In 2015, RBI issued in-principle licenses for a new type of bank, called the Small Finance Bank (SFB), to ten applicants engaged in providing financial services. SFBs are like universal banks in that they perform all the banking functions – payments, accepting deposits and lending. RBI’s guidelines for licensing of SFBs in the private sector[1], states that the objective of SFBs is to ‘further financial inclusion by setting up savings vehicles to the unserved and underserved, and to provide credit to small business units; small and marginal farmers; micro and small industries; and other unorganised sector entities’. To this end, RBI has designed the SFB license with specific business-model-level regulatory prescriptions– SFBs are required to dedicate 75% of their Adjusted Net Bank Credit (ANBC) to priority sector lending and must have at least 50% of their lending portfolio be comprised of loans and advances of up to Rs. 25 lakhs each. There are differences in the capital requirement as well for SFBs, among other things – the minimum paid-up capital cannot be below Rs. 100 Cr (one-fifth that of universal banks), and the minimum capital-to-risk-weighted-assets ratio must not be below 15% (more than 1.5 times that of universal banks).

We at Dvara Research set up a performance tracker to analyse the available information[2] on SFBs and determine to what extent such a business model arising out of regulatory prescriptions has been successful/ has made progress towards achieving the RBI’s mandate.

What we found

- SFBs have largely done well in maintaining profitability despite the more stringent regulatory mandates on PSL and loan sizes.

This has been driven by the high spread between deposit[3] and lending rates[4] and holds despite their cost of funds being double that of public and private sector banks.

| Bank Group | Net Interest Margin[5] | Cost of Funds[6] |

| Public Sector Banks | 2.4% | 5.08% |

| Private Sector Banks | 3.5% | 5.16% |

| Small Finance Banks | 8.4% | 10.29% |

| All Scheduled Commercial Banks | 2.8% | 5.05% |

Table 1: Bank-Group wise Metrics – FY 2018

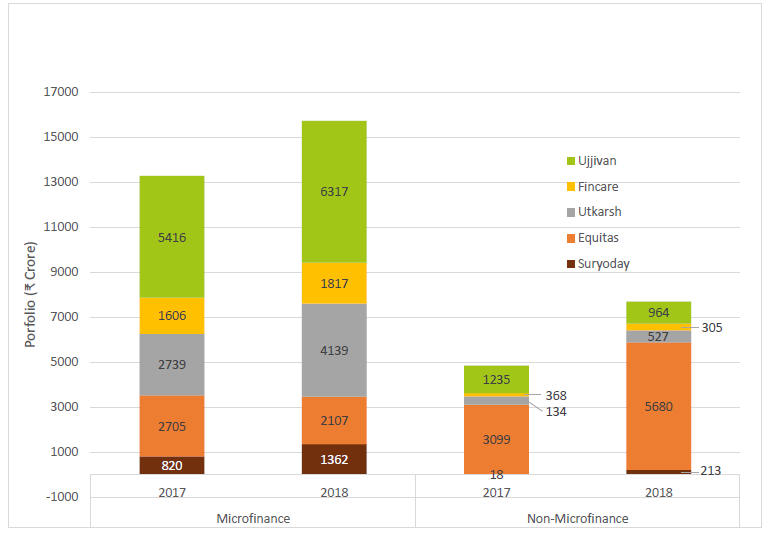

Microfinance still forms a sizeable portion of the loan book for SFBs, this is likely to contribute in keeping the portfolio-level lending rates higher than that of other bank groups. Figure 1 shows the microfinance and non-microfinance components for the five SFBs for which this data was available. Microfinance book formed 67% of the total loan book for these five SFBs.

Figure 1: Trends in Microfinance and non-microfinance portfolios of five SFBs

The increase in the non-microfinance component has been through the provision of new products, with MSME, vehicle and gold loans being the most common ones.

- SFBs’ strategy and expansion seem most akin to that of private sector banks.

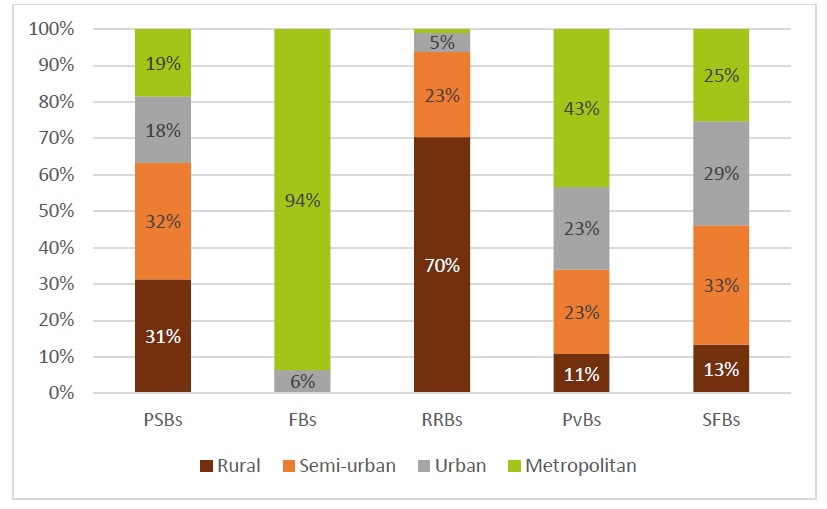

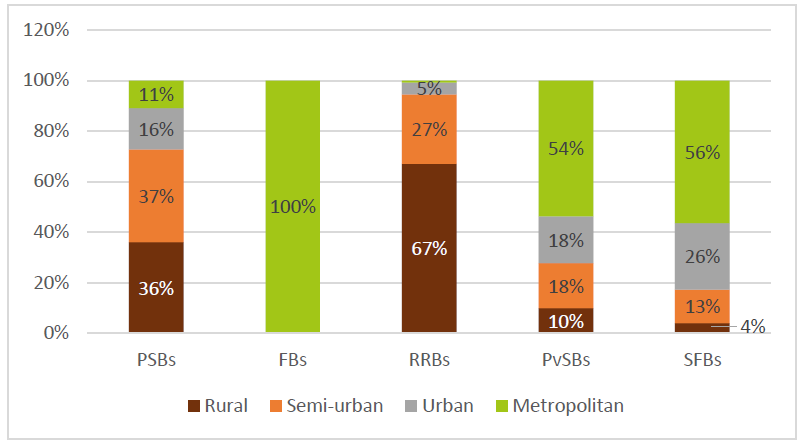

Much of the SFB branch network (62%[7]) is in the semi-urban and urban areas[8],[9]. SFB lending and to an extent deposit-taking, does not see rural centres being serviced more than what is already being done by existing banking models (except for RRBs) (Figures 2 and 3). SFBs’ credit picture sees a geographic skew with only 17% of credit accounts and 20% of credit amount in the rural and semi-urban areas

Figure 2: Geographic Spread of Number of Deposit Accounts of Bank Groups – March 2018

Source: RBI DBIE[10]

Figure 3: Geographic Spread of Number of Credit Accounts of Bank Groups – March 2018

Source – RBI DBIE[11]

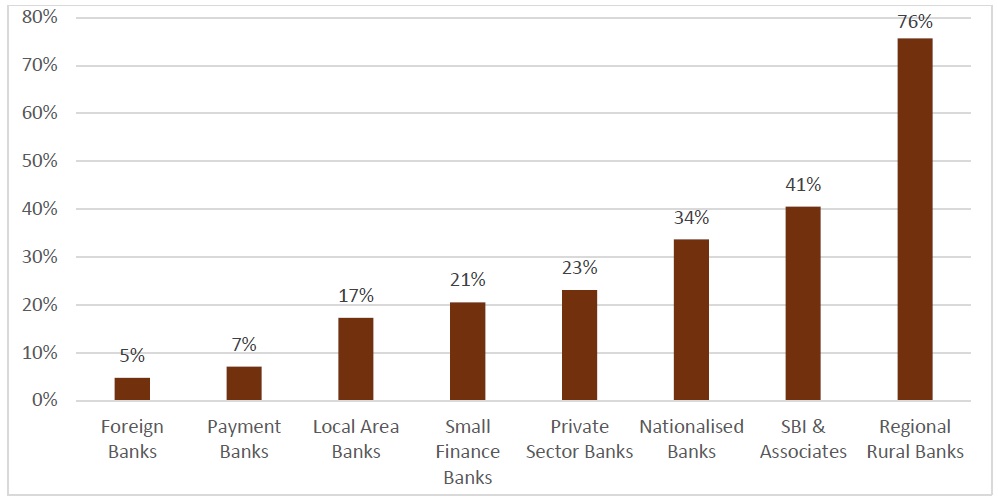

Assessing whether the SFBs have met their mandate of serving the underserved or not can be done by looking at how many of the unbanked centres are now being served by the SFBs. However, the publicly available data is limited to the locations which are ‘banked’, i.e., have at least one operational bank branch. Therefore, to analyse the reach of the SFBs, we adopt a different metric for locations – ‘underbanked’ for those locations which have five or fewer bank branches. The share of SFB branches in underbanked locations constitutes only 21% of their total bank branches (Figure 4). The highest such proportion is that of Regional Rural Banks at 76%.

Figure 4: Proportion to total bank branches in underbanked areas

Data source: RBI DBIE[12]

Considering the SFBs’ choice of business and expansion strategy, it thus brings to question how well the business-model-level regulatory prescriptions help in fulfilling a financial inclusion mandate. A deeper analysis with more and better data that can give a granular understanding of benefits at the customer level is required to understand how many of the previously unbanked/underbanked populations are being catered to by SFBs.

Read our full analysis and report here.

[1] Guidelines for Licensing of Small Finance Banks in the Private Sector, RBI Circular – Feb 22, 2013. Available at: https://www.rbi.org.in/scripts/bs_viewcontent.aspx?Id=2901

[2] SFB Annual Reports, their websites, RBI DBIE data, news articles

[3] As of October 2019, the SFBs, on an average, offer interest rates of about 1.5 percentage points more than that of the universal banks.

[4] The average 1-year MCLR for SFBs as of September 2019 stands at 14%. In comparison, the total average of the public sector, private sector and foreign bank groups (not including SFBs) as of August 2019 is at 8.57%;

[5] Net Interest Margins (NIMs) are annualised. They are calculated as the ratio of annualised net interest income to average total assets. Net Interest Margin of SFBs is average of values sourced from SFB annual reports. Source for other bank groups – Chart 2.1: Select Performance Indicators, Chapter II Financial Institutions: Soundness and Resilience, Financial Stability Report Issue No.18- December 2018. Available at: https://www.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=917

[6]According to RBI’s definition, Cost of Funds=100*(Interest Expended)/ average (Deposits + Borrowings) for Current and Previous Years. Source: Table 10. Bank Group-wise Select Ratios of Scheduled Commercial Banks – up to March 2018, Statistical Tables Relating to Banks in India, RBI DBIE. Available at: https://dbie.rbi.org.in/DBIE/dbie.rbi?site=publications

[7] Source – Directory of Commercial Banks in India, RBI Database on Indian Economy – updated as of August 2019. Available at: https://dbie.rbi.org.in/DBIE/MOFSelectParam.jsp

[8] Semi-urban and Urban are Population Groups which are classified by RBI accordingly: Rural – up to 9,999; Semi-urban – 10,000 to 99,999; Urban – 1,00,000 – 9,99,999 and Metropolitan – above 10,00,000

[9] While this categorisation is strictly not geographic but is rather driven by population sizes of each centre, we use the word ‘geographic’ to describe spread of any metric across regions with varying population densities. This is because we do not have a more granular metric that can track geographical spread. However, we can conclude that the more sparsely populated regions are certainly the more difficult centres to serve.

[10] Table No 2.1 Population Group and Bank Group-wise Deposits and Credit (total credit and credit of small borrowal accounts) of SCBs, Basic Statistical Returns of Scheduled Commercial Banks in India – March 2018, RBI Database on Indian Economy. Available at: https://dbie.rbi.org.in/DBIE/dbie.rbi?site=publications

[11] Table No 2.1 Population Group and Bank Group-wise Deposits and Credit (total credit and credit of small borrowal accounts) of SCBs, Basic Statistical Returns of Scheduled Commercial Banks in India – March 2018, RBI Database on Indian Economy. Available at: https://dbie.rbi.org.in/DBIE/dbie.rbi?site=publications

[12] Directory of Commercial Banks in India, RBI Database on Indian Economy – updated as of August 2019. Available at: https://dbie.rbi.org.in/DBIE/MOFSelectParam.jsp

One Response

A good analysis considering the limited data available. The comparison on underbanked location branches is perhaps has to be reviewed. RRBs had more than 14000 branches in March 2016 before the massive amalgamation began. RRBs were district banks originally and required to open branches within that area and hence by default most of their branches were in underbanked areas. Once someone opens a branch in an underbanked location no others can come there in the medium term unless the location develops exponentially. Better indicators would be proportion of small customers, proportion of loans below the Rs 25 Lakh threshold set by RBI.

Srinivasan