Similarly, no formats presently capture data on the income profile-based debt serviceability of the borrowers. These issues prevent the RBI from constructing the proposed Framework.

Finally, to develop the proposed supervisory capacity at the RBI, it would be necessary for RBI to make changes to the existing reporting paradigm. Though adding new features to existing formats would have its costs, such costs are expected to be minimal.

The full report is accessible here.

[1] In the past we have discussed these definitions in detail in a blog post titled “Household Over-indebtedness in Europe: Definitions, Indicators and Influencing Factors” (January 2019); accessible at: Dvara Research Blog | Household Over-indebtedness in Europe: Definitions, Indicators and Influencing factors