In this ongoing series, we will cover stories of citizens who have been excluded from social protection benefits delivered through the Direct Benefit Transfer (DBT) and Public Distribution System (PDS). In collaboration with Gram Vaani*, a grassroots-level social tech company, we document the stories of beneficiaries who have faced challenges in welfare access in M.P., Bihar, U.P., and Tamil Nadu.

The following case study illustrates how poor monitoring of activity in the last mile of the financial services ecosystem may expose Direct Benefit Transfer (DBT)[1] beneficiaries to instances of fraud, depriving them of their G2C entitlements. Instances of fraud at banking points assume greater significance in the context of government transfers for two key reasons. First, the DBT system is designed to rely on the current banking infrastructure which continues to remain inadequate in rural areas which have been traditionally targeted under welfare schemes. Second, the failure to receive entitlements from the government due to inefficiencies in a delivery chain facilitated by private players (individual banking agents in this case) raises questions on accountability, clearly illustrated in this case study.

Mr. Arun Lodhiya, a resident of Shivpuri, M.P., opened his bank account in 2015. In the absence of easily accessible ATMs, the two cash-out points he frequented included a bank branch at some distance from his village and a Customer Service Point (CSP)/banking kiosk operated by a national bank. However, between 2015 and June 2020, he was only able to withdraw a sum of Rs. 5,800 despite multiple withdrawal attempts at the CSP, which were purportedly unsuccessful. Mr. Lodhiya informed us that every time he visited the CSP to withdraw cash, he was made to authenticate himself using his thumbprints, post which he was informed by the operator that he had insufficient balance in his account or that his account seemed to have been blocked.

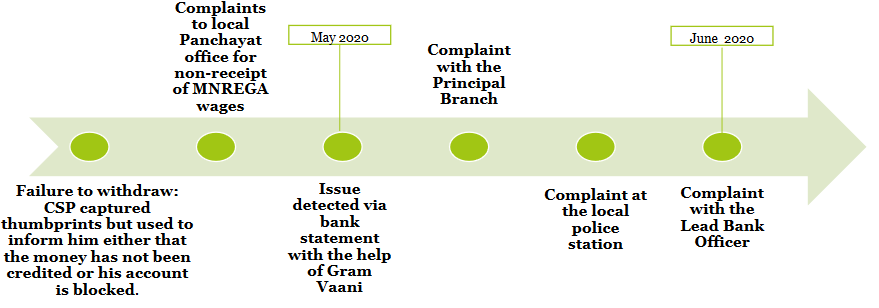

Having been informed thus, he complained to the Panchayat office for not transferring the MNREGA wages due to him into his account. The Panchayat officials, in turn had claimed that the wages had already been transferred. Suspecting that there was an issue with his bank account, Mr. Lodhiya visited the bank branch in May 2020 and requested for a full bank statement. This was done with the help of the Gram Vaani team after her had registered his grievance through their Mobile Vaani service. The team had then helped him to generate his bank statement which revealed some improprieties. The statement revealed that transactions worth Rs. 1,05,000 had been done at the CSP, with the date and time of those transactions corresponding to the multiple failed visits he had made to the CSP. As of June 2020, he has filed complaints at multiple points including the principal bank branch, local police station, and finally with the lead bank officer. The investigation is reportedly going on but the CSP operator continues to function (as stated by Mr. Lodhiya), without any penalties imposed.

Figure: Timeline of Exclusion

In this case, Mr. Lodhiya filed complaints at three different points for failure of delivery of a G2C payment, in the absence of any clarity around which entity should exactly bear the responsibility for occurrence of such improprieties. There are no established rules of engagement in the last-mile of DBT. To ensure that the less financially literate beneficiaries or those unaccustomed to banking are not excluded from welfare provisions, delivery protocols need to be monitored effectively, if not revised altogether. Practices adopted by functionaries at citizen interface points (CSCs/BCs/bank personnel in the case of DBT) need to be monitored closely and effectively to identify areas for improvement.

A working framework to study exclusion in social protection has been employed to analyse this case, mapping points of exclusion across the four key stages of scheme design and delivery as detailed here.

* The author would like to thank Aaditeshwar Seth, Sultan Ahmad, Matiur Rahman, Ashok Sharma, and the Field Operations team at Gram Vaani for facilitating these case studies.

[1] Under the Direct Benefit Transfer system, scheme beneficiaries receive their entitlements from the concerned Ministry into their bank accounts.