The Micro-insurance sector has been often in the news in the recent times. This is primarily because of IRDA’s recent recommendation towards an “everything product” approach for which the Life Insurance Council has been asked to prepare a blue-print. Mr. Hari Narayana, the Chairman of IRDA has described the “everything product” in the following manner: ‘It will be a single product. Basically it is a product to protect life and against personal accidents. It protects against the loss of assets – cattle, vehicles’.

It can therefore be inferred that this product would collate all insurable risks of the customer, be it related to health, livestock, shop, house, accident or life. It would be interesting to know the design, pricing and implementation mechanisms for a single product aimed at covering all insurance needs of the poor. Keeping in mind the underlying idea of an ‘everything product’, we try to analyse the feasibility of the product in terms of its design and delivery mechanism.

Product Design:

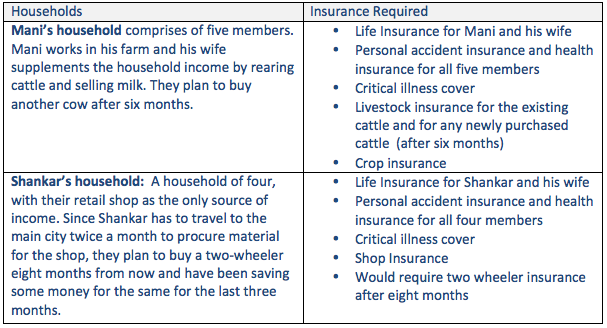

Each rural household, like any other urban household, is unique and has unique requirements. The following examples of households highlight the importance of customising the ‘everything product’ to suit its specific need.

As evident from the above table, not all households need to be protected against all risks. Some households face risks that other households may not face. In the absence of proper customisation, the ‘everything product’ will not suit the requirements of rural households. It would act contrary to IRDA’s current view of suitability expounded in the Draft guidelines on Prospect Product Matrix for life insurance1.

Although, there are certain types of risks which are common to every household, categorizations need to be specified according to risks associated with specific assets. For example, human capital (economic value of a person/earning capacity of a person) is one asset which is common to all households. A composite insurance for risks pertaining to human capital, such as disability, critical illness (which doesnot lead to death but reduces capacity of a person to earn or increases her expenditure on healthcare) will collate different insurance requirements to the benefit of the customer.

The chief purpose of insurance is to cover the customer to the extent of her insurable interest. The current definition of micro-insurance limits the sum insured to Rs. 50,000 for all micro-insurance products and with an additional limit of Rs. 30,000for health insurance. As per SBI life insurance calculator, the sum insured for a typical labour who earns Rs. 46000, per annum and supports a family of four (self+ wife+ two children) with annual expenses of Rs. 36000, is Rs. 3,41,0591 2. This clearly illustrates the flaw in the definition of micro-insurance itself.

Also, each household is exposed to a gamut of risks. Of these risks, there are some that the household is most exposed to. In the case of the “everything product” approach, where premiums are clubbed and risks are bundled into one insurance product, the premium could be too high for most of the BPL households. Given petite margins of income, the “everything product” may remove any option the rural household may have, to adequately insure themselves against even those risks that affect their financial wellbeing the most.

For instance, at KGFS we have a suite of insurance products like Personal Accident Insurance, Group Term Life Insurance, Shop and Content Insurance, and Livestock Insurance. The sum assured for personal accident and term life insurance are as high as Rs. 300,000 and Rs. 250,000 respectively. This segmentation provides an option to the rural consumer to adequately insure themselves for the risks they are most exposed to.

Delivery Channels:

Efficient distribution channels can exponentially influence the take-up of insurance. By taking on the onus of proficient distribution, these channels can eliminate the possibility of bad or forced sale. For example, when well-designed standalone insurance products are backed by the Wealth Management approach of KGFS, through geographically focused branches (one branch covers 4 to 5 kms of radius), a significant uptake of insurance products has been observed:

• 225,906 Personal Accident policies since inception in January 2009, with 85,506 active policies

• 67,311 Term Life Insurance policies since September 2010, with 49,149 active policies

IRDA has also proposed a lead insurer model with two or three insurance companies assigned to a specific geography to design, develop and distribute micro-insurance products3. Such an approach would act against the principle of competition and would adversely impact product innovation and pricing. Moreover, the lead insurer approach also works against basic principles of insurance, that envisages the spreading of risks across geographies.

The need of the hour is to understand requirements of rural households and design suitable products which fully insure rural customers’ insurable interest. Given the realities of low-income households, we need to work towards solutions that reduce the cost of insurance charges for the target segment without compromising on suitability and adequacy.

—

1 – http://irda.gov.in/ADMINCMS/cms/frmGeneral_Layout.aspx?page=PageNo1606

2 – Sum insured will be more if individual expenses are considered.

3 – http://www.livemint.com/2012/05/15230103/New-microinsurance-policy-for.html

2 Responses

Dear Swati,

Thank you for this very well argued commentary. One of the ways to reduce insurance

premia would be to take full cognizance of the fact that within a single

household, correlations across risks are likely to be low and that an insurance

package that covers multiple risks simultaneously is likely to be priced lower

than one in which each element of the package is priced separately. This is

perhaps behind the “Everything” product design proposed by IRDA. Is

it possible of us to approach IRDA and perhaps suggest that that while they

should retain the benefit of low premia implied by the “Everything”

product, they could perhaps permit distributors like KGFS to vary the sum

insured under each category and receive a new quote online — similar to the

approach being taken for rainfall insurance by the Agricultural Insurance

Corporation of India.

Best regards,

Nachiket Mor

Santhanam S: I agree that most of the MFIs have product-driven approach which leads to forced or bad sale of financial products. However, at KGFS, a remote-rural financial product and service provider, we focus on understanding the household with the help of a wealth management approach rather

than product-driven approach. Further information about KGFS and wealth management is available at

http://ruralchannels.ifmr.co.in/.

With the help of geographically focused and well

penetrated network of branches, and the wealth management approach, KGFS customers themselves choose the financial product they require.