Introduction

In India, around 85% of the farmers are small and marginal farmers. The agricultural sector in India is hampered by high transaction costs and low access to credit and agricultural produce markets. There are several legal entities which aim to help farmers reap benefits of economies of scale via aggregation like farmer cooperatives, farmers clubs, farmer interest groups, etc. Farmer Producer Organisations (FPOs) are one such farmers’ aggregate. An FPO can be registered under several legal forms like cooperatives, producer companies, Section 8 company, societies or public trusts[1]. FPOs registered under the Indian Companies Act, 1956 are known as Farmer Producer Companies (FPCs). This post points out the various issues faced by FPOs and provides recommendations on how to address these issues. It is divided into two sections. The first section reviews the status of FPOs in India while the second section discusses the current institutional interventions and recommendations going forward.

Section I

The Preamble of the National Policy for Promotion of FPOs[2] envisions FPOs in various roles. They are to be used as implementing agencies for various agricultural development programmes, linked to Financial Institutions (FIs), and promoted at par with member-owned institutions like cooperatives and Self Help Groups (SHGs)[3]. Before maturing to a point where it is a self-sustainable and self-governing body, an FPO usually goes through 3 stages in its life-cycle as demonstrated below[4].

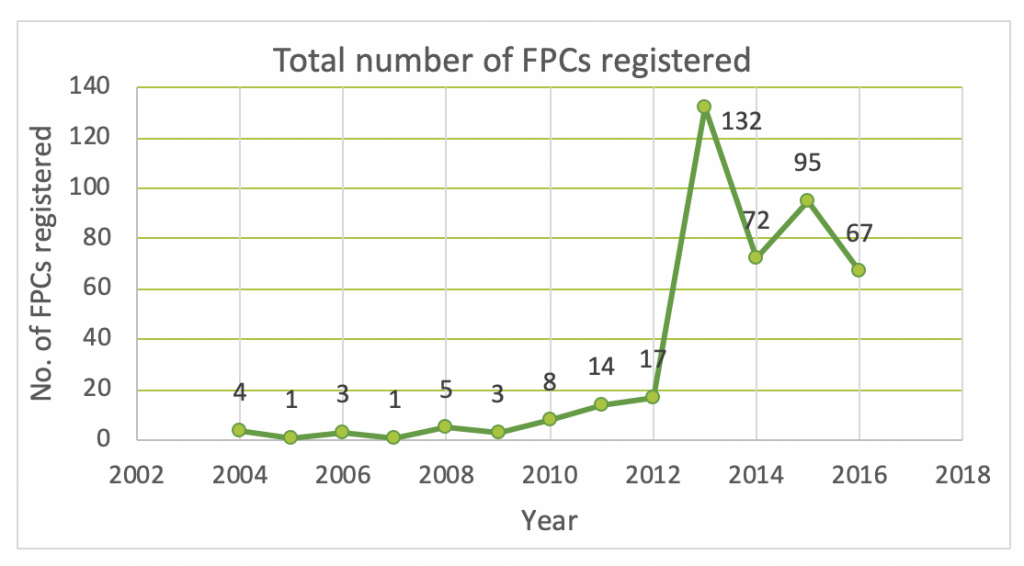

The policy push has been for increasing the number of FPOs and using the number of FPOs as a proxy for agricultural development. As the figure below showcases, there has been a drastic increase in the number of FPCs registered 2012 onwards. Currently, there are 5000 FPOs in the country of which 3200 are registered as FPCs[5]. Most of these FPOs are still at a nascent stage and sustaining on grants. NABARD is set to promote 5000 more FPOs in the coming 2 years[6]. The imperative is shifting towards making the existing FPOs self-sustainable by building better business model rather than concentrating purely on scaling up. If we consider the current programmes and schemes targeted at FPOs, they fall short of covering the spectrum of risks faced. The present guidelines do not treat FPOs and farmers at par with each other[7]. There are significant barriers to access to credit and regulatory compliances which are difficult for nascent FPOs to meet.

Source- Navaneetham et al. (2017)

Treating all farmer aggregates at par with each other and individual farmers

The initial barriers to the growth of FPOs emerge from their differential legal treatment. Farmers and farmer aggregates do not have access to the same kind of benefits. Even within FPOs, there’s differential treatment between FPOs registered as companies and FPOs registered as cooperatives. All agricultural income is exempt from income tax, but the income of a farmer aggregate like an FPC is taxed. FPOs registered as cooperatives are entitled to income tax deductions as per Section 80P of the Indian Income Tax Act[8]. Co-operatives that opt to convert into Producer Companies would still be entitled to all tax and other concessions that they had as co-operatives[9]. But entities registered as FPCs are not entitled to any of these benefits. Removing these discrepancies would give a significant boost to the growth and development of these FPOs. All FPOs should be granted income tax exemption at least for the initial five years to enable them to build surplus and reserves[10]. Further, in lieu of the statutory compliances FPOs are bound by under their respective registration Acts, relief to FPOs from a penal provision in case of certain non-compliances for the first five years would boost growth.[11]

Treating FPOs as agri-start ups

According to a NABARD report on credit issues of farmers, a farmer is “a risk-taking entrepreneur who faces uncertainties from weather, spurious inputs, pests and diseases, and market shocks among other risks”[12]. A start-up, as defined by the Startup India scheme[13], is an entity that’s registered as a private limited company, partnership firm or a limited liability partnership in India. It has a maximum vintage of 7 years, 10 years for the biotechnology sector, from the date of its incorporation. Its turnover for any of the financial years should not exceed INR 25 Crores. Lastly, it must be working towards innovation, development or improvement of products or processes or services, or should be a scalable business model with a high potential of employment generation or wealth creation. Provided an entity qualifies all the specified criteria, it opens the doorway to a host of benefits. These range from tax exemption on capital gains for investors, tax exemptions to start-ups for the initial 3 years, favourable public procurement norms, and easier access to funds[14]. By extension of both these definitions, FPOs are akin to agri-start ups[15]. FPOs should thus be given access to similar if not the same benefits, as specified above. The case here is not for constant handholding, but for providing support in the initial years and progressively introducing regulatory compliances as the FPO matures.

Section II

Incentivising institutional lenders to provide credit to FPOs

On the demand side, raising debt is a huge issue for FPOs as most FIs require collaterals and at least three years of balance sheets for credit assessment[16]. The skilled manpower to provide such documentation or the funds to hire the same is not readily available for an FPO. Additionally, due to accumulated losses in the initial few years, they are likely to have a relatively low credit rating[17]. While on the supply side, there is a lack of products that are tailor-made to the production cycle or development stage of the FPO. All these factors severely limit the ability of FPOs to access credit. We suggest some ways for FPOs to overcome these barriers on the demand and supply side.

- With the introduction of e-Negotiable Warehouse Receipts (NWRs)[18], FPOs can avail the opportunity to efficiently gain access to debt secured by these receipts either from banks, commodity exchanges, or electronic National Agriculture Markets (e-NAMs)[19]. Being at par with a tradable security, e-NWRs would also give the lender power to take legal action against the defaulter. The presence of higher reporting standards and a unified database of receipts would help bridge the existing information asymmetry and instil confidence in lenders[20]. The policy push should be towards nudging FPOs to take up such schemes with a special focus on FPOs having only small and marginal farmers as members.

- We need more originators, beyond commercial banks, who can offer agri-specific loan products. Agriculture lending by banks needs to shift from a statutory Priority Sector Lending (PSL) obligation to a business opportunity[21]. Under Reserve Bank of India (RBI) guidelines for PSL, agricultural lending constitutes of 18% of all domestic scheduled commercial banks’ adjusted net bank credit or credit equivalent amount of off-balance sheet exposure (the higher of the two).[22] Within this, a sub-target of 8% is set just for small and marginal farmers which include loans to SHGs, Joint Liability Groups (JLGs), co-operatives and FPCs consisting of small and marginal farmers directly engaged in agriculture or allied activities. Lending to FPOs is also a part of the PSL guidelines for Urban Co-operative Banks (UCBs) and Regional Rural Banks (RRBs)[23]. While lending to FPOs may be accounted as PSL, bankers are reluctant to lend to FPOs. If loan products for this sector are not designed appropriately, the agribusiness sector will not take off[24]. One way to go about it could be having banks dedicated to doing agriculture lending in India much like other Asian countries like China and the Philippines etc. Surekha Marandi, Executive Director, RBI has been in favour of the central bank in lending a helping hand in designing tailor-made loan products for FPOs, which was done in the case of SHG-Bank Linkage Programme earlier[25].

- Encouraging partnerships between FPOs and Agri-fintechs is a good way to go forward here. A successful example of this would be Samunnati Value Chain Finance which has dispersed over US $15 million in loans with negligible defaults and partnered with more than 70 FPOs as a customised financial service provider[26].

- The idea of FPOs as BCs could also be explored here[27]. There exist approximately 5000 FPOs spread across the country whose memberships range from 100-1000 farmer members per FPO[28]. This gives them good outreach in the rural parts of the country and to some of the most under-served consumers.

- Research around the performance indicators of FPOs could lead to developing a rating tool for FPOs[29]. Since lenders are still new to the concept of FPOs, a rating tool would serve the dual purpose of facilitating credit-assessment and further underwriting. Rating parameters reflecting the state of governance, management, risks mitigation, and sustainability would prove very beneficial. These scores would help establish credibility with investors and formal financial institutions[30].

Private sector investment into FPCs

One of the major concerns in stunting the growth of FPCs particularly are the restrictions on private sector investments, including Foreign Direct Investment (FDI). Bringing in private investment would help in building better organisational capabilities[31] for the FPC, which would assist in aligning incentives towards availing better market prices for the produce. Restrictions on external shareholding can be placed to mitigate concerns of moral hazard and to ensure that the majority of the holding will be with the farmers. Various studies[32] argue that FPOs need to build relationships with the private sector to bring better management and operational practices in the institution. Allowing FDI for FPCs would help in creating assets and setting up risk guarantee funds for credit providers. Another way of bringing in the capital would be to work with the Ministry of Corporate Affairs to encourage funding of FPOs as a part of CSR activities[33].

Revamping existing schemes to reflect the needs of FPOs

Several schemes have been designed to provide financial support to FPOs, especially to aid them in their initial years. Prominent among these is the SFAC equity grant scheme, SFAC credit guarantee scheme, and the NABARD Producer Organisation Development Fund (PODF)[34].

- If we look at the take-up of these schemes, only 43 cases have been sanctioned from 2014 to February 2019 under the credit guarantee scheme [35]. FPOs can also avail the SFAC Venture Capital Assistance Scheme however as it is mandatory to have a term loan sanctioned by banks or an FI, no FPO had been able to avail the scheme until 2012[36]. Available data as of 2019 does not indicate if any FPOs have been able to avail this scheme as of date[37].

- Additionally, several eligibility criteria and guidelines for these schemes either exclude those who need support the most or have no rationale stated.

- For instance, using the number of persons as an eligibility criterion[38] does not tell us anything about the health, credibility, or credit-worthiness of FPOs. Additionally, the threshold for this criterion is high, and it is not easy to mobilise so many people during the initial stages of an FPO[39]. As per Section 581C (1), Part IX-A of The Companies Act, it takes a minimum of 10 people to form and run an FPO[40]. Hence, there is no clear rationale for a minimum requirement of 50 or 500 persons to avail of financial support.

- The moratorium given by PODF NABARD for its loans is 2-3 years[41]. It has been argued with the help of various case studies that an FPO needs at least 5-7 years of handholding and support under the present regime to become self-sustainable[42].

- The rationale for expenditure break-up[43] given by NABARD PRODUCE guidelines, which caps the maximum amount of assistance to be provided, does not elaborate upon their methodology for calculating expenses. Further, the basis for revision of these caps, if any revision is taking place, has not been specified. Ideally, they should at least be inflation-indexed.

- FPOs can be assessed on the Institutional Maturity Index[44] along with the empanelment process employed by them in finalising of Producer Organisation Promoting Institution (POPI) or Resource Institution (RI). This would include looking at the rigour with which diagnostic studies, feasibility analysis and baseline assessment are done. It should be assessed if the final decision of forming an FPO is taken by the Farmer Interest Group (FIG) members at the right time. There is no prescribed “right time” to form an FPO as it may require the producers anywhere between 18 months to 24 months to reach the point when they’re ready for an aggregation. Additionally, POPIs or RIs can be assessed based on how often they employ the Institutional Maturity Index. The creditworthiness of the FPO should be based on a variety of parameters such as past credit activity, cash-flow, and measures taken by the FPO for mitigating risk in the form of insurance or income diversification across multiple crops or multiple geographies.

Tackling market access barriers caused due to Agriculture Produce and Marketing (APMC) Act[45]

As per the model Agricultural Produce and Livestock Marketing Committee (APMLC) Act, any FPO that desires to purchase produce directly from farmers outside the market yard would need to apply for grant/renewal of a license[46].Producer companies currently face difficulties in getting APMC licenses for processing and trading, which acts as a significant market entry barrier[47]. It has been proposed that exempting all FPOs from Mandi cess would help facilitate market entry and increase their bargaining power[48]. Currently, only FPOs registered as cooperatives can avail this cess-exemption[49]. We need all States to incorporate provisions in their respective APMC/APMLC Acts that allow FPOs to trade with minimal barriers.

Conclusion

Farmer Producer Organisations have the potential to give better bargaining power to farmers and lead to more transparent agri-markets. Since most FPOs are still in their incubation stage, they need handholding and financial support to take off. It is heartening to see a policy push and various schemes for FPOs. At the same time, the eligibility criteria for FPOs to avail these schemes need to be relaxed and rationalised. Instead of looking at superficial indicators like the size of the FPO, the focus should be on promotion and development process[50]. Efforts must be made to ease the market barriers in the growth path of FPOs. Incentives should be given to institutional lenders to lend to FPOs and give room for private equity to enter for FPCs to help them transition from a grant-based model to a self-sustaining business entity.

—

References

- [1] These various forms can respectively be registered under the following acts: Cooperative Societies Act/ Autonomous or Mutually Aided Cooperative Societies Act of the respective State; Multi-State Cooperative Society Act, 2002;Producer Company under Section 581(C) of Indian Companies Act, 1956, as amended in 2013; Section 25 Company of Indian Companies Act, 1956, as amended as Section 8 in 2013;Societies registered under Society Registration Act, 1860; Public Trusts registered under Indian Trusts Act, 1882.

- Source- Frequently Asked Questions about Farmer Producer Organisations, NABARD Mumbai, 2015

- [2] Policy and Process Guidelines for Farmer Producer Organisations Issued by Department of Agriculture and Cooperation, Ministry of Agriculture, Government of India published in 2013

- [3] Policy and Process Guidelines for Farmer Producer Organisations Issued by Department of Agriculture and Cooperation, Ministry of Agriculture, Government of India published in 2013

- [4] Financing for Farmer Producer Organisations, Policy Paper, ACCESS Development Services and UNDP. The paper has been put together by Monika Khanna and Ram Narayan Ghatak of ACCESS Development Services. It draws from a background paper drafted jointly by Dr. Venkatesh Tagat and Mr. Muralidharan Thykat, Director (Financial Access to FPOs & SMEs) Catalyst Management Services (P) Ltd, with research assistance from Anirudh Tagat, Consultant Research Analyst, RBI Endowment Unit, Institute of Rural Management, Anand

- [5] Farmer Producers’ Organisations (FPOs): Status, Issues and Suggested Policy Reforms, nd, NABARD National Paper- PLP 2019-20 and State-wise list of SFAC Promoted FPOs on the SFAC website

- [6] NABARD to promote 5000 farmer producer organisations in next 2 years, July 2018, Press Releases, NABARD

- [7] Navaneetham, B. Mahendran, K. Sivakumar, S. and Senthilkumar, S., 2017 Status of Farmer Producer Companies in India and Policy and Process Guidelines for Farmer Producer Organisations Issued by Department of Agriculture and Cooperation, Ministry of Agriculture, Government of India published in 2013

- [8] Note on Producer Companies Registered under Part IXA of The Companies Act to be treated at par with cooperatives to seek income deduction under Section 80P of Income Tax Act prepared by Dr.Irina Garg, Director General, Chaudhary Charan Singh National Institute of Agricultural Marketing. It was sent to Ministry of Agriculture and Farmers Welfare and Ministry of Finance

- [9] Section 581J and 581M, Part IXA, Companies Act, 1956

- [10] Roundtable Discussion on Access to Credit: Financing Options for Farmer Producer Organisations (FPOs) Held at IHC, New Delhi on 31st July 2012 hosted by Friends of WWB, India, and sponsored and supported by Small Farmers Agribusiness Consortium and Venkattakumar, R. and Sontakki, B.S., 2012, Producer Companies in India- Experiences and Implications published in Indian Research Journal of Extension Education Special Issue (Volume I), January, 2012

- [11] National Conference on Agriculture Rabi Campaign, 2018-19, Dept of Agriculture, Cooperation and Farmer Welfare, Ministry of Agriculture and Farmers Welfare

- [12] Report of the Task Force on Credit Related Issues of Farmers Chaired by Umesh Chandra Sarangi submitted to the Ministry of Agriculture, GoI, June 2010

- [13] FAQs What is StartUp India, StartUpIndia website

- [14] 10 Business Loans for Startups and MSMEs by the Indian Government, Team Inc42 published in Inc42 on 6th January, 2019

- [15] Venkattakumar, R. and Sontakki, B.S., 2012, Producer Companies in India- Experiences and Implications published in Indian Research Journal of Extension Education Special Issue (Volume I), January, 2012

- [16] Roundtable Discussion on Access to Credit: Financing Options for Farmer Producer Organisations (FPOs), Held at IHC, New Delhi on 31st July 2012 hosted by Friends of WWB, India, and sponsored and supported by Small Farmers Agribusiness Consortium

- [17] Ibid

- [18] Jha, D., “WDRA to ban paper warehouse receipts by March; issue via electronic mode” published in the Business Standard on 5th January, 2018

- [19] “Shri Ram Vilas Paswan launches ‘Electronic Negotiable Warehouse Receipt (e-NWR) System’”, Ministry of Consumer Affairs, Food and Public Distribution, Government of India published in the Press Information Bureau on 26th September, 2017.

- [20] Report of Expert Committee on Integration of Commodity Spot and Derivatives Markets published by Department of Economic Affiars, Ministry of Finance, Government of India in February 2018

- [21] The FPO Round-Table, Agri Business Banking in India: Opportunities and Challenges, IIM Bangalore, April 5, 2014

- [22] RBI Master Circular – Priority Sector Lending- Targets and Classification for Scheduled Commercial Banks amended up to December 15, 2015

- [23] RBI Revised guidelines on Priority Sector Lending for Primary (Urban) Co-operative Banks (UCBs) as of May 10, 2018 and RBI guidelines on Regional Rural Banks – Priority Sector Lending – Targets and Classification as of December 3, 2015

- [25] 37th Foundation Day commemoration seminar on “Collectivisation and Market Linkages: Farmer Producer Organisations” hosted by NABARD on July 2017. Press release – https://www.nabard.org/PressReleases-article.aspx?id=25&cid=554&NID=40

- [26] Can Next-Generation Startups Unite Agritech and Fintech for Farmers in Emerging Markets by Sneha Sampath published in the NextBillion blog on September 18, 2017 and Case Studies/Success Stories from Samunnati Value Chain Finance website

- [27] Roundtable Discussion on Access to Credit: Financing Options for Farmer Producer Organisations (FPOs), Held at

- IHC, New Delhi on 31st July 2012 hosted by Friends of WWB, India, and sponsored and supported by Small Farmers Agribusiness Consortium

- [28] Farmer Producers’ Organisations (FPOs): Status, Issues and Suggested Policy Reforms, nd, NABARD National Paper- PLP 2019-20 and State-wise list of SFAC Promoted FPOs on the SFAC website

- [29] Ibid

- [30] Ibid

- [31] Bikkina, N. Turaga, R. and Bhamoriya, V., nd, Farmer Producer Organizations as Farmer Collectives: A Case Study from India and Trebbin and Hassler (2012), Farmers’ producer companies in India: a new concept for collective action?, and Conclusions and Recommendations of a Round Table Meeting of Experts on Connecting Farmers to Regulated Markets: Challenges and Opportunities co-organised by CII, hosted by NCDEX and knowledge partner NCDEX Institute of Commodity Markets and Research on 24th March, 2017

- [32] Venkattakumar, R. and Sontakki, B.S., 2012, Producer Companies in India- Experiences and Implications published in Indian Research Journal of Extension Education Special Issue (Volume I), January, 2012

- [33] Roundtable Discussion on Access to Credit: Financing Options for Farmer Producer Organisations (FPOs), Held at IHC, New Delhi on 31st July 2012 hosted by Friends of WWB, India, and sponsored and supported by Small Farmers Agribusiness Consortium

- [34] SFAC schemes are just for FPCs and do not include all FPOs e

- [35] Synopsis of Equity Gtant and Credit Guarantee Fund Scheme, SFAC website

- [36] Roundtable Discussion on Access to Credit: Financing Options for Farmer Producer Organisations (FPOs) Held at IHC, New Delhi on 31st July 2012 hosted by Friends of WWB, India, and

- [37] VCA Sanctioned by SFAC in Executive Committee as of 30th November,2017, Venture Capital Scheme Success Stories, and Sanctions of Investment Committee dated 15th February, 2019. Source- SFAC website

- [38] SFAC equity grant and SFAC credit guarantee scheme both set criteria based on the number of members. It is 50 for the former and 500 for the latter scheme.

- [39] Financing for Farmer Producer Organisations, Policy Paper, ACCESS Development Services and UNDP. The paper has been put together by Monika Khanna and Ram Narayan Ghatak of ACCESS Development Services. It draws from a background paper drafted jointly by Dr. Venkatesh Tagat and Mr. Muralidharan Thykat, Director (Financial Access to FPOs & SMEs) Catalyst Management Services (P) Ltd, with research assistance from Anirudh Tagat, Consultant Research Analyst, RBI Endowment Unit, Institute of Rural Management, Anand

- [40] Section 581C. (1), Chapter II, Part IXA of The Companies Act, 1956

- [41]Financing and Supporting POs, NABARD website

- [42] Financing for Farmer Producer Organisations, Policy Paper, ACCESS Development Services and UNDP

- [43] Frequently Asked Questions, Farmer Producer Organisations, NABARD, Mumbai, 2015

- [44] The IMI is constructed by collating several categories under Financial and Business Efficiency and Member Economics. Annexure 9 Policy and Process Guidelines for Farmer Producer Organisations Issued by Department of Agriculture and Cooperation, Ministry of Agriculture, Government of India published in 2013

- [45] Venkattakumar, R. and Sontakki, B.S., 2012, Producer Companies in India- Experiences and Implications published in Indian Research Journal of Extension Education Special Issue (Volume I), January, 2012 and Policy and Process Guidelines for Farmer Producer Organisations Issued by Department of Agriculture and Cooperation, Ministry of Agriculture, Government of India published in 2013

- [46] Section 75(1), Chapter-VII, The State/UT Agricultural Produce and Livestock Marketing (Promotion and Facilitation) Act, 2017

- [47] Venkattakumar, R. and Sontakki, B.S., 2012, Producer Companies in India- Experiences and Implications published in Indian Research Journal of Extension Education Special Issue (Volume I), January, 2012

- [48] National Conference on Agriculture Rabi Campaign, 2018-19, Department of Agriculture, Cooperation and Farmer Welfare, Ministry of Agriculture and Farmers Welfare

- [49] Singh, S. and Singh, T., 2013, Producer Companies in India: A study of organization and performance, CMA Publication No. 246, Centre for Management in Agriculture, Indian Institute of Management, Ahemdabad,

- [50] Annexure 3-9, Policy and Process Guidelines for Farmer Producer Organisations Issued by Department of Agriculture and Cooperation, Ministry of Agriculture, Government of India published in 2013

5 Responses

Really very insightful article , being a banker while working in rural areas such constraints are incomprehensible even to those who are in-charge of facilitating these things. Lots of ground work to be done before vibrant FPOs become the backbone of our rural economy

This article focus only on the Financial aspects of FPOs. There is a more fundamental issue in the FPOs.Originally it was envisaged o find an appropriate replacement of the Cooperative Society form as it involved political interference. So, to replace it, the original thinkers thought of bring in a model to be operated on business lines with good management of the enterprise. To operate on this theme, it required that the FPO is managed well by qualified Manger with experience to manage a business on sound business principles. What turned out was the FPO brought in farmers with some experience and clout as Managers. This is the first fault line. Secondly the formation was left to farmers willing to become members of the FPO. So this left people’s desire to join as members and doing their own way of production. If they needed any assistance they would approach the CEO of the FPO, like inputs, banking assistance or market linkage assistance and any other help the farmer may need. Te FPO never go into any other form of help. So the only difference farmers saw and experienced were firstly they are into a group and if any Government assistance is given to farmers through the FPO they would benefit( I have not heard of any such help to individual farmers) from them. Generally, the FPO are given assistance in the form of a meager capital assistance that is not even adequate to run their operations. With these infirmities the FPOs are not every successful and how the Government in this Budget has said that they are planning to install 10,000 FPOs throughout the country. The Government’s is only to Register a body if it applies. Beyond this there is no role! Registration also depends upon the desire for the farmers to for into a group with such a promotion near their village. NABARD an agency that is involved in the promotion of he FPOs acknowledge these inadequacies that i mention here. The farmers associated with the FPOs are generally those who are able to conduct farming in some form but need assistance that they look forward from the FPOs. I do not understand the word ‘collectives’ used in this article.

Instead, my take on the whole issue is slightly different. Farming on fragment lands by farmer are unsustainable and farmers need to understand this clearly. This is true of farmers who are classified as small, marginal and sen-medium, who hold almost 95% of the cultivable lands. Secondly, farming has become tough for framers as the attendant resources are deficient with them and marketing is a challenge. Farmers do not understanding scientific way of farming as they depend on pouring fertilisers in quantities that affect the soil health. Therefore the best option for these farmers is to pool their lands in their villages and let entrepreneurs join them and form into Agribusiness with entrepreneurs, who are also looking at agriculture as a business option. Many are known to leave their jobs be it in India or even abroad and come to agriculture, as their investigation like me have proved that if agriculture is done with competence, technology and marketed well, there is a lot of wealth in this business. When this is done, farmers worry on production and marketing and taken off their shoulders and their living will become simple and happy. This is what the Government means by saying that farmers should have ease of bushiness and ease of living. They can just work on the pooled lands and get salary like a factory worker. The entrepreneurs will bring Management. Technology and Marketing with them to generate profits for the firm. Farmers will be treated with respect and a Lokpal can also be set up to take any measures that may arise out of any disputes. y website, farmer emancipation .in has details.

Thank you for your comment.

We agree with your point that the role of the FPO, as legally mandated, is much beyond providing just capital assistance. Not only is this capital assistance inadequate but the criteria for granting this, as you’ve also mentioned, such as size and number of FPOs is irrational. FPOs need to expand beyond just performing transactional operations. Access to private capital and venturing into the full range of activities within their legal mandate would help create more sustainable and diverse business-models.

Excellent post you shared here.

Thanks for sharing such a informative info you shared here.

Thank you for your explanation about FPO, I have just a question: Can we implement Cooperative 7 principles in other FPO or not?

Thank you for your consideration.