What would it take to foster a measurable increase in the availability of agriculture finance to small and medium farmers? Panayotis N. Varangis from the International Finance Corporation explored some answers to this question when he spoke at IFMR on “Innovations in Agriculture Finance and Weather Index Insurance”. We bring you some of the thoughts he shared on making agriculture finance more accessible to small and medium farmers.

Agriculture finance, especially to small and medium farmers, is riddled with risks and challenges. Some of the broad categories of risk include –

- Climate change risk – exposure to variations in weather patterns

- Production/yield risks due to natural hazards

- Market and price risk

- Collateral limitation in the form of weaker and riskier security

- Government interventions weakening local rural credit culture

Many programs take the safe way out and end up lending to large farmers. A more robust way to lend to small and medium farmers is to explore existing delivery channels that focus on small and medium farmers and promote products that mitigate these risks. This is an appropriate time for the lending institutions to take a step back and re- visit the lending strategy.

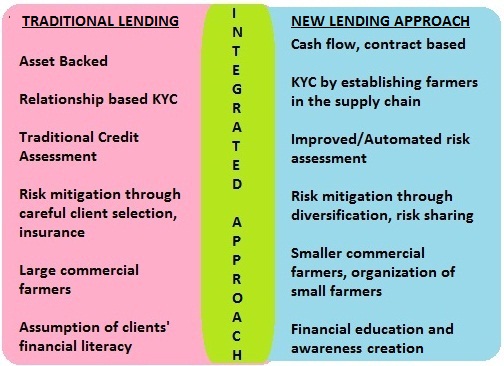

While it is not necessary to abandon the traditional method of lending, it makes good sense to adopt an integrated approach of judiciously combining the old and the new methods of lending.

It is also important to learn from the existing projects to identify success factors, replicate and scale up. Many a time all it takes is designing a sub-component in an existing project than having to start something totally new. Existing channels that connect the small farmers should be identified to build financial capabilities. Lending institutions can leverage these existing linkages in the agriculture supply chain by connecting with participants such as input suppliers, commodity procurement agencies, and farmer groups.

Agri-lending is a challenging task and identifying risks and devising mitigants requires a lot of work with ears close to the ground. There has to be collaborative participation in the system and existing linkages have to be leveraged to the fullest possible extent. A comprehensive solution can be worked out only by bringing together different stakeholders and participants.

How to expand and reach scale?

- Map opportunities – Identify opportunities in the commodity supply chain/breadbaskets and design projects around them.

- Implement projects – Identify key components of success from existing projects, scale up and replicate, map further opportunities for the sector/region

- Capacity building and knowledge sharing – Integrate small farmers into the financial system, including working with producer organizations and leverage farmer capacity building in productivity & standards (e.g. finance investments for new technologies)

- Leverage and replicate – Complement existing initiatives, apply lessons learned/best practices from projects and consider providing incentives (e.g. financing and/or risk sharing at initial stages to demonstrate sustainable new financing approaches/products)

Some important levers for Financial Institutions to increase agriculture lending are

- Loan product design

- Tools to identify and manage risks

- Delivery channels to reach small farmers

- Financial literacy – awareness and training

A recently held regional forum on agriculture finance in Zambia had participants from local banks, producer organizations, input suppliers, NGOs, international organizations, donors, and consulting firms. The participants were asked to point out one change each that, according to them, would bring about effective agri-lending. The 5 winning ideas that emerged were –

- Develop a system of private sector mechanized service providers in rural areas: lead farmer/entrepreneur leases equipment to provide services to surrounding small farmers

- Invest in irrigation systems—community-based , owned and managed

- Develop a franchise model of community based storage facilities, provide real time market information, potential input demand aggregation

- Create private sector led agri-lending training centers for bank staff and farmers

- System of profiling of producer groups on their governance, financial management and performance—profiles that can be used by banks for lending to them

Like these ideas or have an idea to take agriculture finance to small farmers? Voice your thoughts, we want to hear it.

4 Responses

This is a great post. Here is an even lengthier comment. From some of the other material the following nine thoughts emerge for the design of effective agricultural finance:

1. Proximity to the customer is the key – a lot of good agricultural lenders know their customers very intimately. The Trust's KGFS effort is well placed to demonstrate the value of this.

2. Expertise in Agriculture (farming) very important for the financial services provider to have or to build suitable partnerships with people that have this expertise – the Trust’s work with IFPRI in India will help with this.

3. In-kind disbursements have two beneficial effects particularly in a context where finance is already available for other priority needs: (a) they control quality of input; (b) they prevent diversion of funds.

4. Well functioning market access (the Trust is attempting automated, exchange based access to small farmers through its ATMNE initiative) is important so that there is full price realisation.

5. Commodity price risk management needs to be done at the level of the farmer ideally through OTC commodity options and forward contracts (not futures). However, while Options are definitely a superior choice to even forward contracts, and definitely over futures, there is a need for scalable examples. And, the challenge in use of forward contracts is aligning incentives for both parties to the contract, particularly the farmers, to not break it when spot prices are different.

6. Rainfall risk management should be done only for catastrophes (three years of drought so that even the perennial rivers dry up) using parametric insurance and by the provider – it is not a good idea to sell rainfall insurance to farmers unless they are planting high value crops where (a) losses are likely to be higher when rainfall is not normal; (b) profits are higher if things go well.

7. Careful tracking of farmer level cashflows is important to ensure timely finance as well as timely recovery – too much flexibility in the hands of the farmer may not be appropriate. However, the Kisan Credit Card (KCC) has been a very successful product for Indian Banks and it provides infinite flexibility — there is a need to study how this has performed.

8. For capital goods a leasing strategy would be a good one to explore – it will have two beneficial outcomes: (a) it will lead to better credit quality as asset ownership remains with the lender; (b) it will lead to better utilisation of an expensive asset since it is more likely to be shared by other farmers than an owned asset (not clear if being leased or owned has an impact on farmer's decision to rent it out to other farmers — something that needs to be tested on the ground).

9. Post harvest financing needs to be made easily available including local storage and transportation facilities.

I would like to pen down my thoughts on this subject. Many of the companies in the food processing industry, adopt villages and work for the improvement of the villages from where they are sourcing their raw materials. I strongly feel that banks could adopt a similar kind of strategy.

Banks could identify villages, may be just a handful to start with and work on developing a good credit culture in these villages. Many things could be done – educating the people in that village about opening a savings account and earning interest on the money they have saved. May be a door step collection of deposits. The Banks could do a lot of CSR activities in these villages, so that the people start trusting the bank for all the financial needs. The idea is to be become their consultant for all the financial needs, like how a chartered accountant or a lawyer is to many of the SME’s. Basically, we need to start developing model villages, which have developed good credit history and culture.

This is not a process where we can achieve results immediately and we cannot aggressively lend to this sector. The process of inclusion is to be slow and steady for it to be successful. We cannot even expect returns from these villages but over time, the benefits will start accruing.

I am not too experienced to comment about the current procedures adopted by banks to fund to small farmers. But I feel that instead of looking at short-term benefits from these villages, if we learn to see the long term benefits, it would go a long way in changing the way we lend to the small farmers.