Introduction

Artificial Intelligence (AI) promises big gains from automation, efficiency and cost savings, but it also brings with it risks, including bias and opacity in decision-making. Acknowledging the need to address these risks early on in the financial sector and to ensure AI systems remain trustworthy,[1] the Reserve Bank of India [RBI] set up a Committee to shape a Framework for Responsible and Ethical Enablement of Artificial Intelligence [FREE AI] in December 2024. RBI tasked this Committee with four objectives: (a) assessing the current level of adoption of AI in financial services, (b) reviewing regulatory and supervisory approaches, (c) identifying AI-related risks and (d) recommending a framework for its responsible adoption.[2] The Committee’s report, released on August 13, 2025,[3] marks the regulator’s first comprehensive attempt to chart a roadmap for responsible adoption of AI in finance.

In the first blog of this series of two, we break down (i) the Committee’s methodology, (ii) key insights on the current state of AI adoption, (iii) FREE AI Framework and (iv) its recommendations.

- Methodology

The Committee adopted a four-pronged approach to fulfil its mandate: (a) stakeholder consultations across banks, fintechs and industry experts,(b) targeted surveys by the Fintech Department and Department of Supervision of the RBI along with follow up interactions, (c) review of global and domestic regulatory approaches and policy developments and (d) analysis of extant regulations on cybersecurity, data protection, consumer protection and outsourcing in so far as AI related risks are concerned.

- Insights on the state of AI adoption

The RBI administered two surveys, covering banks, NBFCs, fintechs and technology companies to better understand the extent of AI adoption in the financial sector and associated challenges. The key findings are set out below:

1) Adoption rates: Around 21% of the surveyed entities were using or developing AI systems. These numbers are driven mainly by large public and private sector banks and NBFCs who were adopting simpler rule-based models.

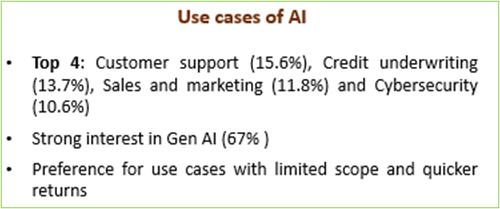

2) Use cases:AI was primarily used for (a) customer support (15.6%), (b) credit underwriting (13.7%), (c) sales and marketing (11.8%) and (d) cybersecurity (10.6%). There was strong interest in Generative AI, with majority of entities experimenting with small-scale pilots, often internal chatbots. Most smaller entities preferred use cases with quick-return, wary of AI’s rapid sophistication and cost of obsolescence.

3) Barriers and risks in AI adoption: Several barriers in wider adoption of AI were cited, including (a) high implementation costs (especially a constraint for smaller entities), (b) AI talent gap, (c) lack of high-quality data for training models, (d) insufficient compute access and (e) legal uncertainty. Many entities remained cautious about advanced or customer facing AI use cases. They cited risks concerning (a) data privacy, (b) cybersecurity threats, (c) governance challenges arising from the opacity and unpredictability of technology and (d) reputational loss.

4) Responsible AI readiness: As the AI adoption grows, safeguards must keep pace with its sophistication and deployment. The surveys reveal that preparedness for responsible AI adoption is low.

(a) Only one-third of respondents, mainly large banks, had some form of board-level oversight for AI.

(b) Most of the entities did not have dedicated policies for training AI models and relied on existing IT, cybersecurity and privacy policies.

(c) Of the 127 entities that report using AI, only 15% reported use of interpretation tools and only 35% validated for bias and fairness, that too at the early stages of development. Far fewer had bias mitigation protocols (10%) and maintained audit logs (18%). On the safeguards around model performance, only 21% monitored for data or model drift, and just 14% conducted real-time performance monitoring.

Notably, a majority of the respondents expressed the need for more regulatory guidance on data privacy, algorithmic transparency, bias mitigation and use of external LLMs.

- FREE AI Framework

The Committee envisions a financial ecosystem that balances innovation with risk mitigation. To this end, based on the analysis of global precedents, India’s regulations and stakeholder surveys, it has devised a framework built around: a) 7 Sutras b) 2 Sub-frameworks and c) 6 Pillars that together shape its twenty-six recommendations. A snapshot of the Framework is presented below:

FREE AI Framework: A Snapshot

a) 7 Sutras: They are a set of interconnected foundational principles that intend to guide the adoption of AI in the financial sector. These are:

- Trust is the Foundation

- People First

- Innovation over Restraint

- Fairness and Equity

- Accountability

- Understandable by Design

- Safety, Resilience and Sustainability

b) 2 Sub-frameworks: a) Innovation enablement and b) Risk mitigation frameworks pursue complementary objectives of supporting innovation through enabling opportunities, removing barriers in tandem with addressing and managing risks AI associated risks.

c) 6 Pillars: Both the sub-frameworks are anchored in six strategic pillars, which define the contours along which the Committee recommendations are focused.

Under innovation enablement framework, the pillars are:

- Infrastructure

- Policy

- Capacity

Under risk mitigation framework, the pillars are:

- Governance

- Protection

- Assurance

The FREE AI Framework is operationalised through the twenty-six Committee recommendations mapped across these six pillars. These recommendations are accompanied by timelines and action owners responsible for their implementation.

Summary of FREE AI Framework Recommendations- Innovation Enablement

Summary of FREE AI Framework Recommendations- Risk Mitigation

In the next blog of the series, we reflect on the FREE AI Committee Report, what we found promising, what raised questions and where we think the conversation should head next.

Download the complete report here

Footnotes:

[1] https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=59245

[2] https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=59377

[3]https://rbidocs.rbi.org.in/rdocs/PressRelease/PDFs/PR902F828551DA4B54AFDA44180762D51FFCD.PDF