By Chinmayanand Chivukula, Intern, Dvara Research

Effective consumer grievance redress is central to consumer protection. Unfortunately, redress in the Indian financial sector is a complex and burdensome process that makes access to effective redress difficult. Although regulators have implemented many schemes to make redress accessible and consumer-friendly, there is room for improvement. In this series, we present Online Dispute Resolution (ODR) as one way to improve grievance redress in the financial sector. This post provides an overview of the financial consumer grievance redress system in India and highlights the issues that make it less effective and less consumer-friendly. It concludes by introducing ODR as a way to improve grievance redress in this sector.

1. Introduction

A consumer’s ability to raise grievances and have them redressed effectively is central to consumer protection (Chapman & Mazer, 2013). In addition to safeguarding consumer interests, effective grievance redress can help build trust between consumers and providers (Sahoo & Sane, 2011). In this way, grievance redress can make or break consumers’ relationships with providers.

It is important for consumer redress to be effective, i.e. accessible, affordable, fair and expeditious (Organisation for Economic Co-operation and Development, 2011). Unfortunately, redress in the Indian financial sector currently is complicated, inaccessible and burdensome for consumers. While bad grievance redress hurts all consumers, it hurts low-income consumers to a greater extent (Cartwright, 2015).

This post is organised into four sections. Section 2 gives an overview of consumer grievance redress in the financial sector. Section 3 discusses the challenges and gaps which make it ineffective. Section 4 concludes by introducing Online Dispute Resolution (ODR) as one way to improve consumer grievance redress in finance.

2. Overview of consumer grievance redressal in the financial sector

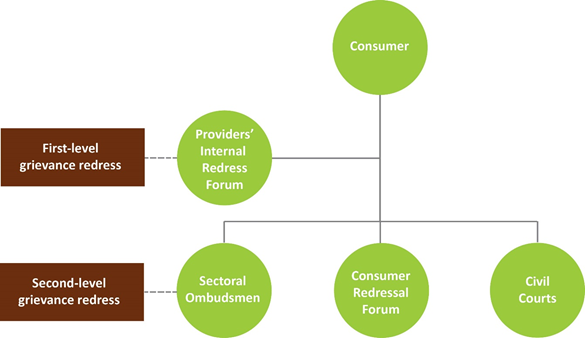

Currently, consumer grievance redress in the financial sector is siloed and addressed separately by each of the financial sector regulators, i.e. the Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority of India (IRDAI) and the Pension Fund Regulatory and Development Authority (PFRDA). Within each of these siloes, redress is further fragmented across many different institutions. The various consumer grievance redress forums available to a consumer are shown in Figure 1.

Figure 1: Consumer grievance redress in the financial sector

Broadly, redress begins with a consumer approaching the internal forum of a financial service provider (FSP) (for example, a bank) against which they have a grievance. Consumers who are dissatisfied with the provider’s response can approach the sectoral Ombudsmen looking for better redress. Ombudsmen perform a conciliatory role. All financial sector regulators, except SEBI, have set up their own Ombudsmen.

Some regulators have created more than one Ombudsman to address grievances with different financial products and services within their sectors. For instance, the RBI has three Ombudsmen: The Banking Ombudsman (BO) to provide redress against banks (Reserve Bank of India, 2006), the NBFC Ombudsman to provide redress against NBFCs (Reserve Bank of India, 2018) and the Digital Ombudsman to provide redress against digital payment service providers (Reserve Bank of India, 2019).[1] The RBI also oversees Self-Regulatory Organisations like the Micro-Finance Institution Network (MFIN) which provides consumer redress in microfinance.

With respect to the SEBI, consumers with investment-related grievances can directly approach the SEBI by making an offline complaint or through the web-based SEBI Complaints Redress System (SCORES). The SCORES redirects the complaint to the concerned FSP if the consumer has not already approached the FSP. In cases where consumers receive an unsatisfactory response or no response from the FSP, the SCORES routes the complaint to SEBI, which performs a conciliatory role.[2] SEBI does not adjudicate upon any complaint (Securities and Exchange Board of India, n.d.; SEBI Complaints Redress System , n.d.).

Finally, consumers can approach the Consumer Dispute Redressal Forums and the Civil Courts seeking redress (Vishwanathan, 2017). Consumer Dispute Redressal Forums were established to make redress more expeditious and accessible compared to the Civil Courts (National Consumer Dispute Redressal Commission, n.d.).

The Ombudsmen are meant to offer expeditious and affordable redress to consumers (Reserve Bank of India, 2006; ECOI, 2020). The Ombudsmen resolve disputes using Alternative Dispute Resolution (ADR) mechanisms, which refer to any means of settling disputes outside of the courtroom (Legal Information Institute, 2017). ADR mechanisms include mediation, negotiation, conciliation, or arbitration that seek to offer consumers more amicable and expeditious redress aimed at arriving at a mutual agreement (Reserve Bank of India, 2017). However, the effectiveness of these measures in improving redress seems to be limited because of two major challenges, which we turn to next.

3. Issues with consumer redress in the financial sector

The two main challenges are (i) modularisation and digitisation in finance and (ii) shortcomings in the design and process of redress forums.

3.1. Challenges arising due to modularisation and digitisation

Financial services in India have been defined by modularisation and digitisation in recent years. Modularisation refers to the unbundling of the financial services value chain into different modules. It entails different entities entering the value chain to perform different functions in a financial transaction, all of which were earlier performed by a single entity (Kumar & Srinivas, 2017). As a result, the number of entities filling the space between the consumer and the FSP in the value chain increases. At the same time, the rapid digitisation of financial services has enabled non-FSPs like technology service providers (for example, mobile payment applications) to enter the financial services supply chain. These new entities may often be unregulated in the financial sector (Chugh, Raghavan, & Singh, 2019). Two challenges arise for consumer redress in this context.

First, the disaggregating of financial services into smaller specialised transactions increases the points of failures and therefore, of grievance in the experience of financial services. Second, increased participation of multiple (regulated or unregulated) service providers in the value chain of financial services makes it hard for consumers to identify the entity liable for causing a grievance. For instance, a UPI-based digital payment in India requires a real time exchange of information between up to 5 different entities (Manikandan, 2020). Any lapse at the ends of any of these entities or at the end of the consumer herself could lead to a failed transaction. However, the source of the error may not be immediately apparent to the consumer, which limits her ability to register grievances. In sum, digital transactions are opaque to the consumer, and neither the points of failure nor the entities responsible for failure maybe easily identifiable for the consumer (Consumers International, 2016).

Second, even if consumers can identify the entity responsible for their grievance, they may find it difficult to identify the appropriate forum where they can obtain redress (Chugh, Raghavan, & Singh, 2019).

For instance, a card-based digital payments transaction between a consumer and a merchant is facilitated by several entities including (i) the consumer’s bank (ii) the payment gateway (iii) payment processors (iv) the card network (Visa/Mastercard etc.) (v) the payment system operator (RBI, NPCI) (vi) the payment authentication agency and (vii) the merchant’s bank.

A transaction failure can occur if any one of these entities is unable to process the transaction for different reasons (The Future of Finance Initiative, 2017). Further, each entity in the value chain tends to have its own, separate grievance redress forum. Therefore, the participation of multiple entities in the value chain also implies that there are multiple redress forums, and the burden of identifying the redress forum associated with the grievance is passed to the consumer. It is quite unlikely that consumers are aware of these sectoral divisions among redress forums and their specific jurisdictions. As a result, they might approach the wrong forum looking for redress. In the current grievance redress framework, approaching a wrong forum with a genuine complaint often leads to the complaint being rejected altogether, as discussed below.

3.2. Challenges due to design and processes of the redress forums

Once consumers are able to identify the appropriate redress forum, they may face challenges due to the ineffective and unsuitable design and process of current redress forums in the financial sector (Jain, 2019). These challenges are set out below:

-

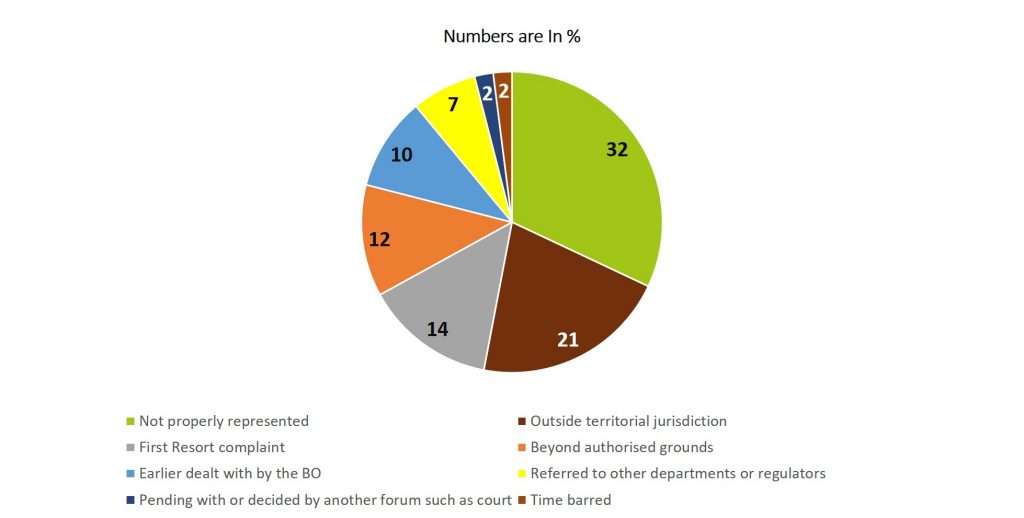

Highly technical and burdensome procedures: Redress forums have highly technical and burdensome procedures that must be followed by consumers. For instance, all complaints before the Ombudsmen need to be in writing only (Reserve Bank of India, 2006; Ministry of Finance, 2017; National Pension System Trust, 2015). In 2018-19, a staggering 32% of the complaints were rejected by the BO because they were not properly represented or for not being able to provide complete information in the complaint (Reserve Bank of India, 2019). Consumers must attach relevant documentary evidence to substantiate their complaint. This can be very difficult in financial transactions which can often be very opaque, and in which consumers are challenged by lack of information (Consiglio, 2020). Similar issues limit access to effective redress at consumer dispute redressal forums (Muringatheri, 2019). Complicating the process further, different sectoral Ombudsmen seem to be having different redress procedures (Reserve Bank of India, 2006; Ministry of Finance, 2017; National Pension System Trust, 2015; Securities and Exchange Board of India, n.d.). Together, these factors can create high barriers for consumers seeking redress.

-

High rates of rejection: The complaints registered with the redress forums have a high rate of rejection on the grounds of consumers not complying with jurisdictional and procedural mandates. Redress forums can reject complaints on numerous grounds including complaint being made to the forum without territorial jurisdiction and complaint not being referred to the FSP first. For example, more than half of the complaints made to the BO were rejected on such technical grounds in 2018-19 alone (See Figure 3) (Reserve Bank of India, 2019; Borate, 2019). The Insurance Ombudsman, similarly, rejected 41.02% of the complaints in that year (ECOI, 2020). The Lok Sabha’s Committee on Subordinate Legislation, which reviewed the Insurance Ombudsman Rules, in 2017, recognised that close to 74% of complaints were rejected by the Insurance Ombudsman in 2017-18 (Committee on Subordinate Legislation, Lok Sabha, 2020).

Figure 3: Reasons for Banking Ombudsman rejecting complaints in FY 2018-19

-

Slow redress: Disputes before the redress forums have a high turnaround time (TAT). For instance, a considerable number of complaints before the Insurance Ombudsman took between 3 months to 1 year, and over 13% of the complaints took more than 1 year for resolution (ECOI, 2020). Further, the grievance redressal process itself could be too lengthy for consumers. In pensions, for instance, redress is lengthy by design since the entire process is allowed to proceed for 11 months for resolution (Pension Fund Regulatory And Development Authority, 2015). Similarly, the Ombudsman for Digital Transactions accepts only those complaints which have been rejected or improperly addressed by the FSP. However, consumers may have to wait for 1 month before they receive a response from the FSP (Reserve Bank of India, 2019). Such high TAT can themselves act as barriers to effective redress (Cartwright, 2015).

-

High rates of pendency: Redress forums including the Civil Courts, consumer forums and Ombudsmen seem to be crippled by high rates of pendency. For example, 21,879 cases are pending before the National Consumer Redressal Forum in 2020 (compared to 19,612 cases in 2019 and 14,319 cases in 2018) (ConfoNet, 2020). Close to 8722 complaints were pending before the Insurance Ombudsman at the end of the financial year 2018-19 (ECOI, 2020). Similarly, close to 12,069 complaints were pending before the BO at the end of the financial year 2018-19 (Reserve Bank of India, 2019).

-

Limited geographical reach and capacity of Ombudsmen: The offices of the Ombudsmen are largely located in metropolitan and urban areas of the country. For instance, there are only four NBFC Ombudsman offices in India to serve all NBFC consumers (Reserve Bank of India, 2017). The PFRDA has only one Ombudsman at its headquarters in New Delhi (National Securities Depository Limited, n.d.). The Ombudsman for Digital Transactions has offices only in metropolitan areas (Reserve Bank of India, 2019). This reduces consumers’ access to redress forums. Only 11.67% of the complaints received by the BO in the FY 2018-19, for instance, were from rural regions (Reserve Bank of India, 2019). The Lok Sabha Committee on Subordinate Legislation expressed a similar concern with the Insurance Ombudsman that has 17 offices for a country as vast as India (Committee on Subordinate Legislation, Lok Sabha, 2020). Such small numbers of offices raise concerns about the forums’ capacity to handle all of the consumer grievances arising across the length and breadth of the country.

4. Conclusion

Consumers must not be expected to navigate a complex financial sector and challenging redress procedures to seek redress. Redress should be as easily accessible as availing of a product or service from the provider.

Online Dispute Resolution (ODR) could facilitate such grievance redress. ODR models use different kinds of technology (like Information and Communication Technology, machine learning algorithms etc.) to provide redress to consumers through various channels including through mobile phones. These models hold potential to make redress more accessible, expeditious and cost-effective for consumers (Abdel Wahab M. S., 2004; Brannigan, 2007; Martinez, 2020; Rabinovich-Einy & Katsch, 2019; UNCITRAL, 2017).

In 2013, the Financial Sector Legislative Reforms Commission (FSLRC) envisaged an ODR-like system that would leverage technology to provide more effective redress to consumers. The FSLRC recommended establishing a unified front-end consumer grievance mechanism for all financial services, independent of sectoral divisions, known as the Financial Redress Agency (FRA). The mechanism would be technologically driven and involve telephonic hearings, video hearings, digital documentation, online complaint registration etc. (Financial Sector Legislative Reforms Commission, 2013; Task force on Financial Redress Agency, 2016). The FRA would first try to resolve the dispute amicably before resorting to adjudication and lengthy legal processes (Task force on Financial Redress Agency, 2016). Developments in ICT and better access to ICT today makes such a redress system possible. For instance, the RBI has recently released regulations for developing ODR models in the payments sector for resolving disputes between consumers and payment service providers (Reserve Bank of India, 2020).

ODR presents an opportunity to complement the physical channels of grievance redress to mitigate jurisdictional, technical and procedural barriers to make redress more effective. The next post will discuss these opportunities of ODR.

[1] At the time of publication, the Reserve Bank of India has expressed its intention to integrate the three Ombudsman schemes to centralise the processing of grievances. See Statement on Developmental and Regulatory Policies, Clause 16.

[2] SEBI first examines if the complaint falls within its purview. Then, it advices the FSP to send a written reply to the aggrieved consumer and also submit an “action taken” report on SCORES (SEBI Complaints Redress System, n.d. ).

References

Abdel Wahab, M. S. (2004). The Global Information Society and Online Dispute Resolution: A New Dawn for Dispute Resolution. Journal of International Arbitration, 143 – 168. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=602021

Borate, N. (2019, December 23). Did banking ombudsman reject your complaint? Retrieved from Livemint: https://www.livemint.com/money/personal-finance/did-banking-ombudsman-reject-your-complaint-11577092475746.html

Brannigan, C. (2007, December 12). Online Dispute Resolution. Retrieved from mediate.ca: https://mediate.ca/wp-content/uploads/2020/04/Mediate-Chapter-on-Online-Dispute-Resolution.pdf

Cartwright, P. (2015). Understanding and Protecting Vulnerable Financial Consumers. Journal of Consumer Policy, 38, 119-138.

Cartwright, P. (2015). Understanding and Protecting Vulnerable Financial Consumers. Journal of Consumer Policy, 38, 119-138.

Chapman, M., & Mazer, R. (2013, December). Making Recourse Work for Base-of-the-Pyramid Financial Consumers. Retrieved from Consultative Group to Assist the Poor: https://www.cgap.org/sites/default/files/researches/documents/Focus-Note-Making-Recourse-Work-for-Base-of-the-Pyramid-Financial-Consumer-Dec-2013_1.pdf

Chugh, B., Raghavan, M., & Singh, A. (2019). Primer on Designing Optimal Regulation. 4th Dvara Research Conference on Regulating Data-Driven Finance. Chennai: Dvara Research.

Chugh, B., Raghavan, M., & Singh, A. (2019). Primer on Suitability for Consumer Data Use and Product Design. 4th Dvara Research Conference: Regulating Data-Driven Finance. Chennai: Dvara Research.

Committee on Subordinate Legislation, Lok Sabha. (2020). Report on The Insurance Ombudsman Rules, 2017. New Delhi: Lok Sabha Secretariat.

Committee on Subordinate Legislation, Lok Sabha. (2020). Report on The Insurance Ombudsman Rules, 2017. New Delhi: Lok Sabha Secretariat.

ConfoNet. (2020). ConfoNet Dashboard: Yearwise Pendency in NCRDC. Retrieved from NCRDC Case Management System: http://cms.nic.in/ncdrcusersWeb/dashboard.do?method=loadDashBoardPub

Consiglio, J. A. (2020). Insights on Financial Services Regulation. Emerald Publishing Limited.

Consumers International. (2016, April). The Internet of Things and challenges for consumer protection. Retrieved from Consumers International: https://www.consumersinternational.org/media/1292/connection-and-protection-the-internet-of-things-and-challenges-for-consumer-protection.pdf

ECOI. (2020). Download Annual Reports. Retrieved from Office of the Executive Council of Insurers: http://ecoi.co.in/annualreports.html

Financial Sector Legislative Reforms Commission. (2013). Report of the Financial Sector Legislative Reforms Commission. Government of India.

Jain, M. (2019, August 14). Consumer Protection in a Digital Financial World – Initiatives and Beyond. Retrieved from Reserve Bank of India: https://www.rbi.org.in/scripts/BS_ViewBulletin.aspx?Id=18408

Kumar, N., & Srinivas, M. (2017, October 20). Designing Regulations for a Rapidly Evolving Financial System – Financial Systems Design Conference 2017. Retrieved from Dvara Research: https://dvararesearch.com/2017/10/20/designing-regulations-for-a-rapidly-evolving-financial-system-financial-systems-design-conference-2017/

Legal Information Institute. (2017, June 8). Alternative Dispute Resolution . Retrieved from Legal Information Institute (Cornell Law School): https://www.law.cornell.edu/wex/alternative_dispute_resolution

Manikandan, A. (2020, November 21). Eight banks suffer a higher rate of failure in digital transactions. Retrieved from The Economic Times: https://economictimes.indiatimes.com/news/international/saudi-arabia/future-of-cities-saudi-arabia-heralds-a-revolution-in-urban-living/articleshow/80570411.cms

Martinez, J. K. (2020). Designing Online Dispute Resolution. Journal of Dispute Resolution, 2020(1). Retrieved from https://scholarship.law.missouri.edu/cgi/viewcontent.cgi?article=1853&context=jdr

National Consumer Dispute Redressal Commission. (n.d.). Commentary on Consumer Protection Act. Retrieved from National Consumer Dispute Redressal Commission: http://ncdrc.nic.in/bare_acts/1_1_2.html

National Pension System Trust. (2015). Grievance Redressal Policy of NPS Trust under PFRDA (Redressal of Subscriber Grievance) Regulations. Retrieved from National Pension System Trust: http://www.npstrust.org.in/sites/default/files/Grievance%20Redressal%20Policy%20of%20NPS%20Trust_0.pdf

National Securities Depository Limited . (n.d.). FAQa on Grievance Redressal-Ombudsman. Retrieved from NSDL e-Governance Infrastructure Limited: https://npscra.nsdl.co.in/nsdl/faq/FAQs_on_Grievance_Redressal-Ombudsman.pdf

Organisation for Economic Co-operation and Development. (2011, October). G20 High-Level Principls on Financial Consumer Protection. Retrieved from Organisation for Economic Co-operation and Development: https://www.oecd.org/daf/fin/financial-markets/48892010.pdf

Pension Fund Regulatory And Development Authority. (2015). Pension Fund Regulatory And Development Authority (Redressal Of Subscriber Grievance) Regulations, 2015. Retrieved from npstrust.org.in: http://www.npstrust.org.in/sites/default/files/GrievReg2015.pdf

Rabinovich-Einy, O., & Katsch, E. (2019). Blockchain and the Inevitability of Disputes: The Role for Online Dispute Resolution . Journal of Dispute Resolution.

Reserve Bank of India. (2006). The Banking Ombudsman Scheme. Retrieved from rbi.org.in: https://www.rbi.org.in/Scripts/bs_viewcontent.aspx?Id=159

Reserve Bank of India. (2017, July 14). FAQ on the Banking Ombudsman Scheme, 2006. Retrieved from Reserve Bank of India: https://m.rbi.org.in/Scripts/FAQView.aspx?Id=24#:~:text=The%20Banking%20Ombudsman%20Scheme%20is,RBI%20with%20effect%20from%201995.

Reserve Bank of India. (2019, January 31). FAQs-The Ombudsman Scheme for Digital Transactions, 2019. Retrieved from Reserve Bank of India: https://m.rbi.org.in/commonperson/English/Scripts/FAQs.aspx?Id=2844

Reserve Bank of India. (2019, December 17). Annual Report of the Banking Ombudsman Scheme and Ombudsman Scheme for Non-Banking Financial Companies for the year 2018-19. Retrieved from Reserve Bank of India: https://www.rbi.org.in/scripts/PublicationsView.aspx?id=19356

Reserve Bank of India. (2020, August 6). Online Dispute Resolution (ODR) System for Digital Payments. Retrieved from Reserve Bank of India: https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11946&Mode=0

Sahoo, M., & Sane, R. (2011, December). A regulatory approach to financial product advice and distribution. Retrieved from Indira Gandhi Institute of Development Research: http://www.igidr.ac.in/pdf/publication/WP-2011-029.pdf

Securities and Exchange Board of India. (n.d.). Investor Grievance Redressal Mechanism at SEBI – Brochure. Retrieved from Securities and Exchange Board of India: https://investor.sebi.gov.in/inv-grie-redre.html

Task force on Financial Redress Agency. (2016). Report of the task force on Financial Redress Agency. Government of India.

UNCITRAL. (2017, May). UNCITRAL Technical Notes on Online Dispute Resolution. Retrieved from https://www.uncitral.org/pdf/english/texts/odr/V1700382_English_Technical_Notes_on_ODR.pdf

Vishwanathan, V. (2017, July 28). What to do if your bank does not listen to your complaint. Retrieved from Livemint: https://www.livemint.com/Money/wKbJOnDknc9uSgBmmG0h7L/What-to-do-if-your-bank-does-not-listen-to-your-complaint.html