In this post, we look at whether the grievances of the Micro, Small and Medium Enterprise (MSME) sector in relation to their use of financial services are adequately represented and captured in the current grievance redressal mechanisms available to them. With about 63 million MSMEs contributing to around a third of the country’s GDP and employing 11.10[1] crore people, the performance of the sector is key to India’s economic growth. However, out of the total debt demand of MSMEs of INR 69.3 trillion, only 16% (INR 10.9 trillion) is sourced from formal institutions[2].

In 1995, the Reserve Bank of India (RBI) introduced the Banking Ombudsman (BO) Scheme (BOS) to ensure inexpensive, expeditious, and fair redressal of grievances of the customers of the various entities regulated by the RBI. Currently, this mechanism covers SCBs, RRB, UCBs, and SFBs. The RBI also introduced the Ombudsman Scheme for Non-Banking Financial Companies (NBFC-O Scheme) in 2018. This scheme was initially set to cover deposit-taking NBFCs only, but it was later extended to non-deposit taking NBFCs with assets of Rs.100 Crore or more. The RBI has combined the annual reports[3] of both the BOS and the NBFC-O scheme into one. This report captures the number, nature, and categories of the complaints received by both the Banking Ombudsmen (BO) and the NBFC Ombudsmen during the year, among other relevant details although the NBFC-O does not have complainant-category-wise break up of grievances.

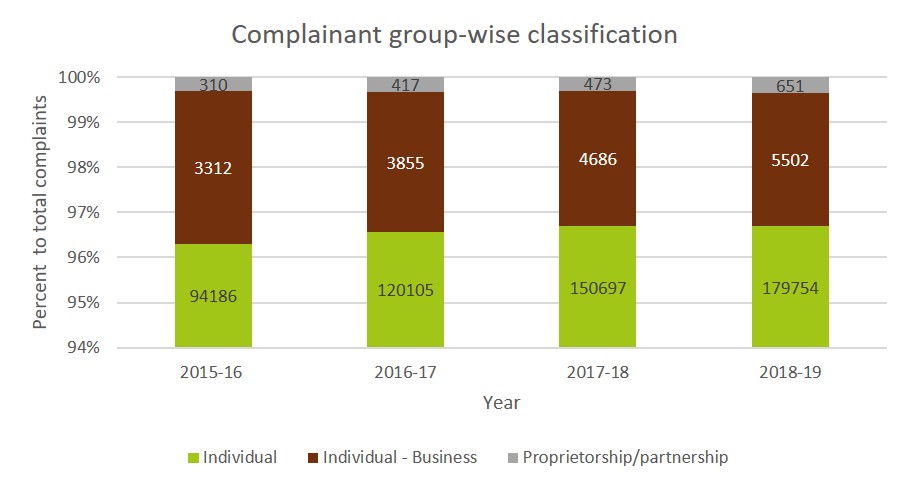

According to the 2019-20 annual report of the Ministry of Micro, Small and Medium Enterprises[4], 608.41 lakh (95.98%) MSMEs out of the total 633.88 lakh are proprietary concerns[5]. A 2018 report published by the International Finance Corporation (IFC) studied the ownership structure of enterprises in the MSME Sector.[6] Sole proprietorships formed 93.83%, partnership firms made up about 1.53%, while public and private companies accounted for 0.04% and 0.23% of the total MSMEs respectively. Figure 1 below captures the numbers of complaints received by the BO from individual customers, individual-businesses, and sole proprietorship/partnerships[7] for the past 4 years. We chose these categories to showcase the differences in the coverage of the complaints amongst the dominant customer categories. Quite noticeably, the proportion of grievances filed by proprietorships/partnerships to those filed by individuals and individual businesses, remains quite low through the years. It is possible that many loans taken by individuals, such as gold loans or microfinance loans or loans against property may have been used for businesses but that they would likely not be categorised under sole proprietorships, and to that extent, some complaints may have fallen into the individual bucket. It is also possible that even if a business is a sophisticated enterprise, the nature of the complaint could well be at the level of the individual who is the representative for that business, and hence the complaint is best categorised under the individual bucket.[8]

Figure 1: Complainant group-wise classification of complaints received

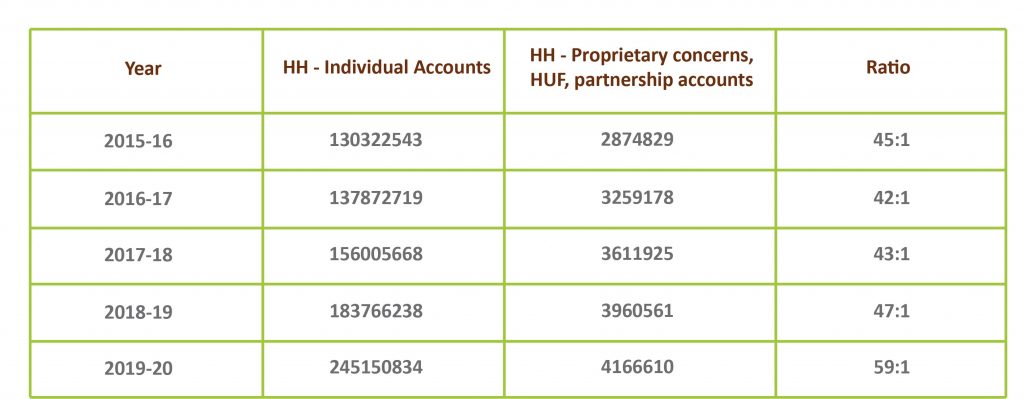

Next, we looked at the number of individual household (HH) credit accounts and those of proprietary concerns/partnerships/Hindu Undivided Families (HUFs)[9]. Table 1 showcases these numbers for the past 4 years, along with the proportion of the accounts.

Table 1: Ratio of Individual to Proprietor/HUF/Partnership credit accounts among Household Sector

We see that on an average, there are about 47 individual credit accounts for every sole proprietorship/partnership credit account. However, in terms of grievances, the average ratio of complaints lodged by individuals to those filed by proprietorships is over 297:1.

Clearly, there is a discrepancy between the number of sole proprietorship accounts and the grievances filed by them vis-à-vis the individual. This seems to suggest that MSME grievances are being under-reported and/or under-represented under the BOS.

In 2007, the ‘Centralized Public Grievance Redress and Monitoring System’ (CPGRAMS) was set up by the Department of Administrative Reforms and Public Grievances (DARPG) to facilitate the forwarding of the grievances received from the citizens to the relevant Central Government Ministries/Departments/Organisation as well as the State governments. The CPGRAMS interlinks 86 Central Ministries/Departments/ Organisations and 37 States /UTs[10]. The complaints received through the CPGRAMS portal are further handled by the Office of the Banking Ombudsman. Further, in May 2020, the government launched a platform dedicated solely to MSMEs. The portal that goes by the name CHAMPIONS (Creation and Harmonious Application of Modern Processes for Increasing Output and National Strength), is a one-stop, single-window system that seeks to encourage and handhold MSMEs with the information they need on a variety of issues, ranging from access to finance, raw materials, and labour to seeking regulatory permissions. The grievances that were earlier filed under Centralized Public Grievance Redressal and Monitoring System (CPGRAMS) are also to be pulled into the CHAMPIONS portal. Although this will help MSMEs to find all the help regarding their problems under a single portal, it does not resolve the issue of inadequate filing of banking and financial-services-related complaints.

The Code of Bank’s Commitment to Micro and Small Enterprises set out by the Banking Codes and Standards Board of India[11] (BCSBI) details the conduct regulations for banks to be followed in meeting their commitments to Micro and Small Enterprises. While the commitment towards addressing the grievances of Micro and Small Enterprises mentioned in the Code is identical to the commitment for other customers (mentioned and defined in BCSBI’s Code of Bank’s Commitment to Customers[12]), there is no mention of commitment towards Medium enterprises. Given that the BOS follows the BCSBI codes of commitment for both individual customers and MSEs, it is unclear why Medium enterprises are not covered under the current code.

The larger question that this exclusion surfaces is that of how the RBI has defined a retail customer for the purposes of clarifying whether an enterprise will qualify for the protections available under the BOS. If a sole proprietorship medium enterprise which falls under the definition of MSME has been mis-sold a credit product because of which it finds itself becoming over-indebted and unable to meet its repayment obligations, it currently does not have recourse to the BOS.

We put forward that the RBI layout an inclusive definition of a retail customer who then has clear coverage under the BOS. ‘Susceptibility to mis-selling’ must be the key criterion for defining the retail consumer. This implies that a retail consumer is to be properly identified as an entity that lacks sophisticated financial knowledge, rather than as an entity with a certain kind of risk appetite or of a certain maximum size (of investment or net-worth for instance) or a legal category (incorporated or not). One way forward would be to define retail consumers as all legal persons and entities except regulated financial institutions, qualified institutional buyers, central, state, or local governments, and businesses above a certain size[13].

There is also a need for reimagining complaint categorisation under the BOS. For example, a record of the distribution of complaints across different stages of the customer-engagement life-cycle like advertising, sale, post-sale, etc. would be of help in identifying the practices that are causing harm/problems for the customer. Further, different regulated entities like Banks, NBFCs, NBFC-MFIs, etc. are all treated differently under the scheme which leads to a difference in the consumer experience. It is recommended that the categorisation be revamped to include categories like Product (credit, insurance, etc.), Issue (incorrect fee charged, misleading product information, etc.), Channel (complaints regarding distributors, accountants, clearing house, FinTechs, general insurer, etc.), Outcome of complaint resolution by the BO (like an apology, monetary compensation, etc.) and Institutional Conduct.

Additionally, there is also the need to broaden the purview of the complaints that can be entertained under the BOS. For example, MSMEs that are over-indebted and facing difficulty repaying their loans currently do not have recourse under the BOS. So is the case where MSMEs face mis-selling from banks or NBFCs on their third-party products. This is because the Code of Bank’s Commitment to Micro and Small Enterprises states that “the provisions of the Code of Bank’s Commitment to Customers will also be applicable to Micro and Small Enterprise customers wherever applicable”. This implies that particularly for certain rights enshrined in the RBI’s Charter of Customer Rights, such as the Right to Suitability, which does not find mention in the Code of Bank’s Commitment to Micro and Small Enterprises, this right may not be upheld for Micro and Small Enterprises aggrieved on this right.

Therefore, a renovation of complaint categorisation, coupled with a more inclusive definition of the retail customer while also widening the scope of complaints that are entertainable under the BOS, would provide a more inclusive protection for micro and small enterprises. It will also help to obtain a more accurate picture of the performance of regulated entities vis-à-vis their institutional conduct towards MSMEs while also facilitating a higher coverage of grievances under the BOS.

[1] See Annual Report 2019-20 of the Ministry of Micro, Small and Medium Enterprises. Accessible at – https://msme.gov.in/relatedlinks/annual-report-ministry-micro-small-and-medium-enterprises

[2] See ‘A wider circle – Digital lending and the changing landscape of financial inclusion’. Accessible at – https://www.pwc.in/assets/pdfs/consulting/financial-services/fintech/publications/a-wider-circle-digital-lending-and-the-changing-landscape-of-financial-inclusion.pdf

[3] See Annual Report 2018-19 of the Banking Ombudsman Scheme and the Ombudsman Scheme for Non – Banking Financial Companies. Accessible at https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/AR201820190FB8B9072F984910A9FC7BA568B634D8.PDF

[4] See Annual Report 2019-20 of the Ministry of Micro, Small and Medium Enterprises. Accessible at – https://msme.gov.in/relatedlinks/annual-report-ministry-micro-small-and-medium-enterprises

[5] This data pertains to the 73rd round of the National Sample Survey conducted during the 2015-16. Accessible at – http://mospi.nic.in/sites/default/files/publication_reports/NSS_581.pdf

[6] See ‘Financing India’s MSMEs – Estimation of Debt Requirement of MSMEs in India’, International Finance Corporation (World Bank Group) in partnership with Government of Japan, November 2017. Accessible at – https://www.intellecap.com/wp-content/uploads/2019/04/Financing-Indias-MSMEs-Estimation-of-Debt-Requireme-nt-of-MSMEs-in_India.pdf

[7] The difference between the categories Individual – Business and Proprietorship/Partnership is not clear.

[8] The annual report of 2017-18 of the Banking Ombudsman Scheme showcases how a complaint raised by an authorized signatory of an FMCG distribution firm regarding debiting of cash handling charges from the firm’s current account without prior notice was categorized as non-adherence to BCSBI’s Code of Bank’s Commitment to Customers. On settlement, the refund was made to the complainant’s bank account. See Annual Report 2017-18 of the Banking Ombudsman Scheme. Accessible at – https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/BANKINGOMBUDSMAN96D76BE8B42A49148A128688485B9DD9.PDF

[9] See Time-Series Publications, Quarterly BSR – 1: Outstanding Credit of Scheduled Commercial Banks, table 1.6 ; and Basic Statistical Return (BSR)-1 (Annual) – Credit by SCBs, table 1.11. Accessible at – https://dbie.rbi.org.in/DBIE/dbie.rbi?site=publications

[10] Accessible at – https://darpg.gov.in/public-grievances

[11] See Code of Bank’s Commitment to Micro and Small Enterprises, August 2015. Accessible at – http://www.bcsbi.org.in/Pdf/CodeOfBankMSE2015.pdf

[12] See Code of Bank’s Commitment to Customers, January 2018. Accessible at – http://www.bcsbi.org.in/Pdf/CBCC2018.pdf

[13] See ‘Universal Conduct Obligations Financial Services Providers Serving Retail Customers’, Deepti George, Dvara Research, May 2019. Accessible at – https://dvararesearch.com/wp-content/uploads/2019/05/Universal-Conduct-Obligations-for-Financial-Services-Providers-Serving-Retail-Customers.pdf