By Dvara Research and Centre for Social and Behavioural Change, Ashoka University

The number of digital transactions taking place in in India is rising steadily [1]. The Reserve Bank of India estimates 26 crore digital payments are processed every day [2]. Around one-third of Indian households, including a quarter of households in the poorest 40% bracket seem to be making these digital payments [3]. UPI payments account for almost two-thirds of these 26 crore digital payments processed daily [4]. Yet, the National Payments Corporation of India (NPCI) anticipates a sizable “suppressed demand” where people are willing but are not able to make use of digital payments [5]. Dvara Research’s work in adjacent contexts of womens’ use of mobile phone and the work of other scholars in jurisdictions similar to India suggest that this suppressed demand can be attributed to a variety of barriers like, capability gaps, social norms, difficulty in using digital services, and perceptions of risk [6][7]. However, literature examining barriers that new-to-tech users face in accessing digital payments through UPI is scant.

With this objective in mind, Dvara Research together with the Centre for Social and Behavioural Change (CSBC) undertook a study to –

- Understand the challenges new-to-UPI users[i] face when using UPI-based digital payment apps (DPAs); and their perceptions, behaviour, and knowledge in regard to DPAs.

- Synthesise design principles that can make these DPAs intuitive and trustworthy for new-to-UPI users.

- Incorporate safeguards in DPAs that can mitigate risks to users and minimise barriers due to capability gaps.

This study was conducted through a donation from WhatsApp Pay. All material created under this study is made available as a public good, accessible through this page

Methodology and Sample

This study comprises three stages (i) literature review, (ii) quantitative study to understand users’ perceptions of DPAsand, (iii) lab-in-the-field experiment to understand their lived experience of interfacing with DPAs.

Stage 1: Relevant literature from India and countries with similar contexts was reviewed. The insights from this literature review were used to inform the quantitative study in the stage 2. The findings from this stage have been summarised in this blog-post.

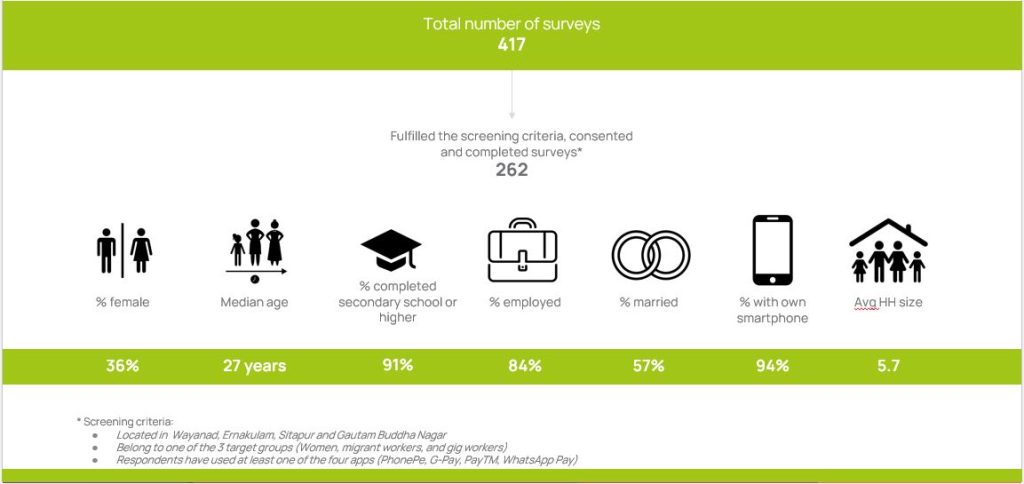

Stage 2: A quantitative survey was administered among 262 respondents in Ernakulam/Kochi and Wayanad (high and low digital inclusion districts, respectively) in Kerala (high digital inclusion state) and Gautam Buddha Nagar and Sitapur (high and low digital inclusion districts, respectively) in Uttar Pradesh (low digital inclusion state) (Figure 1). The respondents were distributed across three focus groups – women, migrant workers, and gig workers (traditional and digital gig workers).

Figure 1: Sample characteristics of the Study | Illustration: Centre for Social and Behavioural Change

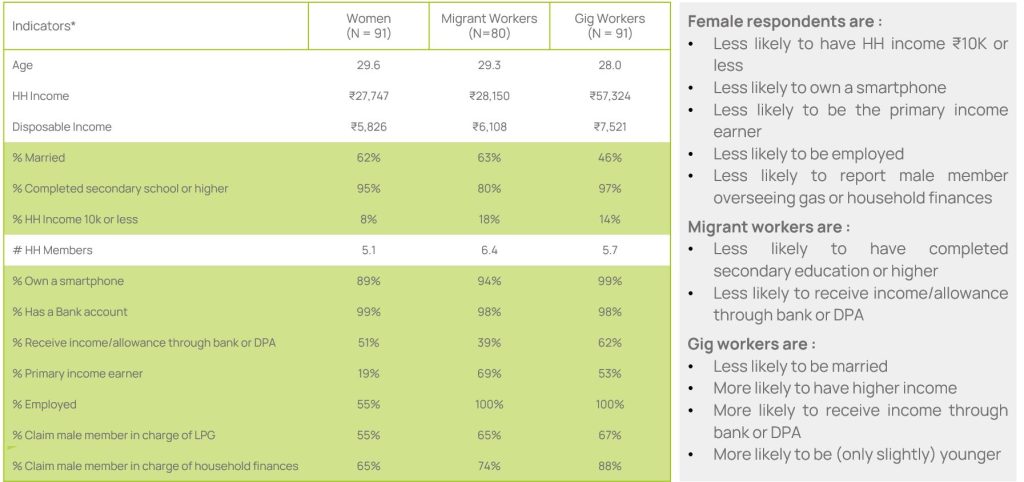

Sample demographics by respondent groups

This survey helped understand (i) users’ experiences with using DPAs, and (ii) the effect of demographic variables (Figure 1) and psychological variables (Figure 2) on users’ adoption and usage of DPAs.

Figure 2: Psychological variables tested in the Study.

Stage 3: In-depth qualitative interviews were conducted with 25 respondents in Gautam Buddha Nagar, Uttar Pradesh, from the larger sample of 262 respondents. These 25 respondents were selected in a way that could help better understand users’ experiences with different DPAs (Google Pay, PayTM, PhonePe, and WhatsApp Pay). Users’ experiences with using a DPA that they do not usually use were observed through a Usability Testing exercise.[ii] Stakeholder conversations were also undertaken with customer protection experts and some DPA representatives to create a rounded view of pathways to designing customer centric DPAs. The findings from each stage of the study will be published on our page over a series of posts. The quantitative dataset (anonymised) will be made available on request.

Visit our page for more information.

[i] ‘New-to-UPI’ users refer to users who want to use UPI but are unable to due to a variety of factors like low literacy, low digital literacy, and low income. It does not include users who are unable to use UPI due to structural barriers like lack of ICT connectivity, smartphone availability etc.

[ii] The findings from this exercise do not identify specific DPAs that were used for usability testing in each interview in Stage 3.

Cite this blog:

APA

Dvara Research and Centre for Social and Behavioural Change, A. U. (2022). Making UPI payments more customer-centric for new-to-UPI users. Retrieved from Dvara Research.

MLA

Dvara Research and Centre for Social and Behavioural Change, Ashoka University. “Making UPI payments more customer-centric for new-to-UPI users.” 2022. Dvara Research.

Chicago

Dvara Research and Centre for Social and Behavioural Change, Ashoka University. 2022. “Making UPI payments more customer-centric for new-to-UPI users.” Dvara Research.