The objectives of sustainable businesses are well-aligned with ensuring the financial health of households, and this holds true for all types of lending businesses. In the specific context of microfinance businesses of NBFC-MFIs, this translates to the business objective of avoiding over-indebtedness of borrowers because of lending to them. Since the universe of borrowers can be characterised as belonging to low-income and vulnerable or potentially vulnerable backgrounds, lending institutions need to be particularly careful in ensuring this business objective is met as a matter of business process. This is particularly so given that the history of the microfinance sector has been chequered with political risk events that have exacerbated business risk in the absence of due process that exhibited an intent by providers to prevent households from becoming over-indebted because of lending to them. We have in the past, showcased evidence to indicate that households are experiencing over-indebtedness from microcredit and that households are undertaking suboptimal coping mechanisms that adversely affected their financial and non-financial lives. In October 2018, Dvara Research conducted a workshop that aimed at engaging with practitioners (NBFC-MFIs and NGO-MFIs) to share this evidence to answer the question of how to assess the suitability of microcredit for borrower households. The proceedings of this workshop were broadly grouped into process-based and product-based solutions, and a summary of these proceedings was published here. We studied existing empirical evidence on what constitutes over-indebtedness and in the specific context of Europe, where we found good literature, we covered its definitions, indicators and influencing factors. Armed with this understanding, we further studied past and current efforts by practitioners that were aimed at avoiding the incidence of over-indebtedness among borrower households. We concluded that the core issue of household distress due to over-borrowing needs greater attention.

Drawing on focussed insights we received from the practitioner workshop, and our learnings from internal research, we proposed a set of practitioner-led solutions to operationalise suitability assessments within microfinance at a Technical Session titled “Operationalising Suitability in Microcredit – Preventing Over-indebtedness among Borrower households”, at the Inclusive Finance India Summit 2018. The full video of the presentations and the panel discussion can be viewed here. In this post, we discuss briefly, an overview of these practitioner-led solutions, also documented in the form of a Note

that we are publishing. The suggestions we make are in the form of business processes that financial institutions can incorporate into their operations to reduce and prevent instances where loan disbursements push borrower households into over-indebtedness. In the note, we outline four steps to do so, which are briefly highlighted below.

Step 1: Defining Suitability in Microcredit

For microcredit, “a loan is unsuitable for a borrower if, based on an assessment of her financial situation at the point of sale, she is likely to face substantial hardship in servicing that loan through the tenure.” In other words, at Point-Of-Sale, the lender must conduct due diligence to ascertain the ability of the retail customer

- To meet his/her repayment obligations when they are expected to fall due (this is for both unique repayment obligations as well as the total repayment obligation under the credit arrangement),

- To meet these repayment obligations out of own income and savings without having to realise security or assets.

Therefore, microcredit lenders must have a point-of-sale assessment process that must reasonably ensure that because of the specific loan, customers will not find themselves in a situation where:

- they have to prioritise repayments over essential expenditures; or

- they end up in non-transient credit-dependent behaviour to make repayments.

Step 2: Assessing Suitability at a Household level

Suitability is to be assessed not for the loan applicant in isolation but for the applicant’s household. A household level approach to assessing indebtedness is not new to microcredit or for retail lending businesses. It is well known that cash flows are managed at the level of a household rather than at the level of the individual borrower, and any credit availed by a member of the household is in most cases, added to the overall cash flows of the household, while repayments most commonly come from pooled cash flows of the household. This, therefore, requires an understanding of the ability to make repayments at the level of the household and building a picture of the household’s formal and informal debt and its repayment capacity – in the note we propose some suggestions on how this can be carried out in a meaningful manner without having to put in place an overly cumbersome process.

Step 3: Determining a workflow for decisioning

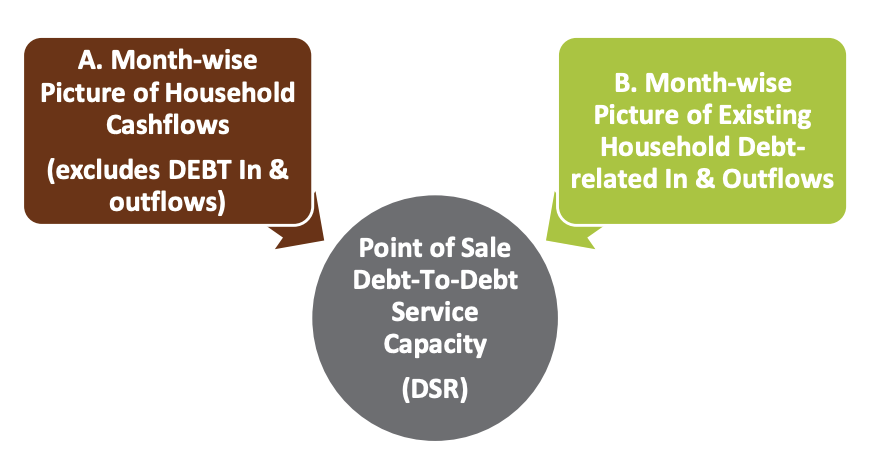

The decision to lend based on the Debt-To-Debt Service Capacity Ratio (DSR) Indicator for the household is to be arrived at using a decisioning logic, first put out by Prathap and Khaitan (2016), and detailed out further in the note.

The decisioning logic requires the calculation of the surplus cashflows of the household and the existing and new DSR of the household, at current and proposed/new levels of debt (if the requested loan was to be availed by the household) and the setting of cut-offs beyond which the household will not be lent to, or lent to only if additional protections are put into place.

Step 4: Setting System-level Capabilities based on Organisational Capacity

The overall workflow that we propose will have the following unique characteristics.

- At the Loan Application Stage: Occupation profiles of the family and income, expense and debt cash flows of the household are captured. This is done either by directly asking the applicant or through suitable proxies, or a combination of both.

- At the Credit Bureau Check Stage: A credit bureau check for not just the loan applicant in question, but also for all other adult members of the household. Such a credit check is to be carried out using “combo reports” to get a complete picture of the total formal debt of each adult member of the household.

- At the Loan Approval Stage: An algorithm that uses as inputs, the information obtained in the previous two stages to calculate the current (with an existing debt of the household) and new (debt of the household including the new loan) levels of debt servicing capacity of the household and to make a decision on whether to approve the loan in question.

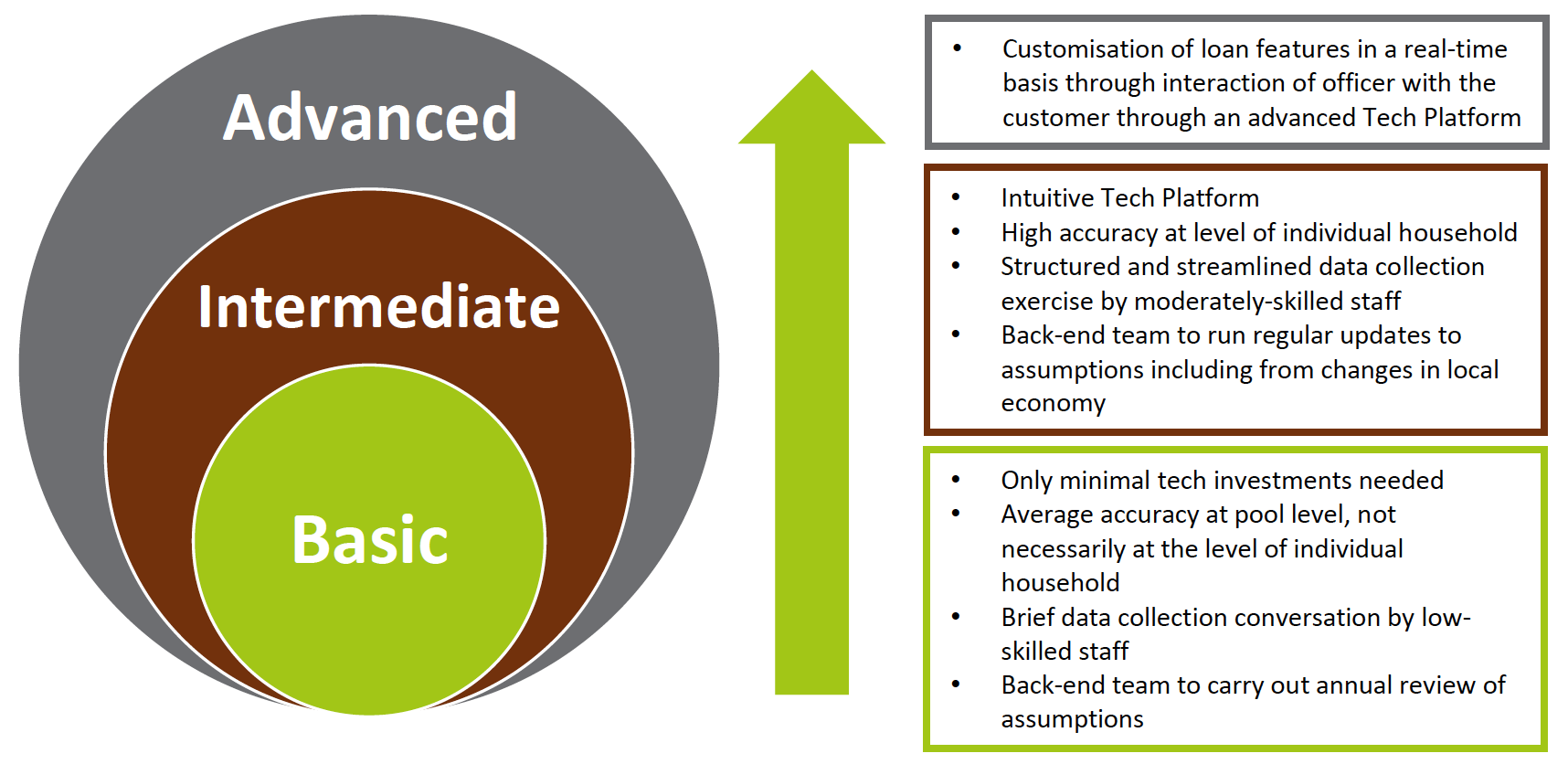

We understand that NBFC-MFIs exist at various scales, have different geography-based and cultural realities and field staff capabilities, and it may not be possible for all of them to operationalise one single uniform suitability assessment process. For this purpose, we propose three levels of sophistication of the suitability assessment process to choose from, to build organisational capacity, provided the following important underlying requirements are put into place:

- Capacity to capture demographic details of all household members. This includes:

- Names, age, the gender of all members of the household, and

- Nature of occupations for each earning member.

- Technology to enable automated decisioning algorithm outlined in Step 3.

- Building basic data analytics capabilities internally and strengthening it depending on the level of sophistication sought.

- Capacity to obtain and utilise credit reports for all members of the household.

Once these are in place, the figure below provides a quick overview of the organisational capacity proposed for each of the three levels:

Three Levels of Organisational Capacity

The note concludes by discussing some of the common concerns in operationalising these suggestions, namely costs in relation to technology, human resources, and the incremental costs of accessing combo reports for all adult members of the household.

The note concludes by discussing some of the common concerns in operationalising these suggestions, namely costs in relation to technology, human resources, and the incremental costs of accessing combo reports for all adult members of the household.

Click here to read the note. We welcome your comments and suggestions to further improve upon these proposed solutions.