Effective grievance redress is central to consumer protection. The previous post in this series, discovered that redress in the Indian financial sector could be inaccessible and onerous, rendering it ineffective for consumers. This post explores the promise of the Online Dispute Resolution (ODR) systems in improving the quality of redress available to consumers. The post concludes with prominent limitations of ODR and preconditions that must exist for ODR to deliver on its promise.

This post is written to continue our engagement with the handbook on “Online Dispute Resolution: Shifting from disputes to resolution”. Read our ODR use case for consumer credit disputes under the section on “Revamping the credit market” on pages 57-59 of the handbook.

The Reserve Bank of India (RBI) has expressed its intentions to create an integrated redress forum called the Integrated Ombudsman for banking and payment-related grievances (Reserve Bank of India, 2021). The Integrated Ombudsman would combine the Banking Ombudsman, the NBFC Ombudsman and the Ombudsman for Digital Transactions. By doing so, the RBI aims to (i) expand the redress system to cover a wider number of entities and grounds of complaint (ii) establish a centralised complaint receipt and processing centre (iii) reduce the time taken for resolving complaints and (iv) delegate power to provide redress on specific types of complaints. The Ombudsman could potentially improve the availability and quality of redress substantially for consumers. ODR can play a key role in operationalising the Ombudsman and facilitating redress.

This post explores how ODR can help make redress in the financial sector more effective and consumer-friendly.[1] The post first highlights the need for ODR in the financial sector through a consumer journey for seeking redress. Then, the post provides an overview of ODR, and the key opportunities for ODR in this space. Finally, it concludes by highlighting some prominent limitations for ODR in India.

1. The need for ODR in the financial sector

The existing grievance redress mechanism in the financial sector is fragmented and complicated for the consumer. Grievances in the financial sector are addressed separately by each financial sector regulator. Within each sector, grievances need to be escalated through different institutions, including the financial service provider, sectoral ombudsmen, consumer redress forums and civil courts (Chivukula, 2020). Consumers can find navigating through these forums and steps very difficult (Chivukula, 2020). This section sets out the challenges faced by consumers in seeking redress in the case of a typical consumer loan transaction.

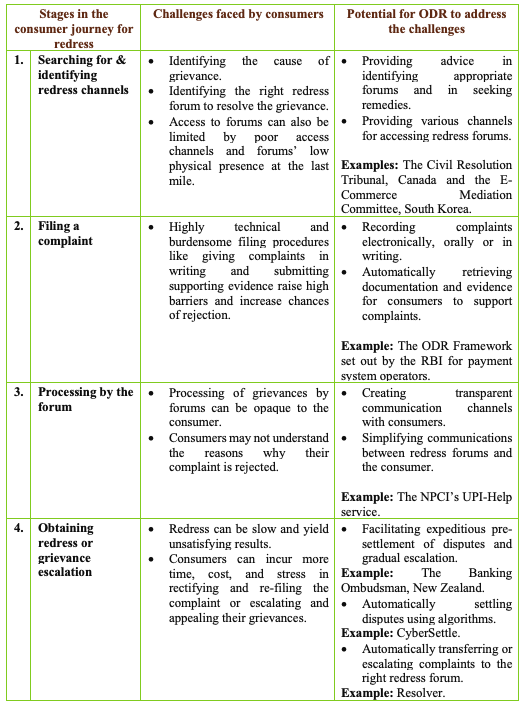

The consumer journey for seeking redress can be divided into four stages (i) searching for and identifying redress channels (ii) filing a complaint (iii) processing of a complaint by the forum and (iv) obtaining redress or grievance escalation. Unfortunately, Consumers face a variety of difficulties at each stage, as discussed in the previous post in this series and summarised in the table below (Table 1).

Table 1: Challenges for consumers in seeking redress in financial disputes

The number of challenges consumers face at each step of the process can leave them distressed and exhausted, and ultimately discourage them from seeking redress. The impact of such a system is more pronounced on low-income consumers who may not have the time or money to afford redress. Effective redress is vital for safeguarding consumer interests, and especially low-income consumer’s interests.

ODR systems offer a variety of mechanisms to simplify grievance redress. Leveraging these systems to provide redress in the financial sector could potentially mitigate many challenges that consumers face. We discuss some of these in the following sections.

2. Overview of ODR

ODR has been described as a mechanism that provides redress with the help of information and communication technology (ICT) (UNCITRAL, 2017). In its initial days, ODR was used to conduct conciliation, mediation, negotiation and arbitration proceedings (collectively known as “Alternative Dispute Resolution” (ADR)) digitally. ADR proceedings help parties resolve disputes amicably and expeditiously outside the traditional court system. Disputing parties appoint independent intermediators (neutrals) who help the parties arrive at a settlement through the proceedings. Neutrals help parties arrive at mutually agreeable settlements in conciliation, mediation and negotiation proceedings, and perform an adjudicatory role in arbitration proceedings when parties cannot arrive at a settlement (Sharma, 2021).

Parties using ODR systems could resolve disputes amicably and remotely through e-mail or teleconferencing (UNCITRAL, 2017).

Today, ODR mechanisms are used as end-to-end redress solutions that support parties throughout the lifecycle of a dispute (presented in Table 1) with complaint filing, procedure and documentation, dispute pre-settlement and settlement, case management and escalation. ODR is also used for consumer grievance analytics to inform future redress solutions and consumer protection policy (Militao, da Silveira, Leon, & Oliveira, 2020). Instances of higher automation are also surfacing with the application of artificial intelligence (AI) technologies for different purposes, including retrieving evidence and arriving at settlements while resolving disputes (Abdel Wahab, 2004; Brannigan, 2007; Martinez, 2020; Narain & Parsheera, 2021; NITI Aayog Expert Committee on ODR, 2020; Rabinovich-Einy & Katsch, 2019; Barnett & Treleaven, 2017).

ODR systems can provide consumers with end-to-end support, from the point of filing a complaint to the complete resolution of their grievance. ODR systems have shown to bring benefits for consumers and providers by –

-

providing a variety of channels for accessing redress systems;

-

creating independent and alternative redress forums outside the traditional redress system;

-

reducing the time taken to resolve grievances;

-

increasing transparency in the redress process, and

-

creating feedback loops with consumers that can provide grass-root level insights to inform policy (Becker & Maia, 2018; Militao, da Silveira, Leon, & Oliveira, 2020; Narain & Parsheera, 2021; NITI Aayog Expert Committee on ODR, 2020; Schmidt-Kessen, Nogueria, & Cantero, 2019; UNCITRAL, 2017).

Similar benefits could arise for consumers and providers in the financial sector if ODR systems complement the existing redress system.

3. Opportunities for ODR in the financial sector

ODR systems can fulfil four broad objectives, along with a variety of other functions, to help simplify redress for consumers. Table 2, below, presents these objectives and functions, together with global ODR tools and practices that can fulfil those objectives.

In the first stage of the consumer journey for redress (Searching for and identifying redress channels), ODR can provide consulting and hand-holding services for consumers to navigate through the redress system. For instance, the Chinese Online Dispute Diversification Resolution Platform and the Canadian Civil Resolution Tribunal seem to provide complainants with the required legal advice to proceed with their complaint (Civil Resolution Tribunal, n.d.; NITI Aayog Expert Committee on ODR, 2020; Becker & Maia, 2018). Similarly, the E-Commerce Mediation Committee in South Korea provides automated consulting and advisory services to consumers to navigate electronic transaction disputes (E-Commerce Mediation Committee, n.d.). ODR can also provide various channels through which consumers can file complaints even at the last-mile.

In the second stage (Filing a complaint), ODR can help consumers simplify filing complaints by retrieving evidence and the necessary documentation to support their complaints. The RBI has implemented this by asking payment system operators to develop ODR systems that can automatically retrieve necessary information about a complaint without burdening consumers (Reserve Bank of India, 2020).

In the third stage (Processing by the forum), ODR can help in simplifying communication and increasing transparency in the redress process. For instance, the UPI-Help service launched by the NPCI proactively provides updates to consumers about their complaints (NPCI, 2021).

In the fourth stage (Obtaining redress and grievance escalation), ODR can help in gradually escalating grievances, beginning with pre-settlement and ending with adjudication, to expeditiously resolve complaints. For instance, the New Zealand Banking Ombudsman seems to use telephonic pre-settlement to try and mutually resolve complaints before escalating the complaint to the mediation stage (Gill, Williams, Brennan, & Hirst, 2014). Further, automating settlements (like Cybersettle) can also help in resolving grievances without requiring consumers to make formal legal representations (CyberSettle, n.d.; Levin, n.d.; Van Den Heuvel, 2000). ODR can help in streamlining the redress process by interlinking redress forums and providing consumers with an integrated front-end. For instance, Resolver, an independent dispute resolution service, collects complaints from consumers to file them with the appropriate authority. It also escalates the complaint to appellate forums when required (Resolver Consumer Online Limited, 2021).

Together, these interventions could help consumers navigate the redress system more comfortably and mitigate the significant challenges they currently face. However, instituting ODR systems by itself does not simplify redress.

Table 2: Opportunities for ODR in the financial sector

4. Limitations of ODR in India

The RBI’s Integrated Ombudsman for banking and payment-related grievances could substantially improve the effectiveness of redress for consumers with the help of ODR. However, the effectiveness of a completely digital-ODR setup can be limiting for the Indian landscape. The most prominent limitation is the sharp disparities in consumers’ access to digital services and their ability to use the digital services.

There is a vast gap in consumers’ access to internet services in urban and rural regions. There are close to 103.98 internet subscribers for every hundred consumers in urban areas. In stark contrast, there are only 34.6 internet subscribers for every hundred consumers in rural areas (Telecom Regulatory Authority of India, 2021). Further, there seem to be a higher number of feature phone users compared to smartphone users in India (Reserve Bank of India, 2019).

Even when consumers have access to digital services, they may not be savvy enough to navigate them. For instance, women may be comfortable using feature phones, but might find it challenging to use smartphones or perform sophisticated tasks on mobile phones. These disparities can vary with different factors like age, literacy, education levels etc. (Narain & Parsheera, 2021; NITI Aayog Expert Committee on ODR, 2020; Sonne, 2020; Sonne, 2021).

The above findings suggest that ODR systems may be inaccessible to key beneficiaries, including low-income and remote, rural consumers. ODR systems and their interfaces will have to be carefully designed and developed to be accessible and usable by all consumer segments (Kinhal & Jain, 2020; NITI Aayog Expert Committee on ODR, 2020). Assisted redress mechanisms can help consumers to overcome these challenges. Courts, paralegal services (such as Lok Adalats) and other community-level endeavours can play a big role in improving consumers’ access and use of ODR at the last-mile (NITI Aayog Expert Committee on ODR, 2020).

[1] The post provides examples of private sector and public sector ODR applications that have been sourced from existing literature. The examples are meant to be illustrative and must not be seen as endorsements by the authors or by Dvara Research.

References

Abdel Wahab, M. S. (2004). The Global Information Society and Online Dispute Resolution: A New Dawn for Dispute Resolution. Journal of International Arbitration, 143 – 168. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=602021

Asian Development Bank. (2010). Designing and Implementing Grievance Redress Mechanisms: A Guide for Implementors of Transport Projects in Sri Lanka. Retrieved from Asian Development Bank: https://www.adb.org/sites/default/files/institutional-document/32956/files/grievance-redress-mechanisms.pdf

Barnett, J., & Treleaven, P. (2017, October). Algorithmic Dispute Resolution – The Automation of Professional Dispute Resolution using AI and Blockchain Technologies. Retrieved from The British Computer Society: https://bit.ly/2TtUFqI

Becker, D., & Maia, A. (2018, September). ODR as an Effective Method to Ensure Access to Justice: The Worrying, But Promising Brazillian Case. Retrieved from Mediate: https://www.mediate.com/articles/becker-odr-effective.cfm

Brannigan, C. (2007, December 12). Online Dispute Resolution. Retrieved from mediate.ca: https://mediate.ca/wp-content/uploads/2020/04/Mediate-Chapter-on-Online-Dispute-Resolution.pdf

Chivukula, C. (2020, February 18). Consumer Grievance Redress in Financial Disputes in India. Retrieved from Dvara Research: https://dvararesearch.com/consumer-grievance-redress-in-financial-disputes-in-india/

Civil Resolution Tribunal. (n.d.). Explore and Apply. Retrieved from Civil Resolution Tribunal.

CyberSettle. (n.d.). Solution: Online Dispute Resolution (ODR). Retrieved from CyberSettle: http://www.cybersettle.com/

E-Commerce Mediation Committee. (n.d.). What is Automatic Consulting? Retrieved from E-Commerce Mediation Committee: https://www.ecmc.or.kr/ecmceng/subIndex/238.do

Gill, C., Williams, J., Brennan, C., & Hirst, C. (2014, October 31). Models of Alternative Dispute Resolution: A report for the Legal Ombudsman. Retrieved from Virtual Mediation Lab: https://www.virtualmediationlab.com/wp-content/uploads/2014/12/ombudsman.pdf

Government of the United Kingdom. (n.d.). Make a court claim for money. Retrieved from Government of the United Kingdom: https://www.gov.uk/make-court-claim-for-money

Harland, D. (1987). The United Nations guidelines for consumer protection. Journal of Consumer Policy, 10, 245-266.

International Commission of Jurists. (2019, November). Effective Operational-level Grievance Mechanisms. Retrieved from International Commission of Jurists: https://www.icj.org/wp-content/uploads/2019/11/Universal-Grievance-Mechanisms-Publications-Reports-Thematic-reports-2019-ENG.pdf

Katsh, E., & Rabinovich-Einy, O. (2017). Digital Justice: Technology and the Internet of Disputes. Oxford University Press.

Kinhal, D., & Jain, T. (2020, July). ODR: The Future of Dispute Resolution in India. Retrieved from Vidhi Centre for Legal Policy: https://vidhilegalpolicy.in/wp-content/uploads/2020/07/200727_The-future-of-dispute-resolution-in-India_Final-Version.pdf

KISA. (n.d.). What is Automatic Consulting? Retrieved from E-Commerce Mediation Committee: https://www.ecmc.or.kr/ecmceng/subIndex/238.do

Levin, D. J. (n.d.). Cybersettle makes the case for resolving disputes online. Retrieved from Mediate: https://www.mediate.com/articles/LevinDbl20080227B.cfm

Martinez, J. K. (2020). Designing Online Dispute Resolution. Journal of Dispute Resolution, 2020(1). Retrieved from https://scholarship.law.missouri.edu/cgi/viewcontent.cgi?article=1853&context=jdr

Militao, L. O., da Silveira, P. B., Leon, A. J., & Oliveira, L. P. (2020, July 3). Consumer Claims, on-line Dispute Resolution and Innovation in the Public Administration: A Case Study of the Consumidor.gov Platform in Brazil during 2014-2019. Retrieved from Teoria e Practica em Administracao: https://bit.ly/2VcCCG1

Narain, R., & Parsheera, S. (2021, April 14). Online dispute resolution in India: Looking beyond the window of opportunity. Retrieved from The Leap Blog: https://blog.theleapjournal.org/2021/04/online-dispute-resolution-in-india.html

NITI Aayog Expert Committee on ODR. (2020, October). Designing the Future of Dispute Resolution: The ODR Policy Plan for India. Retrieved from NITI Aayog: https://niti.gov.in/sites/default/files/2020-10/Draft-ODR-Report-NITI-Aayog-Committee.pdf

NPCI. (2021, March 15). UPI-Help for Digital Payments goes live on BHIM UPI. Retrieved from NPCI: https://www.npci.org.in/PDF/npci/press-releases/2021/NPCI-Press-Release-Online-Dispute-Resolution-for-Digital-Payments-goes.pdf

OECD. (2011, October). G20 High-Level Principles on Financial Consumer Protection. Retrieved from OECD: https://www.oecd.org/regreform/sectors/48892010.pdf

Portable. (n.d.). Online Dispute Resolution. Retrieved from Portable: https://www.portable.com.au/services/online-dispute-resolution

Rabinovich-Einy, O., & Katsch, E. (2019). Blockchain and the Inevitability of Disputes: The Role for Online Dispute Resolution. Journal of Dispute Resolution.

Reserve Bank of India. (2019, May 15). Payment and Settlement Systems in India: Vision – 2019-2021. Retrieved from Reserve Bank of India: https://m.rbi.org.in/SCRIPTs/PublicationVisionDocuments.aspx?Id=921

Reserve Bank of India. (2020, August 6). Online Dispute Resolution (ODR) System for Digital Payments. Retrieved from Reserve Bank of India: https://m.rbi.org.in/Scripts/BS_CircularIndexDisplay.aspx?Id=11946

Reserve Bank of India. (2021, February 8). Annual Report of Ombudsman Schemes, 2019-20. Retrieved from Reserve Bank of India: https://www.rbi.org.in/Scripts/PublicationsView.aspx?id=20327

Resolver Consumer Online Limited. (2021). About. Retrieved from Resolver Consumer Online Limited: https://www.resolver.co.uk/about

SAMA. (n.d.). Rules & Procedures. Retrieved from SAMA: https://www.sama.live/rules_and_procedures.php

Sane, R., Sharma, S., & Suresh, K. (2021, February 26). Grievance Redress in the Financial Sector in India: Lessons from the field. Retrieved from The Leap Blog: https://blog.theleapjournal.org/2021/02/grievance-redress-in-financial-sector.html

Schmidt-Kessen, M. J., Nogueria, R., & Cantero, M. (2019, April 18). Success or Failure? – Effectiveness of Consumer ODR Platforms in Brazil and in the EU. Retrieved from SSRN: https://bit.ly/3xjTSHs

Schmitz, A. J. (2019, January 1). Expanding Access to Remedies through E-Court Initiatives. Buffalo Law Review, 67(1). Retrieved from https://digitalcommons.law.buffalo.edu/cgi/viewcontent.cgi?article=4724&context=buffalolawreview

Sharma, L. (2021, February 7). Evolution of ADR Mechanisms in India. Retrieved from SCC Online: https://www.scconline.com/blog/post/2021/02/07/evolution-of-adr-mechanisms-in-india/

Sonne, L. (2020, June). What do we know about women’s mobile phone acess and use? A review of evidence. Retrieved from Dvara Research: https://dvararesearch.com/wp-content/uploads/2020/06/What-Do-We-Know-About-Womens-Mobile-Phone-Access-Use-A-review-of-evidence.pdf

Sonne, L. (2021, June). Women’s Mobile Phone Access and Use: A Snapshot of Six States in India. Retrieved from Dvara Research: https://dvararesearch.com/wp-content/uploads/2021/06/Womens-Mobile-Phone-Access-and-Use-A-Snapshot-of-Six-States-in-India.pdf

Telecom Regulatory Authority of India. (2021, April 27). The Indian Telecom Services Performance Indicators October – December 2020. Retrieved from Telecom Regulatory Authority of India: https://www.trai.gov.in/sites/default/files/QPIR_27042021_0.pdf

The Consumer Protection Act, 1986. (n.d.). Retrieved from National Consumer Dispute Redressal Commission: http://www.ncdrc.nic.in/bare_acts/consumer%20protection%20act-1986.html

UNCITRAL. (2017, May). UNCITRAL Technical Notes on Online Dispute Resolution. Retrieved from https://www.uncitral.org/pdf/english/texts/odr/V1700382_English_Technical_Notes_on_ODR.pdf

UNCTAD. (2016). United Nations Guidelines for Consumer Protection. Retrieved from UNCTAD: https://unctad.org/system/files/official-document/ditccplpmisc2016d1_en.pdf

United Nations General Assembly. (1985, April 16). Consumer protection: resolution/ adopted by the General Assembly. Retrieved from Refworld: https://www.refworld.org/docid/3b00f2271f.html

United Nations OHCHR. (2011). Guiding Principles on Business and Human Rights: Implementing the United Nations “Protect, Respect and Remedy” Framework. Retrieved from United Nations OHCHR: https://www.ohchr.org/documents/publications/guidingprinciplesbusinesshr_en.pdf

Van Den Heuvel, E. (2000). Online Dispute Resolution as a Solution to Cross-Border E-Disputes: An Introduction to ODR. Retrieved from OECD: https://www.oecd.org/digital/consumer/1878940.pdf

Wheeler, M. A., & Morris, G. (2001, December). Cybersettle. Retrieved from Harvard Business School: https://www.hbs.edu/faculty/Pages/item.aspx?num=28651

Working Group on Consumer Protection. (2012). Report of the Working Group on Consumer Protection – Volume II. Retrieved from NITI Aayog: https://niti.gov.in/planningcommission.gov.in/docs/aboutus/committee/wrkgrp12/pp/wg_cp2.pdf

Cite this item

APA

Chivukula, C., Prasad, S., & Chugh, B. (2021). Providing grievance redress for financial disputes through Online Dispute Resolution. Retrieved from Dvara Research Blog.

Chicago

Chivukula, Chinmayanad, Srikara Prasad, and Beni Chugh. 2021. “Providing grievance redress for financial disputes through Online Dispute Resolution.” Dvara Research Blog.

MLA

Chivukula, Chinmayanad, Srikara Prasad and Beni Chugh. “Providing grievance redress for financial disputes through Online Dispute Resolution.” 2021. Dvara Research Blog.