By Shweta Aggarwal, IFMR Rural Finance

There has been a lot of stress on assessing a customer’s cash-flows before sanctioning a specific loan, for instance a home loan or a crop loan. However, there hasn’t been enough stress on assessing a customer’s cash-flows before sanctioning a Jewel or a JLG loan. What causes the discriminatory use of cash-flow assessments for the same household given the same provider? For the customer, in both cases he/she has borrowed money and has the responsibility to repay it in a given time period along with the added cost of borrowing (interest rate and processing fee etc).

In the KGFS-way of operations, we have designed a simple process that enables the institution to collect and store customer information and assess a household’s cash-flows before sanctioning any product, not only loans but also insurance, savings and investment products. Let’s go through this process step by step:

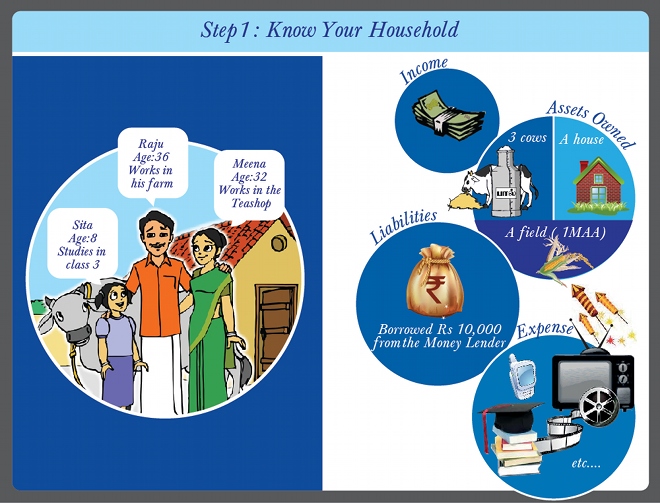

Step 1: Know Your Household

As a part of the KGFS model, each household in a KGFS service area (in the plains, typically a 5km radius around the branch with approximately 2,000 households) is enrolled. The enrolment process involves detailed collection and verification of household information ranging from occupation and income details of all members, household expenses, asset ownership and most importantly outstanding liabilities of each household member. This information is collected and stored in an online customer management system that is accessible to each member of the KGFS ground staff (henceforth: Wealth Manager).

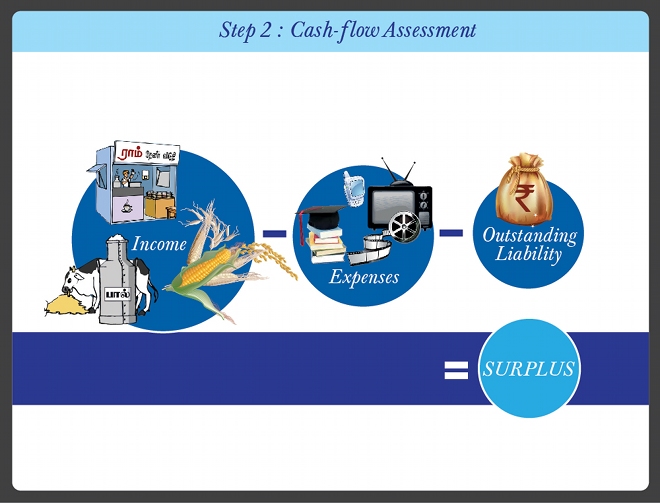

Step 2: Cash-flow Assessment

With this information we arrive at the annual surplus available with each household. While each Wealth Manager is equipped to calculate surplus, as a cross-verification, this analysis is also available through the online systems. This is a household’s debt servicing capability (DSC) or amount of surplus the household has, as one unit, to service debt, buy insurance, save, invest and meet other short term/long term goals. After a thorough Wealth Management conversation, we shift towards a need specific conversation.

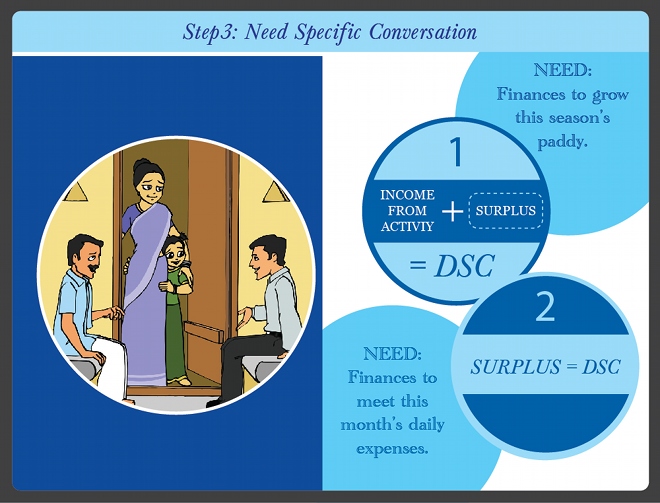

Step 3: Need Specific Conversation

Now that we have a clear assessment of a household’s current financial position and future goals, it is easier to have this conversation. Let’s take a 4 member household with an annual DSC of INR 20,000 with two short-term needs highlighted during the Wealth Management conversation:

- Farmer getting ready for the next season of paddy needs INR 25,000

- Entire household worried about meeting current month’s daily expenses needs INR 15,000

As explained in the Paddy Financing blog-post we collect details about the farmers cropping cycle and calculate expected expenses and income from cultivating that season. Since the loan is for financing crop expenses of INR 25,000 (excluding 20% equity brought in by the farmer), net income should be sufficient to:

- Meet the financing cost of taking the loan (interest + processing fee)

- Contribute to proportional household expenses

If net income is more than sufficient, the loan is sanctioned and remaining income is added back to the household’s DSC. However, if net income is insufficient, the household has the option of digging into its current surplus but is made aware that the cost of taking a loan is now greater than returns earned from the activity. This approach aims at incentivising the household to engage in income generating activities to increase their annual DSC and gain access to higher ticket size loans.

Now, the household still has to meet its daily needs and requires INR 15,000. Given that the household has an unused DSC of INR 20,000 the household can take any of the generic purpose loans like JLG, Jewel or Personal loans from their local KGFS. In case annual DSC of the household was INR 10,000, the household would get the option of structuring a loan for INR 15,000 over two years. This would ensure the household has access to the much needed finance and at the same time is not over-burdened by stress of repaying the entire sum the same year.

This framework is still being refined and future work hopes to address:

1. Creating a liquidity buffer – Is the entire surplus available for servicing debt or should some be kept aside for unexpected circumstances?

2. Accounting for seasonality – Is there more surplus available in some months than others?

—

* – Graphic illustrations by Roshni Jesudoss, IFMR Rural Finance

6 Responses

This is an excellent blog post Shweta and explains very well how the data collection and the analysis proceeds. The diagrams are just excellent as well. I feel though that the longer-term perspective could be included as well because otherwise the dynamic between the longer-term and the shorter-term cashflows does not quite come out.

Nachiket, thank you for sharing your thoughts. Graphics have been illustrated by my colleague Roshni.

I agree, the above post concentrates only on annual cash-flows

of the household and one-year financing needs. For longer term financing, for instance building/buying a home, the framework relies on a comprehensive assessment of long term cash-flows that assesses stability of income and net surpluses. This is our next wave of work since the assessment of risk and financing cost will be of a different order. Will be happy to get inputs on this.

Clearly articulated KGFS approach to lending.

Thank you for you kind comments.

Household as an Unit is a significant financial services opportunity. The service provider needs to identify/understand a) Household Income generation points/avenues b) Household environment enhancement avenues (essentially related to change in living conditions especially w.r.t housing) c) Household knowledge/awareness, education enhancement points d) Household risk coverage and finally e) Household wealth creation. As a provider of the service it serves well to understand each of the opportunities independently as well as address the risks related to each of the above points and then be ready with templated products as well as the right intermediary. This blog has articulated very well a portion of the methodology to identify the opportunities. It would be nice to see the author move beyond the rural shores and attempt to address the vast middle class of this country and attempt a more broader study. Most of the intermediaries in the financial services industry address customers individually and hence miss out quite a bit both on the opportunity side as well as on the risk understanding side. This blog attempts to address this issue to a certain extent. Need to keep awareness creation at the top of the list.

Mr. Ramakrishnan, thank you for your comments.

In the KGFS-way we do believe that a household as a unit of analysis is a true representation of an individual’s ability to repay and grow financially. Through a relationship based approach to lending that involves repeated, high-frequency touch with customers, we hope to ensure that as a responsible service provider, we have updated information for each household. This, as you have rightly mentioned, is crucial while creating products tailor-made to their needs.

Given this approach, awareness/education are not key inputs as the liability always remains with the service provider and not the customer.