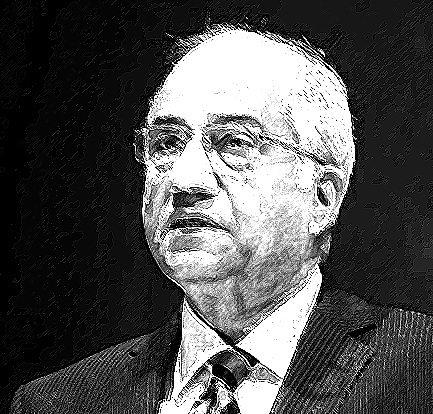

As part of our blog series on the FSLRC report, we will be conducting a series of interviews with key experts to get their perspective on the report and its implications. Below we are posting an email interview that we did with Justice (Retd.) B. N. Srikrishna, Chairman of the Financial Sector Legislative Reforms Commission (FSLRC). Justice Srikrishna is a former Judge of the Supreme Court of India (2002-2006), Chief Justice of the Kerala High Court and Judge of the Bombay High Court. Previously he has been Chairman, Sixth Pay Commission of the Government of India and Chairman, Committee for Separate Telangana before taking over as Chairman, FSLRC.

As part of our blog series on the FSLRC report, we will be conducting a series of interviews with key experts to get their perspective on the report and its implications. Below we are posting an email interview that we did with Justice (Retd.) B. N. Srikrishna, Chairman of the Financial Sector Legislative Reforms Commission (FSLRC). Justice Srikrishna is a former Judge of the Supreme Court of India (2002-2006), Chief Justice of the Kerala High Court and Judge of the Bombay High Court. Previously he has been Chairman, Sixth Pay Commission of the Government of India and Chairman, Committee for Separate Telangana before taking over as Chairman, FSLRC.

Q.The future of financial market regulation in India will be determined by two needs – the need for greater financial innovation and the need to protect consumers from the hazards of excessive financialisation of markets. How has the Commission thought of this while recommending an overall regulatory architecture for India? How will the recommended structure foster greater innovation while protecting the rights of the consumer?

The Commission was of the view that all financial laws and regulators are intended to protect the interest of consumers and that should be the primary focal point of our thinking. Hence, a dedicated forum for relief to consumers and detailed provisions for protection of unwary customers against mis-selling, overselling, underselling, wrong advice, defrauding by smaller print etc has been recommended. There is a marked shift from the traditional thinking of buyer beware, as consumers in our country, even if otherwise educated, are not financially savvy. The overall regulatory architecture is designed around this philosophy. Both regulators have to make regulations to carry forward and implement this philosophy at the ground level. Apart from this, each regulator must be clear and upfront with why it is regulating, what it intends to achieve, get inputs from the regulated entities and the public at large, and put out a statement of costs and benefits analysis in the public domain. The attitude of all is well and status quo, and resistance to all innovation by overkill of excessive caution has also been attempted to be met.

Q.What changes do you expect the recommendations bring to the mission of deepening financial inclusion in the country? What measures have been suggested to ensure that there is a more equitable development of financial markets and enhanced participation of marginalized groups in the country?

The burden of financial inclusion cannot always be thrown on the regulated entities. If financial inclusion means development of the regulated entities to expand the scope of their activities so as to benefit larger numbers, that is legitimate scope of the regulator and can be done by the regulators. If financial inclusion is intended to achieve a social purpose that is not the legitimate scope of the regulator, then it becomes a part of the government’s policy and the government is obligated to compensate the regulated entities which have to carry the additional cost of such financial inclusion. If the government requires the regulators to regulate to this end, then it has to bear the additional cost. That way, there is financial inclusion, but that cost is not solely thrown upon the regulated entities. That comes out clearly in the recommendations made.

Q.FSLRC’s approach to consumer protection represents a paradigm shift from the approach traditionally followed in India (caveat emptor). What is the rationale behind this shift in approach and placing consumer protection at the heart of regulation?

The rationale is that the consumer in India is still unaware of his own rights, either because he is ignorant, illiterate and uneducated. Even if literate and educated, he is trammelled by the traditional caveat emptor approach. To some extent, there is consumer awareness in the general sectors and the consumer fora are alleviating the situation. But, financial products are much more complex as compared to other consumer goods and therefore it was felt that a consumer forum dedicated to deal with problems and grievances of consumers of financial product was necessary at the trial and appellate stage. That certainly marks a new step forward.

Q.What transitional issues do you foresee if the recommendations of the Commission are accepted? What safeguards need to be kept in place to ensure that the smooth functioning of the market is not disrupted during this period?

Transitional issues are many. First, the status quo mindset has to change. Second, the notion that there is no need to fix the system as it is not broken, has to be abandoned because what is envisaged by the Commission is not routine repair work, but creation of an ethos necessary to be the frontrunners in the world economy at some time in the not too far future. Third, the existing regulators will oppose the recommendations as they are bound to see them as affecting their turfs. Fourth, setting up of the UFA (Unified Financial Agency) with requisite qualified personnel will pose a formidable challenge. Finally, recruiting suitable persons with requisite knowledge to man the consumer fora and the FSAT (Financial Sector Appellate Tribunal) will also be a difficult task. All these are no doubt challenges, but can be overcome with determination and persistence. Else, we as a country must give up ambition to be the leaders in world economy some day and continue with our all is well attitude. As a high functionary in the finance ministry told me in Australia, “It is better to make changes in peacetime and not when war has broken out”.

Q.The Indian Financial Code written by the Commission itself represents a shift in the way drafting of laws have been done in the country- it is written in simple English and is immensely readable. What factors motivated the Commission to break away from the traditional over-use of legalese and how difficult was it to ensure that a high quality of drafting?

We adopted our existing legislative language from the British and continue to use it even now, although they have abandoned it. Reading their latest Financial Acts there we were struck by the fact that it is written in simple English. While they have advanced in this regard, we continue to use unnecessarily complicated language and make life difficult for everybody. We modelled the language on the present British law.

Q.The Commission has proposed a Unified Financial Code for India – What ramifications does it have for the other financial sector laws in India-will they become null and void or will they need to be suitably amended? Can you throw more light on the law-making process that will ensue if the recommendations are accepted?

The Commission has recommended some amendments to existing laws, some wholesale repeals and some new legislations. These changes will have to be carefully brought about accordingly. The remit of the Commission was to suggest a Financial Architecture that can withstand the pace of development that is envisioned. It is envisaged that by 2050s our economy will grow into 35 trillion USD economy. The big issue is, can our creaking financial apparatus keep pace with it? In the view of most of the experts who interacted with the Commission, the answer was in the negative, hence, the bold and – perhaps to unaccustomed thinking – brash attempt to design a new financial architecture taking the wisdom from several experts in this country and abroad.