We have recently read comments on various blogs which suggest that MFIs are comparable to Ponzi schemes. These bloggers suggest that once new MFI loan disbursements slow down, borrowers will not be able to make the payments on their old loans.

We would like to present data from some of our partner organisations operating across India which soundly refutes this notion.

Out of 13 MFIs whose data has been shared here, only one operates in Andhra Pradesh.

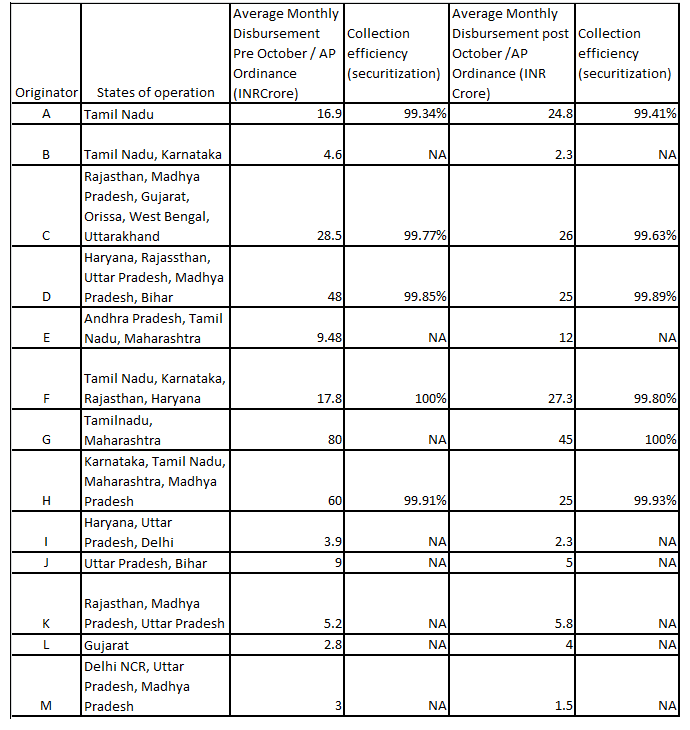

In the following table the data on the collection rate is split into before and after the Andhra Pradesh Ordinance came into effect. As one can see collections rates remain above 99% despite the fact that many MFIs have significantly cut disbursements.

10 Responses

I am glad that this data is being published regularly and that CRISIL has also recently reaffirmed that the securitised portfolios rated by them are continuing to perform at the highest levels despite the crisis. I often feel that these concerns that have been raised by commentators both here and abroad are based on a very low-trust Prior about low-income households and not on any Indian data that they have seen or are able to cite outside of post-crisis Andhra Pradesh. Several organisations that were accustomed to seeing these households as “beneficiaries” for years have watched with amazement how these very same households were actually able to be “clients” and take responsiblity for their own lives. The Andhra Pradesh MFI Ordinance Crisis I think they saw as a vindication of their prior beliefs so that instead of acknowledging that the cause of this crisis was hostile government and regulatory action they looked for “deeper” causes. Any systematic evidence presented to them was rejected by them has being improperly collected or biased becuase it did not accord with their prior beliefs. It is unfortunate that even the Malegam Committee at the end reaches conclusions that reflects this low-trust Prior. In my view the only anti-dote is to keep collecting and presenting systematic evidence. It may eventually reveal a picture that is far more nuanced than either of our low-trust and high-trust Priors are able to capture.

I am glad that this data is being published regularly and that CRISIL has also recently reaffirmed that the securitised portfolios rated by them are continuing to perform at the highest levels despite the crisis. I often feel that these concerns that have been raised by commentators both here and abroad are based on a very low-trust Prior about low-income households and not on any Indian data that they have seen or are able to cite outside of post-crisis Andhra Pradesh. Several organisations that were accustomed to seeing these households as “beneficiaries” for years have watched with amazement how these very same households were actually able to be “clients” and take responsiblity for their own lives. The Andhra Pradesh MFI Ordinance Crisis I think they saw as a vindication of their prior beliefs so that instead of acknowledging that the cause of this crisis was hostile government and regulatory action they looked for “deeper” causes. Any systematic evidence presented to them was rejected by them has being improperly collected or biased becuase it did not accord with their prior beliefs. It is unfortunate that even the Malegam Committee at the end reaches conclusions that reflects this low-trust Prior. In my view the only anti-dote is to keep collecting and presenting systematic evidence. It may eventually reveal a picture that is far more nuanced than either of our low-trust and high-trust Priors are able to capture.

To be fair, David Roodman and Daniel Rozas did clarify in the comments section of David’s blog that they were not asserting all of Indian microfinance to be a “ponzi”. However, we thought it would be useful to put this data out in the public domain so that there is a more nuanced understanding of portfolio performance across the country. This along with CRISIL’s clarification on the performance of securitised paper (http://www.crisil.com/Ratings/Brochureware/News/CRISIL-Ratings_mfi-loan-secu-papers-pr_020211.pdf) reveal that mfi collection challenges are ring-fenced to AP where the Govt has not backed down from its legislation despite the MC recommendations.

To be fair, David Roodman and Daniel Rozas did clarify in the comments section of David’s blog that they were not asserting all of Indian microfinance to be a “ponzi”. However, we thought it would be useful to put this data out in the public domain so that there is a more nuanced understanding of portfolio performance across the country. This along with CRISIL’s clarification on the performance of securitised paper (http://www.crisil.com/Ratings/Brochureware/News/CRISIL-Ratings_mfi-loan-secu-papers-pr_020211.pdf) reveal that mfi collection challenges are ring-fenced to AP where the Govt has not backed down from its legislation despite the MC recommendations.

The tag “Ponzi” might not be true in the current scenario; however, the recent reveals suggest that the industry is in big mess which have benefitted the promoters a lot (Read recent article on Micro Finance Trust Transfer by ET). Promoters have been drawing salary like anything; so the whole concept of serving the poor as advocated by Nobel Naureate Muhammad Yunus got commercialised..Hope we dont have any more bad news to this industry!

The tag “Ponzi” might not be true in the current scenario; however, the recent reveals suggest that the industry is in big mess which have benefitted the promoters a lot (Read recent article on Micro Finance Trust Transfer by ET). Promoters have been drawing salary like anything; so the whole concept of serving the poor as advocated by Nobel Naureate Muhammad Yunus got commercialised..Hope we dont have any more bad news to this industry!

Out of the 13 MFIs listed, there seems to be only 2 cases where the disbursement is substantially lower(>10%) post AP AND the collection data is presented. How can IFMR come to such a conclusion that there is no correlation between disbursements and collections based on such a small subset of data.

In my opinion, the original post aims to comment on correlation between disbursements and collections in the corresponding regions where these MFIs are operating and NOT on correlation between disbursements and collections for each MFI. In fact, the conclusion discussed and rejected in the earlier post by Venky was not at all made in the first place.

The inference from the table is that although overall disbursements have dropped by 28% post AP, the collection rates in corresponding states/regions are well above 99%. The ponzi scheme argument says that lower disbursement of new loans by MFIs affect borrowers ability to repay old loans. The data presented above is in contrast to the same argument.