In this ongoing series, we will cover stories of citizens who have been excluded from social protection benefits delivered through the Direct Benefit Transfer (DBT) and Public Distribution System (PDS). In collaboration with Gram Vaani*, a grassroots-level social tech company, we document the stories of beneficiaries who have faced challenges in welfare access in M.P., Bihar, U.P., and Tamil Nadu.

Errors in beneficiary records and other issues related to database management in the backend of the Direct Benefit Transfer (DBT) system often lead to failures of credit into beneficiary accounts. These failures may result from clerical errors either during digitization of the said record (as is seen in this case study) or during validation checks when scheme databases are cross mapped with those in the banking system. Given the large amount of data processed and the degree of inter-agency coordination required in the DBT back-end, occurrence of certain errors cannot be fully eliminated, however, the mechanisms to resolve the same can be streamlined to ensure minimum burden on the citizen.

This case study details an incident in which PM-Kisan payments due to a particular beneficiary were transferred into an unrecognised (as per the concerned beneficiary) bank account. Although it remains to be seen how this error came to be, both at the front-end (at enrolment/document submission point) and at the back-end (where PFMS and bank cross-validate the beneficiary details), we document the difficulties it has caused for the farmer beneficiary. The case speaks to broader themes of how allowing decentralised correction of database errors at points easily accessible to citizens could potentially improve beneficiary experience and reduce associated costs.

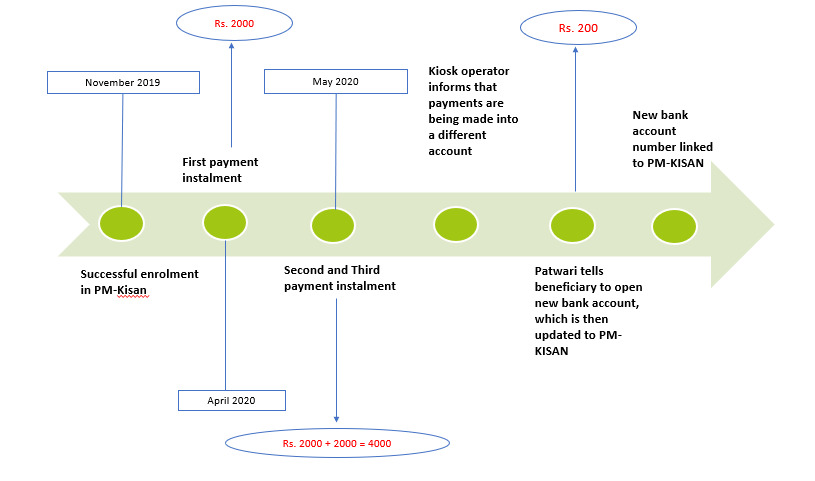

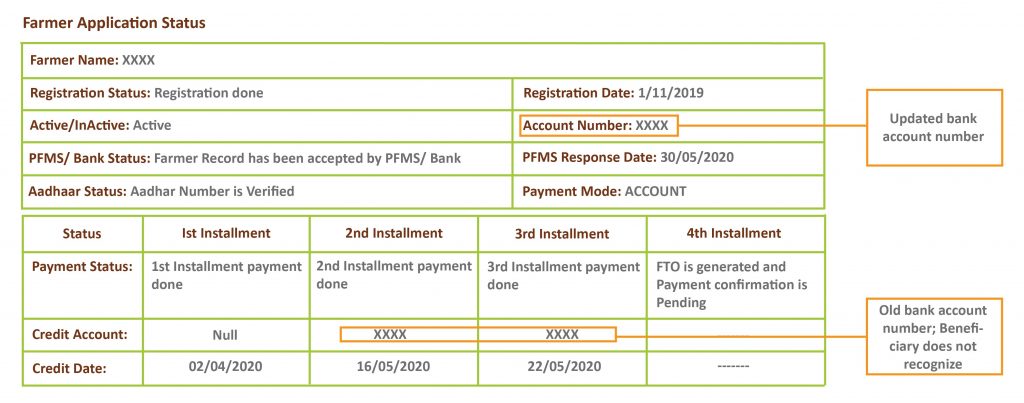

Mr. Mahesh Sahu successfully enrolled himself into the PM-KISAN scheme in November 2019 to receive income support from the government. However, he has not received any of the payment instalments due to him as of June 2020. Upon approaching the local ‘Seva Kendra’ to check the status of payments through the PM-KISAN website, he was told that payments are successfully being made – but into the wrong bank account. Mr. Sahu is unable to identify the bank account number and says it does not belong to him or any of his family members. He approached the local patwari [1] for further resolution, who suggested that he open a new bank account so future payments may be correctly made into it. He was also required to pay Rs. 200 to the patwari at this stage. The new account was opened and is presently reflected in the ‘Kisan corner’ portal as the beneficiary’s updated bank account (see image below). However, the first three instalments have already been paid into the aforementioned unidentified bank account.

This case adds some value to our understanding of how exclusion may inadvertently occur. First, Mr. Sahu is unsure whether the Rs. 6000 paid into some other bank account, would be credited back to him in the future. Though the scheme provides that missed payments will be paid in lumpsum along with future instalments, it is unclear whether this caveat applies in this case (as payments have not been missed according to the PM Kisan portal)[2]. This is a foregone benefit that must be counted as a cost to the beneficiary. In cases of human data entry error such as this, there is no scope for error resolution until the beneficiary has already experienced considerable costs of time, money and effort. In short, the system does not seem able to identify and self-correct such minor errors. This issue of a beneficiary bearing inordinate costs in order to resolve a data entry error has been explored earlier in this series as well.

At present, the ‘Kisan corner’ portal accessed with the beneficiary’s personal information reads that previous instalments have been successfully paid (into a different bank account) while the Fund Transfer Order (FTO) has been generated for the upcoming instalment into the newly updated account[3]. It is apparent that Mr. Sahu’s missed payments are reflected as successfully completed in the system, which complicates grievance redressal. The second question that naturally follows is that how crediting of an unverified bank account was possible in the first place. The standard operating procedure (SOP) for Direct Benefit Transfer (DBT) payments mandates that a payment cannot be successful until the beneficiary’s bank and the National Payments Corporation of India (NPCI) validate the bank account and linked Aadhar number[4]. Ideally, the validation should have flagged this error and the payment should have failed, as seen in the case of Amit Singh, an exclusion case study explored by us previously.

Figure: Timeline of Exclusion and Costs Incurred

Image: Farmer Application Status

*The author would like to thank Aaditeshwar Seth, Sultan Ahmad, Matiur Rahman, Ashok Sharma, and the Field Operations team at Gram Vaani for facilitating these case studies.

A working framework to study exclusion in social protection has been employed to analyse this case, mapping points of exclusion across the four key stages of scheme design and delivery as detailed here.

[1] A patwari is the lowest state functionary in the Revenue Collection System, and is tasked with maintaining land records and tax collection.

[2] Government of India. Pradhan Mantri Kisan Samman Nidhi (PM KISAN) Frequently Asked Questions (FAQs). Department of Agriculture, Cooperation and Welfare. Retrieved from https://pmkisan.gov.in/Documents/RevisedFAQ.pdf

[3] The status of PM Kisan payments was checked online after taking due permission from the said beneficiary.

[4] DBT Mission. Standard Operating Procedure (SOP) Modules for Direct Benefit Transfer (DBT). New Delhi: DBT Mission Cabinet Secretariat. Retrieved from https://dbtbharat.gov.in/data/documents/Standard-Operating-Procedures.pdf