Household finance research is a discipline that examines the ways in which households manage their finance, mitigate risks, smoothen their consumption, and meet their life goals. Two core functions that finance must fulfil for every household is (i) management of risk by movement of resources across contingent states and spaces (ii) inter-temporal consumption smoothing by movement of resources across time (Ananth & Shah, 2013). Formally the field of household finance research has been defined as “the study of how institutions provide goods and services to satisfy the financial functions of the household, how consumers make financial decisions and how government action affects the provision of financial services” (Tufano, 2009). The definition therefore adopts a comprehensive outlook towards studying household finance as it acknowledges the different actors involved, i.e., financial service providers who cater to the financial needs of households, regulators who regulate the market, and Government who designs policies that impact households’ financial decision making. In this blog post, we summarise the themes of household finance as articulated in a working paper published by the Household Finance Practice at Dvara Research (C et al., 2020) as well as comment on the gaps in a recent seminal paper on Household Finance co-authored by (Gomes et al., 2020).

Themes of household finance research

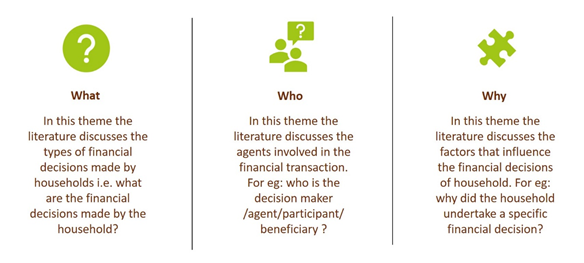

In a recent paper by C, Dasgupta and Sharma (2020) on approaches and challenges in household finance research by Dvara Research, we discussed the broad themes into which this field of research can be categorised. We refer to these themes as the ‘what’, ‘who’ and ‘why’:

Themes of household finance research

The ‘what’ theme covers literature on how households borrow, spend, save, and plan using both financial and non-financial strategies. Specifically, it examines various financial choices made by households such as savings, insurance, pension, credit, investment, and retirement products to manage financial requirements throughout their lifecycle. An example of household finance literature that fits within the ‘what’ theme is the finding that an average Indian household allocates most of their resources in physical assets (like a house or plot of land), followed by durable goods and financial assets. From the literature in advanced economies, we know that a large fraction of the population in advanced economies do not own any stocks (Gomes et al., 2020). The ‘what’ theme also covers literature that discusses the impact of households’ interaction with financial sector providers. For instance, the impact of microcredit on low-income households or the ultimate outcome of an arbitrary lending cap mandated by the regulator may push the customers towards over-indebtedness. Therefore, literature that discusses what the households does/intends to do with their finances, as well as the outcome of their interaction with financial sector providers and regulators, can be categorised under this theme.

The ‘who’ theme covers literature on the ‘agents’ involved in the financial decisions or choices of the household. Here ‘agent’ refers to the ‘household’ itself, but also to those interacting with households, such as financial service provider who provide financial products and services to the end consumer as well as the regulator who regulates the market for financial services and issues guidelines and policies that impact the eventual choices of households. Generally, the findings of these studies would be categorised on certain characteristics of the agents such as their age cohorts, income category, educational qualification, region, gender, religion, race, etc. An example of literature under the ‘who’ theme is that the largest share of assets of young households in India is in durable goods and gold, and as the household approaches retirement, their investments shift towards land and housing (Household Finance Committee Report, 2017). Often studies that are based on secondary data or primary surveys with limited scope, discuss the ‘what’ and ‘who’ aspect of household finance research but may not throw light on the reason behind a household’s financial decisions.

The ‘why’ theme includes literature that explores the underlying reasons for a household’s financial decision. For instance, Indian households invest in gold not only because of its cultural significance but also because it enables them to shift to non-farm labour outside their local regions and improve their wages (Goedecke et al., 2018). In advanced economies, households’ participation in the stock market is low because of household preferences, costs (both pecuniary and informational) of participation, risks faced by households, and the influence of peers (Gomes et al., 2020). This theme would also include literature that discusses the role of culture and behavior in influencing a household’s financial preference. Some of the behavioural factors that lead to consumer choice inefficiencies are time preference, self-control, and psychological bias (Agarwal et al., 2017). In fact, Indian households’ preference for informal mechanisms for debt and risk management can largely be explained by their risk preferences, lack of trust, and general perception of formal financial institutions. To summarise, household decisions are influenced by a range of demand and supply-led factors. Studies based on qualitative surveys, anthropological surveys, and randomised control trials are better placed to explore these factors to better understand a household’s financial behaviour.

Gaps in the household finance literature

A recent seminal paper titled ‘Household Finance’ by Gomes, Haliasson, and Ramadorai (2020)[1], reviewed the existing literature on the theoretical and empirical studies of household finance. The paper included contemporary literature on participation and allocation in assets and liabilities, including mortgage choice, refinancing, default, unsecured credit markets, credit cards, and payday lending. The paper also connects the financial outcomes of the households to their social environment, peer effects, cultural underpinnings, and other household characteristics. However, despite being a seminal work in this field, the paper does not discuss literature pertaining to households in emerging economies. Households in emerging economies have unique financial behaviour, which are far away from the normative theories developed for households from advanced economies. That said, we acknowledge that households in emerging markets have been extensively studied in recent papers (Badarinza et al., 2019). Badarinza et al. (2019) present an interesting distinction between emerging and advanced economies based on their income and wealth quintiles and maps their impact on the financial choices of the household. However, insights from emerging economies could also be incorporated in papers (like Gomes et al., 2020) that intend to conduct a comprehensive review of global household finance literature. Below, we articulate the different ways in which households from emerging economies interact with credit, savings, and risk-protection products to highlight the differences in households’ financial behaviour in emerging versus advanced economies.

While the paper reviews the literature on households’ credit markets, it remains silent on the main sources of borrowing for households in emerging market economies, namely, microfinance institutions, moneylenders, local unregistered creditors offering informal loan contracts[2]. In fact, a central concern in the emerging economy is the overheating of the microfinance credit market resulting in over-indebtedness of low-income households (Prathap and Khaitan, 2016). Microfinance loans are popular in these economies mainly because they are unsecured, joint liability loans, are well-suited for thin-file borrowers. Households in emerging and advanced economies not only differ in their interactions with the financial markets, but they are also very different in their cashflow patterns, social security benefits, exposure to shocks, employment choices, risk protection strategies, and overall access to other financial markets[3]. In addition, the intra-household bargaining power and social norms in emerging markets could be very different from advanced economies, given the differences in family structures, social structures (patriarchy or matriarchy), and preset patterns of financial decision-making.

Households and small-scale enterprises in emerging economies regularly depend on costly informal borrowing from moneylenders or other non-institutional sources. In most cases, households are unable to make any profit as the cost of borrowing is exorbitant. Although we understand their nature of borrowings, we do not yet completely understand why micro-entrepreneurs continue to choose suboptimal credit products even when experiencing diminishing returns to investment (Ananth et al., 2007). For instance, in a randomised control trial study conducted by Karlan et al. (2018), micro-entrepreneurs were given cash grants and financial education for them to close their existing informal loans and to assess if they changed their borrowing habits. However, the beneficiaries did not stop borrowing from moneylenders and were experiencing debt traps within six weeks. About savings behaviour, households in emerging economies often participate in a group-based saving instrument like rotating savings and credit associations (ROSCAs), also called chit funds in India. A ROSCA is a group of individuals who come together and make regular cyclical contributions to a fund (called the “pot”), which is then given as a lump sum to one member in each cycle. ROSCAs/Chit funds are widely used in emerging economies as a way of mitigating risks arising from emergencies or shocks. This product is based on social commitment among group members but bears the risk of loss in the case of premature withdrawals and unsafe deposit lockers (Dupas and Robinson, 2013; Breza and Chandrasekhar, 2015). In addition to the low uptake of savings products, households in emerging economies also report low uptake of risk protection accounts or retirement savings. Lack of insurance products leads to borrowing of high-cost loans after the occurrence of shock, resulting in debt burden and adding to the vulnerable state of the household. Lack of retirement savings can be attributed to the informality of labour markets as well as the low-availability of government-sponsored or mandated schemes (Badarinza et al., 2019). The paper by Gomes et al. (2020), however, only focuses on these topics from the lens of developed economy households and falls short of highlighting how households from emerging economies plan for their retirement and manage risks.

The paper also limits a household’s goals to retirement and education. However, emerging economy households have a wider range of life goals like marriage, owning real estate/ land, investing in automobiles, livestock, and other assets. These goals require long-term financial planning and a combination of financial products that facilitate long-term savings. Another aspect that both the Gomes et al. (2020) and the Badarinza et al. (2019) papers do not address is the customer protection issue. Consumer protection concerns are of prominence in the context of emerging economies, given the market imperfections on account of information asymmetry, high transaction cost, and negative externalities. These concerns are further aggravated in emerging economies, where there is a greater fraction of the population concentrated in lower-income quintiles with lower levels of financial knowledge (Halan, Sane & Thomas, 2013). Therefore, research that highlights instances of consumer protection breaches and potential interventions that can overcome these concerns are important in this context.

We strongly feel that the broader literature on household finance should encompass the financial choices and strategies of households in emerging economies. This is also important given the scale of the population in emerging economies as a share of the global population[4]. To understand the financial decision of households in emerging economies, we need more research across the themes, as well as better data on households’ financial behaviour. This will help in addressing some of the questions that remain unanswered and aid in creating better financial policies, products, and processes to serve the last-mile customers.

[1] Machael Haliassos and Tarun Ramadorai are pioneering researchers of contemporary household finance. Tarun Ramadorai also chaired the Household finance committee report (2017) by Reserve Bank of India.

[2] For example, Thandal loans in Tamil Nadu are a unique credit product that offers high cost and short-term loans for small scale vendors

[3] The paper by Gomes et al., does not mention the impact of household heterogeneity on financial market participation. For instance, there is no discussion on households with volatile cashflows, multiple outstanding loans, frequent exposure to shocks, migrant family member, and inadequate risk protection and safety net.

[4] https://www.imf.org/external/datamapper/LP@WEO/OEMDC. As per IMF, Emerging and developing economies include China, India, Indonesia, Malaysia, Philippines, Singapore, Thailand, Russia, Brazil, Mexico, Saudi Arabia, Nigeria and Turkey. As per the World Economic Outlook report by International Monetary Fund (2020), the population in emerging market and developing economies comprises of 86% of the global population

References

Ananth, B., Karlan, D., & Mullainathan, S. (2007). Microentrepreneurs and their money: Three anomalies. Working paper

Ananth, B., & Shah, A. (2013). Financial Engineering for Low-Income Households. SAGE Publications.

Badarinza, C., Balasubramaniam, V., & Ramadorai, T. (2019). The household finance landscape in emerging economies. Annual Review of Financial Economics, 11, 109-129.

Breza, E., & Chandrasekhar, A. G. (2019). Social networks, reputation, and commitment: evidence from a savings monitors experiment. Econometrica, 87(1), 175-216.

Gomes, F., Haliassos, M., & Ramadorai, T. (2020). Household finance.

Jann Goedecke, Isabelle Guérin, Bert D ’Espallier, Govidan Venkatasubramanian. Why do financial inclusion policies fail in mobilizing savings from the poor ? Lessons from rural South India *. Development Policy Review, Wiley, 2018, 36, pp.O201-O219. ff10.1111/dpr.12272ff. Ffird-01413177

Karlan, D., Mullainathan, S., & Roth, B. N. (2018). Debt traps? Market vendors and moneylender debt in India and the Philippines. American Economic Review: Insights, 1(1), 27-42.

Prathap, V., & Khaitan, R. (2016). When Is Microcredit Unsuitable? Guidelines Using Primary Evidence from Low-Income Households in India. CGAP Working Paper

RBI Household Finance Committee. (2017). Indian Household Finance. Reserve Bank of India

Sane, R., Thomas, S., & Halan, M. (2013). Estimating losses to customers on account of mis-selling life insurance policies in India.

Tufano, P. (2009). Consumer Finance. Annual Review of Financial Economics, 227-247

Vishwanath, C., Dasgupta, M., & Sharma, M. (2020). Household Finance in India: Approaches and Challenges.

World Economic Outlook (October 2020), Report by International Monetary Fund