As part of our efforts to better understand over-indebtedness among Indian households, we looked at prior research from Europe that could further aid our understanding of the topic. In this post, we share our learnings from the European context

In the late ’90s and early 2000s, Europe saw the expansion of credit availability and the overall increase in household indebtedness[i]. A study by Disney, Bridges and Gathergood (2008) noted that the United Kingdom had seen a 50% increase in household indebtedness relative to income.[ii] After the recession in 2008, increased household level debt received even more attention, as many studies concluded that countries with higher debt at the household level were hit harder by the recession. This prompted a number of research studies and papers to measure and understand over-indebtedness at the household level in Europe. Most of the research around this subject is based on data from various socio-economic surveys that have been carried out in various European countries, like the British Household Panel Survey, EU Statistics on Income and Living Conditions, and the Bank of Italy Household Income and Wealth Survey.

Definitions of Over-indebtedness

There is no commonly accepted definition of over-indebtedness in the literature. In the UK over-indebtedness is defined as a situation “where households or individuals are in arrears on a structural basis, or at a significant risk of getting into arrears in a structural basis”[iii]. In Germany it is defined as a household whose income, “in spite of a reduction of the living standard, is insufficient to discharge all payment obligations over a long period of time”[iv].

In 2008, a study by the European Commission titled “Towards a common operational Definition of Over-indebtedness” identified a number of common features of the various definitions of over-indebtedness used among different member countries. It recognised over-indebtedness as a multi-dimensional phenomenon with the following dimensions:[v]

- Economic Dimension: All definitions take into account the ability to repay the debt, based on income and the amount of debt.

- Temporal Dimension: Over-indebtedness must be structural in nature, i.e. it must not be something that is temporary but must persist in the medium term.

- Social Dimension: Over-indebtedness definitions also take into account that the household must be able to meet basic necessities after the repayment of debt.

- Psychological Dimension: Some definitions also take into account the stress of being over-indebted.

The study also suggested the following criteria for a common definition of over-indebtedness.

- “the unit of measurement should be the household because the incomes of individuals are usually pooled within the same household;

- indicators need to cover all aspects of households’ financial commitments: borrowing for housing purposes, consumer credit, to pay utility bills, to meet rent and mortgage payments and so on;

- over-indebtedness implies an inability to meet recurrent expenses and therefore should be seen as a structural rather than a temporary state;

- it is not possible to resolve the problem simply by borrowing more;

- for a household to meet its commitments, it must reduce its expenses substantially or find ways of increasing its income.”

According to a research note on over-indebtedness prepared for the European Commission, based on the above criteria, an over-indebted household may be defined as “one whose existing and foreseeable resources are insufficient to meet its financial commitments without lowering its living standards”.[vi]

Measuring Over-indebtedness

As may be seen from the above definitions, it is not easy to identify a household which would meet the above definition of over-indebtedness. Studies have used a variety of indicators depending on the kind of data that is available from different surveys that focus on household wealth. Studies have used both subjective (Ex: level of difficulty in repaying debts) and objective indicators (Ex: debt to income ratio). The study by the European Commission outlines various indicators which were used to measure over-indebtedness in Europe, both at a pan-Europe level and in each member country. It catalogues the indicators into the following four groups:

- Statistics on debt settlements like debt-write offs, or court arranged solutions

- Data on financial arrears

- Indicators like the borrowing-income ratio of a household, household debt-service burden

- Subjective assessment of the financial burden by the household

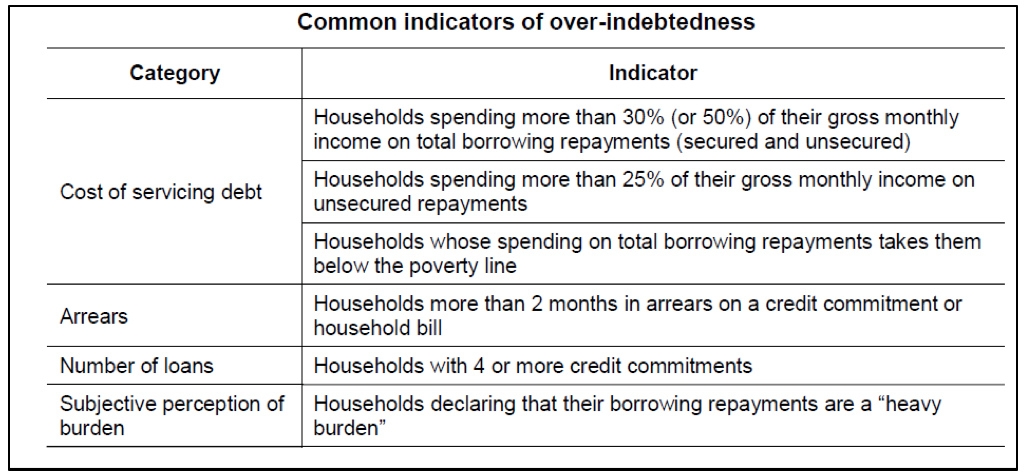

Depending on the data and information available, different countries use different indicators to measure over-indebtedness. D’Alessio and Iezzi (2013), as part of their paper based on data from the Bank of Italy Household Wealth and Income survey, have compiled some common indicators of over-indebtedness which are shown below:[vii]

The separation of home loans from other consumer credits considers the number of assets that a household may have which can be used to pay off the debt in case of difficulty. The paper by D’Alessio and Iezzi (2013) also tried to consider any financial or real assets that a household may possess by looking at debt to income ratio in three different ways:

- Simple Debt to Income ratio

- Reducing debt servicing cost based on liquidating financial assets, while also reducing disposable income to account for a loss of income from financial assets

- Reducing debt servicing cost based on liquidating financial and real assets of the household, and accordingly reducing disposable income

Many subjective indicators are also used to measure over-indebtedness. Despite the many issues associated with subjective indicators (which are self-assessed and self-reported), such criteria take into account the psychological dimension of over-indebtedness as well as expectations about future incomes. The exact indicator used in different studies depends on the kind of questions that were asked as part of the survey on which the study is based. Some such criteria are given below:

- Households reporting that repaying loans is a major burden on them

- Households reporting that they make ends meet with difficulty

The paper by D’Alessio and Iezzi (2013) considers such subjective criteria as the gold standard of measuring over-indebtedness and uses them to compare the effectiveness of other objective criteria. They also compare various indicators using the same underlying dataset and find that very often there is not only quite a lot of variation in the households which are considered as over-indebted based on different indicators, but there is also often limited overlap between these two indicators. For example, based on the Italian Survey on Income and Wealth, 3.17% of households spend more than 30% of income on debt repayments and are thus over-indebted. But of this only 0.35 % of households are actually in arrears on their repayments for more than three months. Thus, while one set of households is being considered over-indebted by one indicator, an almost entirely different set is being identified by a second indicator.

Similarly, the overlap of various objective indicators and subjective indicators also varies quite a bit. For example, among households spending more than 30% on debt repayments, only about half reported that they face difficulty in making ends meet.

D’Alessio and Iezzi (2013) also argue that different indicators may be better at measuring over-indebtedness among different types of households. The performance of indicators also depends on the cut-off points chosen for each of the indicators. They also argue that the limited overlap across different indicators suggest that different indicators measure different dimensions of over-indebtedness.

A paper by Keese (2010), which compares objective and subjective measures of over-indebtedness, takes into account two types of objective indicators, i.e. total debt to household income ratio and ratio of household income after debt-repayment to subsistence income level. For both these indicators, the paper looks at the debt of two different types, i.e. consumer credit only and consumer credit combined with home loans. The paper argues that housing debt is associated with accumulating long-term wealth and home ownership significantly reduces the pressures on household budgets compared to households which are tenants. The paper also looks at the ratio of household income with minimum subsistence level income as a measure of possible over-indebtedness. This indicator considers the social dimension of over-indebtedness. It must be noted that most countries in Europe have policies for minimum income levels which are guaranteed by the state.[viii]

Factors that influence Over-indebtedness

Many studies on over-indebtedness also explore the various factors that influence it. These studies are also based on national or international household wealth and income surveys. Anderloni and Vandone (2008) in their review of the literature on household over-indebtedness outline the following common variables which many studies explore for their link to household over-indebtedness:

- Family composition and age

- Family circumstances

- Economic activity status and level of education

- Income and labour conditions

Other common variables they outline are housing tenure, real estate wealth, savings, the area of residence, health and ethnicity.

The European Commission study outlines many factors that affect the risk of household level over-indebtedness, some of which are outlined below:

- Family type and number of children

- Income levels

- Employment status

- Housing tenure

- Savings and spending patterns

- Unsecured credit commitments

Along similar lines, D’Alessio and Iezzi (2013) explore whether certain measures of over-indebtedness are more suitable for certain particular classes of households based on age, education, and income levels. For example, they find that when using the indicator of debt payments to income ratio, among households where the head of the household is 31-40 years old, 6.5% are over-indebted and of this 2.8 % also subjectively considered themselves over-indebted. But when the head of the household is 51-60 years, 2.9% are over-indebted based on the same objective indicator and 1.6% of these households are over-indebted based on the subjective indicator. The overlap between the subjective and objective indicators is higher among households where the head is between 51-60 years old.

The European Commission study reports that many researchers have linked income with a likelihood of over-indebtedness and concluded that households with lower income are more likely to be over-indebted. But many other pieces of research have also cautioned that a number of other factors also act in combination with income levels. For example, Kempson and Atikinson (2006) find households with above-median incomes but with high credit commitments are also very likely to be over-indebted.[ix]

Several studies also report that households living in rented accommodation also have a higher likelihood of being over-indebted. Studies have also shown that the odds of households with children being over-indebted are higher than those without children, relying on a study by Niviere (2006) which explains that this occurs because a higher proportion of expenditure cannot be reduced, and child rearing can lead to lowering of working hours of one parent.

While such studies have been undertaken to link over-indebtedness with a number of factors in European countries, it remains to be seen whether these relationships hold true among Indian households. An understanding of these factors can help not only to identify reasons for over-indebtedness but can also serve as a tool to recognise whether a particular household is likely to become over-indebted or not.

—

[i] European Commission, 2008, Towards a Common Operational European Definition of Over-indebtedness, (http://ec.europa.eu/social/BlobServlet?docId=762&langId=en)

[ii] Bridges R. et. al., 2008, Drivers of Over-indebtedness, (https://webarchive.nationalarchives.gov.uk/20090609023023/http://www.berr.gov.uk/files/file49248.pdf)

[iii] OXERA, 2004, Are UK Households Over-indebted? (https://www.oxera.com/wp-content/uploads/2018/03/Are-UK-households-overindebted.pdf)

[iv] Haas, Oliver J., 2006, Over-indebtedness in Germany, (http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.460.745&rep=rep1&type=pdf)

[v] European Commission, 2008, Towards a Common Operational European Definition of Over-indebtedness, (http://ec.europa.eu/social/BlobServlet?docId=762&langId=en)

[vi] European Commission, 2010, Research Note 4/2010: Over-indebtedness. (http://ec.europa.eu/social/BlobServlet?docId=6708&langId=en)

[vii] D’Alessio, Giovanni and Iezzi , Stefano, 2013, Household Over-indebtedness: Definition and measurement with Italian Data, (https://www.bis.org/ifc/events/6ifcconf/dalessioiezzi.pdf)

[viii] Directorate General for Internal Policies (European Parliament), 2017, Minimum Income Policies in EU Member States (http://www.europarl.europa.eu/RegData/etudes/STUD/2017/595365/IPOL_STU%282017%29595365_EN.pdf)

[ix] Kempson, E. and Atkinson, A., 2006, Overstretched: People at risk of financial difficulties, (http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.540.5155&rep=rep1&type=pdf)