[Artoo Slate is a software solution designed for microfinance field staff that takes the entire process of data collection and loan disbursement online. Sameer has been recognized as one of Asia-Pacific’s most promising young social entrepreneurs by the Paragon100 Fellowship. He holds a B Tech from the National Institute of Technology, Karnataka and is a StartingBloc Fellow (MIT Sloan). His passion is inclusive technology, something he discovered during his internship with Ujjivan. He, along with Co-founder of Artoo, Indus Chadha, has developed Artoo Slate which helps microfinance companies cut down on operation costs. He shares with us in this guest blog, how technology can make a difference to microbanking institutions that cater to the bottom of the pyramid.]

The Malegam Report is finally here. At first glance, we were all glad to see how well balanced it appeared. But now we have to begin to make sense of the constraints that it places on MFIs in the short term. In the words of Vijay Mahajan of BASIX: “some provisions are so severe that some MFIs will be facing death by April”.

Indeed, most MFIs must be grappling at the moment with what changes they will need to make to stay alive.

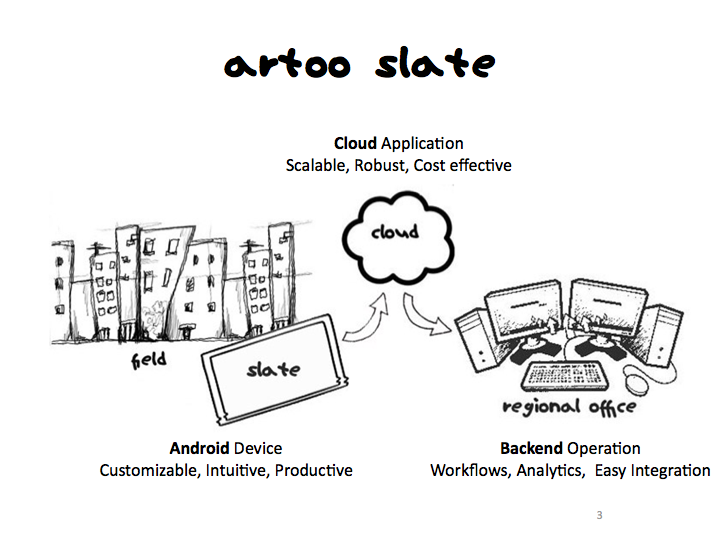

If MFIs need to reduce costs, remove redundancies, and improve efficiencies at all levels, they need to centralize their operations. Centralizing will also help MFIs ensure the quality of the customers they acquire and thereby reduce risks. To centralize operations and still maintain competitive TATs for all customer-centric activities (e.g. customer acquisition, loan disbursement, and repayments) is the hardest part of the puzzle that needs to be cracked. It will be only possible for MFIs to consolidate branches and have their field agents operate over larger geographies (improving borrower to employee ratio) when they can monitor and remotely manage their staff and activities. For that they need technology.

We believe, however, that this needn’t be a question of the survival of the fittest. It could serve as an opportunity for visionary MFIs, regardless of their size and strength, to re-imagine their operations in a way that, while respecting the RBI’s imminent mandates, dramatically reduces their Operating Expense Ratio (OER) and enables them to remain profitable and survive in the face of the Malegam Report.

At Artoo, we wish to catalyze development through inclusive technology and empowering communication. Our software framework, Artoo Slate, can help MFIs bring down their OERs to meet the RBI’s requirements in a timely manner while enabling them to remain profitable. We believe it has the potential to help MFIs become more productive in helping their customers rise out of poverty. Here’s our take on what the Malegam Report is asking MFIs to do and how we might be able to help.

Artoo Slate is a software solution that takes the entire process of data collection (under 18 minutes for complete customer acquisition process*) and loan disbursement online (70+% of Loan Applications can be processed in the field on the same day*). It will capture rich data from the field, do away with the back and forth of paper, avoid innumerable delays (reduction in turn-around-time (TAT) from 3+ days to 1 hour*), and drastically reduce expenses (courier, Document Management System Hubs & outsourced data entry). It will allow for easy exchange of data between field staff and backend systems (CBS/MIS) in a way that will reduce time spent (41% of center meetings take under 1 min to update paper work) on customer query clarification and identification and resolution of errors in customer profile and loan application forms. Even while the credit bureau is stabilizing, it will enable MFIs to implement a field credit check upfront for renewal loans based on internal data and assessment.

Our framework enables field agents to operate remotely and helps distributed MFIs to centralize their operations, while improving their TAT for all customer-centric activities. MFIs can monitor their business on a real time basis: pick up on trends (mass default, political/economic turbulence) as and when they happen directly from the field (defaulter information available instantaneously as compared to 10-15 days lag in previous implementation*). In addition, MFIs can track their social performance on a daily basis.

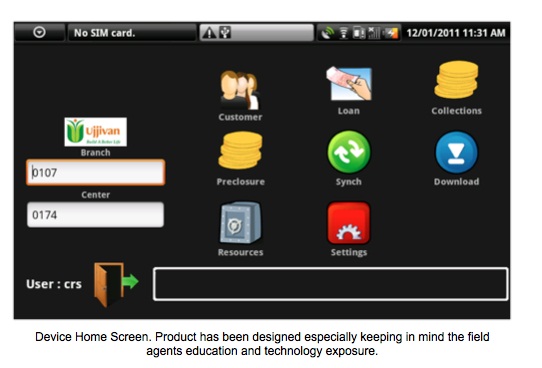

It is an intuitive interface that has been designed keeping in mind field staff’s educational training and exposure to technology. It will also serve as platform through which MFIs can train (e.g. basic English skills, computer skills, updates on new products and offerings) their field staff on-the-go and monitor them on a real time basis to improve their overall service quality. MFIs can improve their field agent quality and build their capacity, reducing their attrition to short-term focused aggressive competitors.

Artoo Slate, in the hands of the field agent, promises to be a scalable way for the MFI to engage more effectively with their end customers through videos, graphics, and other interactive media (imparting life skills, financial planning, healthcare information, conversational English, etc.) Engaging with the end customer will not only give them a reason to attend center meetings but also allow them to recognize their MFI as a real partner in their struggle to climb out of poverty, giving forward-thinking MFIs an opportunity to differentiate themselves, improving customer loyalty and therefore profitability.

Application

We have been really lucky to pilot our solution, Artoo Slate, at Ujjivan microfinance, and are happy to share the interim results of our pilot here. The pilot covers a branch in urban Bangalore and includes processes of customer acquisition, collections, branch transactions, and field agent training.