In the previous blog posts of this series, we had outlined that the various aspects of financial development like depth (Credit to Gross Domestic Product (GDP) ratios), and access (per cent of population with bank accounts in urban and rural areas, and distribution of payment access points per 10,000 eligible persons) vary not only between Indian states, but also considerably between different districts. In this context, in order to assess the depth of credit for each district, it is important to study and understand the trends in district level credit depth defined as the ratio of quantum of credit outstanding in district to district GDP.

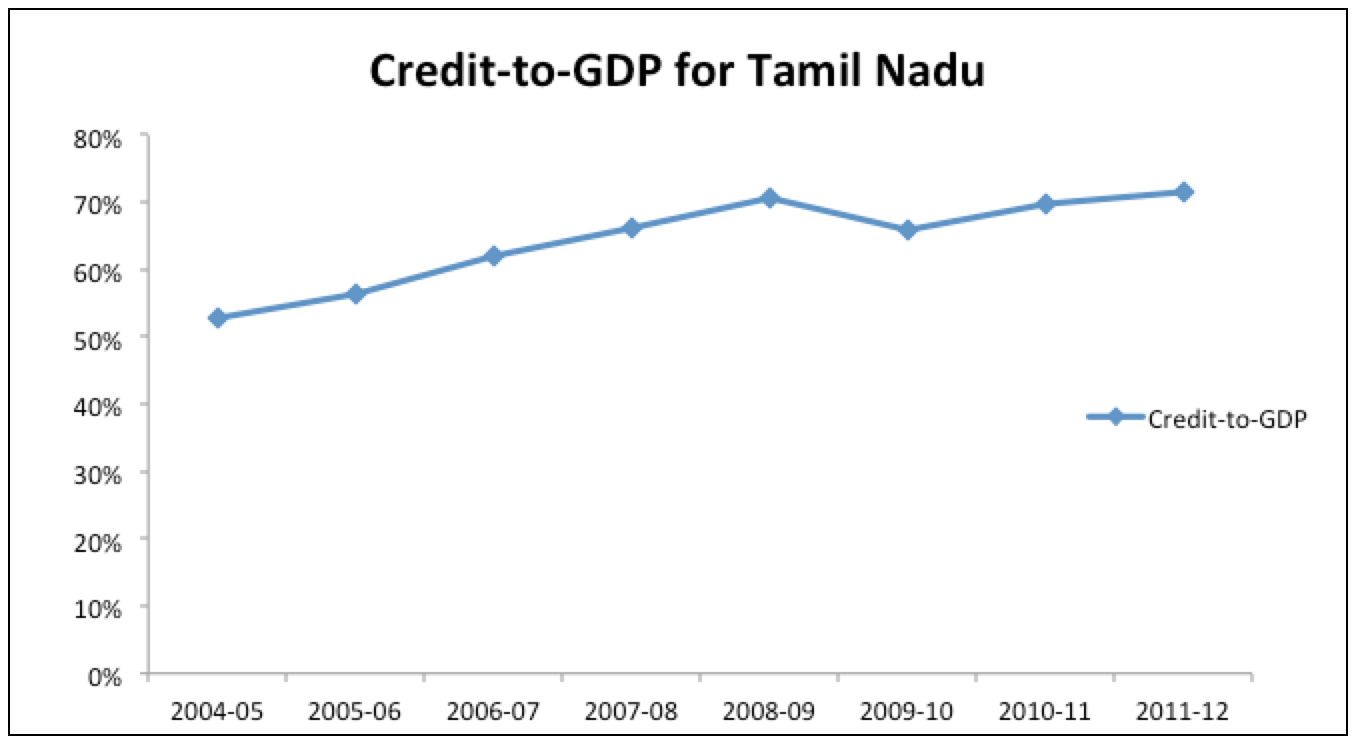

This post will focus on understanding the trend in credit-to-GDP variable for Tamil Nadu as a state, and for the 32 districts in Tamil Nadu for the time period 2004-05 to 2011-12. We also present evidence for increasing median credit depth for Tamil Nadu.

Figure 1: Trend in Credit-to-GDP (Current Prices) for Tamil Nadu from 2004-05 to 2011-12

Observation 1: In 2011-12, the Credit-to-GDP ratio for Tamil Nadu was approximately 71.4% (Tamil Nadu’s credit-to-GDP [at constant prices] was 110% in 2011-12). However, this high value of overall credit depth in Tamil Nadu was mostly driven by the very high levels of credit depth in urban areas like Chennai (561%) and Coimbatore (131%). Conversely, districts such as Thiruvallur and Vellore had low levels of credit depth with 15% and 18% respectively. Hence, there was a wide variation in the levels of credit depth within the districts of Tamil Nadu as of 2011-12.

The mapping visualisation below (Figure 2) captures this variation in credit depth for all districts of Tamil Nadu between 2004-05 and 2011-12. It is important to note that Tirupur district was part of Coimbatore district from 2004-05 to 2009-10. Ariyalur was under Perambalur from 2004-05 to 2006-07. For these districts, the values of parent districts have been applied for time periods in which they did not exist.

Figure 2: Credit-to-GDP Ratio for Districts of Tamil Nadu between 2004-05 and 2011-12 (In Percentage)

Please select the year to load the

corresponding data map for that particular year.

[rtbs name=”credit-depth-tamil-nadu”]

Figure 3 below is a interactive box plot which captures the variations in credit-to-GDP (current prices) ratio from 2004-05 to 2011-12 (with Chennai and Coimbatore being outlier districts have been left out for lucidity in constructing this box plot).

Figure 3: Box Plot of Credit-to-GDP (Current Prices) for Districts of Tamil Nadu between 2004-05 and 2011-12

Observation 2: As is evidenced from the plot above, the median credit depth (shown by the horizontal line inside the box for each year) in the state is increasing (with an anomaly being the year 2010-11 where credit-to-GDP ratio marginally reduced to 0.26 from 0.27 in 2009-10). Simply put, this means that there is a movement towards higher credit depth in the economy of Tamil Nadu from 2004-05 to 2011-12. However, this upward trend could also be primarily caused by the exponential credit growth in urban centres such as Chennai and Coimbatore (as discussed earlier).

Observation 3: Another important observation is that the lowest quartile of credit-to-GDP is increasing from 2004-05 (0.1) to 2011-12 (0.15). While this implies a higher minimum credit depth in 2011-12 than in 2004-05, we cannot, however, ascertain the distribution effects of this increased depth.

The next blog post in this series will discuss the trends in growth of credit-to-GDP variable and highlight important district specific trends.

3 Responses

Interesting analysis. What is interesting is how historically things have not changed much in the state of Tamil Nadu. If one looks at its earlier form of Madras Presidency and sees financial penetration, one is likely to see similar patters. Places like Madras, Coimbatore, Tanjore etc topped the charts back then as well. Yes, absolute penetration has surely improved since then but relatively ranking have barely changed..History continues to shape inclusion in modern Tamil Nadu..

Thank you for you Comment, Amol and I agree. It does seem like the relative ranking credit depth among districts is not changing. Our interest is now to see if there are any changes in relative ranking of districts with respect to socio-economic parameters over the years.

Thank you for sharing such great information. It is informative, can you help me in finding out more detail.