In the first blog in our trust series, we laid down the contours of trust. In this blog, we attempt to unpack what the proximate grounds for trusting Digital Financial Services or DFS may be.

Trust is the most cited motivator for the adoption of digital financial services or DFS (Kajol et al., 2022). Lack of trust is observed to be among the key impediments to DFS take up as evidenced by numerous studies across the world and across services (Jünger & Mietzner, 2020; Chawla & Joshi, 2019; Alalwan et al., 2017; Gao & Waechter, 2017). In our previous blog, we discussed how the intent to trust being implicated in the act of trusting makes it difficult to define trust. Instead, a more feasible approach would be to study the factors that a potential customer (for adoption) or an existing customer (for continued usage) can base their expectations of DFS on or in other words, the proximate grounds to trust DFS. In this blog, we attempt to identify some of these proximate grounds of trust.

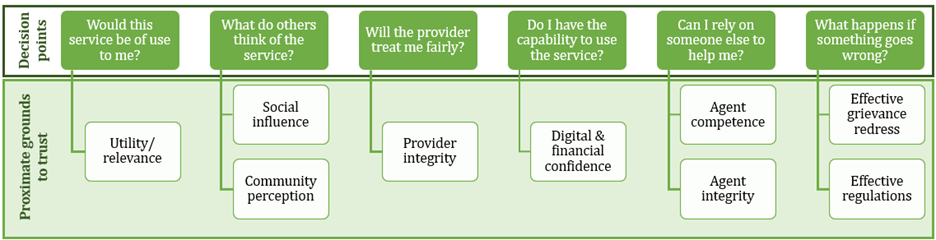

Decision points

In a potential customer’s journey to accessing and using DFS, they have numerous questions they may want answers to. Each of these questions correspond to decisions that are based on one or more factors that serve as proximate grounds for trust. Questions typically asked by a customer could include the following.

- Would this service be of use to me?

A primary question any potential customer of DFS is likely to ask is whether they may have use for the service or whether the service can be expected to fulfil a need. This enquiry can take two paths: (i) where the potential customer has an unmet need and they enquire for services that could meet the said need, or (ii) where the potential customer comes across the service (often as being commonly used by others) and assess how relevant it may be for them.

As discussed in our previous blog, the market for DFS is often skewed against customers. When that is the case, customers’ trust is born more out of necessity than other factors. However, this may not be true for all services. For example, customers can choose to bypass the digital payment market in favour of cash transactions. In such cases trust in DFS could be rooted in utility or relevance than necessity. When customers have considerable choice regarding whether to enter the DFS market, their trust would rely on the use they see for the service (Ideo, n.d.) and the extent to which the service is suited to their need (Sharma et al., 2022).

2. What do others think of the service?

When considering the adoption and use of DFS, potential customers are likely to consider what others think of the service. This may have greater stress when they consider the service to be of high stakes, which is often the case when money is involved. Social influence, through hearsay or experiences of others within their social networks (both good and poor), can impact how customers perceive DFS (Venkatesan & Totolo, 2023; Sawhney et al., 2022). Customers use such experiences as potential evidence for how the service may be expected to play out. If members of their social network have had bad experiences with DFS, this may percolate to influence other members’ decisions on whether to use DFS or not.

Social influence may also be key from a utility perspective and more so in the case of services like payments (Histori, 2022). For instance, the network effects associated with digital payments would imply that the utility one derives from using digital payments is higher when there is collective trust and use of the service within the social network.

In addition to the specific service, how one’s community perceives the DFS ecosystem or more broadly formal banking systems (Omidyar Network, 2017; Demirguc-Kunt et al., 2014), or digital platforms (Suzumski, 2020) can provide the base for customers’ trust/ distrust of DFS. Perceived inconsistencies with community beliefs may deter members of the community from trusting different components (digital/financial) of DFS. Further, community preference for physical businesses and paper trails (Sharma et al., 2022) could also cause a general reluctance to trust DFS.

3. Will the provider treat me fairly?

Even when providers are considered competent to provide the stated service, a concern that is critical to customers is tied to the integrity of providers. By integrity we mean DFS providers consistently doing the right thing and treating customers fairly (Sekhon et al., 2014). This could include- providers offering suitable products, being transparent about terms and conditions and protecting customer data. Customers’ assessment of integrity could entirely be based on what they perceive. Signalling integrity in ways customers can assess is crucial to building trust in DFS. For instance, customers often struggle with the lack of transparency on costs associated with DFS (Modi, 2022). When they are suddenly hit with unexpected charges, it further makes them question the integrity of providers (Bird & Mazer, 2021). While this may be equally true of traditional financial services, DFS may exhibit this issue to a greater extent because the services are often provided over screens with little opportunity for customers to ask questions about the terms and conditions. Further, where any form of data sharing is required, concerns regarding privacy (Sawhney et al., 2022) and security breach (The World Bank, 2014) also emerge. Lack of transparency regarding data use could also lead to questions of provider integrity. Reports of fraud (Bose, 2021), harassment by providers (Chakrabarty, 2022) and lack of access to redress (Venkatesan & Totolo, 2023), further erodes the integrity of providers as perceived by customers.

4. Do I have the capability to use the service?

Confidence in one’s own abilities can serve as a proximate ground for trust when dealing with DFS. Given the nature of DFS, here we are referring to confidence in one’s financial and digital abilities. Even when they trust the promise of DFS, lack of confidence in oneself could mean that a customer does not trust himself/herself to not make errors or fall for frauds while transacting. They fear that even a small mishap, owing to their lack of digital and financial abilities, could result in the loss of hard-earned money (Ideo, n.d.). Familiarity with similar digital or/and financial ecosystems could aid in building financial and digital confidence.

While financial and digital confidence is internal to the user, there could be external factors affecting a customer’s capability to use the service. These could include access to reliable supporting infrastructure, including internet connectivity (Chakravorti et al., 2020).

5. Can I rely on someone else to help me?

When lack of digital skills and a fear of technology (Wright et al., 2020) results in customers not trusting themselves to engage in DFS, an alternative would be to rely on an agent. In such cases, the competence and integrity of these agents in meeting customer expectations can also serve as proximate grounds for trust in DFS. Customer judgement of agent competency and integrity may partly come from what they know of the agents, as individuals they may interact with even otherwise, and partly from how they may experience the service (Omidyar Network, 2017). The extent to which customers may base their trust in DFS on agents is also likely to vary depending on how the agent has been introduced- if they are previously known to customers as friends/family/community members or if they are external parties introduced into the community by providers.

Sometimes issues at the agent level, including digital disruptions, system reliability and agent illiquidity (Wright et al., 2020) are beyond the control of the agent. Regardless, these issues disrupt customer experience, leading to a poor assessment of agents’ competence or capability and by extension in DFS. Practices such as overcharging by agents (Bird & Mazer, 2021) could result in customers questioning the integrity of agents.

6. What happens if something goes wrong?

A key concern for customers when adopting DFS is whether someone has their back when DFS transactions don’t go as expected. Here, the strength of grievance redress mechanisms, be it through DFS providers or regulatory institutions form the base for trust.

Experience of digital channels is often marred by limited recourse mechanisms users have to enforce their rights. Even when recourse mechanisms exist, a lack of awareness of the process can cause problems (Venkatesan & Totolo, 2023). Inability to report or escalate issues due to the absence of effective redress mechanisms can trigger distrust while using DFS (Sharma et al., 2022). Without sufficient information about available grievance redress mechanisms customers may perceive that the system offers them no support and may hesitate to trust DFS.

If customers believe the regulator to have their back and offer redress for any grievance they may have, then they are more likely to engage with DFS. However, a closer look at how credit regulations have currently been framed in India (and elsewhere) indicates a sharper regulatory focus on how customers are verified than providers. Financial regulations are designed to promote stability and protect customers. However, when both these mandates come under the same authority, prudential risks tend to dominate and are often prioritized over customer protection risks (Izaguirre, 2020). As a result, verification of financial providers privileges their robustness from the perspective of systemic stability over their ability to serve customers. This forces customers to invest time and efforts to distinguish trustworthy from untrustworthy players. Even the design of customer verification systems, like KYC, could disproportionately cater to the interests of law enforcement, risking overlooking customer protection concerns (Bhandari, et al., 2022). This skewed regulatory focus results in limited clarity on the regulations governing DFS (Venkatesan & Totolo, 2023), unclear recourse for erroneous transactions and inconsistent enforcement of regulatory norms (Sharma, et al., 2022) all of these leading to negative customer perception of the regulatory ecosystem and by implication, DFS. Even when regulations may exist, weak implementation can have the same effect.

Each decision point (or question) reveals different factors which serve as proximate grounds for trusting DFS (figure 1). Some of these factors (utility, digital and financial confidence for example) are closer or internal to the customer. Some are related to the setting within which the interactions occur, be it the societal context or the regulatory architecture. Some others (provider and agent integrity and competence for example) are closer to the provider. Regardless of where they are placed in relation to the customer, each one or a combination of these factors could influence a customer’s ultimate decision to trust DFS. For different customers, different factors may carry different weightage. The questions/ decision points noted here, as mentioned earlier, are what may be relevant for prospective customers. For existing customers, however, the most relevant question is whether to continue using DFS. Here, their own experience with DFS across different stages will form the evidence upon which customers base their trust.

Figure 1: Proximate grounds to trust DFS

In this blog, we offer a glimpse into what the proximate grounds of trust for DFS may be. It serves to highlight the need to unpack how trust plays out in DFS further. In the blogs to follow, we will explore how customers choose from the different options available to them and use this to build a framework for establishing trustworthiness. Through this, we hope to make DFS more effective in providing actual financial inclusion.

For Part 1, Click here

References

Alalwan, A. A., Dwivedi, Y. K., & Rana, N. P. (2017). Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. International Journal of Information Management, 37(3), 99-110. https://doi.org/10.1016/j.ijinfomgt.2017.01.002

Bhandari, V., Bailey, R., & Goyal, T. (2022). Analysing India’s KYC Framework through the Privacy Lens. SSRN. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4093454

Bird, M., & Mazer, R. (2021). Uganda Consumer Protection in Digital Finance Survey. https://poverty-action.org/sites/default/files/Uganda-Consumer-Survey-Report.pdf

Bose, S. (2021, February 15). High volumes, multiple hops push up digital payment failures. Financial Express. https://www.financialexpress.com/industry/high-volumes-multiple-hops-push-up-digital-payment-failures/2194706/

Chakrabarty, A. (2022, August 26). RBI steps in to end harassment of borrowers, prohibits digital lenders from accessing smartphone data. Financial Express. https://www.financialexpress.com/money/rbi-guidelines-to-end-harassment-of-borrowers-digital-lenders-cant-access-smartphone-data-fintech-regulation/2645612/

Chakravorti, B., Chaturvedi, R., Filipovic, C. & Brewer, G. (2020). Digital in the time of Covid: Trust in the Digital Economy and its evolution across 90 Economies as the planet paused for a pandemic. https://digitalplanet.tufts.edu/wp-content/uploads/2022/09/digital-intelligence-index.pdf

Chawla, D., & Joshi, H. (2019). Consumer attitude and intention to adopt mobile wallet in India–An empirical study. International Journal of Bank Marketing, 37(7), 1590-1618. https://www.emerald.com/insight/content/doi/10.1108/IJBM-09-2018-0256/full/html

Demirguc-Kunt, A., Klapper, L., & Randall, D. (2014). Islamic finance and financial inclusion: measuring use of and demand for formal financial services among Muslim adults. Review of Middle East Economics and Finance, 10(2), 177-218.

Gao, L., & Waechter, K. A. (2017). Examining the role of initial trust in user adoption of mobile payment services: an empirical investigation. Information Systems Frontiers, 19, 525-548. https://link.springer.com/article/10.1007/s10796-015-9611-0

Histori, O. (2022). Financial Literacy, Social Influence And The Use Of Digital Payments: A Literature Review. In Proceeding of The International Conference on Economics and Business (Vol. 1, No. 2, 206-220).

Ideo. (n.d.). Financial Confidence Playbook. https://www.financialconfidence.design/

Izaguirre, J. C. (2020). Making consumer protection regulation more customer-centric. https://www.cgap.org/sites/default/files/publications/2020_06_WorkingPaper_Making_Consumer_Protection_Regulation_More_Customer_Centric.pdf

Jünger, M., & Mietzner, M. (2020). Banking goes digital: The adoption of FinTech services by German households. Finance Research Letters, 34, 101260. https://doi.org/10.1016/j.frl.2019.08.008

Kajol, K., Singh, R., & Paul, J. (2022). Adoption of digital financial transactions: A review of literature and future research agenda. Technological Forecasting and Social Change, 184, 121991. https://doi.org/10.1016/j.techfore.2022.121991

Modi, S. (2022). Digital Adoption of MSMEs During COVID-19. https://content.centerforfinancialinclusion.org/wp-content/uploads/sites/2/2022/09/Digital-adoption-of-Msmes-During-covid19-1.pdf

Omidyar Network. (2017). Currency of Trust: Consumer Behaviors and Attitudes Toward Digital Financial Services in India. https://uploads-ssl.webflow.com/61b9a0d531bc5e31aa66a38d/6245a6ae497b5707c9acf641_17-05-15_Currency_of_Trust_Report_DIGITAL_FINAL.pdf

Sawhney, S., Kumaraswamy, S. K., Singh, N., Kiamba, E., & Sotiriou, A. (2022). No Small Business: A Segmented Approach to Better Finance for Micro and Small Enterprises. https://www.cgap.org/sites/default/files/publications/2022_07_FocusNote_MSE_NoSmallBusiness.pdf

Sekhon, H., Ennew, C., Kharouf, H., & Devlin, J. (2014). Trustworthiness and trust: influences and implications. Journal of Marketing Management, 30(3–4), 409–430. https://doi.org/10.1080/0267257X.2013.842609

Sharma, S., Ghoshal, T., & Basoya, S. (2022). Design for Bharat: Solving for Mistrust in Digital Financial Services.

Szumski, O. (2020). Technological trust from the perspective of digital payment. Procedia Computer Science, 176, 3545-3554.The World Bank. (2014). Digital Financial Inclusion. https://www.worldbank.org/en/topic/financialinclusion/publication/digital-financial-inclusion

Venkatesan, J., & Totolo, E. (2023, February). Consumer protection. Strive. https://www.strivecommunity.org/insights/financial-services/consumer-protection

Wright, G., Narain, N., & Kapoor, R. (2020, February 18). Trust Busters! A dozen reasons why your potential customers do not trust your agents (particularly in rural areas). MicroSave. https://www.microsave.net/2020/02/18/trust-busters-a-dozen-reasons-why-your-potential-customers-do-not-trust-your-agents-particularly-in-rural-areas/