Taking a significant step towards curbing illegal collection of deposits by unauthorized and illegal entities, RBI recently set up a website named ‘Sachet‘ (Alert). This initiative is in line with a recommendation made by the Committee for Comprehensive Financial Services for Small Businesses and Low Income Households (CCFS, 2014)[1] on Citizen led-surveillance, namely that “RBI should create a system by which any customer can effortlessly check whether a financial firm is registered with or regulated by RBI.”

The website is a one-stop point for citizens to lodge and track a complaint against illegal acceptance of deposits/money by any scrupulous individual or entity. The website will enable citizens to lodge a complaint with a plethora of regulators. The information provided here is expected to be immediately shared with the concerned Regulator/Law Enforcement Authority who would initiate necessary action as per their procedures and processes. Citizens can also check whether an entity is registered with any regulator and whether they are permitted to accept deposits. The website also serves as an easy point of access to inform citizens about the regulations prescribed by all financial regulators and across central and state legislations. Having said this, it would have been greatly beneficial for the public to understand legislation if there were links that would direct to helpful content such as that on the NCFE website that provides impartial and easy to understand financial educational content (a similar example in another jurisdiction is that provided by ASIC’s MoneySmart website for Australia).

The Sachet website is also a platform for State Level Coordination committee[2] (SLCC) to disseminate information among members of SLCC, which in turn will help in curbing illegal and unauthorized money raising activities.

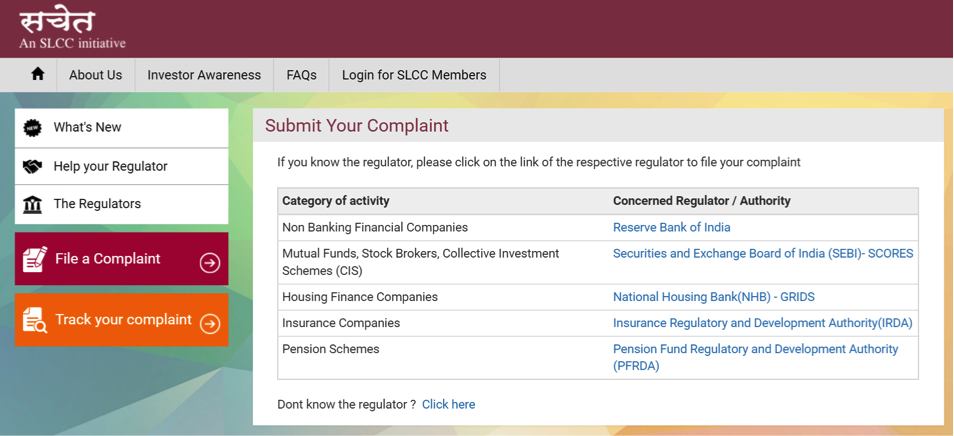

A snapshot of the regulators listed on the website (provided below) interestingly excludes certain categories of institutions in whose name fraudulent activities can be performed, such as banks, cooperative banks, and regional rural banks, as well as those types of entities that do not fall under the purview of any of the financial sector regulators, such as cooperative societies, trusts, NGOs and so on.

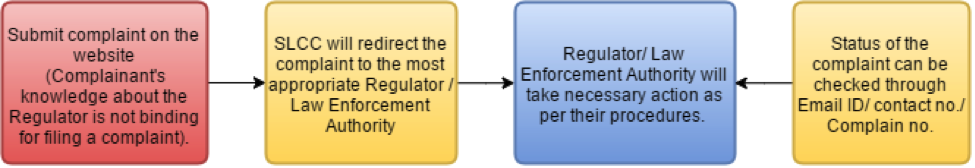

The Complaint Filing process is illustrated below:

If the SLCC does not forward the complaint to the respective authority within 30 days, the complainant can send a reminder to them.

It is important to note that this website is not intended as a solution to the last mile problem of difficulties in accessing external customer grievance redressal mechanisms. There is no link to the external grievance redressal mechanisms such as the Banking Ombudsman (for banks), Insurance Ombudsman (for insurance companies), SCORES for SEBI-regulated entities, or PFRDA (for pension products). Once a complaint enters the Sachet system, a seamless link to these websites would bring down customer distress considerably.

This is a significant first step in the right direction towards protecting customers from illegal and unauthorized individuals or entities that collect deposits, whether or not they are able and willing to repay these deposits. For a holistic last-mile solution, practitioners like various financial institutions as well as post-offices and district-level government offices can also get involved in the process of disseminating information about Sachet.

—

1 – CCFS Report – https://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/CFS070114RFL.pdf, Pg 187.

2 – State Level Coordination Committee (SLCC) is the joint forum formed in all States to facilitate information sharing among the Regulators viz. RBI,SEBI,IRDA,NHB, PFRDA, Registrar of Companies (RoCs) etc. and Enforcement Agencies of the States viz Home Department, Finance Department, Law Department, Economic Offences Wing (EOW)

One Response

Hey, thanks for this great informative content. I loved reading your other blogs also.