This is the first post in our blog series on the concept of financial depth and the various methods to measure it. The introductory post summarizes the literature pertaining to the significance of financial depth. The subsequent posts in the series covers the limitations of the various measures of financial depth and delves on the concepts of Equilibrium Credit and Financial Possibility Frontier. The series will also cover the advantages of these concepts over previously-used measures, especially when attempting to measure financial depth at sub-national levels.

The relationship between financial development and economic growth has been long discussed and debated. The earliest school of thought led by Joseph Schumpeter[1] posited the idea that countries with well-developed financial systems tend to grow faster than the rest. However, recent studies suggest that unrestrained and unchecked use of financial instruments and practices has led to macroeconomic crises[2].

In the context of this blog series, financial development is to be broadly understood as a multidimensional concept that includes measures of depth, access, efficiency[3] and stability[4]. Financial depth refers to the size of financial institutions and markets. It is captured by measures such as credit-to–GDP ratio, pension fund assets-to-GDP ratio as well as mutual fund assets-to-GDP ratio. Access is the degree to which individuals can and do use financial institutions and markets. Efficiency is understood as the efficiency of financial institutions and markets in providing financial services. Stability refers to the stability of financial institutions and markets as captured through growth volatility.

Within these broad measures for financial development, we undertook a review of literature to further our understanding of approaches that focus on ‘Credit Depth’ (Credit-to-GDP ratio) as a measure of financial depth, as well as its relationship with economic growth, inequality and poverty. This post summarises our key findings from the literature survey.

Financial depth is positively correlated with economic growth across countries

Joseph Schumpeter[5] (1912) postulated that financial development drives technological innovation and consequently, the rate of economic growth. Also, recent empirical economic evidence across a cross-section of 80 countries over the time period 1960-1989 shows that higher levels of financial development are significantly and robustly correlated with faster current and future rates of economic growth, physical capital accumulation, and economic efficiency improvements[6]. In other words, when countries have relatively high levels of financial development, economic growth tends to be relatively fast over the next 10 to 30 years[7].

Financial depth influences growth rates of sectors within a country

Industries that are more dependent on external finance (defined as the difference between investments and cash generated from operations) grow disproportionately faster in countries with a more developed financial sector[8]. For example, in Malaysia, which has high levels of financial depth, the Drugs and Pharmaceutical industry (which is relatively heavily dependent on external finance) grows at a 4% higher annual real rate than Tobacco (which is relatively less dependent on external finance). In Chile, which was in the lowest quartile, drugs grew at a rate of 2.5% lower than Tobacco.

In India, expansion of directed credit lending (from 1998 – 2002) to medium-sized firms (firms with requirement for capital stock between INR 6.5 to 10 million) shows that this increased availability of credit accelerates their rate of growth of sales, and consequently, profits[9].

Financial deepening reduces poverty and inequality

Research shows that financial deepening significantly raises the average income of the lower 80% of the population of the world and lowers inequality across 70 middle and low income countries[10]. Empirical research also shows that with every 0.1% increase in the level of credit available in an economy, head count poverty ratio reduces by 2.5% – 3%[11].

The positive impact of financial deepening on reducing poverty holds for within-country studies too. Empirical studies show that financial depth has a negative and significant impact on rural poverty (head- count ratio and poverty gap) in India[12]. Financial deepening works positively towards reducing poverty by increasing opportunities for entrepreneurship in rural areas and enabling migration from rural to urban areas[13].

Financial depth, beyond a threshold, leads to adverse macroeconomic effects

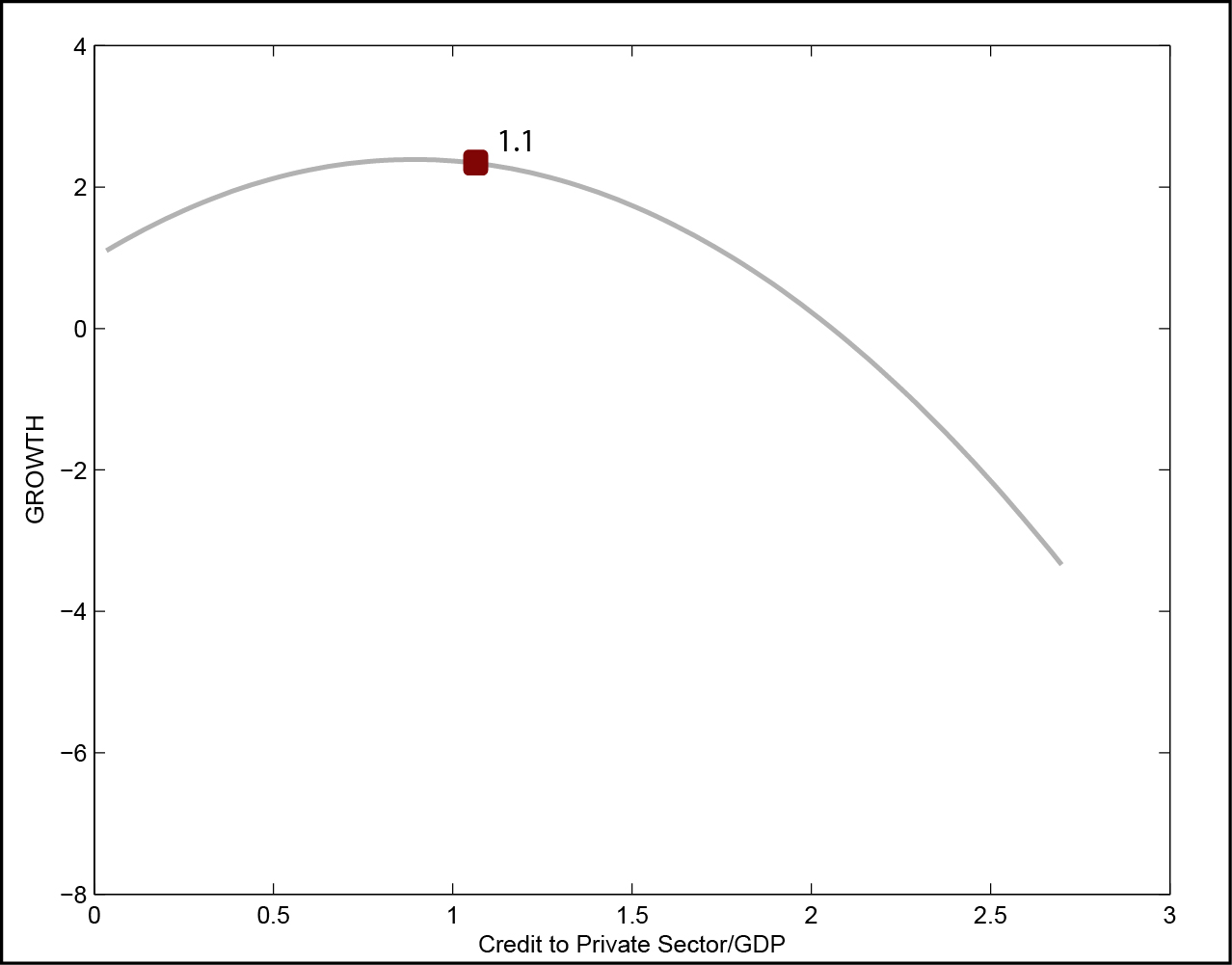

A deeper financial system is significantly associated with lesser growth volatility; however, the relationship appears to be nonlinear. As the financial system becomes larger relative to GDP, systemic risk becomes relatively more important, and acts to reduce stability. In other words, when there is excess credit within an economy, there can be a “vanishing effect” of financial depth on economic growth. The threshold above which this vanishing effect occurs is estimated to be when private credit goes beyond 110% – 120% of Gross Domestic Product (GDP)[14].

Figure 1: Replicated from the results from table 5 of Arcand et al(2012). The grey line shows that as credit to GDP ratio goes beyond 1.1, the slope of the graph becomes negative.

Having discussed the significance of financial depth on the macro-economy, the next question that naturally follows is regarding the ways to measure financial depth. The next blog post in this series will briefly discuss the various measures used in literature and their limitations.

—

[1] Levine, 1997. “Financial Development and Economic Growth: Views and Agenda”

[2] Loayza and Ranciere, 2006. “Financial Development, Financial Fragility, and Growth”

[3] Sahay et al, 2015. “Rethinking Financial Deepening: Stability and Growth in Emerging Markets”

[4] Čihák, Demirgüč-Kunt, Feyen and Levine, 2013. “Financial Development in 205 Economies, 1960 to 2010″

[5] King and Levine, 1993. “Finance and Growth: Schumpeter Might Be Right”

[6] ibid

[7] ibid

[8] Rajan and Zingales, 1998. “Financial Dependence and Growth.”

[9] Banerjee and Duflo, 2012. “Do Firms Want to Borrow More? Testing Credit Constraints using a Directed Lending Program”

[10] Honohan, 2004. “Financial development, growth, and poverty: how close are the links?”

[11] ibid

[12] Ayyagari, Beck and Hoseini, 2013. “Finance and Poverty: Evidence from India”

[13] ibid

[14] Berkes, Panizza and Arcand, 2012. “Too Much Finance?”

5 Responses

While I don’t disagree with the basic premise you are getting at, a couple of observations for your consideration :

i) I’m not sure tobacco is the best example to use as a comparator. Chile has a history of a high smoking country with some landmark legislation introduced only as late as 2013. Plus the industry may have hit a mature state (as a market) before that reflecting in lower growth.

ii) External finance and growth – I’m not entirely convinced about the cause and effect here. If one is operating in a fast growing market, more cash and investments are needed. Such capital may exceed own capital. Hence, borrowings increase. The market doesn’t grow (on the consumer side) because producers enhance investments – for a variety of products and services. There are other segments – such as a new product/service introduction where investments precede markets. Though, even then, scale investments are often from own funds. So I feel you may need a more convincing argument or appropriate caveats on the cause/effect you postulate.

iii) Financial deepening will have to measure more than by just aggregate credit expansion. For example, the number of active bank account holders and funds ploughed through those accounts (own funds), will create the case for banks providing credit. Bank credit to these segments, unlike traditional money lenders or even MF groups, is for income generation oriented activities. The smoothening of cash flows – provided by the latter segments (MFs etc) also enables non-banking borrowers to make commitments of investments on their income earning activities. While I understand some of this data will be tough to come by, you have the advantage of IFMR’s own operations.

I’d like to be able to steal your arguments, with solid data to back it, to use in forums that I may be part of from time to time. So would request you take the above points made in that context, rather than just as criticism!

Dear Pras,

Many thanks for your insightful comments. Please find below our clarifications for the concerns you have raised:

1) The research paper on which we base this conclusion is ‘Financial Dependence and Growth’ authored by Raghuram Rajan and Luigi Zingales (1998) (http://www.jstor.org/stable/116849 ). The first step that the authors take towards understanding the effect of financial depth on industrial growth rates is to establish that the Drugs & Pharmaceuticals industry is more dependent on external finance than the Tobacco industry (across a cross-section of countries). Table 1 of this paper is our motivation in comparing Tobacco and Drug & Pharmaceutical industries. Secondly they claim that ceteris paribus, an industry such as Drugs and Pharmaceuticals, (which requires relatively more external funding) should develop relatively faster than Tobacco, (which requires relatively little external finance) in countries that are more financially developed. Towards this end, they compare industrial growth rates (the growth rate for each industry is adjusted for the worldwide growth rate of that industry) across 41 countries and cite the example of Malaysia and Chile.

2) We agree with your suggestion that there does not exist a really strong case for causality. Results from Rajan and Zingales (1998) suggest that “the ex-ante

development of financial markets facilitates the ex-post growth of sectors dependent on external finance. This implies that the link between financial development and growth identified elsewhere may stem, at least in part, from a channel identified by the theory: financial markets and institutions reduce the cost of external finance for firms”. Their analysis suggests only that “financial development liberates firms from the drudgery of generating funds internally. It is ultimately the availability of profitable investment opportunities that drives growth, and we have little to say about where these come from”.

3) This again is a great point. Our subsequent post will deal with the limitations of conventionally used financial depth measures.

Thank you again for your thoughtful comments.

Thanks,

Nishanth Kumar

Dear Nishant,

Thanks for your patient and detailed response. A quick response seriatim on the above:

i) I’d have the same question to pose to Rajan and Zingales as well. I haven’t read their full paper (so thanks for sharing that). To illustrate, new drug introduction requires close to $1 to $1.5 bn R&D investments and anywhere between 8 – 10 years. Even the “greenwashing” patents will go through atleast half that cycle – clinical trials hog lots of time. The biggest attraction is the patent available (limited period monopoly), for investors. At this point, the drug still caters to each approved market separately. So an FDA approved or EU approved drug still has to go through a process of field trials in India. I know this from personal experience, as possibly have you. All this requires up front capital that’s huge. This kind can only be supported through external finance or companies like big pharma, the oil companies etc for whom a billion is a fraction of the annual cash flow. Tobacco isn’t complicated to establish – the entire process of distribution and retail is a nightmare – quite simply because its highly regulated. You can’t just transport tobacco from Chennai to Bengaluru. For a comparable industry like liquor, you even need “route permits”, i.e., the truck is iicensed for the road it must take through a state. The regulatory environment almost ensure that its easier to run a smaller localised business and not a national one, barring premium low volume stuff like Havana Cigars! Add to this, that for 40 years at least, since big tobacco lost the cancer case, the industry is under an increasingly global campaign to tell people to not smoke! Its hardly the kind of industry that will excite entrepreneurs and then big finance! Just illustrating why I believe what I do!

ii) Just thinking aloud, since we agree on this, it may be worthwhile – maybe in a separate study – to consider how regulations inhibit flow of finance and / or make it expensive. It seems an anomaly that moneylenders seems to freely provide local finance for anything and miraculously find it profitable. Most banks think its not worth their while, even after big time arm twisting by govt! Such moneylending is also to farmers – horticulture and livestock. Is there some clever way to align regulation better and, due to increased competition locally, drive down costs of borrowing also. I realize this sounds utopian, but I don’t believe it is. We’re at a tech stage where a lot of things are more possible now.

iii) If I have any more ideas (half-baked or otherwise) I will throw them your way, as I’ve been doing!

Thanks again for making the time to read and respond.

Great post. Thanks for sharing this. I have a query regarding the following statistic.

“Empirical research also shows that with every 0.1% increase in the level of credit available in an economy, head count poverty ratio reduces by 2.5% – 3%”.

In this context, what do we have to say about microfinance? It increases access to credit. So, does it mean that it reduces poverty as per the above relation? Some studies on microfinance seem to be skeptical about this line of argument.

Can you please elaborate on this?

Thank you

Dear K,

Thanks for your comment.

Microcredit as a concept has attracted considerable debate, especially in recent years.

I am sharing the following papers that might be of interest to you in this regard: ‘Where Credit is Due’ http://www.povertyactionlab.org/publication/where-credit-is-due (J PAL Policy Bulletin, February 2015) finds that although microcredit access does not lead to increased income, it can give low-income households more freedom in optimising the ways they make money, consume, and invest. ‘Six Randomized Evaluations of Microcredit: Introduction and Further Steps’ http://economics.mit.edu/files/10475 (Banerjee et al, 2015) reaffirms the above results, and suggests that expanded access from MFIs helps borrowers substitute for credit from informal credit sources. ‘Microcredit Under the Microscope: What Have We Learned in the Past Two Decades, and What Do We Need to Know?’ http://economics.mit.edu/files/9071 (Banerjee, 2013) gives clear evidence that as long as credit is reasonably priced, it leads to business creation and/or some amount of expansion. Moreover, there is an increase in ownership of consumer durables and business assets, especially if home repair and livestock ownership (both of which provide services into the future) count as durables. However, there is no evidence of large sustained consumption or income gains as a result of access to microcredit.

Our objective through this blog series is to identify optimal credit depth- neither excess nor deficient provisioning of credit- at sub-national levels. The idea of ‘equilibrium credit’ which we will be discussing in our next post may be of interest to you in this regard