The KGFS model is structured around the concept of financial well-being and aims to maximize the financial well-being of every individual and every enterprise. Among the questions that immediately arise are: What is financial well-being? How do we know that it is being maximized?

These questions are not always easy to answer as there is no one universally accepted definition and method of measuring financial well-being. IFMR Rural Finance and IFMR Finance Foundation is working together to develop the notion of financial well-being in order to assess the impact and viability of the KGFS model. The team is also developing an index to measure changes in financial well-being of households on an ongoing basis. This is a complex task as financial decisions are intricately linked and extremely dependent on each other and hence, not easy to discern.

We define financial well-being as:

The state in which a household can optimally choose patterns of consumption over time and in uncertain states of the world

In other words, a household’s ability to grow, manage liquidity and weather downturns across different periods of time and states of the world can be used to determine its financial well-being. Using this working definition, we structure the index around four domains: Protection, Liquidity Management, Diversification and Growth. The core wealth management methodology adopted by KGFS is designed around these four domains, allowing and encouraging households to achieve their goals and dreams over time.

Developing the Index

Each of the four domains is specified by indicators that capture a household’s ability to maximize its financial well-being. All the indicators have identical underlying characteristics:

1. Efficiency: Relying largely on institutional data (i.e. CMS, CBS), rather than survey data. This will make data collection process continuous and cost effective

2. Reliability and Validity: Ensuring consistency and exactness of measurement of the intended variable

3. Timeliness: Easy to obtain and amenable for periodic updation

4. Comparability: Fair measure of comparison across regions, taking into consideration region specific factors that may affect outcomes

Effort has been made to ensure that all indicators have these characteristics. However, efforts at refining and fine-tuning them, specifically for comparability, are underway.

The Domains

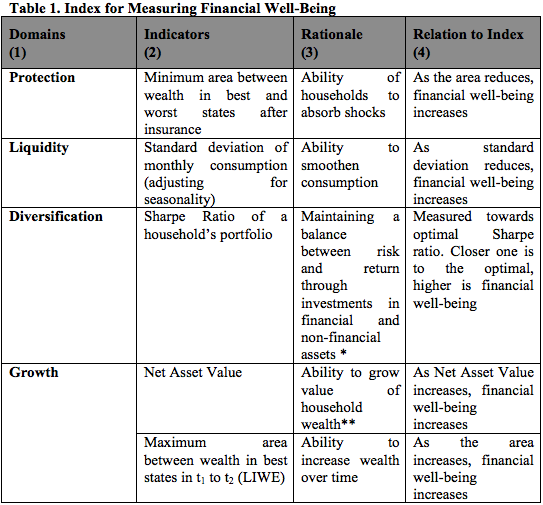

The table below gives an overview of the four domains and potential indicators. Column 3 offers the underlying rationale for using these indicators in assessing financial well-being of a household, while column 4 highlights how a movement in these indicators will effect the overall index. We discuss some of these indicators later.

*Assumptions for measuring the Sharpe Ratio will take into consideration diversification across financial and non-financial assets along with geographical diversification of physical assets, such as accounting for land within the district as opposed to land owned in another district.

**We account for value of human capital in NAV and include investments in education and other vocational courses made as contributing to human capital.

Protection: The ability of households to safeguard their assets and spread and manage their liabilities effectively.

To capture a household’s level of protection, independent of growth, and taking into account optimality and, individual needs and preferences, proved much harder than expected.

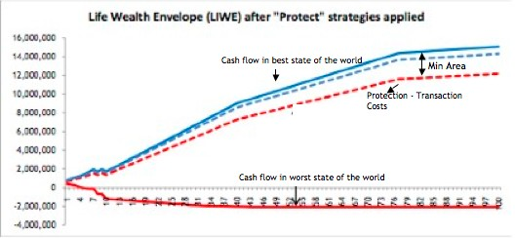

We decided to use the Life Wealth Envelope (LIWE) simulator developed by IFMR Trust, for advising households on the optimal levels of financial services they need, depending on their current and future financial needs. The graph below highlights how we can use the simulator to measure protection levels of a household.

The optimal level of protection is reflected through minimizing the area between the line reflecting cash flows in the best and worst states of the world, given their acquired level of insurance – life, health, accident and livestock. This is generated specific to each household, taking into account current income states and future financial needs, requirements and obligations. This measure also takes into account volatility in a household’s cash flow and can be updated regularly to reflect any change in a household’s financial state.

Liquidity: The ability of households to manage cash flows and maintain a balance between current and future requirements, to maximize the utility derived from lifecycle consumption.

To successfully manage liquidity, a household must be able to smoothen consumption and income over a period of time (Morduch, 1995). Given below is a method to comprehensively capture liquidity of a household: Standard Deviation of Monthly Consumption (adjusted for seasonality)

Consumption includes “all expenditures on nondurables plus imputed service flows from consumer durables, income, savings (net worth), and borrowed funds. It refers to that part of disposable income (income after taxes paid and transfer payments received) that is not included in savings”. Given this definition of consumption, we can even account for expenditure on education and other vocational courses while estimating cash flow of a household.

We recognize that accessing and gathering such data on consumption using institutional resources may be difficult. However, given the need and effort made to smoothen consumption, this information is essential and the indicator above will help in aligning all future services and products for the estimation of household cash flows.

Diversification: Diversification is defined as the ability of households to reduce the volatility of return on the asset portfolio by investing in a variety of assets, including financial and non-financial.

Diversification is imperative to maintain an ideal risk-return portfolio that increases the probability of a smooth cash flow in all states of the world.

We use a variation of the Sharpe Ratio to measure diversification. Our assumptions take into account issues of extra-local versus local investments, along with diversification over physical and financial assets. The correlation and covariance matrices designed for this purpose will reflect all such assumptions. To measure improvements in a household’s level of diversification, we can measure the movement towards an ideal Sharpe Ratio overtime.

Growth: Growth may be defined as the ability of households to access capital and identify avenues to help increase their cash flow.

Measuring growth of a household over time is important to capture the effect of financial services on their overall financial wealth and worth. We identify two indicators to capture growth – Net Assets Value (NAV) and using LIWE by maximizing the area between wealth in the best states across time.

The NAV measure is an indicator of how much the household’s wealth has changed since last year. We include investments in education and other vocational courses as contributing to an increase in the total value of human capital, thereby increasing the net value of assets.

Our second option for measuring growth is to use the LIWE framework again and capture movement of the upper bound of the envelope. This will capture the impact on cash flows of a household over time, taking into account all assets, earnings and liabilities. An increase in the area between the current upper bound and previous upper bound will positively affect the index, as it will reflect growth in a household’s wealth.

Moving Forward

Moving forward, we must address a number of complex issues. We have managed to tackle some of them effectively by providing solutions to contentious issues such as measurement and collection, as well as conceptual and alignment issues. Questions that remain are those related to aggregation and normalization that are currently being discussed and debated. Some of the key questions we addressed are:

1. Do these indicators capture each domain effectively, taking into consideration a household’s short and long-term needs, while keeping in mind current status?

2. How can we make sure that the data collected is accurate and includes all attributes defined in the index? For instance, a dynamic indicator, such as consumption, is not only difficult to define but even harder to measure comprehensively and accurately.

3. Given the list of indicators, what method of aggregation can be used to construct an index without losing information and compromising on accuracy? The existing indices, such as the HDI and the Grameen PPI, are options worth considering, but cannot be taken as the final choice. We could give each indicator a score – a higher score if they are close to optimality and a lower score if they are further away. However, given that we have four domains, aggregating four scores to a single score may result in loss of information. Given this over-simplification process, a choice of a 4-number index, one for each domain may be a more comprehensive indicator of financial well-being.

In conclusion, the Index should represent and measure our mission of providing complete access to financial services to each household and enterprise, while maximizing their financial well-being. Building such an index is a complex task and is being done keeping in mind precision, fairness and comprehensibility.

6 Responses

It is interesting that in your definition you equate well-being directly with consumption. Most of the research on human wellbeing tells us that while consumption is of course important for well-being it is not enough just to focus on that. In research that I and colleagues have conducted a key element of well-being that relates to the financial domain (and thus could be considered integral to people’s sense of financial wellbeing) is security. From my own research in the past I also would argue that the security of having relationships that enable access to credit (and sometimes to lend) are an important binding ingredient for many people in wide range of societies. Allister McGregor, IDS UK.

Hi Allister, thanks for your comment. I think there are two main worries that you pose about the index, a) is equating well-being directly with consumption ideal, and b) what about security of having relationships that enable access to credit. Addressing the first concern: For the purpose of this financial well-being index, we concentrate on aspects of an individual’s life that can be directly addressed by financial services. We take consumption, which is indicative of an individual’s goals for resource utilization, as a proxy for well-being and “ability to choose consumption patterns”, i.e. freedom to move resources across all states of the world to match optimal consumption needs, and ensuring safety of those resources in bad states of the world, as a proxy for financial well-being. There may be other aspects of well-being or quality of life that are not directly addressed by financial services.Regarding the second concern: The ability to lend and borrow through all channels, including individual relationships, gets accounted for in liquidity management. The more reliable and continuous these relationships are, the more it will show in the household’s ability to manage liquidity, thereby increasing overall financial well-being. I hope this answers your questions and worries. Regards, Shweta

It is interesting that in your definition you equate well-being directly with consumption. Most of the research on human wellbeing tells us that while consumption is of course important for well-being it is not enough just to focus on that. In research that I and colleagues have conducted a key element of well-being that relates to the financial domain (and thus could be considered integral to people’s sense of financial wellbeing) is security. From my own research in the past I also would argue that the security of having relationships that enable access to credit (and sometimes to lend) are an important binding ingredient for many people in wide range of societies. Allister McGregor, IDS UK.

Hi Allister, thanks for your comment. I think there are two main worries that you pose about the index, a) is equating well-being directly with consumption ideal, and b) what about security of having relationships that enable access to credit. Addressing the first concern: For the purpose of this financial well-being index, we concentrate on aspects of an individual’s life that can be directly addressed by financial services. We take consumption, which is indicative of an individual’s goals for resource utilization, as a proxy for well-being and “ability to choose consumption patterns”, i.e. freedom to move resources across all states of the world to match optimal consumption needs, and ensuring safety of those resources in bad states of the world, as a proxy for financial well-being. There may be other aspects of well-being or quality of life that are not directly addressed by financial services.Regarding the second concern: The ability to lend and borrow through all channels, including individual relationships, gets accounted for in liquidity management. The more reliable and continuous these relationships are, the more it will show in the household’s ability to manage liquidity, thereby increasing overall financial well-being. I hope this answers your questions and worries. Regards, Shweta

My only comment is that I wish the ‘formal’ financial sector – funds, insurance companies, banks – would look at this model and think of the world from the point of view of the consumer of financial products. The model is an out-of-the-box look at how to use financial products to solve indvidual problems, while dealing with the issue that any mass market presents. There is a greater need to rethink the agent-driven product-push model that the world currently has. Financial products are not soda and chips. They need to be thought through differently and this paper is a big step forward in that direction.