Efforts to promote financial inclusion achieved momentum in the country with the RBI guidelines in January 2006, allowing appointment of non-bank Business Correspondents (BC) as agents for the delivery of financial services outside bank branches. The BC model is a type of branchless banking wherein BC acts as an intermediary between the customer and the bank. The agents appointed by the BCs provide banking services to the customers on behalf of the principal Bank.

In spite of the model’s enormous potential to rapidly expand access to banking for the unbanked population, its implementation has been faced with significant challenges. Many of the efforts launched by various banks are still in the pilot stage and have not been able to scale up, on issues like viability and effectiveness.

State Bank of India – IFMR Finance Foundation partnership

Motivated by a common interest in improving the viability, effectiveness and scale of the business correspondent channel, State Bank of India (SBI) and IFMR Finance Foundation (IFF) have partnered to develop various approaches to implement the BC model. This involves a two-stage roll out, with the first stage focusing on testing and developing various approaches, and the second stage, a rapid scale up through various BC types. It was decided that some of the key ideas being developed need to be tested through field pilots.

Pilot project with Pudhuaaru KGFS as SBI’s Business Correspondent

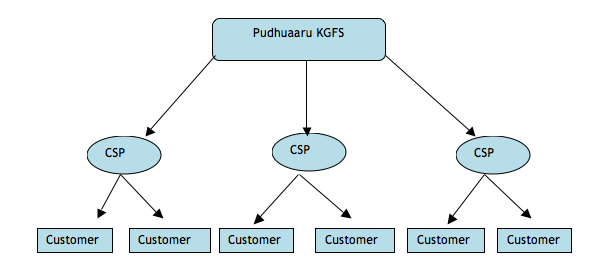

It was in this background, Pudhuaaru KGFS (Section 25 Company) was appointed as a circle level Business Correspondent by SBI’s Local Head Office at Chennai. To ensure the viability of this model and round the clock accessibility to banking services to the customers, Pudhuaaru KGFS appointed retail shop owners as their CSPs (Customer Service Point) in each village. The retail shop owners with an already existing source of income would not exclusively depend on the BC business for viability, and this allows appointment of such CSPs even at low population levels, increasing the convenience for clients. These retail shop owners are responsible for dealing with the customers and providing banking facilities. The channel structure can be depicted as follows:

The CSPs have been identified by the BC after careful screening and selection process. Minimum education qualification of CSP is required to ensure that they get well versed in banking services. As accessibility to the CSPs have been found as an important factor affecting the frequency with which the customers transact, Pudhuaaru KGFS has made certain that the selected CSPs are located in areas where they can be easily accessed by all the people in the village. The customers can easily access the CSPs for transactions, save money and time by avoiding travel to the nearest bank branch or ATM. The CSPs are given training on banking products, technology, communication skills as well as their roles and responsibilities.

The pilot was launched with five CSPs in five different villages in the Thanjavur district of Tamil Nadu. On the day of the launch, a total of six customers were enrolled by the CSPs. The channel provides no frills savings account and any villager that fulfills the required KYC norms is eligible to open the account with SBI through the CSP. The project has been launched with the savings bank account and remittance products. Other products like Recurring Deposit, Fixed Deposit, mobile recharge and bill payments will be soon offered through the channel.

Technology and transaction process

Technology deployed has a bearing on the capital required and the ease of use, therefore influences the viability and effectiveness of the model. Pudhuaaru KGFS-SBI BC project has deployed the mobile banking technology with Eko as the technology provider. The technology is simple to use and the only investment required on the part of the CSPs and the customers is a basic mobile phone, which is usually available with most CSPs and clients.

Customer authentication happens entirely through a combination of one-time passwords contained in a Eko-issued booklet and a user-selected PIN. The solution is available to any customer owning a SIM card and therefore having a mobile phone number. Presently, customers of Airtel and BSNL can directly issue payment instructions using USSD codes, while customers of other networks need to use SMS for transactions. Owning a mobile handset is not necessary, because the customers can either insert his/her SIM card into another person’s phone for transaction, or do the transaction using the CSP’s phone in “assisted mode”. The assisted mode allows a special syntax to be used for transaction by clients using CSP’s phone.

Account opening process starts with the CSPs filling account opening forms, which are then digitised and sent to Eko and then to SBI. The actual account opening is done at the link branch, which receives the hard copy of forms from Pudhuaaru KGFS and the soft copy from SBI back-office, and uploads the account to the SBI Core Banking System. For starting the transactions, Pudhuaaru KGFS pre-purchases electronic value from SBI with the help of technology provider Eko, after depositing an equivalent amount with SBI. Pudhuaaru KGFS then allocates portion of this limit to the various CSPs. When customer deposits cash with the CSP, the CSP instantaneously transfers an equivalent amount of electronic value from his/her mobile account to the customer’s account, and collects the equivalent amount in cash from the customer. The opposite process is followed in a withdrawal transaction. If the CSP faces a shortage of cash or account balance during the day, Pudhuaaru KGFS provides cash management support, which is built into the channel design.

Over the next few weeks, this pilot will be expanded to about 20 CSPs, and we will stay with this number till the basic objectives in terms of viability and usage of the channel have been met. The pilot experience is being documented carefully with the purpose of: recommending potential process improvements to SBI and Eko; identifying key channel and product design bottlenecks for viability and effectiveness; and highlighting the critical components of a successful BC roll out plan using a third-party technology provider.

This and other full-fledged pilots planned under the SBI-IFF partnership will help us to test the business model and technology innovations, and document the factors that can contribute to the viability and effectiveness of the BC channel. The learning’s would be incorporated to modify the model effectively thereby enabling SBI to scale up the model across the country in a viable manner.

11 Responses

It is excellent that IFMR Finance Foundation is constantly exploring new ways of bringing high quality financial services to remote rural communities with both traditional and non-traditional partners. I look forward to learning more about this particular partnership with State Bank of India is progressing.

It is excellent that IFMR Finance Foundation is constantly exploring new ways of bringing high quality financial services to remote rural communities with both traditional and non-traditional partners. I look forward to learning more about this particular partnership with State Bank of India is progressing.

Congratulations to the team that has worked to make sure that this initiative is up and running. Success of the BC model is key the completion of the financial inclusion agenda. While factors such as customer service and smooth transaction level functioning would be key initially, the important questions to answer are on viability and risk management. Hopefully this partnership will show the way on those fronts..

Congratulations to the team that has worked to make sure that this initiative is up and running. Success of the BC model is key the completion of the financial inclusion agenda. While factors such as customer service and smooth transaction level functioning would be key initially, the important questions to answer are on viability and risk management. Hopefully this partnership will show the way on those fronts..

I am a keen observer in the innovations piloted by IFMR esp in the BC viability study. Surely, Farzana and group is creating the space for rural poor to enjoy! Thumbs Up guys!!!

I am a keen observer in the innovations piloted by IFMR esp in the BC viability study. Surely, Farzana and group is creating the space for rural poor to enjoy! Thumbs Up guys!!!

The Banking to the Mass can be achieved in a country like India is only by Innovative Methods, My wishes to the IFMR Team. Team IFMR keep the Good Work Going..

The Banking to the Mass can be achieved in a country like India is only by Innovative Methods, My wishes to the IFMR Team. Team IFMR keep the Good Work Going..

These are some comments by Ms Nancy Barry – Founder and President of “Enterprise Solutions to Poverty”

“The pilot looks interesting, particularly the following features:

Use of mobile rather than FINO type equipment to bring down the fixed costs. Would be useful to know the reason why Airtel and one other carrier allow more direct payment instructions vs. SMS required for customers of other carriers.

Use of shopkeepers rather than dedicated agents. Are there any early results on the time available by shopkeepers, and the likely incremental income to them relative to normal revenues to align incentives?

Cash management provided by the Pudhuaara KGFS, closer than SBI bank to the CSPs. .

Would be useful to know the following:

Has IFMR Foundation projected likely earnings by CSPs, KGFS and SBI at full operations, overall and from fees on no frill savings, remittances and other offerings? Am particularly interested on how IFMR is moving to increase the average balance and the transactions on the no frills savings accounts, which seem to have been tiny and dormant in other BC experiences.

In your judgment, does the BC model with independent shopkeepers require a third party intermediary such as KGFS/IFMR Foundation to do the selection, orientation, training, cash in-cash out? Can commercial banks do this themselves, as has been the case in Latin American countries, or is intermediary key?

These are some comments by Ms Nancy Barry – Founder and President of “Enterprise Solutions to Poverty”

“The pilot looks interesting, particularly the following features:

Use of mobile rather than FINO type equipment to bring down the fixed costs. Would be useful to know the reason why Airtel and one other carrier allow more direct payment instructions vs. SMS required for customers of other carriers.

Use of shopkeepers rather than dedicated agents. Are there any early results on the time available by shopkeepers, and the likely incremental income to them relative to normal revenues to align incentives?

Cash management provided by the Pudhuaara KGFS, closer than SBI bank to the CSPs. .

Would be useful to know the following:

Has IFMR Foundation projected likely earnings by CSPs, KGFS and SBI at full operations, overall and from fees on no frill savings, remittances and other offerings? Am particularly interested on how IFMR is moving to increase the average balance and the transactions on the no frills savings accounts, which seem to have been tiny and dormant in other BC experiences.

In your judgment, does the BC model with independent shopkeepers require a third party intermediary such as KGFS/IFMR Foundation to do the selection, orientation, training, cash in-cash out? Can commercial banks do this themselves, as has been the case in Latin American countries, or is intermediary key?

Excellent blog and in-depth one got a lot of information about the top.

Thank you for sharing this helpful piece of information.

We hope you can share more knowledge with us.