Due to the demonetisation of currency and recall of the currency notes of Rs. 500 and Rs. 1000 denominations announced by the government there was some panic in the initial days and the mandis were closed for some days. However, things are becoming better with the passage of time.

Recent visits to the mandis and fresh feedback received from the market participants indicates that arrivals have started improving in the mandis. The Rabi sowing status, which was feared to be disrupted due to cash crunch, has not seen any major impact as most of the essential inputs were available on credit or in old currency notes.

In the weeks after demonetisation, it was observed that commercial small farmers in “tight” value chains (such as sugarcane delivered to a specific neighbouring sugar mill, fruits, vegetables, milk, tea, specialty coffee and spices, fertilisers, seeds) benefitted from the strong relations between buyers/traders and producers and quickly adopted digital payment. These tight value chains generally involve greater control of the flow of goods and funds to ensure repayment (via delivery of the crop) and limit the opportunities of side selling (when the farmer delivers somewhere else to avoid repayment of loans extended under value chain financing models).

Government policies that support and encourage such value chains will speed up the shift to formal bank financing, financing from buyers (e.g., sugar mills, cotton ginners, milk companies), increase financial literacy and understanding about banking requirements among small farmers.

In looser supply chains where crops can be sold on the side and where repayment is difficult to capture through delivery, local lenders who are near farmers have an advantage, as proximity closes the asymmetric information gap, facilitates credit assessment, and makes repayment enforcement easier. Government policies should use input suppliers in the area, local credit unions, credit cooperatives, and microfinance institutions (MFIs) in that location for reaching out to such farmers.

The current situation, therefore, warrants exploring and providing more user-friendly and easily accessible scale-neutral technology, which can serve the economic needs of India’s 138 million farms. Fortunately India has already developed and successfully tested some of the best farm market-based ecosystem in the form of online agricultural markets.

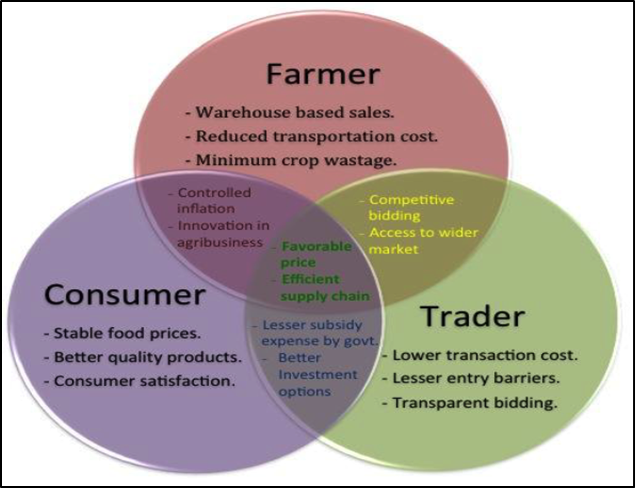

Digitisation is opening up new opportunities for cost-saving automation, accuracy, speed and vastly-improved efficiency in agricultural trade documentation, storage, finance, and risk management. Supported by the right policies and market infrastructure institutions, it can transform Indian agriculture’s financing models, risk mitigation models, and distribution models.

1) Re-launch Exchange-traded Forwards and Launch Options

Exchange-traded commodities have already demonstrated the advantages from digitisation through greater speed, transparency, global reach, accuracy and reduced cost. Exchange traded Forward contracts (permitted by the erstwhile FMC, since suspended by SEBI), futures, and options allow crop prices to be locked in prior to the actual delivery of the product.

Exchange traded forwards can bring to cash-less and traceable (in addition to reducing defaults and better quality based sales) systems the entire Rs 7 – 9 lakh crore agri produce in India every year and enable the entire value chain to adopt newer and more compliant ways of doing business, including government procurement.

Except in wheat and rice that have partial protection through government procurement, Indian farmers are buffeted by price volatility. The availability of options can be the ideal instrument for insuring their margins. Farmer producer companies and cooperatives can be encouraged to use options to manage commercial risk in the production, processing and marketing of agricultural products. Banks can extend credit to purchase price insurance.

In other words, under the new agricultural market structure, farmers will be able to sell through transparent, digital markets such as the exchange-traded forwards or the National Agricultural Market/State Agricultural Market. They will also be able to sell to government agencies at the minimum support price through exchange-traded forwards. And they will be able to protect themselves from price volatility by using options.

Similarly, call options – that give the government the right – but not the obligation – to buy pulses when prices rise, for example, will reduce the need for accumulating physical stocks and add transparency by setting clear rules for government intervention. The food subsidy budget for FY17 is Rs 1.34 lakh crore, of which Rs 1.03 lakh crore is to be routed through FCI to the intended beneficiaries.

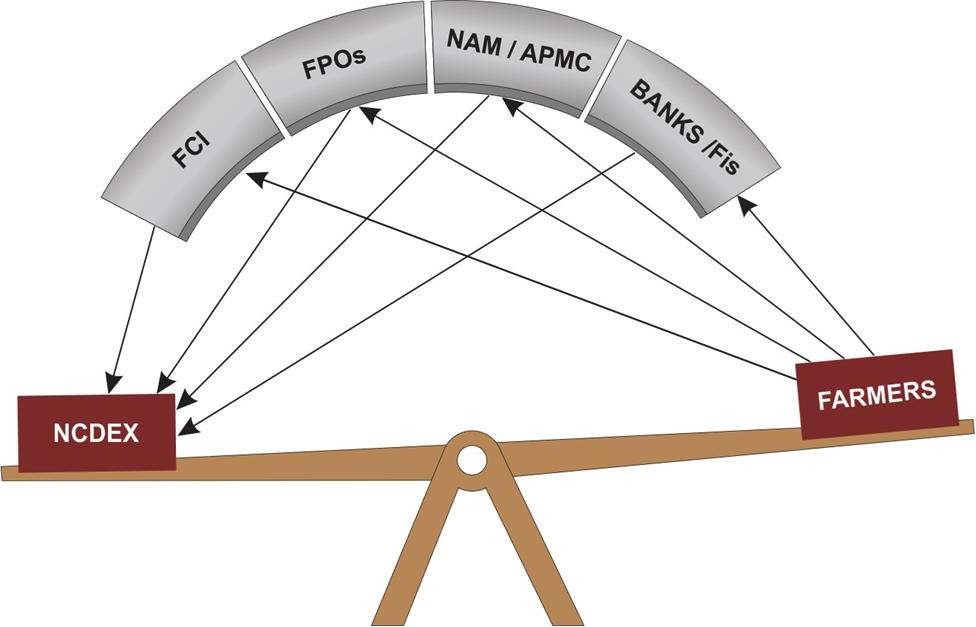

Exchanges can thus become the fulcrum of the new cashless agricultural economy if they move upfront on the developmental agenda of policymakers, regulator and political agencies.

2) Create more capacity in commodity exchanges in order to encourage more agricultural value-chain participants to use regulated markets for risk management and financing.

Agricultural sector companies not involved in primary production (i.e., traders, processors, food companies, input suppliers) have their own financing, and production and price risk management needs. Working capital, funding for acquisition of assets (movable and real estate), cash flow management services, hedging and insurance are often needed by these agricultural companies.

Increasing position limits, adding many more commodities for trade (such as pulses, rice and dairy), and reducing taxes (such as CTT) will encourage them to increasingly use the exchange platform for low-cost risk management, marketing, and inventory financing.

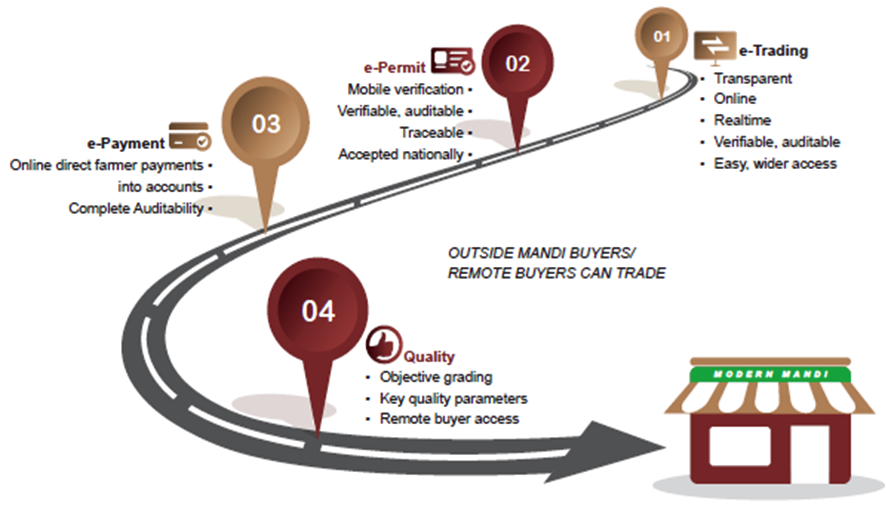

3) Expand the digital mandi network by connecting National Agricultural Market and State Agricultural Markets (SAM)

Early indications are that although NAM has been implemented in 250 mandis across India, it is still currently restricted to post-trade data entry and not functioning as real price discovery, clearing and settlement driven markets.

On the other hand, SAM initiatives in Karnataka have implemented e-trading virtually end to end. Rashtriya e-Market Services Limited (ReMS), a joint venture of Karnataka Government and NCDEX Spot Exchange Limited (NSPOT) was formed to setup a Unified Marketing Platform (UMP) for modernising more than 300 APMC regulated market yards into a single online marketplace for the state, and enhancing the efficiency of regulated markets in the state. The Karnataka Government provided unified licenses for all APMCs within Karnataka. It also allowed for warehouse-based sales, warehouse receipt-linked loans and single point levy of market fees across the state, making Karnataka one of the first few states to adopt all recommendations of model APMC Act. More than 66 lakh farmers have successfully completed transactions worth Rs 32,000 crore till date through the Unified Market Platform in Karnataka. A simple trading platform for “Tur” pulses trading in Gulbarga Mandi was provided and eventually government provided an e-trading UMP across the state. Through the e-platform, the state Government and NCDEX have played a key role in linking smallholders to a wider market and helping them realize better prices for their produce.

A study covering impact assessment of e-tendering of agricultural commodities in Karnataka conducted by National Institute of Agricultural Marketing, Government of India, reveals that about 83% of stakeholders felt that the operations have become more transparent and time-efficient. Farmers have reported an 18% increase in income realization and traders have reported at least 25% of their time being saved through the online process. Overall, all the mandis have experienced an increase in trading volume and revenue because of increased sale at the higher side of price range and stable prices.

Creating interoperability between NAM and SAM will help accelerate digitisation of mandis. Digitalisation is an important step for reducing inefficiencies in agricultural markets, developing rural financial services, transparent pricing and promoting better organised agricultural value chains. By connecting the two networks through interoperability to establish a comprehensive market architecture, farmers in almost 500 market yards can seamlessly experience the benefits of digitisation.

4) New WDRA-regulated repository will boost warehouse-based sales and commodity finance

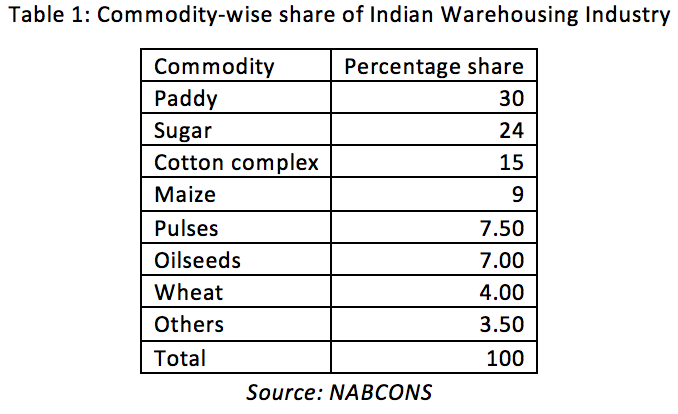

Agricultural warehousing accounts for 15% of the warehousing market in India and is estimated to be worth Rs 8,500 crore.

Beginning can be made by exempting the 450 exchange-accredited warehouses, with a combined capacity of 2 million tonnes, from Stock Control Order under the Essential Commodities Act to encourage inflow of crops in this transparent and regulated warehousing network.

Simultaneously, the WDRA can encourage a pan-India digital network through the new Repository of all licensed warehouses for real-time data collection on food stocks. The benefits of switching to electronic accounting are almost immediate and lie in speed, ease of use, accuracy and cost. Automation reduces overheads and man-hours, with document transmission constrained only by the speed of the Internet.

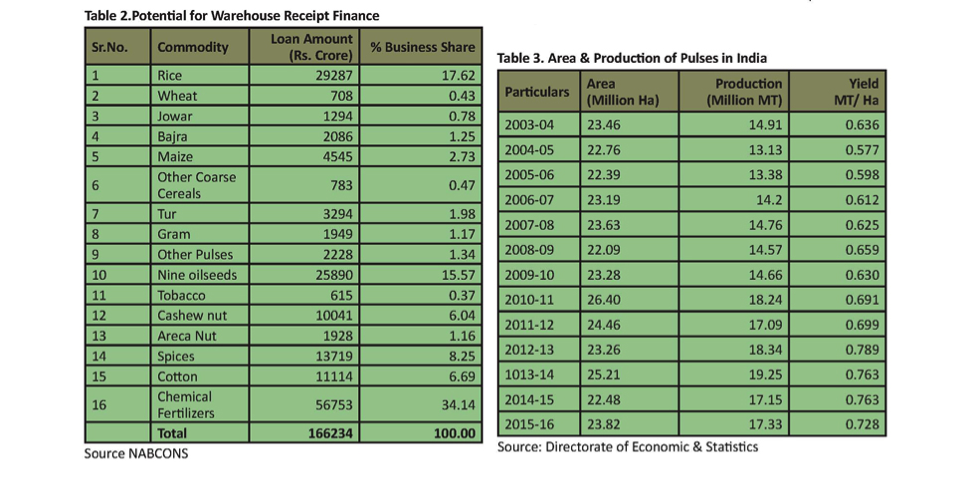

The commodity repository will provide the legal and regulatory environment for inventory financing and warehouse receipt lending to encourage the use of these financing mechanisms. While currently the size of the market is estimated at about Rs 30,000 crore, as per a recent study by NABCONS, the potential for finance against collateral of major agri commodities and fertilisers is Rs 1,66,234 crore.

The combination of repository, digital warehouses, digital mandis, and warehouse receipts will create a legal environment that ensures easy enforceability of the security, and makes warehouse receipts a title document. It will create a network of reliable and high-quality warehouses that are publicly available. It will introduce a system of licensing, inspection, and monitoring of warehouses. It will lead to the creation of a performance bond and banks that trust and use the system. It will encourage agricultural market prices that reflect carrying costs. It will reduce the threat of hoarding of essential commodities and ease raw material procurement. And it will promote well-trained market participants.

5) Strengthen producer organisations as important aggregators for delivering digitised financial and non-financial services to smallholder farmers.

More than 18,500 small and marginal farmers have successfully hedged their crops on NCDEX in the last 10 months through nine Farmer Producer Companies. By creating the right mechanisms, more such companies can be encouraged to connect to formal, regulated, cash-less markets. There is also the need to invest resources in capacity building for financial and managerial skills as well as improved corporate governance.

For small farmers, the advantages of joining a collective are direct access to a viable market (local, regional, global) for the end product; a clear, transparent pricing mechanism, a price that is attractive; shift away from mono-cropping low-value high-volume crops; avoiding overreliance on credit to purchase inputs; leveraging a competitive advantage in production, quality certifications, proximity to the end market; and, credibility of the buyer and trust among farmers via regular direct interaction between the buyer and the farmers.

There are already a number of NGOs and initiatives that work to strengthen farmer producer organisations, but a more conscientious effort and a bigger scale is needed.

Post-demonetisation innovation can improve the following constraints in the agricultural sector:

- Enable transparent, efficient market structure (e.g., through greater adoption of exchanges)

- Reduce administrative and distribution costs of food procurement (e.g., through options and exchange-traded forwards)

- Improve security of the collateral and cash flows (e.g., warehouse receipt financing, price hedging, insurance).

- Improve competitiveness of small and marginal farmers (eg. Farmer producer companies)

- Increase the share of formal finance in agricultural commodity markets.