In the last five years, the microfinance sector in India has grown into a stable and well-regulated sector thanks to a strengthened regulatory framework and credit bureau infrastructure. The regulatory oversight on NBFC MFIs and the advent of the microfinance credit bureau infrastructure with mandatory reporting requirements have made it possible to go beyond anecdotal evidence and analyse these issues in a robust manner which is the objective of this post. NBFC MFIs are generally registered with Equifax and/or Highmark to do credit bureau checks and report credit information on their portfolio periodically. Under RBI guidelines, NBFC MFIs cannot lend to a customer who already has two MFI lenders or whose total indebtedness exceeds INR 1,00,000. Gaps in the information available on bank lending to microfinance clients through the Self Help Group (‘SHG’) model are expected to be addressed over a period of time as banks start complying with the recent RBI guidelines relating to bank reporting on their SHG portfolio. NBFC MFIs also make higher provisioning including on standard assets of 1%. The silos in credit bureau market infrastructure are also expected to reduce as all credit institutions start reporting information to all credit bureaus under the guidelines issued by RBI in January 2015.

How far has the microfinance sector come since 2010? What is the quality of growth of rapidly growing MFIs? Is growth adversely affecting customer well-being? In this post, we attempt to understand these issues based on rigorous data. Given that a large proportion of excluded Indians, women in particular, depend on MFIs for their only source of financing, conclusions must be drawn with a great deal of responsibility.

Sources of data/information

Field observations discussed in this blog are based on over 200 field surveillance and monitoring visits conducted by IFMR Capital since April 2013. During these regular visits, the team covered more than 1000 microfinance centre meetings across 200 districts and 20 states, including interview-cum-discussion meetings with branch managers, loan officers, JLG borrowers and senior management at Head Office.

The microfinance sector performance data discussed in this blog is based on mainly two sources: (a) Microfinance sector level pincode reports for more than 500 districts subscribed from Equifax, one of the largest microfinance credit information bureaus in India, and (b) Performance data on microfinance portfolio based transactions, with underlying microfinance loans worth more than INR 3500 crores, structured by IFMR Capital.

Question 1: Is pipelining rampant?

Credit pipelining is the practice of borrowers routing the availed loan amount to another person, who may be a member of the group or a third person, referred to as beneficiary. The beneficiary usually uses the money for her/his own purpose and makes periodic repayments through the group. In lieu of their KYC and attendance at the centre meetings, borrowers may receive compensation (commission) from the beneficiary. If repayments are regular, it is difficult to identify such cases; it is only when the beneficiary is under financial distress and he/she finds it difficult to repay instalments, that pipelining is discovered. Such pipelining incidences are neither uncommon nor limited to a particular district, region or state. Credit pipelining, as discussed subsequently in this blog, is often a result of operational process dilution. Sporadic cases are observed across states during regular monitoring visits by IFMR Capital.

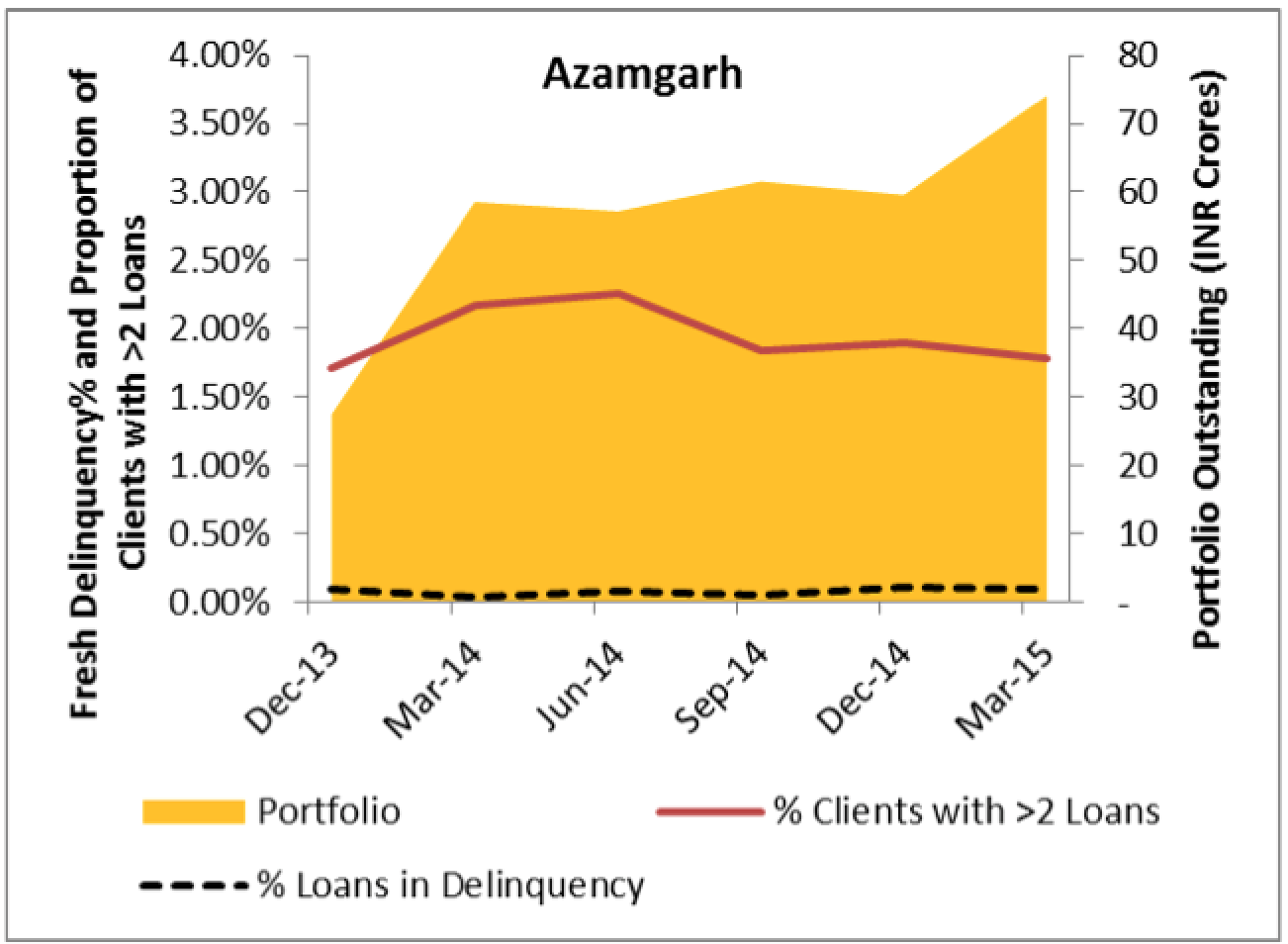

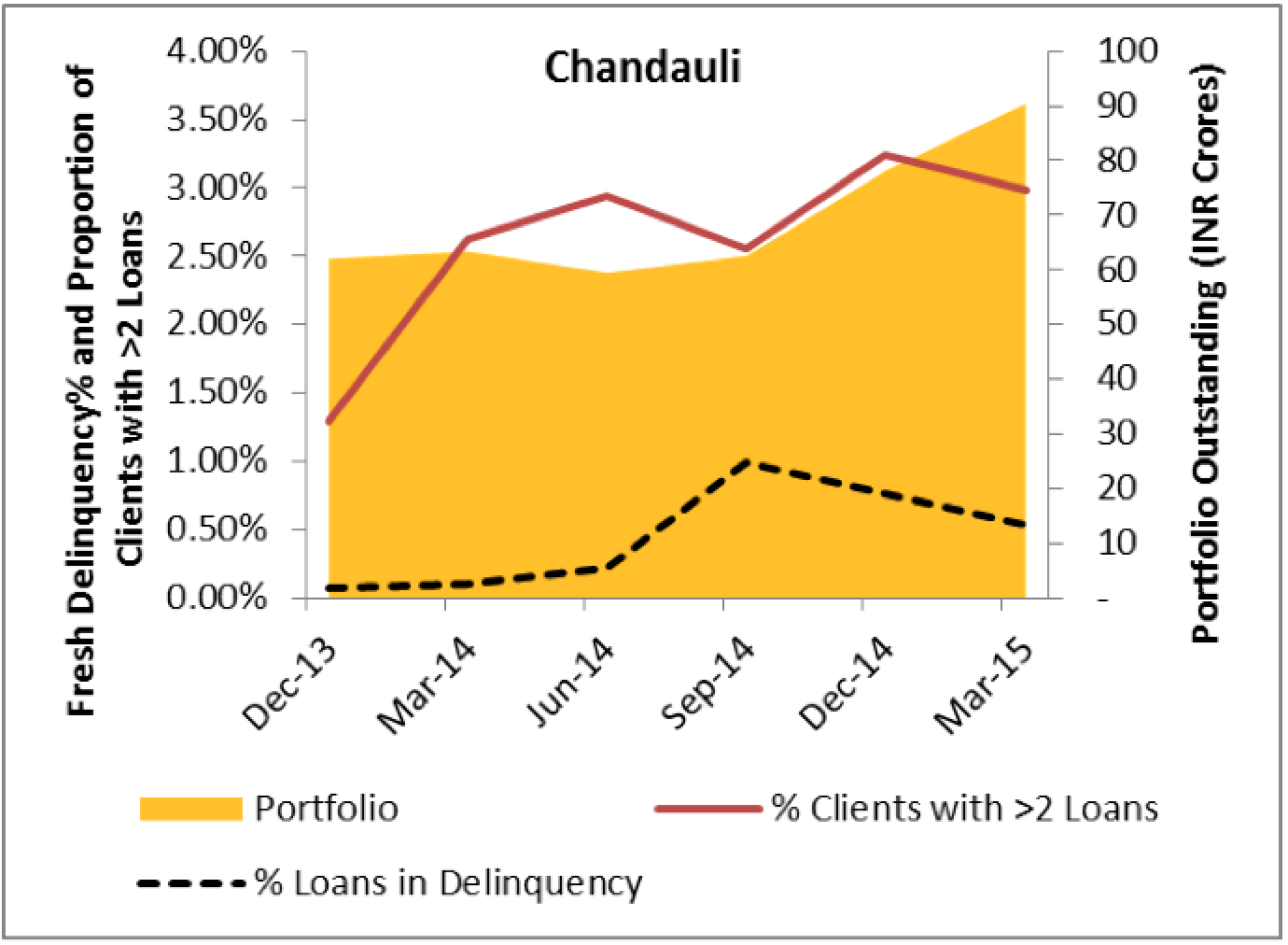

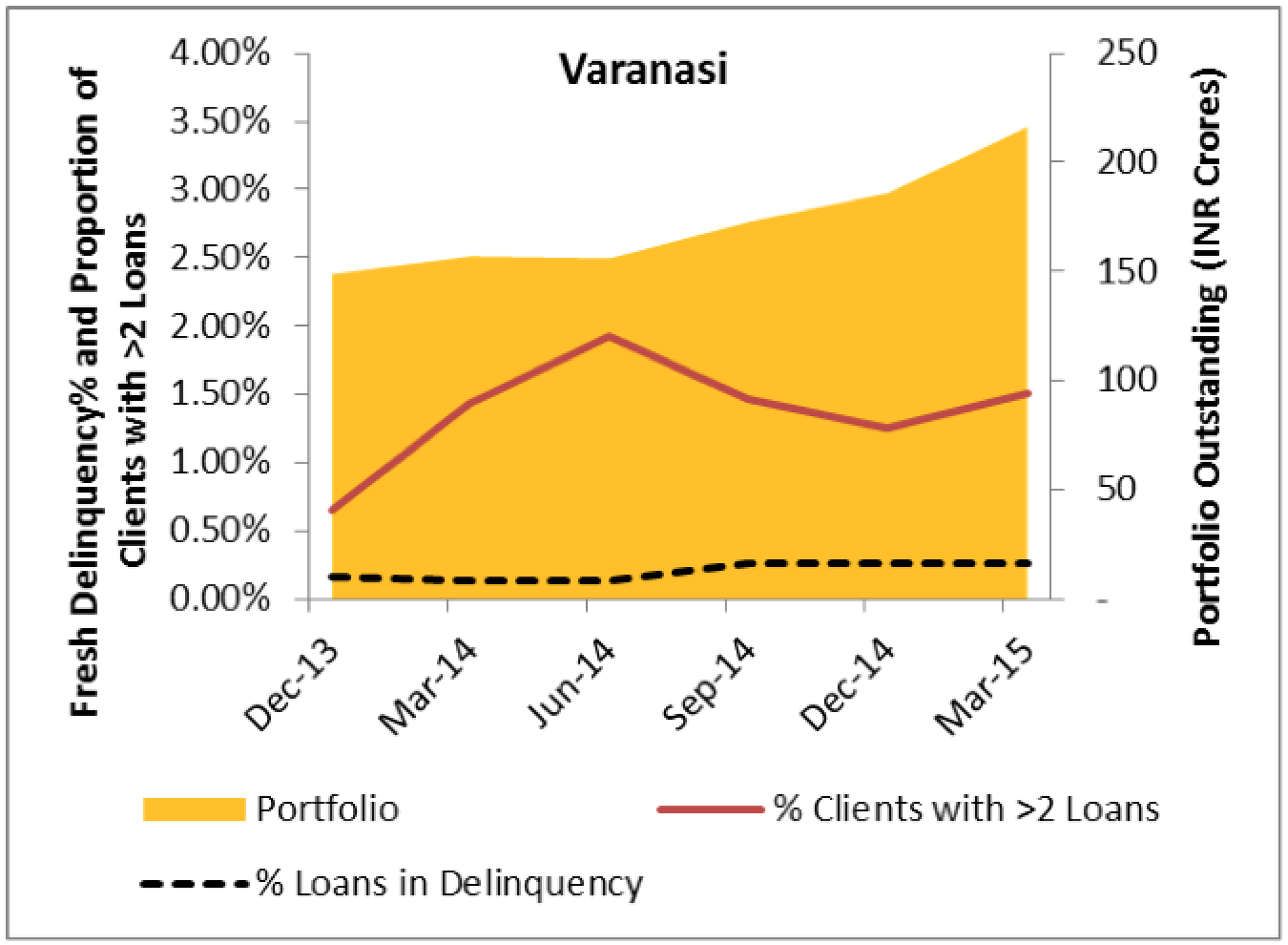

The recently highlighted instances (link) of credit pipelining and multiple lending, and events which unfolded subsequently in a village in Eastern UP are extremely unfortunate. Such instances undoubtedly require prompt and effective corrective action that must be institutionalised at the highest levels in an MFI. We completely disapprove practices that result in such instances and our position towards these is enshrined in our underwriting guidelines. While we continue seeing sporadic episodes across the country, our field analysis and data however don’t support the wide-spread nature of such issues. Based on pincode level data, we drilled down to district level and looked at the trend of portfolio performance, portfolio growth and multiple lending for the three eastern UP districts in recent focus – Azamgarh, Chandauli and Varanasi. The data does not show evidence of excessive multiple lending by MFIs in these districts with less than 3% clients having more than two MFI loans.

Portfolio growth, proportion of clients with more than two MFI loans and delinquency levels in Azamgarh, Chandauli and Varanasi

*Source: Equifax

It is important to note that the underlying factors behind pipelining as well as the mitigating steps needed to curb pipelining are not new to the sector. Though it is true that pipelining is difficult to uncover, sooner or later such cases result in repayment delays by the involved members bringing these to the attention of the lender. Credit pipelining is often seen in centres where some or all of the following factors are present: (a) borrowers are not aware of the consequences of payment default such as negative profile in credit bureau and possible denial of credit in future, (b) Loan utilization checks are weak, (c) dilution of group formation and origination processes such as group recognition test (GRT) and continuous group training (CGT) and (d) MFI loan officer’s reliance on a single centre member (‘centre leader’) for centre operations such as group formation and collection of payments during the centre meeting. It is true that increasing competition and pressure to raise loan officer productivity may result in dilution in key processes and reliance on influential centre lenders.

In our discussions with management during monitoring visits, we have found that MFIs are aware of the underlying factors which result in such incidents and are increasingly focusing on mitigating mechanisms such as (i) Ceiling on origination linked incentives for loan officers (ii) disbursement conditional on strict compliance to CGT and GRT (iii) residence verification and meeting borrower’s family or spouse to ascertain loan utilization and to restate implications of credit default (iv) adherence to loan utilization checks (v) compliance to credit bureau processes and (vi) strengthening internal audit.

Question 2: Is there overheating?

Another concern discussed often in microfinance is over-indebtedness and the issue of borrowing by JLG members from multiple sources including MFIs. During monitoring visits to our NBFC MFI partners, we have observed a very high compliance to regulatory guidelines on multiple lending and borrower indebtedness across the sector. While the challenge posed by the usage of multiple KYCs by borrower is not unfounded, our understanding is that the prevalence and impact is limited. In addition to KYC identifiers, microfinance credit bureaus also rely on advanced algorithms to track borrowers in their database by matching borrower name, spouse or relative name, address string and address pincode. Based on the loan level portfolio scrub data queried from one of the credit bureaus, we observed that same client with different KYC documents and ID numbers was identified based on name and address string. Such algorithms reduce the risk of multiple lending due to multiple KYC IDs, alerting the lending institution on matches found in the credit bureau information even when different KYCs are used.

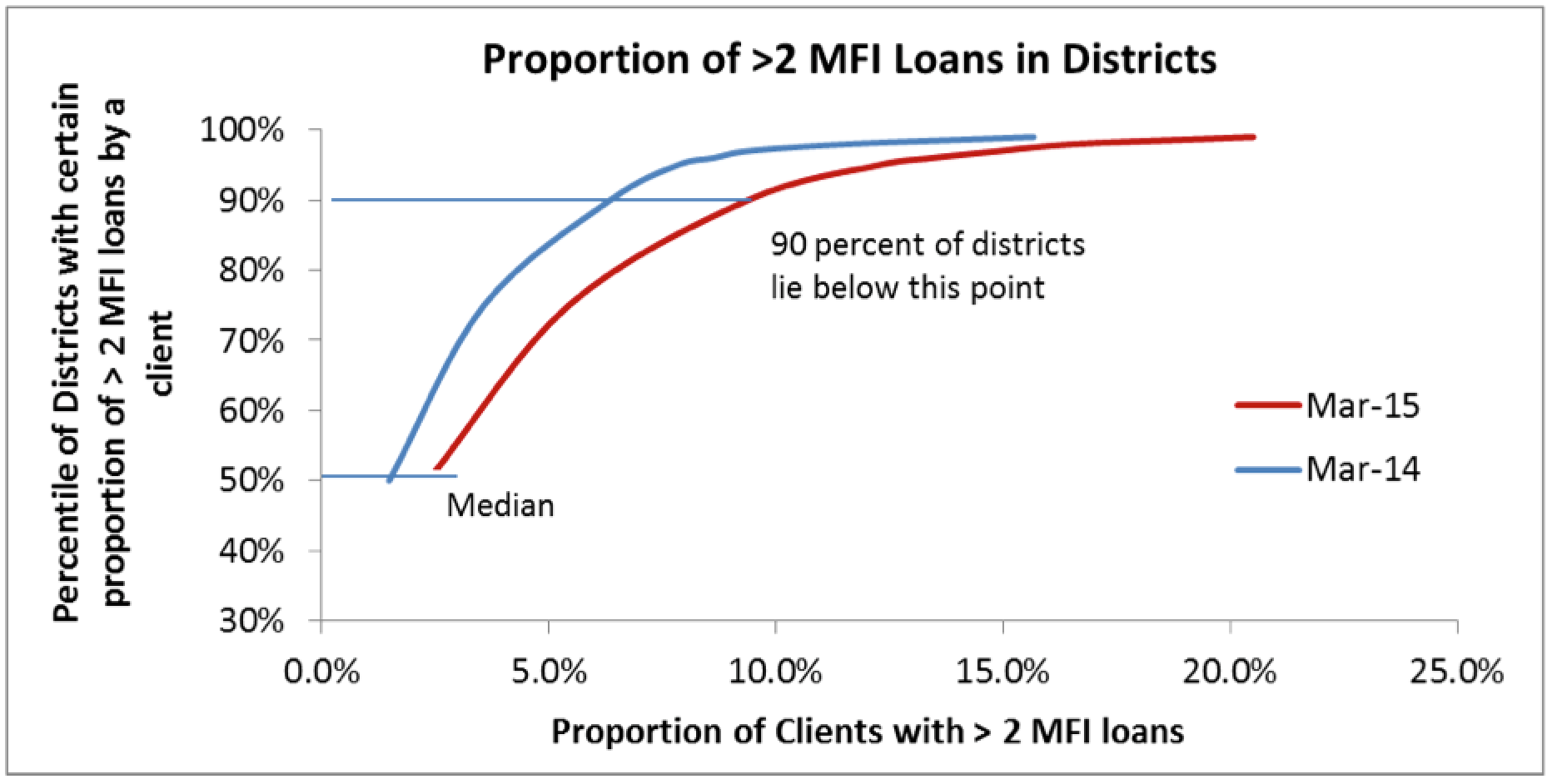

We used pincode level microfinance loan performance data available for nearly 6000 pincodes across more than 500 districts, to measure the prevalence and impact of multiple lending. We define multiple lending as availing of more than two MFI loans by a single client at a given time. We measured multiple lending in a district as the proportion of clients with more than two MFI loans.

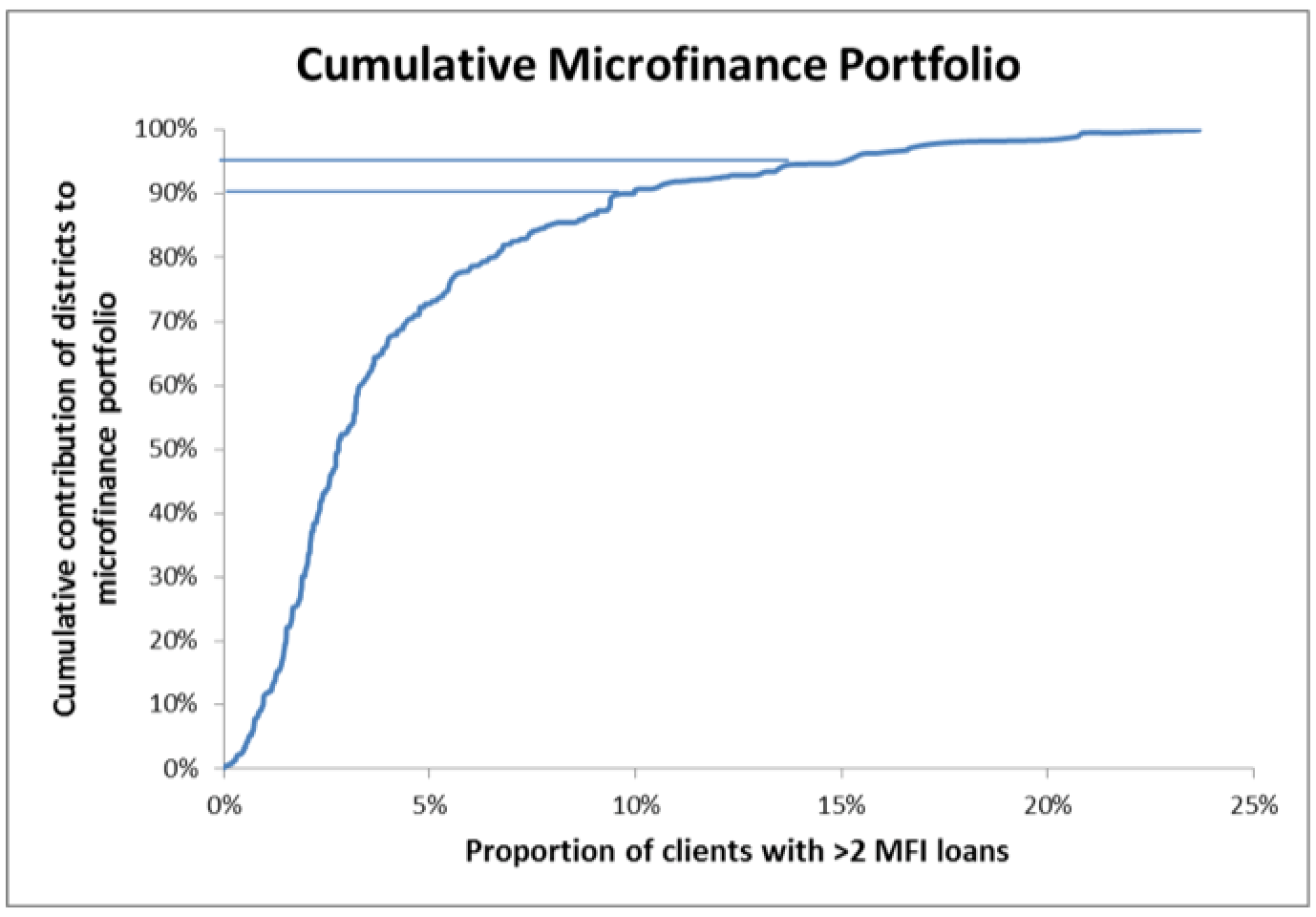

Our findings suggest that a median multiple lending of 2.35% and 1.50% as of Mar-2015 and Mar-2014 respectively. For 90% of districts, which incidentally also account for 90% of microfinance portfolio, the multiple lending measured is less than 9% as of Mar-2015 (up from 6% as of Mar-2014). It should be noted that our measure of MFI multiple lending is fairly conservative. Even during monitoring visits, we often see clients with three MFI loans. One of the primary reasons is the lag between the disbursal of a new loan and its reporting to the credit bureau by the MFI. During such period, the client may receive loan from another MFI (or MFIs) as credit bureau check may not show the existing loans accurately in the short transition period. However, the prevalence of this operational issue is limited. With many NBFC MFIs moving to weekly sharing of performance data with credit bureaus, we expect to see a decline in multiple loan instances due to such operational reasons.

Proportion of more than 2 MFI loans in districts

*Source: Equifax

We also checked for the microfinance portfolio being originated in districts with different proportion of multiple lending. In simple words: are districts with higher multiple lending contributing disproportionately more to the sector portfolio outstanding? The graph below shows that nearly 90% of portfolio is originated in districts where less than 9% clients have more than 2 loans from MFIs. Similarly, nearly 95% of portfolio is originated in districts where less than 15% clients have more than 2 loans from MFIs. Certainly, this data does not account for loans taken by borrowers under SHG scheme as well as loans from non-NBFC MFIs, private money lenders, and other such sources which do not report to credit bureaus. Also, the data may include limited microfinance portfolio originated by banks through business correspondents.

Cumulative portfolio contribution by districts with multiple lending

*Source: Equifax

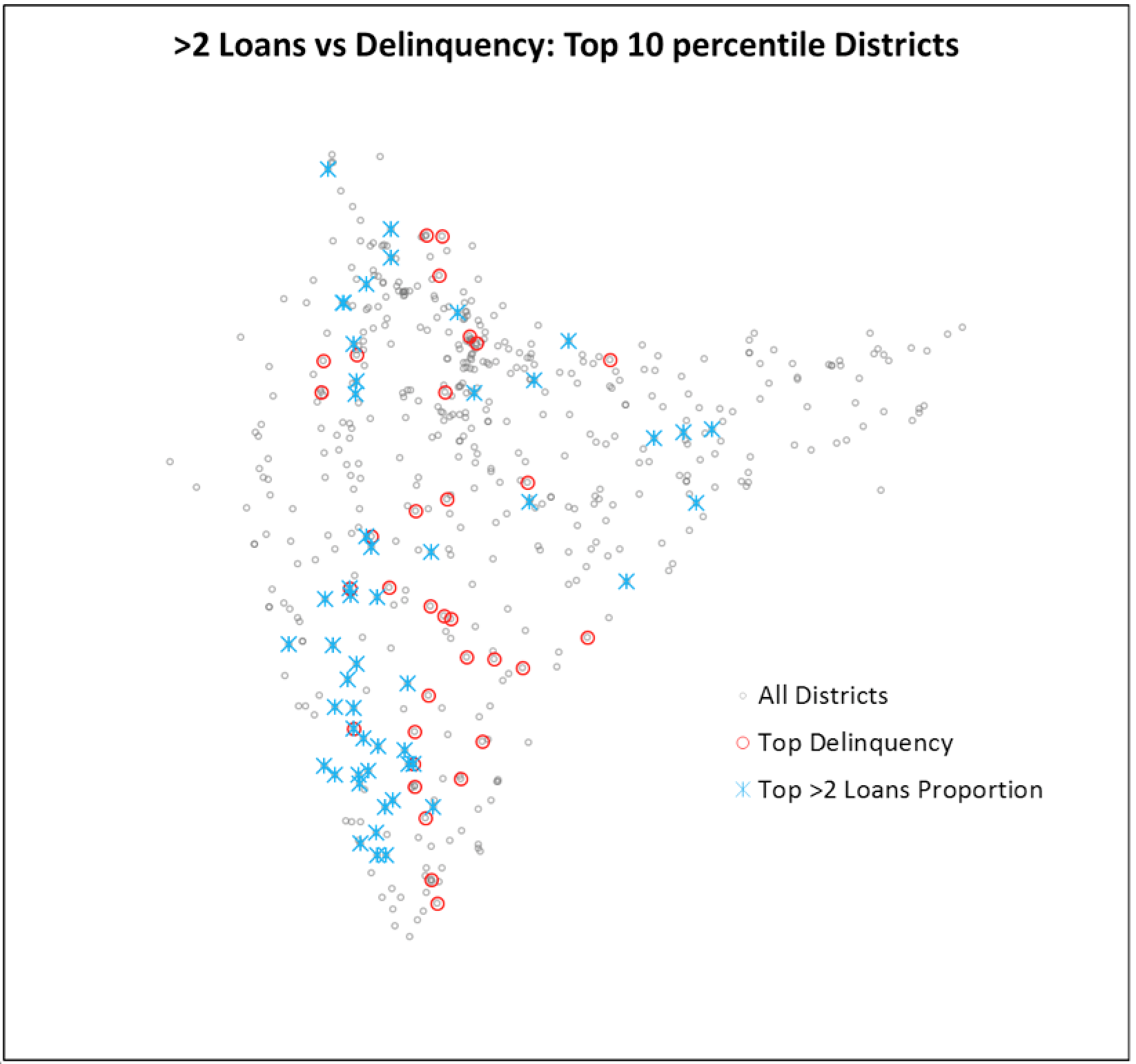

Additionally, we also look at portfolio performance in districts with high proportion of clients with more than 2 MFI loans. We found little overlap between the top ten percentile districts with highest delinquencies and districts with highest proportion of clients with more than 2 MFI loans as of Mar-2015.

Top 10 percentile districts: Delinquency vs Clients with >2 MFI Loans

*Source: Equifax

**Grey dots show districts with MFI presence. The representation is to show microfinance presence and is not an official map of the country or state.

Question 3: Is growth affecting credit quality?

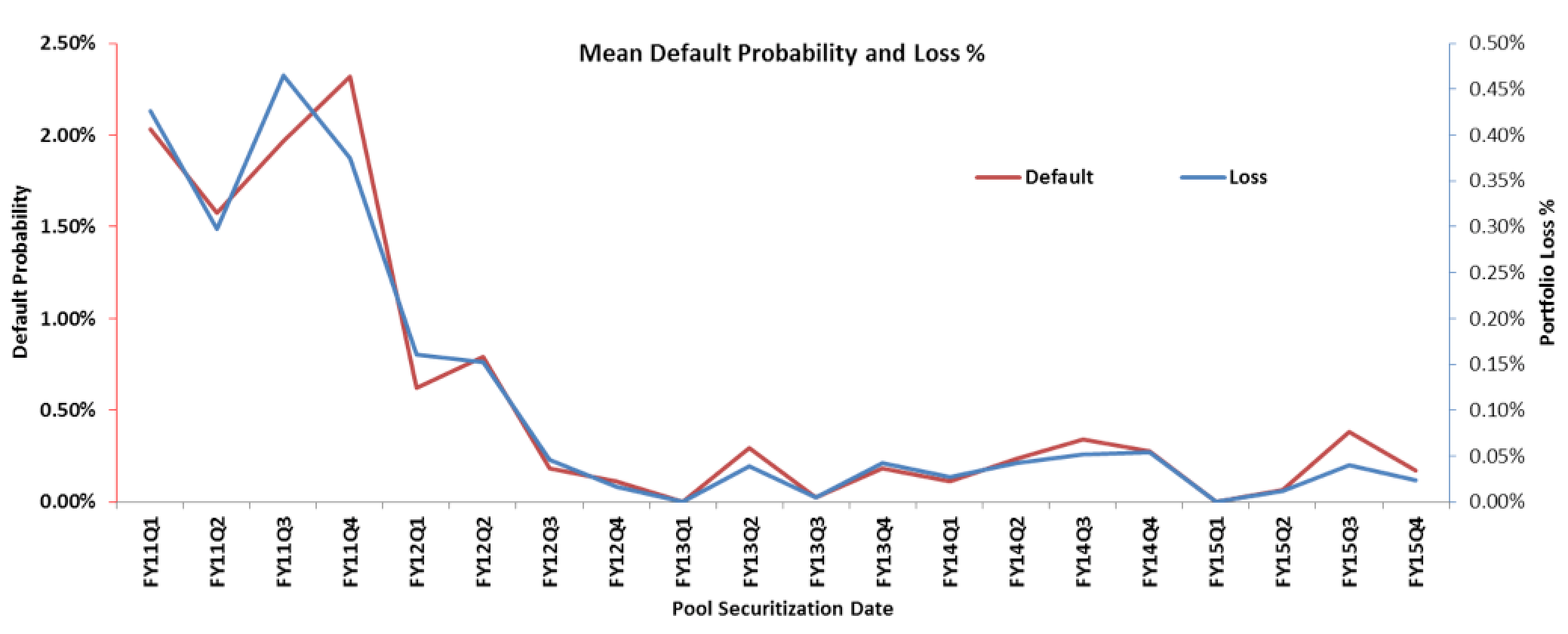

We looked at data to see if higher growth would result in process dilution and subsequently lower quality portfolio. The performance of microfinance portfolio transactions structure by IFMR Capital shows a significant improvement over the last few years.

Loss and Default percent on microfinance portfolio transactions structured by IFMR Capital (based on 286 pools underlying loans worth INR 3.5 thousand crores)

*Source: IFMR Capital

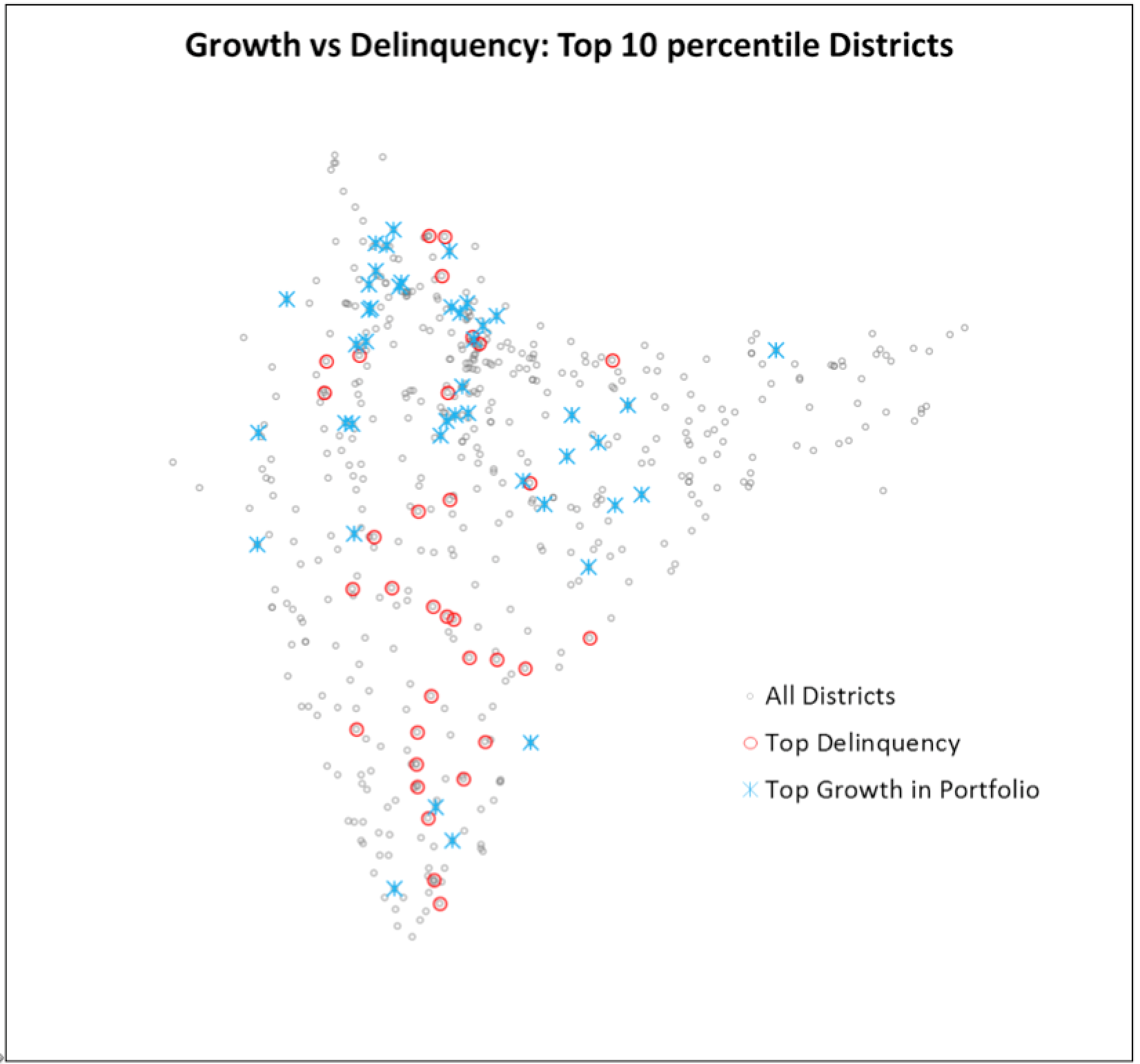

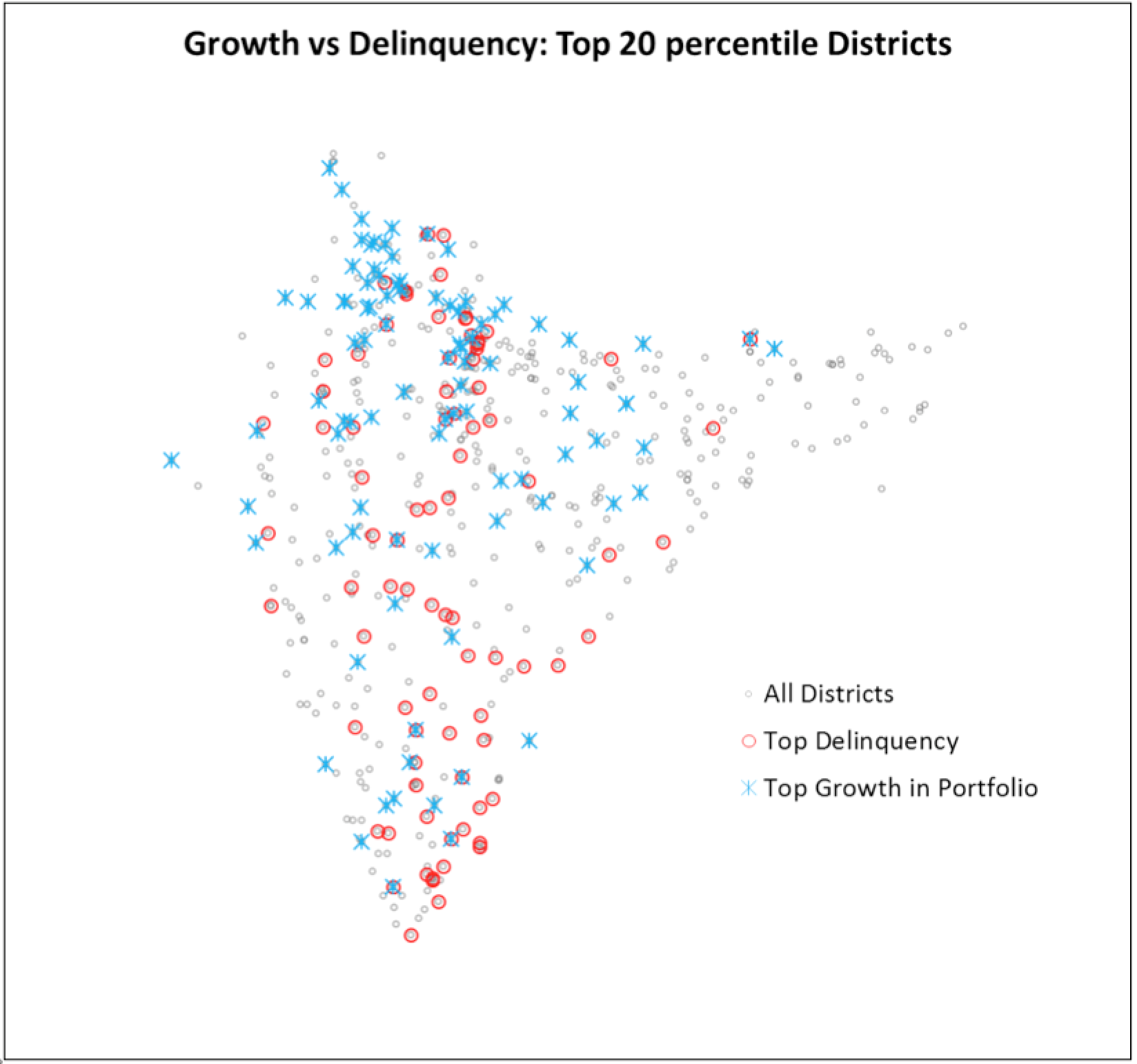

Sector level microfinance performance data also substantiates a stable and healthy growth for the sector. Based on the district level portfolio growth from FY13-14 to FY14-15 and fresh delinquency occurrence (loans overdue by 0 to 180 days) as of FY14-15, we identified the top 10 percentile and top 20 percentile districts in both categories. One would expect that if portfolio growth is unrestrained in a district, it would result in higher delinquency. We found little overlap between the two group of districts, i.e. top growth and top delinquent districts, suggesting that growth is higher but not unrestrained, and is not necessarily resulting in process dilution and subsequent lower quality portfolio.

Comparison of top portfolio growth and top delinquency districts

*Source: Equifax

**Grey dots show districts with MFI presence. The representation is to show microfinance presence and is not an official map of the country or state.

Findings

Our data does not support wide-spread prevalence of pipelining or over-lending. Neither does it support deterioration in portfolio quality due to growth. The effective implementation and usage of credit information bureaus by MFIs is key to controlling these issues. Challenges related to KYC documents of borrowers exist. Using technology, credit bureaus have tried to address this problem by matching borrower and spouse names as well as address strings to identify duplicate borrowers in the system. Further, to mitigate the risk of using multiple KYC documents, MFIN has provided guidelines to all member MFIs to adopt the Aadhaar number as the unique KYC identifier over the next two years. There is also a need to bring other sources of credit in the formal regulated regime. Credit performance data under the self-help group (SHG) program should also be brought onto the credit bureau reporting system to ensure complete visibility on indebtedness and credit performance. In a significant step towards ensuring this, RBI recently issued another circular (link) directing banks to complete reporting of SHG data to credit bureaus in two phases by July 2017.

2 Responses

This is a great analysis of the microfinance sector in the last five years. You also make a very important point about the absence of correlation between portfolio growth and delinquency. With increased awareness of credit bureaus amongst clients, even if they are borrowing for consumption, this is likely to be a loan that they can repay. If the loan is for income generation, then this is even more intuitive since one would expect the income generating activity/livelihood to grow and expand, thereby continually requiring higher capital. Operational process dilution is often a function of misaligned incentives, as you have pointed out, combined with rapid growth in a short period of time. Would you be able to find out from your data on delinquent districts if this was indeed the case? Second, I find your insight that customers get a third loan during the transition period between loans. In terms of policy, is there sense in creating a cooling period between loans when one can check the data but not sanction a loan?

Thanks Jayshree for your comment. You have raised an important question: is there an optimum growth rate for microfinance in a geography? Our data analysis does not provide evidence of correlation between higher annual growth and higher delinquency. However, during regular monitoring visits, we often come across instances where operational process dilution results in delinquency and deteriorating credit quality. Such process dilutions are usually branch specific and may or may not be a direct consequence of higher growth. We also looked at relation of portfolio growth (till month X) and 6-month forward delinquency measured on lagged portfolio (Delinquency in month X+6 as a ratio of portfolio in the month X). We found little correlation between growth and lagged PAR. Regarding the issue of multiple loans during the transition period, we believe, in addition to rigorous compliance with credit bureau check policy before disbursing a new loan, increasing the frequency of performance reporting by MFIs to credit bureau is a highly effective solution.