Both financial inclusion and financial stability are high on international policy makers’ agenda. For instance, the G-20 has called for global commitments to both advancing financial inclusion (the Maya Declaration and the Global Partnership for Financial Inclusion) and enhancing financial stability (the Financial Stability Board, Basel III Implementation, and other regulatory reforms). One challenge is that there can be important policy trade-offs between the two objectives.

A rapid increase in financial inclusion in credit, for example, can impair financial stability, because not everyone is creditworthy or can handle credit responsibly—as illustrated in the last decade by the subprime mortgage crisis in the United States and the Andhra Pradesh microfinance crisis in India. In addition, trade-offs between inclusion and stability could arise as an unintended consequence of bad or badly implemented polices.

At the same time, there may be important synergies between inclusion and stability. For example, a broader use of financial services could help financial institutions diversify risks and aid stability. Similarly, financial stability can enhance trust in financial systems and the use of financial services. It follows that understanding the synergies and trade-offs is paramount for policy makers who strive to advance financial inclusion and stability in tandem.

When evaluating financial sector outcomes, and prioritizing the design and implementation of alternative financial policies, policymakers could miss important aspects by ignoring the interactions between financial stability and inclusion. To illustrate this point, it is useful to consider the following intuitive framework:

Deploying policies to achieve financial stability and policies to achieve financial inclusion may not deliver the intended results if there are major tradeoffs between the two outcomes. But if the deployed policies can generate synergies between inclusion and stability, mutual reinforcement of the two goals can occur. The last term in the equation above highlights the possible interdependence between inclusion and stability, which can thus either add or subtract from the independent goals of stability and inclusion. While most studies and policies have typically focused on either achieving the outcome of stable or inclusive financial systems independently, limited attention has been paid to the interdependence between the two outcomes.

In a recent paper, Cihak, Mare, and Melecky examine a wide array of measures of household and firm inclusion to estimate an overall tradeoff between financial inclusion and stability. They find that, particularly for individuals, the use of financial services is negatively correlated with higher bank capitalization. Moreover, there is a positive correlation (tradeoff) between many inclusion indicators and the costs of banking crises. Greater financial inclusion (increase in account ownership or debit card penetration) is associated with more costly financial crises (output and fiscal costs, as well as the peak NPL ratios during crises).

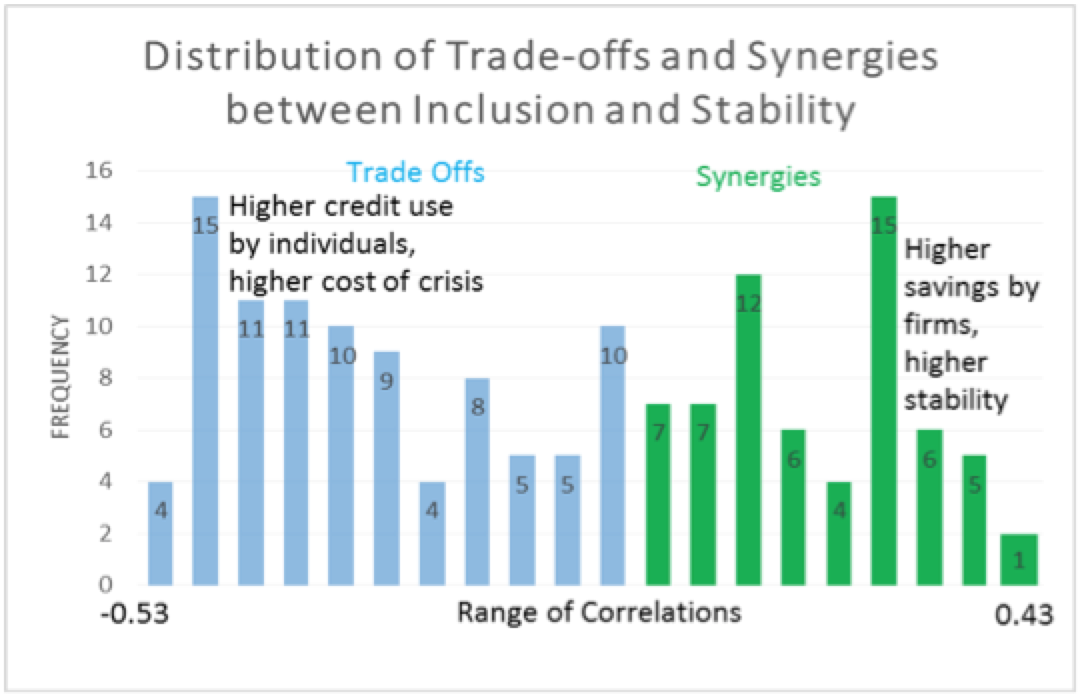

Interestingly, synergies between inclusion and stability are almost equally probable as tradeoffs—as indicated by the two-peak (bimodal) histogram or correlations in Figure 1. Dissecting financial stability into resilience measures, volatility measures, and crises measures reveals that financial inclusion can help mitigate volatility of growth in bank deposits and the volatility of bank deposit rates. While financial inclusion of individuals, such as account ownership, use of electronic payments, formal savings and credit, help reduce the volatility of bank deposit growth and bank deposit rates, savings by firms can help enhance financial stability across all three dimension: resilience, volatility, and low probability and cost of crises.

Figure 1: Although tradeoffs between financial inclusion and stability prevail on average, synergies between the two outcomes could arise with almost equal probability

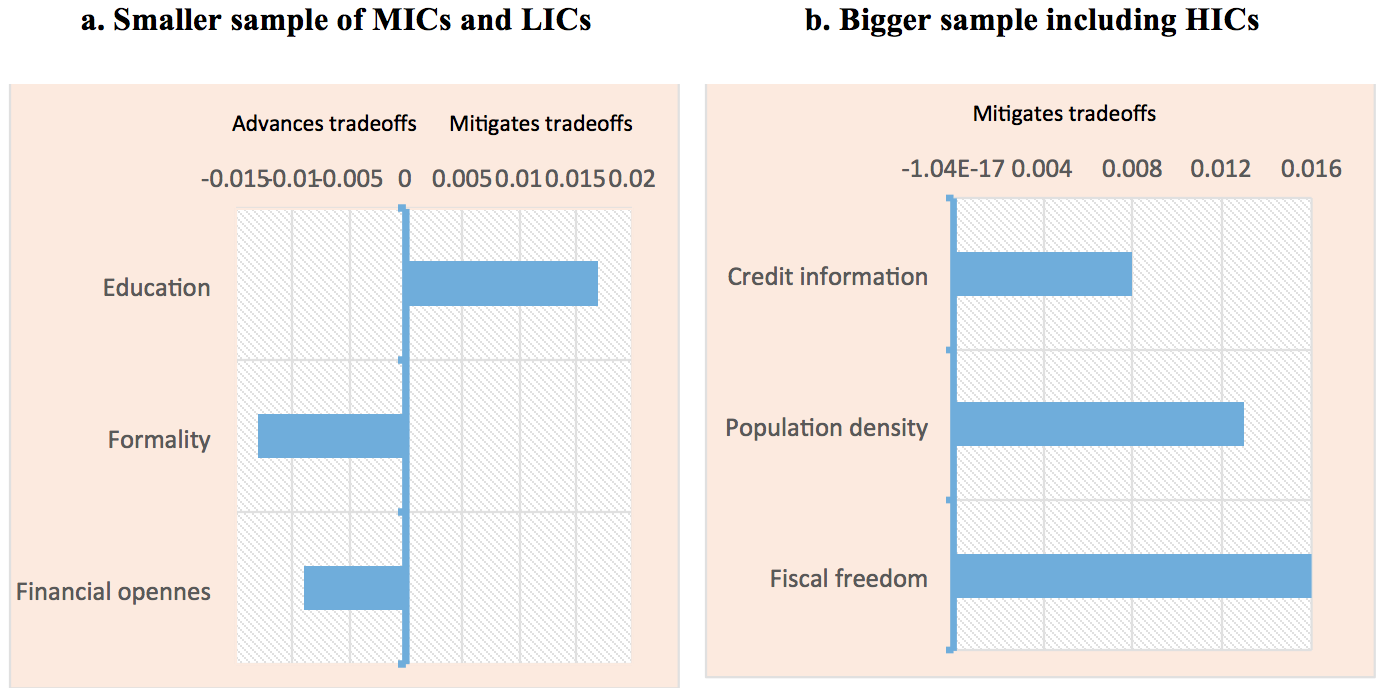

The relationship between inclusion and stability is systematically influenced by country characteristics, such as financial openness, tax rates, education, informality, population density, and the depth of credit information systems. While financial openness and formalization of the economy increases tradeoffs between inclusion and stability, low tax rates, education, and credit information depth help generate synergies between the two goals (Figure 2).

Figure 2: The inclusion-stability nexus is systematically influenced by country characteristics

Greater financial openness and movement of capital is particularly challenging in middle and low income countries, which tend to have a limited capacity to manage capital flows and ensure prudent and efficient allocation of the funding to creditworthy firms and individuals.

Countries with higher informality, as measured by the number of years firms operated without formal registration, experience a lower tradeoff between financial inclusion and stability. A potential explanation is that previously informal firms that enter the formal sector tend to be greater risk-takers. Being higher risk-takers may have allowed these firms to earn higher returns to pay for more expensive informal credit. Because risk appetites are unlikely to change fast after becoming formal, rapid increases in credit to previously informal firms that enter the formal sector should be monitored for potential threats to financial stability.

Low tax rates may generate synergies by stimulating precautionary savings due to smaller social safety nets and greater probability of unexpected increases in taxes. Education can generate a positive relationship between inclusion and stability by improving financial literacy and responsible financial inclusion that helps the financial system reap the benefits of economic scale and risk diversification.

The depth of credit information systems generates synergies by improving screening of creditworthy customers, including new users of credit, and aids stability by, for example, improving the accuracy of estimations of expected losses. Finally, greater information depth also promotes competition in oligopolistic markets, decreases the cost of finance, and encourages more firms and people to start using a financial service or use more than one financial service. Particularly if financial policy focuses on advancing the financial inclusion of individuals, complementary policies to deepen credit information systems could help mitigate the estimated tradeoffs with financial stability.

These findings have important policy implications. Because tradeoffs and synergies between financial inclusion and financial stability are significant, they need to be addressed in policymaking. In many countries, multiple government agencies (in many countries the central bank and other financial supervisors) and ministries (in many countries the ministry of finance, economic development, or strategic planning) are responsible for policy on both financial inclusion and financial stability. Therefore, the tradeoffs and synergies must be addressed at a high enough policy-making level to ensure effective coordination. One important tool to formulate high-level policy for the financial sector are the financial sector strategies that could be exploited for that purpose (Maimbo and Melecky, 2015).