Credit Derivatives are great financial tools that help entities manage their risk in a better, more efficient way. They isolate specific aspects of Credit Risk from an underlying instrument and transfer that risk between two parties, thus helping the parties to the contract manage their exposure to Credit Risk. They are particularly efficient as they isolate specific risk from the asset with which the risk is associated. The most popular type of credit derivative is the Credit Default Swap (CDS). The first Credit Default Swap contract was introduced by JP Morgan in 1997.

The Reserve Bank of India, recently released the Draft Guidelines for introduction of CDS in the Indian markets.

At a recent Spark session, Shruti Viswanathan from IFMR Capital spoke about the essential elements of a CDS contract and highlighted the key features of the RBI Draft Guidelines.

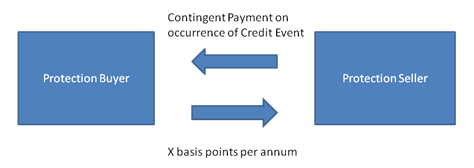

Credit Default Swaps, in their simplest form, are bilateral financial contracts in which the Protection Buyer pays a periodic fee in return for a Contingent Payment by the Protection Seller following a Credit Event.

The following section gives a brief explanation of the various terms and entities involved in a CDS transaction.

Credit Risk: In common usage credit risk is the risk that the counter-party will default. It can also be the risk of a credit rating downgrade or a technical default – deterioration in the current ratio of a project or a violation of bond covenants.

Reference Entity: It is the entity whose risk of default is being traded. Generally, Reference Assets are underlying debt obligations like bonds or loans

Protection Buyer: The Party that buys the CDS on a Reference Entity.

Protection Seller: The Party that sells CDS on a Reference Entity.

Naked CDS: When the Protection Buyer does not own the Reference Asset, the contract is called a Naked CDS.

Credit Event: A credit event triggers payment from the Protection Seller to the Protection Buyer. Consequently, the definition of a credit event is, arguably, the most important part of a CDS contract. Generally, a Credit Event includes bankruptcy (for non-sovereign entities) or moratorium (for sovereign entities only), repudiation, material adverse restructuring of debt, obligation acceleration or obligation default. However, it is the parties to the CDS contract who, after negotiation, decide the specific definition of the Credit Event.

There has been an increasing move towards standardisation on the definition of a Credit Event. In 1999, the International Swaps and Derivative Association published documentation which set out standard definitions for all the Credit Events. The adoption of these definitions reduces legal risk, decreases administrative costs and increases the tradability of the instrument.

Contingent Payment: The amount that the Protection Seller pays the Protection Buyer upon occurrence of the Credit Event. The contract generally lays down the method to calculate the same.

Settlement: Parties to a contract decide on the mode of settlement. This can be through:

a) Physical Settlement: After the occurrence of the Credit Event, the Protection Seller pays the contingent fee to the Protection Buyer. The Protection Buyer physically delivers the bond to the Protection Seller. Physical settlement implies that the Protection Buyer owns the Reference Entity.

b) Cash Settlement: Cash payment equal to Par less Recovery rate of Reference Asset, is made by the Protection Seller to the Protection Buyer. For eg: If the value of the bond has dropped from Rs.100 to Rs. 25 after the Credit Event, the Protection Seller shall pay the Protection Buyer is Rs. 75.

c) Binary Settlement: The counterparties settle on a pre-determined sum for the contingent payment.

With a basic understanding of the terms in a CDS contract, we now turn to the actual working of the contract.

How do CDS contracts work?

The Protection Buyer negotiates a CDS contract with the Protection Seller and pays a quarterly premium spread to the Protection Seller. The premium spread depends on the risk of the Reference Entity. As the perceived risk on the Reference Entity increases, so does the premium spread. Upon the occurrence of the pre-determined Credit Event, the Protection Seller pays the Protection Buyer the Contingent Payment.

One of the advantages to using a CDS is that it allows parties to efficiently manage their exposure to Credit Risk. By isolating specific aspects of Credit Risk, credit derivatives allow the transfer of even illiquid credit exposures. CDS require no consent/ involvement of the Reference Entity thus allowing good customer relations to persist.

On the downside, CDS allows for huge speculation, especially in the case of Naked CDS. Successive offsetting contracts also grossly increase the notional value of transactions, which far exceed the real value of the underlying assets. For eg: In Jan 2010, the total value of the CDS market was $30.4 trillion, nearly 7 times the value of the US Treasury at the time ($4.4 trillion).

CDS in the Indian Market

The Reserve Bank of India had previously proposed the introduction of CDSs to the Indian market but delayed its plans due to the economic crisis in 2008. In February, the RBI placed its Draft Guidelines on Introduction of CDS on its website. Some of the key features of the Draft Guidelines are –

-

Participants in a CDS market have been classified as Users and Market Makers. Users can only buy protection but Market Makers can buy and sell protection. The Draft Guidelines list a number of entities that will be allowed to act as Users and Market Makers. FIIs can act as Users.

-

Naked CDS is not permitted.

-

CDS will be allowed only on corporate bonds (excludes loans, CPs).

-

Users cannot enter into an offsetting contract and can sell the underlying bond only with permission of Protection Seller.

-

Restructuring does not qualify as a Credit Event.

-

Creates limits on credit exposures for Users and Market Makers.

-

Mandatory trade reporting within thirty minutes.

The restriction on Naked CDS contracts will help avoid indiscriminate speculation, excessive leverage and instability in the cash market and the mandatory trade reporting within 30 minutes will help create greater transparency and more information in the market. If CDS were allowed on other instruments such as syndicated loans, it would help expand the potential of the CDS market. Also, the limits on credit exposures for Users and Market Makers will ensure that no entity engages in indiscriminate CDS selling or buying.

CDS is a unique risk management tool that presents great opportunities to the Indian market. If used in an efficient manner and backed by a well thought out regulatory policy it will definitely prove to be a boon to the financial markets.

4 Responses

Really nice article…CDS explained very lucidly.

The boon becomes a bane when such instruments are not properly priced. That is the real challenge. What models to use for pricing and how to calibrate the models.