This article first appeared in socialprotection.org

A key aspect of social protection in South Africa is the system of social grants (unconditional cash transfers), which one-third of all South African adults depend on. In a 2012 deal worth R10 billion, the South African Social Security Agency (SASSA) contracted a private company to design a national payment and registration system to deliver these grants to beneficiaries. The delivery of cash transfers through this public-private partnership (PPP) caused various inconveniences to the grantees. For instance, there was much uncertainty regarding the future of their payments and many complaints arose – of unlawful automatic deductions from grant accounts or overcharging at cash-out points. This impact on the grantee experience prompts an exploration of regulatory oversight in the South African context, which may serve as important learnings for similar PPP efforts in other countries.

SASSA is a government agency formed through the South African Social Security Agency Act of 2004, to standardize payment and administration of the grants system on behalf of the South African Department of Social Development (DSD). In 2012, SASSA contracted a private company to design a national social assistance payment and registration system to deliver cash grants to welfare beneficiaries in a deal worth R10 billion (Cilliers, 2017). Grants form a key aspect of South Africa’s social protection system, with almost 17 million of its population depending on the grant for subsistence (Nkosi, 2017).

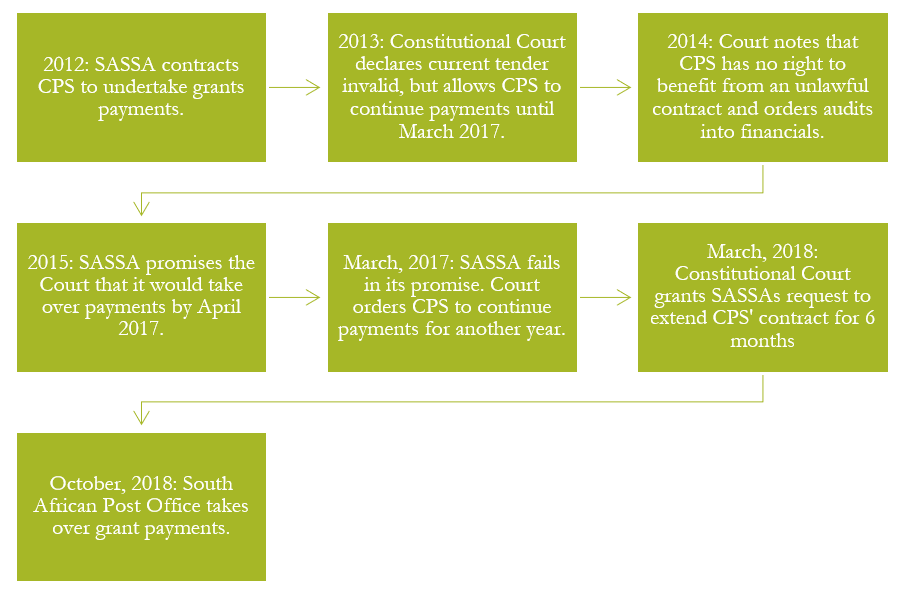

The private company contracted was Cash Paymaster Services (Pty) Ltd, a non-bank payment service which managed the Universal Electronic Payments System (UEPS)[1]; technology of its parent company, Net1 UEPS Technologies Inc. CPS and Net1 also partnered with a private bank, Grindrod, which provided the banking architecture to support grants delivery. Figure 1 details the process flow of the grants transfer system established under this PPP.

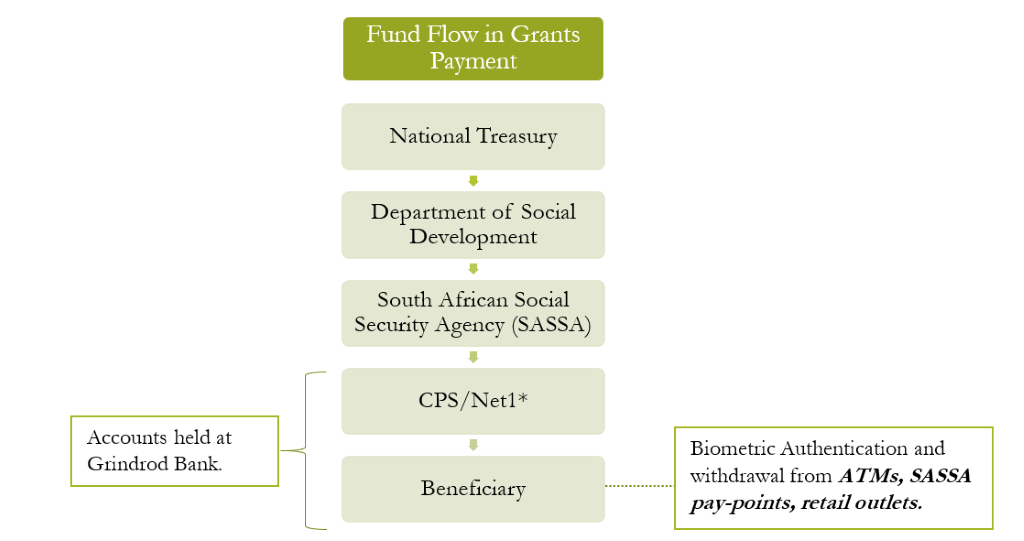

The contract between SASSA and Cash Paymaster Services Ltd (CPS) took effect in 2012, but bidding process improprieties were flagged by a competitor shortly after (AllPay vs SASSA and CPS: The ConCourt judgment, 2013). In 2013, the Constitutional Court decreed the contract constitutionally invalid but ordered it to be continued in order to avoid disruption to beneficiaries (SASSA v Minister of Social Development, 2018). The contract ended in 2018 when the South African Postal Office took over grant payments. Figure 2 details the timeline of this case study.

Figure 1: Cash Flows in the Grants Payment Process

Figure 2: Timeline of the PPP between SASSA and CPS

CPS, a private company, had become an organ of state performing public functions under a public power and was to assume responsibility as such (Public Accounts [SCOPA], 2017). Further, its contract was extended two additional times (in 2017 and 2018) primarily due to SASSA’s failure to identify alternate contractors. This created uncertainty for beneficiaries regarding the future of their grant payments (Nkosi, 2017). It is against this backdrop that we explore the various factors that resulted in certain improprieties in grant delivery under the SASSA-CPS set-up.

Regulatory Governance

One of the key institutional factors that resulted in sub-optimal outcomes was the lack of proper regulatory oversight by SASSA, which allowed CPS to unfairly profit off grant recipients. Beneficiaries were affected in two ways: non-consensual deductions from grants and predatory lending.

One-fifth of all beneficiary accounts witnessed deductions (Vally, 2016) towards mobile and electricity connections, funeral policies or water sold by other Net1 subsidiaries (Blacksash, 2019). Beneficiaries were unaware of most such deductions (Torkelson, 2019). In 2016, 105,756 unlawful deduction disputes were lodged with SASSA, an underestimate due to supposed repression of complaints (Business Day, 2017). A grantee could visit a local SASSA branch and fill dispute forms, by way of recourse.

Complaints were processed very slowly, and very few were actually reimbursed for the amount lost. This made dispute resolution costly and inaccessible (Blacksash, 2020). Some recipients believed the deductions were tactical, to generate more borrowings from a micro-lending service provided by Net1 (Ibid). These deductions were direct impediments to beneficiaries’ daily lives – making it challenging to consume basic necessities and run their households smoothly (Blacksash, 2019).

Next, loans were given out with the social grants as collateral, and reimbursement automatically deducted from future grants with exorbitant interest disguised as ‘service-fees’ (Vally, 2016). This allowed Net1 to maintain a zero-risk position as grantees could not default on their debts. Repayments depended not on consumer behaviour, but on the pay-out of grants. With limited risk, the company could indiscriminately issue burdensome loans, forcing grantees to turn to informal lenders to meet consumption needs (Torkelson, 2019).

Some years into the contract, Net1 began migrating grantees to an ‘EasyPay’ account, out of the SASSA banking environment and into a private arrangement. As a result, the private company still has the biometric information of 1.5-2 million grantees despite the payments process having been handed over to the Postal Bank in 2018. EasyPay was allegedly misrepresented to beneficiaries as ‘the new SASSA card’, or as mandatory to receive payments (Mbovane, 2018).

The move was suspicious, given SASSA had just introduced rules restricting the type and amount of automatic deductions from grants (Foley and Swilling, 2018). Beneficiaries were now in a new virtual domain, beyond the reach of SASSA (Torkelson, 2019), which made the earlier SASSA mechanism for recourse inaccessible.

The issues around the legality of Net1’s business practices have not yet been established, though some complaints have been lodged which are ongoing matters in court (Foley and Swilling, 2018).

Last-Mile Delivery Issues

A significant operational lapse in this PPP was also the activation of local retailers as payment points in 2012 (Moorad, 2015), adding another layer of insecurity for beneficiaries. Local retailers acted as disbursement points of grants payments, a move by Net1 without any formal communication to SASSA.

Beneficiaries complained that retailers encouraged them to spend 10% of their grant at the store (Mail & Guardian, 2012a), requiring them to spend some amount of their grant at withdrawal (Mail & Guardian, 2012b). Heavy queuing at ‘grant-only’ lines versus faster checkout during the purchase of items acted as a subtle coercion strategy causing most beneficiaries to spend their grants (Vally, 2016). Such a setup causes inconvenience to beneficiaries who may have earmarked grants for specific expenses.

A variety of regulatory and operational levers could have been utilized to prevent a majority of these issues. To begin with, the initial contract should have precluded opportunities for profiteering by the private party contracted. Clearly, mismanagement of third-party incentives can cause inconveniences to recipients of social welfare.

Failing this, SASSA having a legal responsibility to administer social assistance (Social Assistance Act, 2004), should have closely monitored the behaviour of the private agency[2]. A swift response to complaints as they arose would have made the grants experience dependable and trustworthy. Judicial intervention by the courts should have been the final option, but the inadequacy of checks and balances, in this case, compelled stakeholders to resort to judicial remedies.

The state of PPP in welfare delivery in India is not as centralized as in South Africa, nor does the disbursement infrastructure rely extensively on private players. Those aspects of Indian welfare delivery that depend on private players (private Fair Price Shop owners, Common Services Centres, Business Correspondents) do not provide overarching responsibilities to a single party. Resultingly, the potential for disruptions to the system is not so large-scale. Still, there are some learnings for the Indian context, which we plan to explore in a future post.

References

AllPay vs SASSA and CPS: The ConCourt judgment [2013] ZACC 42 (Case CCT 48/13). Retrieved from https://www.politicsweb.co.za/opinion/allpay-vs-sassa-and-cps-the-concou…

Blacksash. (2019). BLACK SASH SUBMISSION UN GENERAL ASSEMBLY ON DIGITAL TECHNOLOGY, SOCIAL PROTECTION AND HUMAN RIGHTS. Blacksash. Retrieved from https://www.ohchr.org/Documents/Issues/Poverty/DigitalTechnology/BlackSa…

Blacksash. (2020). Black Sash’s Hands Off Our Grants [HOOG] Campaign – a case study in defending, promoting, advancing S27(1)(c) – Right of access to social security (Social Assistance). Blacksash. Retrieved from https://www.wider.unu.edu/sites/default/files/Events/PDF/Slides/Paulus_S…

Business Day. (2017). Extent of grant deduction problem understated, says Black Sash. Retrieved from https://www.businesslive.co.za/bd/national/2017-04-26-extent-of-grant-de…

Cilliers, J. (2017). Fate of the Nation. Johannesburg: Jonathan Ball Publishers.

Foley, R., & Swilling, M. (2018). HOW ONE WORD CAN CHANGE THE GAME: Case Study of State Capture and the South African Social Security Agency. Retrieved from https://www.markswilling.co.za/wp-content/uploads/2018/12/SASSA-State-Ca…

Mail & Guardian. (2012a). Grants: Short-changed in long queues. Retrieved from https://mg.co.za/videos/2012-02-02-grants-shortchanged-in-long-queues/

Mail & Guardian. (2012b). Stores score on pension payday. Retrieved from https://mg.co.za/article/2012-02-03-stores-score-on-pension-payday/

Mbovane, T. (2018). Unsuspecting SASSA beneficiary duped into getting green EasyPay card. Retrieved 22 July 2020, from https://www.groundup.org.za/article/sassa-beneficiary-duped-getting-gree…

Moorad, Z. (2015). Top SA Retailers, banks struggle it out. Daily Dispatch. Retrieved from https://www.pressreader.com/south-africa/daily-dispatch/20151117/2817154…

Nkosi, M. (2017). Sassa crisis: South Africa’s social security payments in chaos. BBC. Retrieved from https://www.bbc.com/news/world-africa-39231776

Public Accounts (SCOPA). (2017). Minister of Finance on SASSA and Cash Paymaster Services contract | PMG. Retrieved 22 July 2020, from https://pmg.org.za/committee-meeting/24143/

SASSA V MINISTER OF SOCIAL DEVELOPMENT, 48/17 ZACC 26 (CCT 2018). Retrieved from https://www.concourt.org.za/index.php/judgement/256-sassa-v-minister-of-….

Torkelson, E. (2019). Collateral damages: Cash transfer and debt transfer in South Africa. World Development, 126, 104711. doi: 10.1016/j.worlddev.2019.104711

Vally, N. (2016). Insecurity in South African Social Security: An Examination of Social Grant Deductions, Cancellations, and Waiting. Journal Of Southern African Studies, 42(5), 965-982. doi: 10.1080/03057070.2016.1223748

_

[1]The UEPS technology includes smartcards protected by biometric identification, POS devices and other back-end infrastructure needed to pay out grants.

[2] Section 4 of the Social Assistance Act, 2004 states one of the responsibilities of SASSA is ‘to establish a compliance and fraud mechanism to ensure that the integrity of the social security system is maintained.’