The Malegam Committee’s (referred to hereinafter as the “Committee”) recommendations to increase the supervisory capacity of the RBI, to make MFI regulation consistent at the national level, to promote good corporate governance and to increase bank lending to MFIs are welcome.

At the same time, many of the tactical and operational prescriptions made by the Committee require to be examined in the context of (a) broadening the RBI’s financial inclusion agenda, (b) regulatory approaches to pursuing this agenda (c) operationalising the recommendations in an effective and inclusive manner and (d) ensuring sustainable development and orderly growth of the industry by limiting externalities and developing a series of best practices.

Definition of the Sector

1. Under 2.1 of the Committee’s report, the Committee has defined microfinance as “an economic development tool whose objective is to assist the poor to work their way out of poverty. It covers a range of services which include, in addition to the provision of credit, many other services such as savings, insurance, money transfers, counselling, etc.”

2. At the same time, the Committee has confined itself to “micro-credit” for the purpose of the report.

3. The Committee has subsequently defined a separate category – NBFC-MFIs – for NBFCs operating in the microfinance sector, and stated that, in such firms, over 90% of assets must comprise of “qualifying assets”. At the same time, the Committee suggests that NBFCs should either allocate over 90% of assets to “qualifying assets” or less than 10%

4. We suggest that it is counter-productive to limit micro-credit or the supervision of micro-credit to NBFCs in the fashion as described above for the following reasons:

a) These recommendations, if accepted, would prevent the transformation of microfinance into full service finance for rural customers.

a. One of the main reasons for becoming an NBFC is that the entity is then able move beyond traditional JLG lending, and gradually start to offer larger loans, individual loans, enterprise loans, crop loans, equipment loans, etc. while continuing to offer the original JLG product.

b. This allows the entity to meet completely the requirements of those borrowers that need larger amounts as well as use the wider product-scope to spread its cost structures over a much larger pool of assets and bring its lending rates down, eventually well below even the caps specified by the Committee for the traditional JLG product.

c. Entities operating in this space would have to grapple with low value of transaction and still remain viable. Multiple sources of revenue would provide such viability to such entities.

b) The 90/10 recommendations (Clause Numbers 5.9 and 5.10), if accepted, would essentially freeze the sector to permanently stay in its current form since nobody else would even be allowed to address the needs of this sector and no other business models would evolve.

a. And for this reason, there would also then be no impetus for interest rates to come down further below the caps specified by the Committee. Costs of operations, using new technologies and economies of scope and scale can be brought down to as much lower levels relatively quickly.

b. This would also take away the entities’ incentive to invest effort in working in a challenging environment.

c) The recommendations would leave out significant microfinance providers from the regulatory framework

a. It is quite possible that Banks may emerge as substantial providers of micro-credit and other forms of microfinance, but microcredit (as defined by the committee) may not form 10% of their assets. This will leave out a significant institution-type from the regulatory ambit. The proposed regulation must cover all microfinance providers

i. However, it may be argued that microfinance, at present, is being provided by multiple non-profit entities that are not within the regulatory ambit of the RBI. Recognising this, we propose that microfinance regulation must cover at least all existing forms of entities regulated by the RBI, i.e. Banks and NBFCs

ii. The microfinance operations of such entities, be in micro-credit, micro-savings, distribution of micro-insurance etc., must be reported separately as an SBU to the RBI, to permit efficient information dissemination, transparency and effective regulation

iii. For entities outside RBI’s regulatory ambit, regulation could make the principals (in case of business correspondents) and lenders (in case of microcredit) to the providers aware of the importance adherence to client protection standards by the providers. These principals and lenders should be actively encouraged to broaden their due diligence and monitoring processes to ensure that the providers are not just maintaining financial discipline but also adhering to ethical standards of client protection.RBI must also actively use such measures to enforce covenants on entities not regulated by RBI to create a level playing field and uniform standards.

d) Further,

a. If entities were forced to concentrate over 90% of their assets in the microfinance sector, lack of diversification within their asset portfolios could emerge as a significant systemic risk.

b. In India, portfolio protection for institutions providing services to low income rural households against the vagaries of systemic and catastrophic losses, i.e. rainfall reduction, weather variations, crop losses, floods and other events etc. are still not available on a large scale

5. Hence, we recommend that the definition of microfinance be applied at a functional level, rather than at the entity level. This would imply that entities providing microfinance would be required to create separate business units, tailor internal policies to provide efficient service delivery and at the same time be able to leverage internal financial, technology and process strengths in this regard.

6. Ensuring complete access to finance for every individual and every enterprise in India will require continuous innovations in financial products, delivery channels, and human resource management by a wide array of strong firms competing with each other to do business with the low-income household in a responsible manner. By opening up the sector to multiple institutions will enhance competition and meet the regulator’s objectives

Capital adequacy requirement

7. The committee has not offered any rationale for the Rs. 15 crore minimum capital requirements even for pure non-deposit taking NBFCs despite recommending very conservative loan limits and being aware of the very low default rates that have been observed for this sector in India for over a decade.

8. Such a requirement clearly favours the established large microfinance providers, which making it even more difficult for smaller, locally focused entities to emerge.

The issue of “Qualifying Assets”

9. The Committee has defined a low income household as one with annual household income less than Rs 50,000

10. IFMR Trust’s experience is that though a large number of microfinance clients belong to households with less than Rs. 50,000 annual household income, there are also a very large number of households with higher incomes who can and do benefit from microfinance mechanisms.

a) This happens mainly because of limitations of the credit appraisal methods of traditional financial providers. Many rural and urban low income households cannot access credit through these mechanisms – their assets cannot be easily collateralised; their incomes are hard to estimate; and their past repayment records are not recorded in accessible databases.

b) So, though most poor are financially excluded, many financially excluded households have household incomes exceeding Rs 50,000. Much of urban microfinance caters to such clients. Restricting microfinance to the poor will make the financially excluded non-poor more vulnerable.

11. We believe that it would be detrimental to the interests of a large section of the population to define low income households in the manner as recommended by the Committee. Further, this definition implies that originators (and perhaps their lenders) have the wherewithal to collect information regarding household income, which is unlikely and expensive

12. The Committee has also stated that credit to individual clients be limited to Rs 25,000 per member

13. This is not clear and raises the following questions

a) What are such households to do when their credit needs outstrip Rs 25,000 per individual member?

b) Shouldn’t the committee focus on “regulating the lender” rather than “regulating the household’s debt needs”?

c) Is it not wasteful for such a household to approach multiple lenders, rather than avail of a single “one-stop shop” solution for financial needs?

d) Effect of inflation on household credit requirements are not factored in

14. Given the above negative effects on a household’s credit access, we find it difficult to believe this is the Committee’s intention. We suggest that it is up to the household to determine its own debt needs and requirements, and for the provider to determine the creditworthiness.

15. Given that the objective is to regulate the originators, we suggest the following approach

a) The Committee has opined that multiple loans given to a single household may increase the risk of non-repayment and amplifies systemic risk

b) At the same time, it is the objective of the committee to ensure that the maximum number of households come under the coverage of financial inclusion

c) Therefore, to incentivise organisations to enhance coverage and limit multiple lending to a single household it is proposed that a higher capital charge be levied upon institutions providing the third or further loan to a single household (at the time of providing the loan)

a. Therefore, the first loan to a household could attract a capital charge of 75%, the second loan 100%, the third loan 125% and so on

b. This could be tracked by stipulating the use of biometric authentication, and a credit bureau

16. It is useful to note that the group-based method (followed at present by MFIs as well as SHGs) ensures that each borrower is forced to assess his / her co-borrowers before forming a group. The ability of this methodology to impose credit discipline is well-documented. Even during the current crisis, IFMR Trust has monitored repayment behaviour in over 200 districts across the country outside Andhra Pradesh, where repayment behaviour has been flawless1

Our experience tells us that, contrary to popular belief, low income households are rational and well able to take complex financial decisions. Rather, such households are limited by the quality and depth of the financial instruments that they have access to. This evidence is bolstered by the book “Portfolios of the Poor” and a recent impact study2 conducted in Hyderabad by MIT researchers.

17. The committee seems to be taking a view that it not only needs to regulate the lenders, but also the households’ financial lives. It should focus on regulating the lenders and developing ways to indirectly reduce the risks of over-leveraging and systemic risks. Therefore, credit discipline on lenders through usage of capital charge, is a better risk management tool that will also form an effective check on over-lending, rather than imposing an external limit on the borrowing ability of households.

18. Further, it is incorrect to assume that rural households have no collateral at all to provide for raising debt. Banks are known to have substantial exposure to the agricultural sector that is collateralised through land holdings, household gold and farm equipment

a) We had earlier made the argument favouring using microfinance providers for delivery of multiple services for efficient service delivery at lower cost

b) Though much of microfinance has focused on credit, it should include other services as well. IFMR Trust’s experience with remote rural households across three states (Tamil Nadu, Uttarakhand and Orissa) shows the benefits clients can get from such complete offering, and how such a multi-service approach helps the institutions improve efficiency by leveraging economies of scope, which can be tapped in the context of financial services.

c) Therefore, we submit that organisations should be permitted to offer a complete suite of financial services to low income households viz.

a. Loans – both secured and unsecured. Secured loans that require a high penetration of distribution include crop loans, loans against warehouse receipt, MSME loans etc.

b. Distribution of savings, either through Banks or through mutual funds

c. Distribution of insurance – life, cattle, weather, crop, accident, health etc.

d. Remittances

d) It is necessary that such organisations develop the breadth of knowledge and understanding that is necessary to understand low income household needs and prevent mis-selling. This is something that can be periodically audited by the RBI

Pricing of Loans

19. The Committee feels that “Given the vulnerable nature of the borrowers, it becomes necessary to impose some form of interest rate control to prevent exploitation”

20. Evidence from other countries however shows that pricing caps have historically hurt the poor3 . Pricing caps and margin caps incentivise originators to expand only to easily serviceable geographies and ignore remote areas and lower income clients.

21. Further, the sharp increase in financing costs for MFIs post the AP Ordinance has indicated that originators are not insulated in any manner from high borrowing costs during either (i) a liquidity crunch or (ii) a credit situation / event risk

22. IFMR Trust has, on several occasions, opined that the current interest rates and margins charged by MFIs are high and there is room for reduction. However, at the same time, we believe that competition and transparency should pave the way for reduction of rates rather than impose a hard cap. This is indeed the view RBI has taken on pricing of services offered by banks through business correspondents, allowing banks to decide the price they want to charge, but requiring them to have the pricing approved by the boards, and transparently communicate it to RBI and other stakeholders.

23. Suggestions to this effect include enhancing competition, imposing transparency in pricing (already recommended by the Committee) and monitoring the originators by tracking reduction in interest rates over a period of time

a) Further, originators could be encouraged to augment lending revenues through fee based income achieved through distribution of specially tailored products for low income households, e.g. livestock insurance, low ticket savings and remittances. This would permit originators to reduce costs on lending products

b) Originators that provide other forms of secured products, together with unsecured loans, could also avail of cheaper funding from lenders that could be used to reduce lending rates for the unsecured loans

Purpose / end use of the Loan

24. The Committee believes that microfinance should largely focus on income generating purposes, and has opined that a minimum of 75% of microfinance loans should be for “income generating purposes”

25. This topic needs to be examined from three aspects:

a) What exactly is an “income generating loan”?

b) What are the current purposes for which borrowers are using loans?

c) Loans used for functions that other services usually fulfil

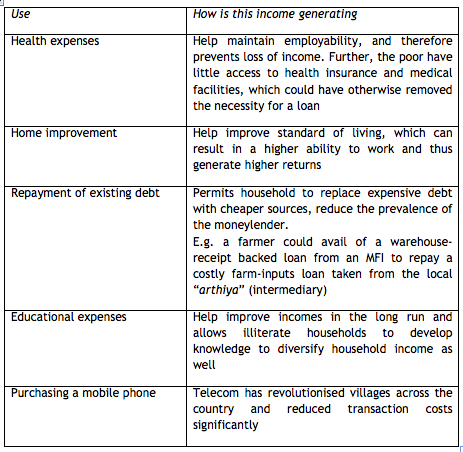

26. What exactly is an income generating loan? Evidence shows that loans are used by low income households for a variety of purposes including:

It is difficult to opine that households should be restricted from using external financing for any of the above activities, especially when the middle-class and the rich are permitted to borrow for all of the above purposes and have access to funds as well

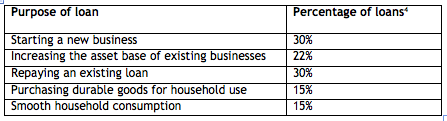

27. It is clear from studies that low income households have utilised MFI loans for a variety of purposes. Recent evaluation of an MFI’s urban microcredit programme in Hyderabad revealed a variety of uses for the loans:

While such percentages vary widely across households, it is clear that each household is faced with a specific set of economic, social and risk variables that require a certain course of action. It is counterproductive to impute (or impose) a specific end-use pattern to a household.

28. Loans used for functions that other services usually fulfil: Since most of these households may not have a savings facility, they might be using a short-term loan to “save-down”, instead of “saving-up” as one does using a savings bank account. Some researchers have also posited that microfinance helps because it acts as a disciplining device for people to save, and they can use the discipline of weekly repayments to help bind themselves into putting money aside, which they otherwise would not have been able to do5 . Transformation of small amounts into lump sums is an important function for households6 , and in the absence of other mechanisms (like savings account, recurring deposits), microfinance serves as a mechanism to help make this transformation. These other purposes (consumption smoothing by transforming small amounts of money into lump sum; reducing cash outflows by repaying expensive old debts; etc) can be and often are welfare enhancing

29. Traditionally the low income household is only familiar with credit as a tool for financial needs and have developed coping mechanisms based on access to credit. While other financial products would clearly be useful to such households, they would need time to adapt to such tools.

30. While financing for certain end-use could be encouraged (i.e. through the priority sector guidelines), it is counter-productive to impose end-use restrictions on households when no such restrictions exist on higher income households. It is conceivable that, through disincentives on multiple-lending, originators would take greater care in ascertaining the repayment capability of the household, as well as diversify into products that would be directly linked to business activities, e.g. retailer loans, crop loans, small business loans etc.

31. The view the Committee eventually takes on the manner in which poor women conduct their financial lives and their maturity and sagacity is deeply disturbing. Microfinance plays multiple roles in the lives of low income households including seasonal cash management (so that school fees can be paid even during the seasonal troughs); asset transformation from small savings to larger valued assets (such as higher quality roofs and beds); refinance of high cost loans from money lenders; and as a substitute for good commitment-savings products. This is also acknowledged by the Committee but while making its recommendations it surprisingly reaches an opposite conclusion without citing any research or offering any rationale for overlooking its own earlier observations or suggesting any alternative solutions.

32. These recommendations of the Committee along with those restricting the amounts she can borrow and severely limiting the choice of providers that she can access, constitute an infringement of the rights of the low income household, particularly women, to conduct their own financial affairs as they think best fit. Similar stipulations, if imposed on middle and upper income households would be resisted very strongly, but have been recommended for imposition on poor women without any evidence that they are in any way less rational than high and middle income customers and good evidence that the opposite is actually the case.

Incentives for Orderly Growth

33. The Committee has recommended the creation of a Credit Bureau for ensuring orderly sharing of information. We wholeheartedly support this initiative and believe that fully functional (and competing) credit bureaus are essential for the orderly development of the sector

34. Further, and very critically, the Committee has suggested that a single regulator is necessary and sufficient to monitor microfinance activities. This is extremely important, especially in the context of the AP Ordinance, and will go a long way towards dispelling uncertainty on the legal and regulatory environment

35. We also have a few other suggestions regarding the role that the RBI can play in facilitating orderly growth. These include:

a) Ensuring incentive alignment of stakeholders to enable market-based regulation –

a. Use of the priority sector guidelines

b. Securitisation

b) Ensuring continuity of service

c) Promoting healthy competition amongst originators

36. Incentive alignment

a) The priority sector guidelines can be used very effectively by the RBI in controlling and at the same time incentivising originators and lenders to behave responsibly. The Committee has recommended continuation of priority sector for microfinance advances and we are in support

Some additional steps that could be brought in the priority sector guidelines:

a. Unsecured loans provided to a household could attract a higher priority sector weightage than secured loans (the RBI has already moved a step in this direction by stating that gold loans made for agricultural purposes may no longer be treated as direct or indirect agricultural advances)

b. First and second unsecured loans given to a household could have a higher weightage than subsequent loans – tracked through a credit bureau

b) Securitisation and other capital market transactions: traditionally, originators of financial services to low income households have been far too dependent on bank borrowings (the Committee estimates that 75% of loans to MFIs are from banks)

IFMR Trust has been working closely with high quality originators to assist them in availing capital market financing through securitisations and bond issuances. We strongly feel that the additional transparency imposed by a capital market transaction is very beneficial in incentivising originators to “raise the bar” in MIS, reporting, operational processes and systems, so as to be able to meet the scrutiny of rating agencies and investors

37. Continuity of service: Continuity of service delivery should be seen from the perspective of “who is taking risk on whom”, because based on this the importance of and strategy for ensuring continuity of service delivery will be determined.

Clients taking risk on the institution (Savings, Insurance, Investment, Remittance): For services like savings and insurance, there is a strong case for high level of prudential regulation to prevent failure of institutions, because of the need to protect clients’ savings and insurance. For these services, the regulation should continue on the path of letting prudentially regulated, well-capitalised, well-diversified institutions provide microfinance through agent-led models, like the business correspondent model. To ensure continuity of these services, the continuity of both the principal and the agents is necessary.

The principal institutions (banks, insurance companies, asset management companies, etc) are already governed by detailed prudential norms, which are meant to minimise the risk of failure. For such agent-led models, the regulator should make the principal financial institution (eg. banks appointing the business correspondent) responsible for ensuring continuity of service delivery to the clients, with penalties if an acquired client is not able to access the service continuously for a certain period of time. These principal institutions should then draft their own due diligence and monitoring criteria to ensure this.

At the same time, the model should ensure that every originator (who serves as an agent) has sufficient risk participation to prevent the risk of moral hazard.

Institution taking risk on the clients (Loans): Considering the fact that most of the microfinance providers (except banks) in India do not mobilise public deposits, we believe that the RBI need not take further steps towards regulating such institutions except defining basic prudential norms on institutions that are non-systemically important.

However, we strongly believe that the RBI should focus on ensuring that a microfinance originator’s practices do not have negative externalities for other originators. IFMR Trust’s experience is that maintaining high quality field processes is a must for microfinance. Hence, regulation that is focused on reducing negative externalities will be immensely useful. Some suggestions:

a) Develop an external audit mechanism through third parties: Such third parties auditors could (i) verify through sample checks the quality of origination and reported profiles of customers, (ii) define process standards for processes in origination, collection, risk management etc7 and audit the same, (iii) provide feedback to the institution on their findings, (iv) provide inputs to the lenders of such originators

b) Use differentiated capital charge, as outlined earlier, to prevent multiple lending

Client Protection

38. The Committee has recommended certain steps with regard to client protection including

a) Prevention of coercive collection practices

b) Customer protection code

c) Transparent pricing

39. We are in agreement with the broad line of thinking and offer a few suggestions regarding the same

a) While it is fair to state that borrowers of group-based lending are not to be visited for non repayment at their residence, the same is not true for borrowers of individual loans / business loans / crop loans etc. The RBI should make a distinction between loans where group liability serves as a cushion against individual default, and individual unsecured loans

b) Where security is available to the originator (property, gold, movable assets), the originator should have clearly defined, board-approved, policies regarding any appropriation, auction and disposal of such assets. Such policies must follow the Fair Practices Code and every such incident of recovery from security must be monitored at the highest level in the originator’s organisation

c) IFMR Trust’s stringent underwriting guidelines stipulate that no originator should use the services of or incentivise third parties to originate and service the loan clients. While it has been observed that originators use group leaders or center leaders for such purposes, this must be completely stopped

d) Transparent pricing to clients must be enforced, displayed in loan agreements, explained during customer interactions etc. The RBI could consider prescribing standard communication components which cover various methods of calculation of interest (Upfront fees, flat rate, reducing balances rate etc.) and also various repayment cycles (Equated, ballooning, variable) to bring them to ‘effective cost to client’ numbers so that clients can make informed decisions

e) Prevent mis-selling: Regulation should prescribe fair origination practices by microfinance providers. Some activities that should be actively discouraged are: compulsory bundling of products, miscommunication about product features and giving wrong advice to clients. Explicit confirmation from the clients that such practices have not been indulged in should be obtained by external process auditors to create pressure towards adherence

f) Mechanism for redressal of grievances: All originators must be required to have in place timely and responsive mechanisms for complaints and problem resolution for their clients. This requires ensuring that clients are able to contact a person who can then address their grievances effectively and in a time-bound manner. Apart from this the regulator must make available mechanisms outside of the institutional framework to address unresolved queries or queries of larger magnitude. The banking ombudsmen with enhanced capacity would be best placed to perform this function without conflict of interest

g) Privacy of client data: The privacy of individual client data must be respected in accordance with the existing laws and regulations, and such data cannot be used for other purposes without the permission of the client. Explicit regulations around when and how information sharing is possible should be notified. Severe implications must be notified to ensure that originators do not overstep on this requirement

IFMR Trust believes, and has learnt through experience, that small, local financial institutions are best placed to understand the financial needs of low income households and deliver financial services to their doorstep. It is critical to avoid a situation where regulation favours large players over smaller ones. Several provisions of the Committee’s report that may have this unintended consequence are:

➢ Interest rate/Margin cap

➢ Allowing only 2 lenders per household

➢ Minimum networth

These recommendations favour the largest existing originators, are likely to drive smaller MFIs out of businesses, and create entry barriers for any new players. The larger originators benefit from economies of scale and will be more easily able to comply with the increased capital requirements. They will be more easily able to build the infrastructure recommended and move faster into the market place where they could corner the maximum market share thereby preventing the entry of smaller or newer MFIs in that market.

We strongly feel that such measures will be detrimental to the financially excluded and will not serve the RBI’s motive of financial inclusion. Permitting only larger originators to flourish will imply an oligopolistic situation, lesser product innovation, poor customer service and ultimately choking the household’s credit requirements.

We believe that there is an important role for the regulator to play in making sure that innovation is encouraged among responsible players in a manner that benefits low income households, and we are hopeful that the RBI will agree with our view when it reviews the Malegam Committee’s report.

—

(1) This observation is based on (a) over twenty field visits conducted in states outside AP, post the AP Ordinance, (b) data from securitized pools in over 200 districts, (c) behavior of borrowers of IFMR Trust’s own retail financial services venture in remote rural areas of Tamil Nadu, Uttarakhand and Orissa

(2) The paper titled “Miracle of microfinance? Evidence from a randomised evaluation” can be found here: http://econ-www.mit.edu/files/4162

(3) CGAP Occasional Paper No. 9. http://www.cgap.org/gm/document-1.9.2703/OP9.pdf

(4)These percentages don’t add up to 100 because some loans were used for multiple purposes.

(5)http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1598959

(6)See page 17 of http://www.portfoliosofthepoor.com/pdf/Chapter1.pdf

(7)IFMR Trust has developed detailed underwriting guidelines for such providers of financial services, including detailed process and system guidelines that such an institution must follow

2 Responses