This post is part of our blog series on the Conference on Designing Regulations for a Rapidly Evolving Financial System hosted by Dvara Research (formerly known as IFMR Finance Foundation).

In a previous post of this series, we introduced the recent trend of ‘Modularisation’ that formed the basis for the deliberations at the third Financial Systems Design Conference. Moving away from the traditional model of service delivery where financial institutions perform all the functions associated with the delivery of a product to a consumer, the trend of Modularisation has seen the emergence of specialist institutions that perform only a subset of the universe of functions that were traditionally performed by a single financial institution, and many such specialist institutions together combine to offer a financial service to the end-customer. It is to be noted that Modularisation goes beyond the use of specialised intermediaries for certain functions such as cash management or loan sourcing, which is common practice in traditional financial services delivery. For instance, the sale of a credit product may now involve online aggregator platforms that create and manage the relationship with the consumer. Borrower verification and risk assessment may involve multiple firms such as credit information companies and data analytics firms. Product design may involve a lending institution with specialised knowledge of the particular customer segment and an eventual financial institution that aggregates the risk and provides the balance sheet resources. This presents new opportunities for consumers and new entrants while introducing new challenges for incumbent institutions as well as for the regulators overseeing the functions under question.

Strategic Evolution of Business Model Archetypes

Modularisation has brought in its wake disruptions to traditional business models in financial services. This is due to:

- The decoupling of manufacturing and distribution functions and the creation of marketplaces that move away from one-to-one to many-to-many principal-agent relationships;

- The embedding of financial product delivery into both offline and online real sector businesses, resulting in the blurring of the lines between financial and non-financial service delivery.

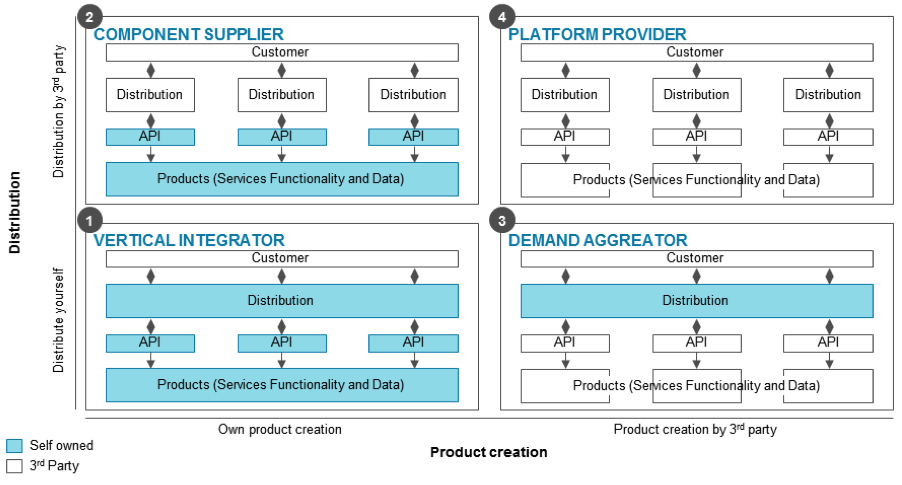

One of the ways to understand Modularisation in financial services is to segregate the functions of a financial service provider into two broad categories: Product Creation and Product Distribution. We visualise this distinction by classifying the emergent business models into four categories, as described in the Report[1] by Oliver Wyman titled “Modular Financial Services: The New Shape of the Industry”.

- Vertical Integrator – This category represents a fully integrated institution which handles all functions from product creation to the delivery of product and its servicing. Universal banks are an example of a vertical integrator.

- Component Supplier – This category represents institutions that design the financial product but distribute through third party institutions. A typical example is a bank using business correspondents to originate loans.

- Demand Aggregator: A business correspondent is a typical example of a demand aggregator. It distributes products and services which are designed and manufactured by another institution.

- Platform Provider: In a fully modular environment, a platform provider links customers to multiple suppliers. The tasks involved in the manufacturing and distribution of financial products are performed by a variety of specialist firms. The platform provider links firms providing various functions such as product design, risk analytics, back-office operations, payments, balance sheet management and so on to cater to the end customer.

The Component Supplier and Demand Supplier models have enabled the embedding of financial products into the retail commerce sector. These modularised models of finance enable the sale of credit and insurance products along with the sale of goods on platforms such as e-commerce websites. A typical example of a platform provider in India would be an e-commerce platform such as Flipkart or Amazon that enables the sale of credit products along with the sale of retail merchandise. This integration allows the consumer to avail extremely customised products through a seamless delivery experience.

To set the context for the Conference, Duncan Woods, Partner at Oliver Wyman, led the introductory session on mapping this recent trend of Modularisation (See video below). He also covered business models that are shaping the ‘modular’ financial system and elaborated on their potential in serving the un/under banked segment.

Benefits to the Consumer

There are several factors that have motivated the trend of Modularisation in the financial services industry. Most important among these, is that Modularisation of financial services will potentially benefit the consumer in multiple ways:

- Providing convenient and efficient services:. The emergence of the digital medium as a powerful channel for the delivery of financial products has enabled the consumer to have access to financial products offered by a multitude of providers. Firms such as e-commerce websites and social networking sites are now leveraging their existing relationship with the consumer to provide financial products. Service providers are now able to access relevant and clean sources of data on consumers through APIs which are enabling the provision of easier and more targeted and customised services. This availability of on-demand and holistic financial services through digital channels is allowing these newer firms and channels to challenge the traditional brick-and-mortar banking model.

- Enabling access to customised products at reduced costs: The unbundling of processes involved in completing the delivery of a financial product has provided financial institutions the choice of employing specialised institutions in a manner that significantly reduces operating expenses. This, coupled with existing cost-effective and scalable technologies in financial services, is bringing down the costs associated with the delivery of products. For instance, in the case of credit, online origination platforms are able to reduce loan processing and underwriting costs. This may enable financial services providers to offer smaller-value loans to households and small businesses in a more cost-effective manner. This may permit better alignment of products to the preferences of these consumers.

In subsequent posts, we explore challenges for regulation in a modularised world.

[1] Modular Financial Services: The New Shape of the Industry, Report by Oliver Wyman, 2016 (http://www.oliverwyman.com/content/dam/oliver-wyman/global/en/2016/jan/OliverWyman_ModularFS_final.pdf)