Early in April 2021, as part of the bi-monthly Statement on Developmental and Regulatory Policies, the Reserve Bank of India’s Governor proposed some regulatory measures concerning the payments and settlements sector in India. Some of these measures directly impact the Payments Bank and Prepaid Payment Instrument models and also have implications for the payments and settlement systems as a whole. In this post, we analyse the proposed policy changes and how they might impact the payments ecosystem, particularly Payments Banks and Prepaid Payment Instrument providers.

The Reserve Bank of India (RBI) proposed significant changes to its regulatory framework for payment and settlement systems in its Statement on Developmental and Regulatory Policies (The Statement) on April 7, 2021 (Reserve Bank of India, 2021). The most prominent among these relate to deposit limits, interoperability, cash withdrawal services and access to Centralised Payment Systems (CPS) for Payments Banks (PBs) and Prepaid Payment Instruments (PPIs). The RBI has already begun notifying some of these changes through its notification dated May 19, 2021 (the Notification) (Reserve Bank of India, 2021). The proposed changes could have direct implications for the growth of Payments Banks and Prepaid Payment Instruments, provision of financial services at the last-mile and systemic stability.

This post first introduces the key distinctions between the PB and PPI models under the existing framework. Then, the post analyses how the proposed changes to the frameworks would affect the models. Finally, the post provides a glimpse of what the changes would mean for the banking and payments sector as a whole.

1. Payments Banks versus Prepaid Payment Instruments

1.1. Payments Banks & Prepaid Payment Instruments: A comparison

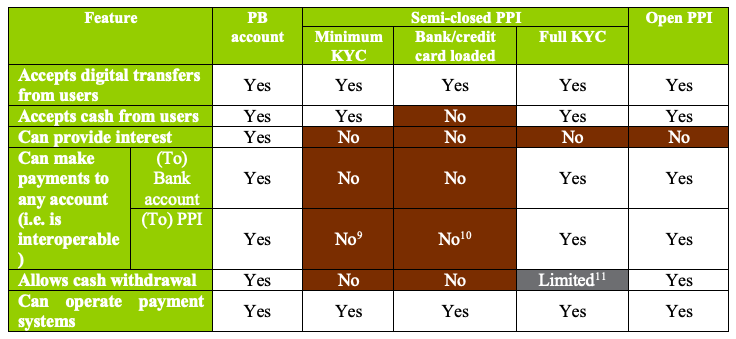

PBs and PPIs are regulated under two different frameworks of the RBI (Reserve Bank of India, 2014) (Reserve Bank of India, 2017). The key differences between PBs and PPIs are presented in Table 1. These differences have been mapped between the PB and PPI frameworks prior to the changes made to the PPI framework by the Notification.

Table 1: Key differences between PBs and PPIs under the framework prior to the Notification.[1]

PBs operate under a Payments Bank license. PBs can accept savings deposits from users, provide interest on the deposits and help users make payments to any bank account. PBs also offer users cash withdrawal services. However, PBs cannot undertake credit functions (Reserve Bank of India, 2014).

PPIs operate based on permissions obtained from the RBI under the Master Direction on the Issuance and Operation of Prepaid Payment Instruments (Reserve Bank of India, 2017). PPIs can accept deposits from users (in the form of wallet/prepaid card balance), although no interest accrues on the deposits. Further, PPIs can be used to purchase goods and services from providers who have a contract with the PPI provider and are equipped with the necessary acceptance infrastructure. Certain categories of PPIs can also be used to make peer-to-peer (P2P) transfers as long as the payee’s wallet or bank account is supported by the payer’s PPI provider through a registration mechanism. The PPI framework allows cash withdrawal only from one category of PPIs – open-system prepaid cards (which can only be issued by banks) at ATMs or Point-of-Sale (PoS) terminals or merchant locations.[8] Like PBs, PPIs are unable to undertake credit functions (Reserve Bank of India, 2017).

The changes announced by the RBI to the PB and PPI models in the Statement and in the Notification could eliminate most of the differences between PBs and PPIs.

1.2. The effect of the proposed changes under the Statement on Payments Bank & Pre-Paid Payment Instruments

The Statement in April 2021 proposed the following changes to the PB and PPI frameworks:

-

Increasing the deposit limit in PB accounts from INR 1 lakh to INR 2 lakhs.

-

Increasing the deposit limit (wallet balance) in full-KYC PPIs from INR 1 lakh to INR 2 lakhs.

-

Making interoperability mandatory for full-KYC PPIs and for all PPI payment acceptance infrastructure.

-

Allowing cash-withdrawal from full-KYC non-bank PPIs.

-

Permitting non-bank payment system operators to directly participate in the CPS, i.e., RTGS and NEFT systems for settling payments.

Of these, the RBI notified items (ii), (iii) and (iv) through the Notification. These changes to the PPI framework primarily affect Full-KYC PPIs. A comparison between PBs and full-KYC PPIs post these changes is presented in Table 2.

Table 2: Key differences between PBs and PPIs under the envisaged framework

Drawing on Tables 1 and 2, the changes under the Statement and the Notification could remove most distinctions between a PB and a full-KYC PPI. The only two significant differences appear to be that (a) PBs can provide interest on deposits made with them while PPIs cannot, and (b) that PB accounts can enable much higher cash-out opportunities for account holders than can PPIs.

2. Implications for the banking and payment sector

The changes under the Statement and the Notification can have many implications for the banking and payments sectors. Some speculations are set out below.

2.1. Better quality of services for consumers

The proposed increase in balance limits for both PB and PPI accounts could benefit users, especially merchants and business owners who would store higher value at the end of a business day. Better interoperability and cash withdrawal options for PPIs could also increase their utility for users at the last mile (High Level Committee on Deepening of Digital Payments, 2019; Narang, 2020).

Further, the Statement proposes to give non-bank PPIs access to the CPS. This would allow non-bank PPIs to offer their users high-value transaction services through the NEFT and RTGS systems. These developments, coupled with increased ability for users to withdraw cash from their PPI, could give users greater liquidity and allay fears about the accessibility of their wallets. This could consequently improve the level and quality of financial inclusion in banking and payment services at the last-mile. PBs and PPIs, with their vast rural presence through branches, agents as well as BCs, could play a crucial role in this process (Neelam & Tiwari, 2020; Committee on Comprehensive Financial Services for Small Businesses and Low Income Households, 2014).

2.2. Implications for the growth models of PBs and PPIs

Currently, the growth model for both, PBs and PPIs, seems to be linked to the scale of their operations (Reserve Bank of India, 2014; Committee on Comprehensive Financial Services for Small Businesses and Low Income Households, 2014). PBs have been able to extend themselves to the last-mile through branches and through Business Correspondent (BC) networks to reach a larger user base. Unfortunately, the PB model has seen limited success with respect to profitability, with only two out of six PBs claiming to have made profits (Neelam & Tiwari, 2020). PBs can better leverage the network effects generated by their reach to a larger number of users at the last-mile (Ghosh & Ranade, 2020).

Similarly, PPIs may be suitable for making low-value high volume transactions through light acceptance infrastructure (like QR Codes) at the last-mile (High Level Committee on Deepening of Digital Payments, 2019). However, the growth in PPI usage in India has been very slow compared to some other payment methods.[12]

The changes under the Statement could help PBs and PPIs strengthen their network effects among users and increase their scale. Increased interoperability and better cash-out services could bring more users to use PPIs at the last-mile. This could also help PBs, like PayTM or Airtel, which operate their own PPIs. PBs which also offer PPIs seem to be adopting a platform model. Apart from providing their own services, PB and PPI providers are tying up with other financial and real sector providers to provide different products and services to users. An increase in the use of PBs or PPIs could, therefore, bring more users onto their platforms and help providers generate additional revenue. The user data generated by increased activity could, in turn, be used to provide better services and gain more users (Ghosh & Ranade, 2020).

However, it is difficult to conclude if the proposed changes will definitely create strong network effects. In the absence of adequate data, it will be difficult to understand if the revenue generated from stronger network effects will make the PB and PPI models more viable and lucrative.

PBs can invest the PPI deposit balances in securities prescribed eligible for the maintenance of Statutory Liquidity Ratio (SLR) to earn more revenue. That PPIs cannot offer interest rates on their balances might not be a limiting factor to their usage, as can be inferred from the high-velocity deposits of the PB accounts that are functionally equivalent to PPIs (Neelam & Tiwari, 2020).[13] This distinction may, therefore, no longer be a significant consideration for users who need to choose between a PB account and a non-bank PPI wallet.

2.3. Potential for reducing settlement risks in PPI payment transactions

The Statement envisages giving non-bank PPIs direct membership to CPSs to minimise settlement risk in the financial system (Reserve Bank of India, 2021).

Non-bank PPIs can currently clear and settle transactions only through their sponsor banks (Reserve Bank of India, 2017). This could create settlement risks in transactions made through PPIs due to the reliance on third parties (like the sponsor bank) to settle transactions (The Economic Times, 2020). Allowing non-bank PPIs access to the CPS could mitigate such settlement risks and facilitate PPIs to provide better payment services to users. Whether settlement risks will truly reduce (as mentioned in the RBI Governor’s statement) would depend on the changes that may need to be made to the escrow requirements that PPIs must have with sponsor banks under the current PPI framework.

It is unclear what giving non-bank PPIs access to the CPSs would mean for escrow requirements. Continuing requirements for non-bank PPIs to maintain escrow accounts with sponsor banks might not mitigate settlement risk. If the escrow arrangements are changed so that non-bank PPIs hold wallet balances on their own balance sheets, non-bank PPIs would become akin to “deposit-taking” entities without permissions to deploy the deposits. Such a measure would also create room for the RBI to consider minimum reserve or collateral requirements for non-bank PPIs that must be kept with the RBI. Alternatively, the RBI might itself take on the settlement risk of these non-bank PPIs. This might increase the financial costs of managing a non-bank PPI license, a cost that was so far incurred by PBs in the form of cash reserve ratio (CRR) requirements (Reserve Bank of India, 2014). It is unclear whether non-bank PPIs have had to incur a similar expense in the form of collateral or other forms of reserves to be kept with their sponsor banks, and whether this cost will increase or decrease due to direct settlement with the RBI.

2.4. Potential risks of self-dealing by PPI providers

One of the primary reasons for requiring PPIs to hold their customer monies under escrow is to prevent any self-dealing within or from its own balance sheet. This is in addition to a more utilitarian reason that only banks had access to payment and settlement systems, as a result of which PPIs needed banks to execute transactions on their behalf. To prevent risks of self-dealing under the changed regime where non-bank PPIs can settle directly with the RBI, the RBI could require non-bank PPIs to hold their customer monies in –

-

A current account with the RBI, or

-

a bankruptcy-remote special purpose vehicle (SPV) which then can invest in Money Market Mutual Funds (MMMFs) instead of on the PPI’s own balance sheets (Shah, 2012). However, this option would converge the PPI and the PB designs, making the current designs of both the PB and the PPI redundant

2.5. Considerations for the credit creation theory of banking

Allowing non-bank PPIs to keep deposits on their own balance sheets without intermediating deposits to earn interest (by lending or investment) could crowd out money that might otherwise be available for lending or investment. This might not be a concern for the RBI if it believes that, contrary to popular wisdom, money gets created by banks not as a multiplier of reserves at the central bank, but rather by the act of lending (which in turn creates fresh deposits). Such a view was endorsed by the Bank of England in 2014 (McLeay, Radia, & Thomas, 2014). It would be interesting to see if this signals a shift in RBI’s overall position on the subject, as this would have further implications for monetary policy and banking and payments system design.

3. Conclusion

We conclude that the changes announced have the potential for increasing the velocity of money without contributing to an increase in the money supply since non-bank PPIs do not have permissions to earn interest income. We concluded that there was indeed a higher velocity for funds in PB accounts, while the same could not be calculated for PPIs due to a lack of data (Neelam & Tiwari, 2020). The general increase in velocity may therefore result in an increase in general price levels and inflation in the long run. It waits to be seen which specific policy tool the RBI will choose in its role as settlement agent for non-bank PPIs who till now needed sponsor banks to undertake the settlement function for them.

[1] See RBI notification titled “Prepaid Payment Instruments (PPIs) – (i) Mandating Interoperability; (ii) Increasing the Limit to 2 lakh for Full-KYC PPIs; and (iii) Permitting withdrawal from Full-KYC PPIs of Non-Bank PPI Issuers” dated May 19, 2021.

[2] The payee bank account needs to be pre-registered with the PPI issuer.

[3] The payee bank account needs to be pre-registered with the PPI issuer.

[4] Minimum-KYC PPIs are not permitted to make peer-to-peer payments. However, minimum-KYC PPIs can be used to make payments to purchase goods and services provided that the merchant has registered with the PPI provider.

[5] PPIs which are loaded only from bank accounts can be used only for the purchase of goods and services and not for transferring funds.

[6] Payments are limited to pre-registered PPIs of the same PPI issuer.

[7] Payments are limited to pre-registered PPIs of the same PPI issuer.

[8] Cash withdrawal at PoS for open-system PPIs was limited to only Rs. 2000 per day in rural areas and Rs. 1000 per day in urban areas (changed since May 19, 2021).

[9] Minimum-KYC PPIs are not permitted to make peer-to-peer payments. However, minimum-KYC PPIs can be used to make payments to purchase goods and services provided that the merchant has registered with the PPI provider.

[10] PPIs which are loaded only from bank accounts can be used only for the purchase of goods and services and not for transferring funds.

[11] Maximum limit of ₹2,000 per transaction with an overall limit of ₹10,000 per month per PPI instrument.

[12] Calculated from Table 66: Payment System Indicators, Financial Sector Statistics, RBI Database on Indian Economy.

[13] See: Annexure 3: Transactional Value to Deposit Balance Ratio, Tracking Performance of Payments Banks against Financial Inclusion Goals.

References

Ahmed, S., & Chavaly, K. (2020, September). Deconstructing Digital-Only Banking Models: A Proposed Policy Roadmap for India. Retrieved from Vidhi Centre for Legal Policy: https://vidhilegalpolicy.in/wp-content/uploads/2020/09/Deconstructing-Digital-only-Banking-Model-A-Proposed-Policy-Roadmap-for-India-FINAL.pdf

Committee on Comprehensive Financial Services for Small Businesses and Low Income Households. (2014). Report of theCommittee on Comprehensive Financial Services for Small Businesses and Low Income Households. Retrieved from Reserve Bank of India: https://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/CFS070114RFL.pdf

Ghosh, I., & Ranade, A. (2020, July 15). Can Payments Banks Succeed? A Trilemma and a Possible Solution. Retrieved from Economic & Political Weekly: https://www.epw.in/journal/2020/15/special-articles/can-payments-banks-succeed.html

High Level Committee on Deepening of Digital Payments. (2019, May). Report of the High Level Committee on Deepening of Digital Payments. Retrieved from Reserve Bank of India: https://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/CDDP03062019634B0EEF3F7144C3B65360B280E420AC.PDF

Kumar, K. (2020, October 14). White Label ATMS may face closure in rural areas. Retrieved from The Hindu Business Line: https://www.thehindubusinessline.com/money-and-banking/white-label-atms-may-face-closure-in-rural-areas/article32854363.ece

McLeay, M., Radia, A., & Thomas, R. (2014). Money creation in the modern economy. Retrieved from Bank of England: https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

Mehta, L. (2020, December 22). 2021: The year of hybrid banking, new players and even newer technologies. Retrieved from The Economic Times Rise: https://economictimes.indiatimes.com/small-biz/money/2021-the-year-of-hybrid-banking-new-players-and-even-newer-technologies/articleshow/79851859.cms

Narang, L. (2020, August). Effects of Mobile-based Financial Services on Migrant Households’ Remittances and Savings. Retrieved from Dvara Research: https://dvararesearch.com/wp-content/uploads/2020/08/Effects-Of-Mobile-Based-Financial-Services-On-Migrant-Households-Remittances-And-Savings.pdf

NASSCOM . (2019, July 31). Member Update: KYC challenges faced by Prepaid Instruments (PPIs) Community. Retrieved from NASSCOM: https://community.nasscom.in/communities/policy-advocacy/member-update-kyc-challenges-faced-by-prepaid-payment-instruments-ppis.html

Neelam, A., & Tiwari, A. (2020, September). Tracking Performance of Payments Banks against Financial Inclusion Goals. Retrieved from Dvara Research: https://dvararesearch.com/wp-content/uploads/2020/09/Tracking-Performance-of-Payments-Banks-against-Financial-Inclusion-Goals.pdf

Razorpay. (2021, March 15). What is a Neobank? Everything you should know. Retrieved from Razorpay: https://bit.ly/2SiL9pw

Reserve Bank of India. (2014, November 27). Guidelines for Licensing of Payments Banks. Retrieved from Reserve Bank of India: https://rbi.org.in/scripts/bs_viewcontent.aspx%3FId%3D2900

Reserve Bank of India. (2017). Master Direction on Issuance and Operation of Prepaid Payment Instruments (Updates as of November 17, 2020). Retrieved from Reserve Bank of India: https://www.rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=11142

Reserve Bank of India. (2020, November 11). FinTech: The Force of Creative Disruption. Retrieved from Reserve Bank of India: https://www.rbi.org.in/Scripts/BS_ViewBulletin.aspx?Id=19899

Reserve Bank of India. (2021, May 19). Prepaid Payment Instruments (PPIs) – (i) Mandating interoperability; (ii) Increasing the Limit to 2 lakh for Full-KYC PPIs; and (iii) Permitting Withdrawal from Full-KYC PPIs of Non-Bank PPI Issuers. Retrieved from Reserve Bank of India: https://rbi.org.in/Scripts/NotificationUser.aspx?Id=12094&Mode=0

Reserve Bank of India. (2021, April 7). Statement on Developmental and Regulatory Policies. Retrieved from Reserve Bank of India: https://rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=51382

Shah, A. (2012, June 20). How to achieve safety in payments. Retrieved from The Leap Blog: https://blog.theleapjournal.org/2012/06/how-to-achieve-safety-in-payments.html

The Economic Times. (2020, March). Yes Bank moratorium hits PhonePe services. Retrieved from The Economic Times: https://economictimes.indiatimes.com/smallbiz/startups/newsbuzz/yes-bank-moratorium-hits-phonepe-services/articleshow/74505513.cms

Cite this item

APA

Neelam, A., & Prasad, S. (2021). Looking Ahead: Implications of the changes to Payment Banks and Prepaid Payment Instrument Frameworks . Retrieved from Dvara Research Blog.

Chicago

Neelam, Amulya, and Srikara Prasad. 2021. “Looking Ahead: Implications of the changes to Payment Banks and Prepaid Payment Instrument Frameworks .” Dvara Research Blog.

MLA

Neelam, Amulya and Srikara Prasad. “Looking Ahead: Implications of the changes to Payment Banks and Prepaid Payment Instrument Frameworks .” 2021. Dvara Research Blog.