In an increasingly digitized world, Digital Financial Services (DFS) have emerged as a key tool for transacting, borrowing, saving, and investing. Policymakers and Financial Service Providers (FSPs) are keen to leverage DFS to advance financial inclusion, particularly for women from Low-Income Households (LIHs). However, a significant gap exists between present DFS offerings and the financial realities of these women. Understanding the distinct financial needs of LIHs is paramount, particularly in providing relevant context-specific solutions to women from such households, who often bear a primary responsibility for their household’s financial management. Failure to incorporate these money management nuances in financial products and services risks further exclusion of these women, and consequently their families, many of whom have limited engagement with formal financial instruments, let alone DFS. Yet, amidst these challenges lies an opportunity: DFS has the potential to be tailored to better suit the needs of LIHs and women (Pazarbasioglu et al., 2020), and this makes it crucial to grasp the context of their financial lives so that meaningful financial inclusion can be achieved.

To first understand the two key tenets of the financial lives of LIHs, we rely on the works of Collins et al. (2009), Zollman and Collins (2010), Zollman (2014), Mas (2015), and Mas and Murthy (2017):

- Employment and Income: The nature of a household’s income inflows and its ability to meet financial needs are primarily determined by its income-generating activities, a concept that applies to LIHs as well. Studies, such as financial diaries in countries like India, Bangladesh, South Africa, and Kenya, show that LIHs predominantly engage in the informal economy. This sector encompasses intermittent, part-time, and casual work, including self-employment such as running petty shops, home-based occupations, agriculture, construction, domestic help, and gig work. These sources of income carry inherent risks due to the unpredictable nature of employment and sporadic work availability, contributing to the financial instability of LIHs. This instability manifests in low-income levels relative to their needs and the unpredictable nature of income flows contribute to volatility in their financial lives.

- Centrality of Day-to-Day Money Management: The informality of employment and the resulting income instability affects LIHs’ ability to meet day-to-day expenses, save, borrow, and prepare for unexpected events. Despite the persistent need to meet essential and expected expenses like food, shelter, clothing, utilities, and children’s education, income may be irregular or insufficient to match these expenses. Therefore, effective cashflow management, including both inflows and outflows, becomes central to stabilizing income flows and ensuring consumption smoothing.

In essence, the ability of LIHs to meet their financial needs, both planned and unplanned, large, and small, depends on how effectively they can manage their cashflows on a day-to-day basis. It is important to note that while money management decisions to be made are infrequent and regular for other households and arrived at after careful analysis, LIHs make them continuously to adapt to changing circumstances. For them, these decisions are frequent, irregular, intuitive, automatic, and undocumented, often reflecting family or community wisdom. These complexities give rise to the following question:

What does money management in LIHs look like, and what strategies do they employ to cope with the circumstances brought about by the nature of their income?

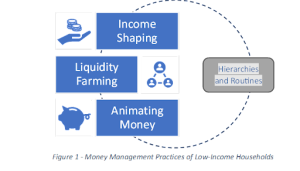

LIHs, like other households, typically rely on a variety of financial tools such as savings, dissavings, and borrowing, but the difference is in their heightened frequency of use and reliance on informal systems. These informal systems encompass relationships within and outside their community, as well as various informal instruments like local savings and credit groups, savings at home or with money guards, and borrowings from acquaintances. These practices are part of broader money management strategies aimed at addressing the persistent need for liquidity. Mas (2015) introduces a categorical framework termed ‘coping strategies’ to break down the complexity of LIHs’ financial lives, providing insight into the rationale behind these practices. We discuss the three coping strategies below:

- Income Shaping – This strategy involves LIHs attempting to shape by matching their income flows with recurrent and one-off larger expenditures to maintain predictable incoming cashflows. Mas (2015) notes that LIHs often pursue income diversification to meet cash flow needs, whether it be in terms of value or timing, often making sacrifices such as working long hours or multiple jobs.

- Liquidity Farming – This strategy involves LIHs building potential sources of liquidity by cultivating relationships within and beyond their communities. This can involve acts of generosity and community involvement to encourage reciprocity and mutual support. The inherent instability of informal employment, coupled with the likelihood of emergencies, may surpass the capabilities of income shaping to provide adequate and timely liquidity. However, LIHs can mitigate such situations by leveraging their established relationships, such as obtaining credit from a local grocery store or employer with whom they have cultivated trust.

- Animating Money – This strategy involves LIHs storing liquidity to protect money from unwarranted uses, employing methods such as allocating money or savings to receptacles with specific purposes or mentally categorizing income streams. The goal is to foster savings discipline by aligning savings or any form of accumulation with designated goals or income sources. LIHs achieve this by assigning symbolic significance or moral values to each savings pot, such as earmarking funds for children’s weddings to specific assets like jewelry or livestock. Given the persistent need for liquidity, these methods offer flexibility, allowing access to funds during emergencies or for use for multiple purposes while preserving savings goals. For example, savings entrusted with a reliable employer (acting as a “money guard”) can be designated for a particular goal yet remain accessible for urgent needs.

Furthermore, Mas and Murthy (2017) argue that underlying all three strategies are two broad sets of rules – hierarchies and routines – that aid decision-making. Hierarchies represent decision trees, aiding LIHs in prioritizing their financial needs, obligations, income, and liquidity sources, tailored to different situations. For instance, questions like which friend to call upon in a financial emergency or which expenses to prioritize during income shortfalls may be answered by hierarchies. Routines, on the other hand, are a set of defaults that provide a pattern to money management. Consistently adhering to routines instills a sense of financial control for LIHs amid the volatility of their finances. Examples include allocating money routinely for expenses such as food, utility expenses, school fees, and savings, or shaping income routinely.

In this blog post, we explored the unique financial dynamics of LIHs and the strategies they employ to navigate their circumstances. Given this complexity, it is imperative for formal financial products, digital or otherwise, to take these complexities into consideration when catering to LIHs. This is especially true for women from these households who tend to rely heavily on a complex repertoire of daily money management practices and draw on the relations they cultivate and leverage in their communities to manage their financial lives. DFS holds promise in delivering tailored financial services that meet the distinct needs of women in low-income households (LIHs), enabling them to better manage their finances.

References

Collins, D., Morduch, J., Rutherford, S., & Ruthven, O. (2009). Portfolios of the poor: How the world’s poor live on $2 a day. Princeton University Press.

Collins, D., & Zollman, J. (2010). Financial capability and the poor: Are we missing the mark. FSD Insights, 1-11. Retrieved from https://www.fsdkenya.org/blogs-publications/publications/financial-capability-and-the-poor-are-we-missing-the-mark/

Global Gender Gap Report (2023). World Economic Forum. Retrieved from: https://www3.weforum.org/docs/WEF_GGGR_2023.pdf

Mas, I., & Murthy, G. (2017). Money Decisions and Control. Retrieved from: https://www.cgap.org/research/publication/money-decisions-and-control

Mas, I. (2015). Money Resolutions, a Sketchbook. Retrieved from https://www.cgap.org/sites/default/files/researches/documents/Working-Paper-Money-Resolutions-Sketchbook-Jan-2015_0.pdf

Pazarbasioglu, C., Mora, A., Uttamchandani, M., Natarajan, H., Feyen, E., & Saal, M. (2020). Digital Financial Services. https://pubdocs.worldbank.org/en/230281588169110691/Digital-Financial-Services.pdf

Wright, G., Jaitly, S., Tandon, S. (2022). Women and DFS. MicroSave Consulting. Retrieved from: https://www.microsave.net/2022/03/11/women-and-dfs/