In recent years, policymakers have attempted to solve the last-mile conundrum in welfare programmes through a variety of technological interventions. These have included leveraging a national biometric identification system, digitisation of beneficiary records, and institutionalisation of direct cash transfers, among others. While these efforts are taking place, it is important to take a step back and assess who is it that we are trying to improve delivery for? The desired outcomes of policy interventions in the last-mile should ideally be placing value in not only plugging leakages but also on expanding coverage and tackling exclusion errors. Are the two goals of leakage reduction and expanding coverage diametrically opposed or can policy be devised to achieve both? Welfare delivery in India, especially in the wake of the COVID-19 pandemic, currently sits at the intersection of these policy choices. Our research on accessibility to welfare measures shows that exclusion from welfare interventions has been a major issue both pre and post-COVID-19 outbreak.[1]

In this context, we have directed our research efforts* towards identifying the various factors that cause beneficiaries to fall through the cracks in the welfare pipeline. In this blogpost, we propose a framework that can be used to document the various axes of exclusion in Direct Benefit Transfers (DBT) against the broad policy context detailed in one of our previous posts.

Layers of Exclusion

Although significant strides have been made in the domain of financial inclusion, existing bottlenecks have compromised the delivery of cash transfers that rely on the extant banking infrastructure.[2] Some of the pre-requisite design features for the DBT system to work seamlessly are end-to-end digitisation of records, error-free seeding of Aadhaar with beneficiaries’ bank accounts, efficient back-end processing of transfers in the banking system, responsive grievance redressal, and a fully working cash-out architecture. These features continue to remain inadequate in many regions, especially those which lack basic electric or digital connectivity in the first place and those which are more likely to be populated by households in need of welfare transfers.[3]

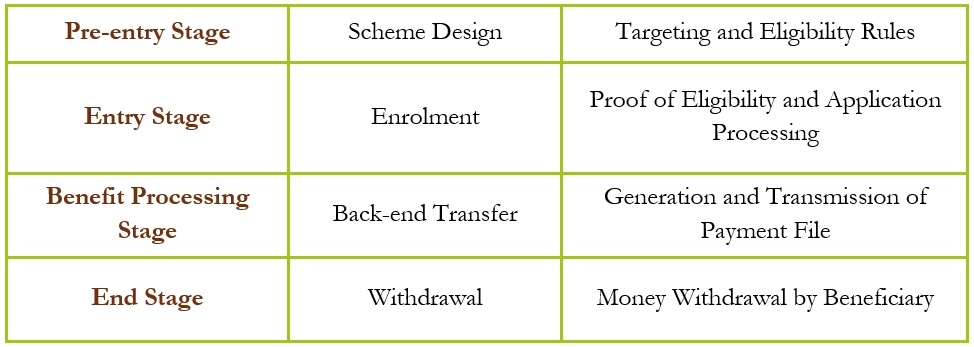

For a comprehensive analysis of the DBT ecosystem, we categorise the various processes a citizen has to undergo under the following broad heads:

Table 1: End-to-End Mapping of Stages under DBT

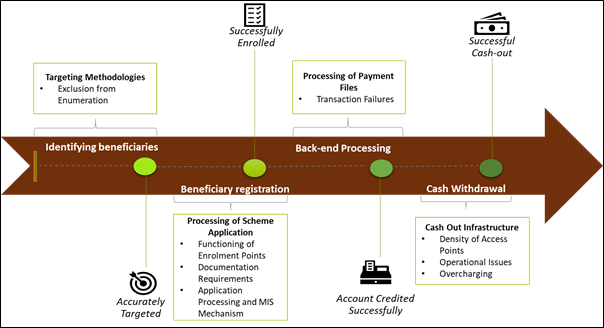

We document the various layers of exclusion for each of the aforesaid stages as follows:

Figure 1: Layers of Exclusion in DBT

First Layer of Exclusion: The first point of exclusion within the DBT system is the targeting methodology for identifying beneficiaries. Although a few schemes allow for self-registration,[4] most depend on the Below Poverty Line (BPL) and Socio-Economic Caste Census (SECC) lists for identifying beneficiaries. The reliability of Proxy Means Testing[5] (PMT), as seen in the case of identifying deprived households in SECC, has been called into question multiple times in the past. Although SECC is an improvement over the BPL approach, concerns related to its data have emerged. Vested interest to overstate the extent of deprivation by respondents and errors in enumeration, leading to under-counting of the poorest sections are some of the major concerns associated with SECC (2011).[6] Lastly, SECC was conducted in 2011 and is therefore an outdated data source, prone to exclusion errors.[7]

Second Layer of Exclusion: Given the targeted nature of most DBT schemes, the process of enrolment consists of stringent eligibility checks which require the beneficiary to submit a range of documents to prove his or her eligibility. Prospective beneficiaries have to incur significant costs, for instance, foregoing a day’s wage, because they have had to make multiple visits to finish the enrolment process or procure necessary documents. Secondly, given the digitised formats under DBT, database/spelling errors during the data-entry stage might also lead to the failure of validation checks during the onboarding of beneficiaries onto the Public Financial Management System. Such errors may take an inordinately high time to get corrected, given the fragmentation of enrolment points under DBT. For instance, the functional capacity of enrolment points such as Common Services Centres (CSC) or local government functionaries (such as the lekhpal[8] or patwari[9]) has been limited to the collection and submission of scheme applications and not been extended to include functions such as record corrections in scheme databases, corrections in Aadhaar details (except for PM Kisan[10]), etc. The task of record correction in schemes’ management information systems (a major factor causing inordinate delay in credit of beneficiary accounts) continues to be the monopoly of government departments, subject to typical bureaucratic delays. The lack of a streamlined system, despite the presence of Common Services Centres[11] and cumbersome documentation requirements form the key sources of exclusion at this stage.

Third Layer of Exclusion: Back-end processing involves the transfer of funds in the form of payment files from the relevant Ministry/Department to beneficiary accounts via the National Payments Corporation of India’s digital infrastructure. Most DBT transactions rely on the digital infrastructure of the Aadhaar Payment Bridge (APB) and are routed using the Aadhaar-enabled Payment System (AePS).[12] This stage may be characterised by transaction failures, i.e., failure of crediting a beneficiary’s account, which may occur due to a variety of reasons.[13] These include improper Aadhaar seeding, invalidity of account status (blocked/frozen/dormant), pending Know Your Customer (KYC), etc.[14]

Fourth Layer of Exclusion: Assuming the beneficiary did not fall through any of the aforesaid fractures in the DBT pipeline, and their account was credited successfully, they may still face issues while withdrawing the benefit amount. This issue might sometimes be the very unavailability of a cash-out point (especially exacerbated during the COVID-19 lockdown) or operational issues such as network failures, biometric failures, and in some cases, overcharging/fraud. For instance, Dvara Research’s COVID-19 Impact on Daily Life (CIDL) survey highlighted that, irrespective of the lockdown, banking points have not been available in close proximity to many villages present in the sample, and the residents of those villages have had to travel to other villages to avail banking services.[15] Even when cash-out points are accessible, networks errors or glitches in Point of Sale (PoS) devices might lead to multiple visits by beneficiaries, leading to high costs, especially for those residing in peri-urban and rural areas. Lastly, welfare beneficiaries unaccustomed to banking are left vulnerable to overcharging and fraud[16] in the last-mile in the absence of robust monitoring mechanisms and inadequacy of incentives paid out to last-mile functionaries.[17]

It must be noted that the various exclusionary factors detailed above may either be contingent or structural in nature. Some require concerted efforts from policymakers and the corresponding use of regulatory levers while others can be tackled by a simple revision of standard operating protocols that would lead to process improvements. The plurality of both state and non-state actors on the supply-side in DBT also mandates a closer look at how each entity is governed and monitored against benchmarks that uphold citizen-centricity. There is a clear need for allocation of accountability within the DBT ecosystem that can facilitate the institutionalisation of a public grievance redress system. Establishment of governance standards across public, quasi-public, and private actors within the DBT architecture along with the creation of a public complaints repository to bring about more transparency in the system are some of the key pathways that will help reduce exclusion in social welfare.

[1] Falling through the Cracks: Case Studies in Exclusion from Social Protection – Dvara Research. (2020). Retrieved 28 December 2020, from https://dvararesearch.com/social-protection-initiative/falling-through-the-cracks-case-studies-in-exclusion-from-social-protection/

[2] Draboo, S. (2020). Financial Inclusion and Digital India: A Critical Assessment. Retrieved 9 February 2021, from https://www.epw.in/engage/article/financial-inclusion-and-digital-india-critical

[3] Narayan, R., & Dhorajiwala, S. (2021). Length of the Last Mile. LibTech India. Retrieved 10 February 2021, from http://libtech.in/length-of-the-last-mile/

[4] India News – Times of India (2020). Pushing to increase beneficiaries under PM-Kisan, govt allows farmers to self-register for scheme. Retrieved from https://timesofindia.indiatimes.com/india/pushing-to-increase-beneficiaries-under-pm-kisan-govt-allows-farmers-to-self-register-for-scheme/articleshow/73160769.cms

[5] Proxy Means Test involves targeting individuals/households below a given threshold by scoring and weighing observable characteristics as proxies for given measures of well-being. For more details, see Kidd, S. et.al. (2017).

[6] Saxena, N. (2015). Has It Ignored Too Many Poor Households? Socio Economic Caste Census. Economic & Political Weekly (EPW), 50(30). Retrieved from https://www.epw.in/journal/2015/30/commentary/socio-economic-caste-census.html

[7] Mehta, B., & Kumar, A. (2019). Dear Govt, Welfare Schemes Will Work When Poverty Data Is Reliable. Retrieved 8 July 2020, from https://www.thequint.com/voices/opinion/poverty-data-tendulkar-committee-outdated-bjp-government-welfare-schemes

[8] A lekhpal is a clerical government officer who primarily maintains revenue accounts and land records at the village level.

[9] A village registrar or the patwari is the lowest state functionary in the Revenue Collection System and is tasked with maintaining land records and tax collection.

[10] Under PM Kisan, beneficiaries can correct their Aadhaar details online.

[11] In the Pragya Kendra Assessment study, more than four in ten of the survey respondents indicated that they had to additionally visit an elected official/government official to get their work done, indicating that CSCs were not functioning as one-stop shops.

[12] Standard Operating Procedure for DBT Payments. (2019). Retrieved 4 November 2020, from https://dbtbharat.gov.in/data/documents/SOP%20for%20DBT%20Payments.pdf.

[13] See relevant case studies: Exclusions in Tamil Nadu’s Labour Welfare System, Exclusion from PM Kisan due to payment of instalments into wrong bank account, and Exclusion from PM Kisan due to delay in correction of PFMS records.

[14] In January 2021, we conducted a data scraping exercise using the PM Kisan online portal for the district of East Godavari in Andhra Pradesh. The analysis revealed that out of the 39,000 records of registered beneficiaries who had not received any instalments (as of January 2021), 51% of them listed Aadhaar-related issues as the reason for failure.

[15] Ashraf, H. (2020). Where are Welfare Transfers Failing? Understanding the access to PMGKY. Retrieved from https://dvararesearch.com/where-are-welfare-transfers-failing-understanding-the-access-to-pmgky/

[16] Gupta, A. (2020). Agent Fraud in Welfare Transfers: A Case Study in Exclusion. Retrieved 28 December 2020, from https://dvararesearch.com/agent-fraud-in-welfare-transfers-a-case-study-in-exclusion/

[17] Parthasarathy, A., & Gupta, A. (2020). The ‘Common Services Centre’ Model: A no-win scenario?. Retrieved 28 December 2020, from https://dvararesearch.com/the-common-services-centre-model-a-no-win-scenario/