This post is the first in a series on Social Security for the Indian Unorganised Sector. The series will look at the challenges in the current implementation of social security schemes in India, and aim to provide a comprehensive framework for effective design, ownership, governance and delivery. This series is based on the report “Comprehensive Social Security for the Indian Unorganised Sector: Recommendations on Design and Implementation” authored by IFMR Research – Centre for Microfinance & IFMR Finance Foundation.

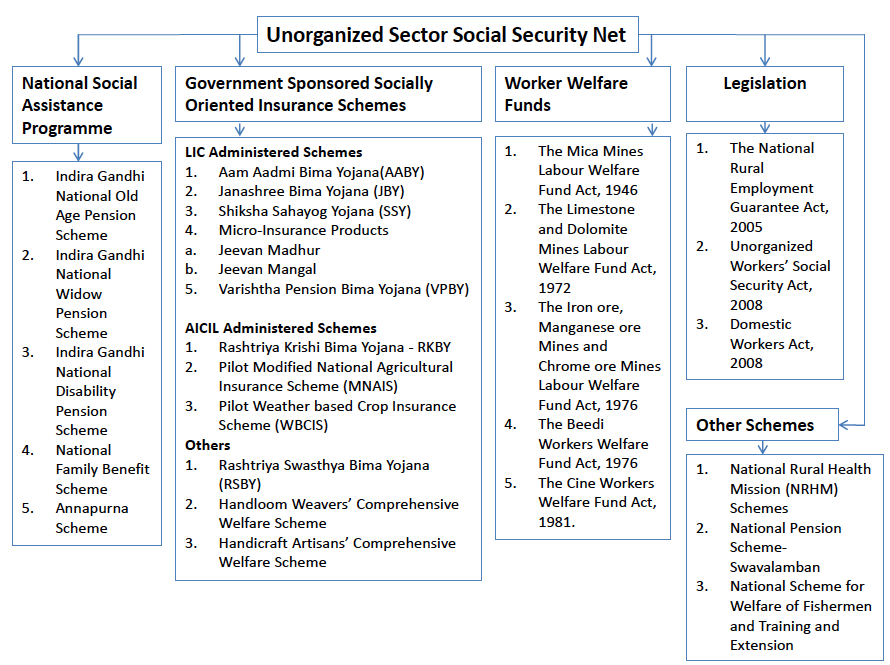

Approximately 85% of India’s 460 million strong labour force are categorised as ‘unorganised sector’ workers. As the National Commission for Enterprises in the Unorganised Sector (NCEUS) argues, the unorganised sector workforce does not enjoy three types of social protection – employment security (no protection against arbitrary dismissal), work security (no protection against accident and health risks at the workplace) and social security (health benefits, pensions, and maternity benefits). In the spirit of extending social security to the unorganised sector and keeping in mind long term demographic trends which indicate a rapidly ageing population and a non-declining unorganised sector workforce, the Government of India passed the Unorganised Workers’ Social Security Act (UWSSA) in 2008. The passage of the UWSSA also tied in with the introduction of several publicly provided, social security schemes in the insurance and pension sectors, the three predominant schemes being Rashtriya Swasthya Bima Yojana (RSBY), a national health insurance scheme largely for the below poverty line population; Aam Aadmi Bima Yojana (AABY), a life insurance scheme; and National Pension Scheme – Swavalamban (NPS-S), a pension scheme specifically for the unorganised sector workforce. (For a summary of the major features of these schemes, click here.)

Approximately 85% of India’s 460 million strong labour force are categorised as ‘unorganised sector’ workers. As the National Commission for Enterprises in the Unorganised Sector (NCEUS) argues, the unorganised sector workforce does not enjoy three types of social protection – employment security (no protection against arbitrary dismissal), work security (no protection against accident and health risks at the workplace) and social security (health benefits, pensions, and maternity benefits). In the spirit of extending social security to the unorganised sector and keeping in mind long term demographic trends which indicate a rapidly ageing population and a non-declining unorganised sector workforce, the Government of India passed the Unorganised Workers’ Social Security Act (UWSSA) in 2008. The passage of the UWSSA also tied in with the introduction of several publicly provided, social security schemes in the insurance and pension sectors, the three predominant schemes being Rashtriya Swasthya Bima Yojana (RSBY), a national health insurance scheme largely for the below poverty line population; Aam Aadmi Bima Yojana (AABY), a life insurance scheme; and National Pension Scheme – Swavalamban (NPS-S), a pension scheme specifically for the unorganised sector workforce. (For a summary of the major features of these schemes, click here.)

While these schemes represent an important step forward in India’s ability to provide adequate, reliable, and affordable social protection options for its vulnerable population, they still suffer from considerable weaknesses:

1. Fragmented ownership structure and lack of coordination: This is, perhaps, the biggest challenge in the present institutional design of social security schemes. Consider, for instance, the three schemes mentioned above. NPS-Lite is overseen by the Pension Fund Regulatory and Development Authority (PFRDA), AABY is under the Ministry of Finance, and RSBY is under the Ministry of Labour and Employment. Moreover, multiple stakeholders own the social security schemes. For example, AABY is a scheme that can be said to be owned by three entities. At the national level, the scheme is administered by the Life Insurance Corporation of India (LIC) but the implementation is done through state level nodal agencies. For instance, in Andhra Pradesh, there are two levels of Nodal Agencies to administer the scheme – the Society for Elimination of Rural Poverty (SERP) is responsible for overall facilitation, monitoring and evaluation of the Scheme, while at the district level the Zilla Samakhya functions as implementation agency for overall management of the Scheme. None of the entities in the scheme have an explicit marketing role leading to a lack of delineation of clear responsibilities on customer awareness, customer acquisition, and customer servicing. The same holds true of other social security schemes as well; there is an absence of any clear idea about who owns the customer under RSBY and AABY. While the matching government contribution in NPS-S and payment of premium for health and life insurance are incentives for enrolling into the program, it should be noted that the distribution channel of the product and the implementation of the scheme are just as, if not more, important than the design.

2. Wide disparities in the coverage of social security schemes: Since social security is a subject in the Concurrent List of the Constitution, there are several instances of overlap between social security schemes provided by the Centre and the state governments. For instance, many states provide a minimum pension floor that has come into conflict with the centrally provided National Old Age Pension Scheme (NOAPS) and the NPS. While it is admirable that some states provide higher benefits to their citizens, a lack of coordination between the centre and the state governments has led to inequitable distribution of social security benefits across India, where richer states provide much higher benefits compared to poorer ones. There are also wide disparities in the coverage of social security schemes across states. For instance, beneficiaries in two states, Andhra Pradesh and Maharashtra, accounted for 52% of all beneficiaries covered under the AABY scheme. Additionally, close to 80% of all claims processed under the scheme were from Andhra Pradesh.

3. Low levels of product innovation, development, and learning: As a result of this fragmented ownership structure, data on social security schemes are captured separately today. For example, analysis of RSBY data is contracted out to GIZ, life insurance data is housed at LIC, and pension data is housed by the Central Record Keeping Agency and owned by PFRDA. There is no way to access data on usage across schemes for a single individual, as datasets are not merged. Fragmented collection of data combined with the lack of human resources devoted to data analysis has resulted in low levels of product innovation, development, and learning. Access to high-quality data relating to take-up and use of social security by beneficiaries is a pre-requisite for identifying weaknesses and innovating on changes to drive the design and implementation of schemes.

4. Problems with identification of beneficiaries: Moreover, schemes like AABY and RSBY rely on beneficiary lists like the BPL list (merged with other employment lists such as NREGA workers’ or railway porters’ list) to identify beneficiaries. The use of such lists is fraught with multiple difficulties. First, people move in and out of poverty frequently due to various income and health related shocks that can occur instantaneously, and a listing exercise conducted once every ten years is an inadequate mechanism to capture these shifts in economic well-being. Second, there is a question on the veracity of BPL lists as being actually representative of the true BPL population. BPL lists often suffer from the dual problems of capture of benefits by those who are undeserving due to the mis-allocation and the non-issuance of BPL cards to those who deserve them. These problems have served to further the inequitable distribution of social security benefits.

5. Multiple window architecture: The fragmented ownership structure and the lack of coordination among the different Ministries running the scheme has led to an equally fragmented delivery of schemes. Currently, an unorganised sector worker who is eligible under all three schemes has to enrol at three separate windows in order to be completely covered under the scheme- she has to enrol for health insurance at an RSBY enrolment station, buy a pension through an aggregator such as a bank or MFI, and enrol for life insurance through one of LIC’s nodal agencies. Further, the nodal agency led delivery model1 does not provide ease of access to the beneficiary on a continuous basis. Currently, most enrolments are done through enrolment camps that are run periodically – once a year. If a beneficiary were to miss this camp, it becomes very difficult to get access to the product.

The issues highlighted above point to four key design elements that will be essential in a well-functioning ownership, governance, and delivery structure for social security in India:

i. A unified agency to own schemes so as to ensure convergence.

ii. A degree of separation between the political set up and implementation.

iii. Active coordination between the central implementing agency and states.

iv. An open architecture that aims at universal coverage.

—

1 – The traditional distribution channel in social security programs like RSBY and AABY is the state nodal agency (SNA) led model. Under this approach, the state governments appoint a nodal agency, usually a state government department, to oversee the overall implementation of the program. In 44% of RSBY implementing states, the nodal agency is the Department of Labour.

One Response

Thanks for the wonderful post Mr. Vishnu. The problem of not having a ‘unifying architecture’ in technical terms, and a way of legislation to provide the required distribution channels renders all these good intentioned (even if the amounts are minuscule) schemes toothless.

And regarding the data about AP, did you figure out why there is such a large adoption of the AABY scheme? Is this linked to some state-sponsored scheme that makes it so attractive in AP?

P.S: Would it be possible to get a .mobi / .epub of the report? That will make it easier to make notes when reading the report (PDF annotations are not that great on ebook readers).